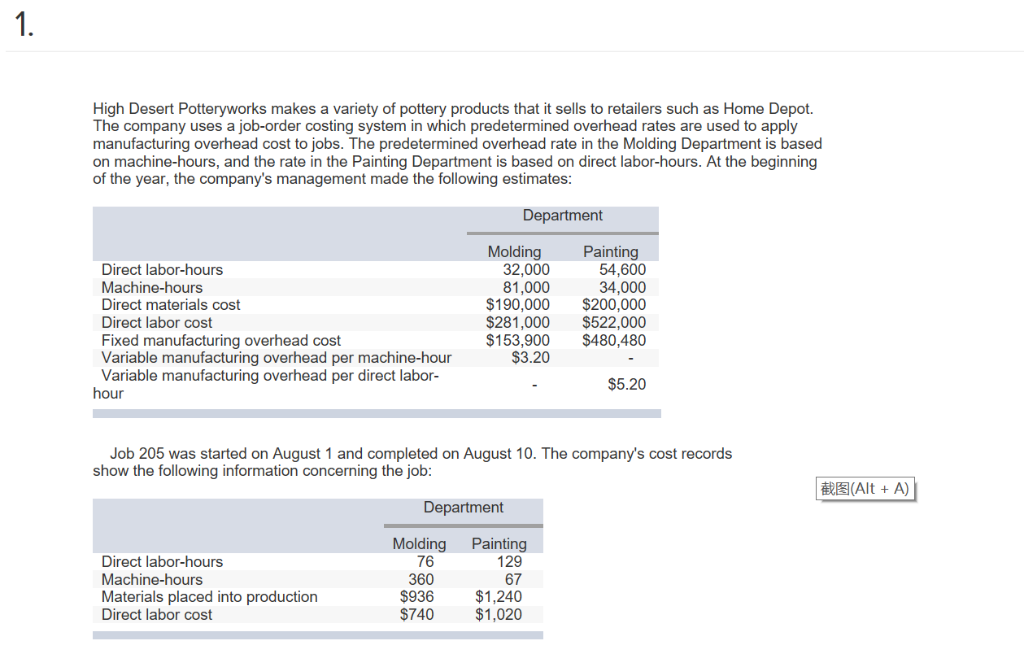

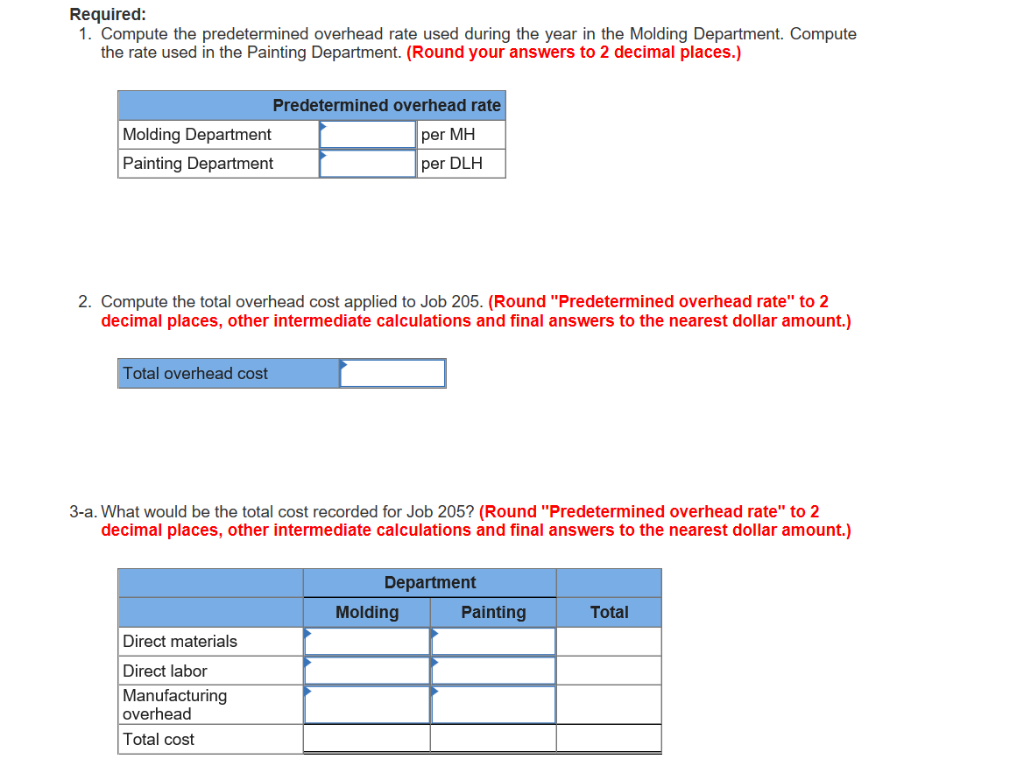

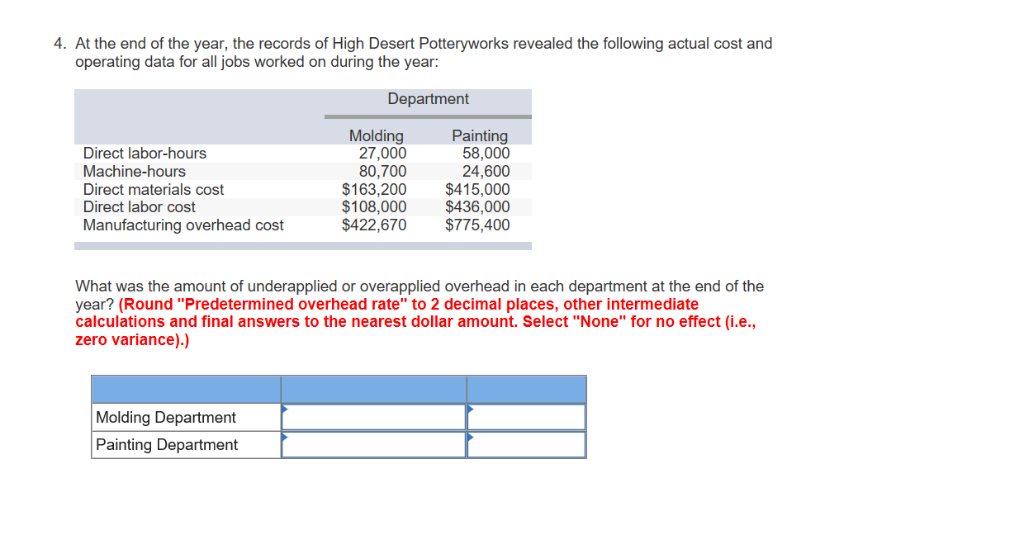

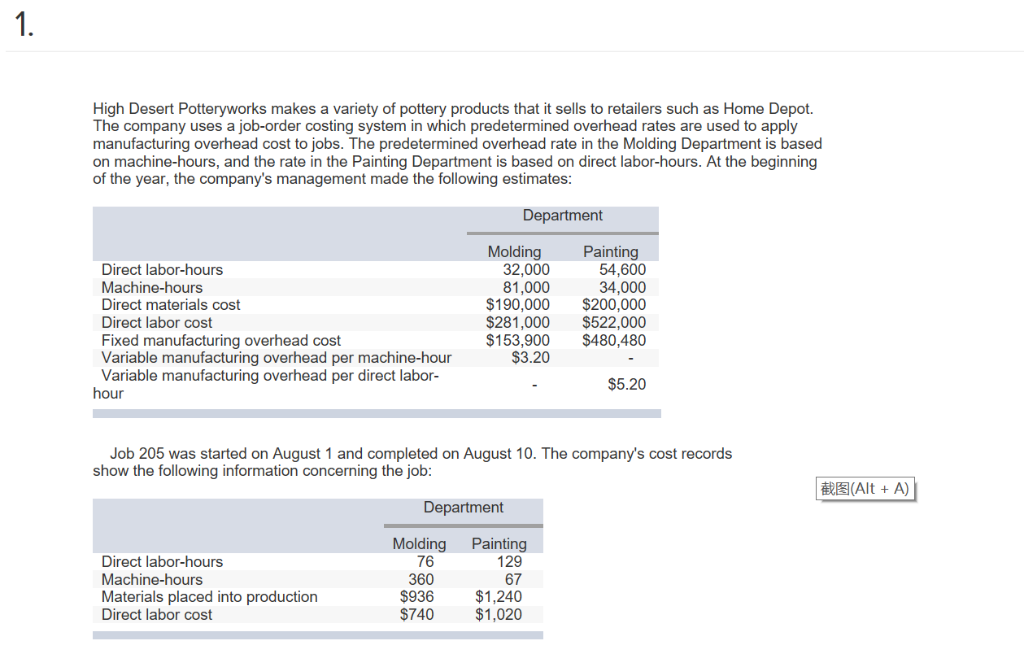

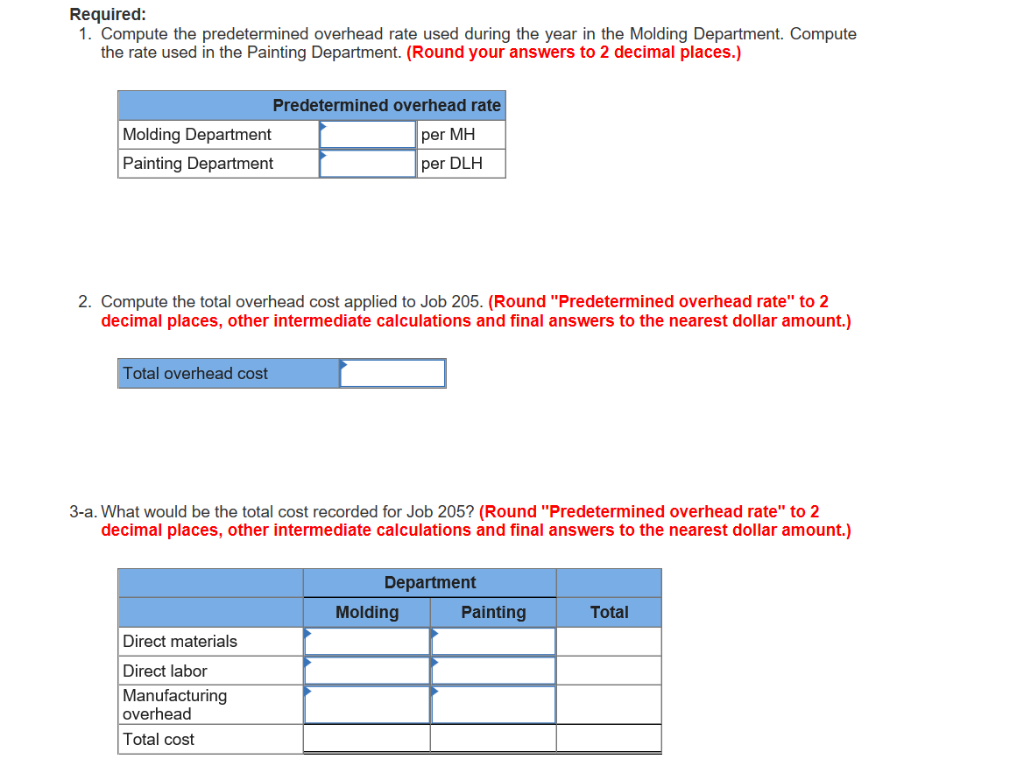

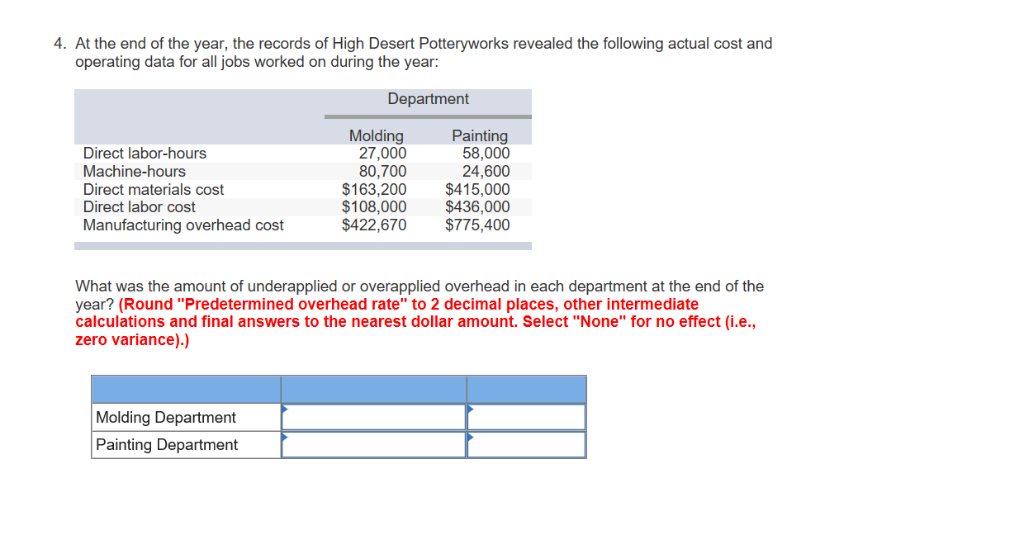

High Desert Potteryworks makes a variety of pottery products that it sells to retailers such as Home Depot. The company uses a job-order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company's management made the following estimates: Department Direct labor-hours Machine-hours Direct materials cost Direct labor cost Fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor- hour Molding 32,000 81,000 $190,000 $281,000 $153,900 $3.20 Painting 54,600 34.000 $200,000 $522,000 $480,480 $5.20 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Alt + A) Department Direct labor-hours Machine-hours Materials placed into production Direct labor cost Molding 76 360 $936 $740 Painting 129 67 $1,240 $1,020 Required: 1. Compute the predetermined overhead rate used during the year in the Molding Department. Compute the rate used in the Painting Department. (Round your answers to 2 decimal places.) Predetermined overhead rate Molding Department per MH Painting Department per DLH 2. Compute the total overhead cost applied to Job 205. (Round "Predetermined overhead rate" to 2 decimal places, other intermediate calculations and final answers to the nearest dollar amount.) Total overhead cost 3-a. What would be the total cost recorded for Job 205? (Round "Predetermined overhead rate" to 2 decimal places, other intermediate calculations and final answers to the nearest dollar amount.) Department Molding Painting Total Direct materials Direct labor Manufacturing overhead Total cost 4. At the end of the year, the records of High Desert Potteryworks revealed the following actual cost and operating data for all jobs worked on during the year: Department Direct labor-hours Machine-hours Direct materials cost Direct labor cost Manufacturing overhead cost Molding 27,000 80,700 $163,200 $108,000 $422,670 Painting 58,000 24,600 $415,000 $436,000 $775,400 What was the amount of underapplied or overapplied overhead in each department at the end of the year? (Round "Predetermined overhead rate" to 2 decimal places, other intermediate calculations and final answers to the nearest dollar amount. Select "None" for no effect (i.e.. zero variance).) Molding Department Painting Department