Question

High Energy Company (HEC) is currently 100% equity financed. Its only asset is a license to buy an oil field where it can extract 5

High Energy Company (HEC) is currently 100% equity financed. Its only asset is a license to buy an oil field where it can extract 5 million barrels of oil this year (Year 0). The license expires after this year. The acquisition cost is $255 million. For simplicity, assume that extraction cost is zero. The extraction time is Year 0. That is, if HEC decides to purchase the oil field and extract oil now (Year 0), it can sell the oil next year in the market (Year 1). The oil price is now $60/barrel and can be $71/barrel or $51/barrel next year with equal probability. Assume no convenience yield or storage costs. The risk-free interest rate is 3%. HECs tax rate is 15%. Assume all costs are incurred at the start of Year 0 and all sales are made at the start of Year 1. Please answer the incorrect one, don't copy from others!!!!!

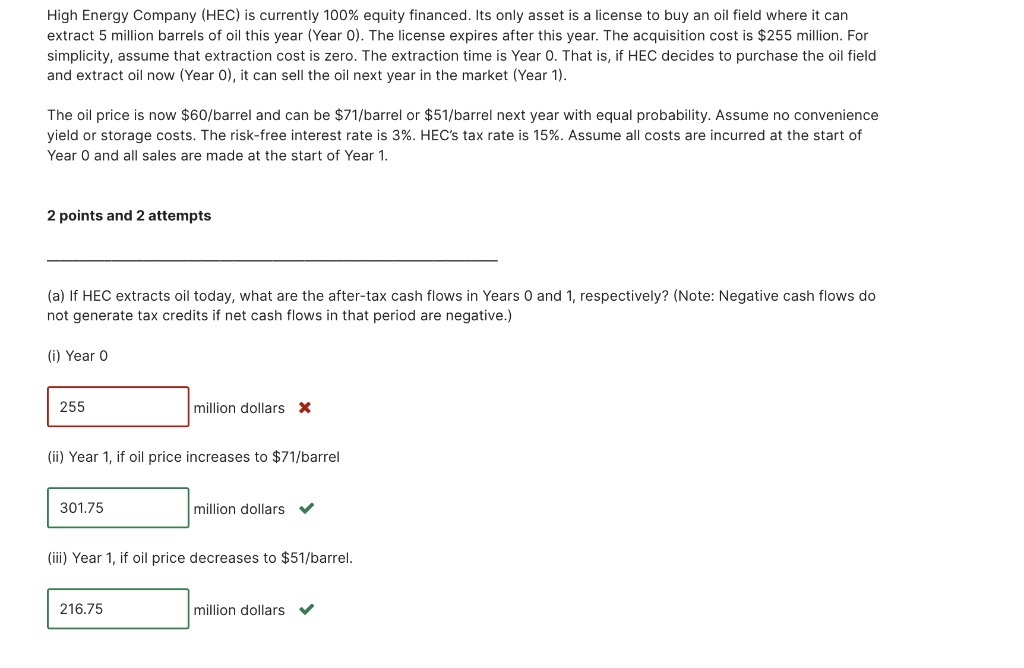

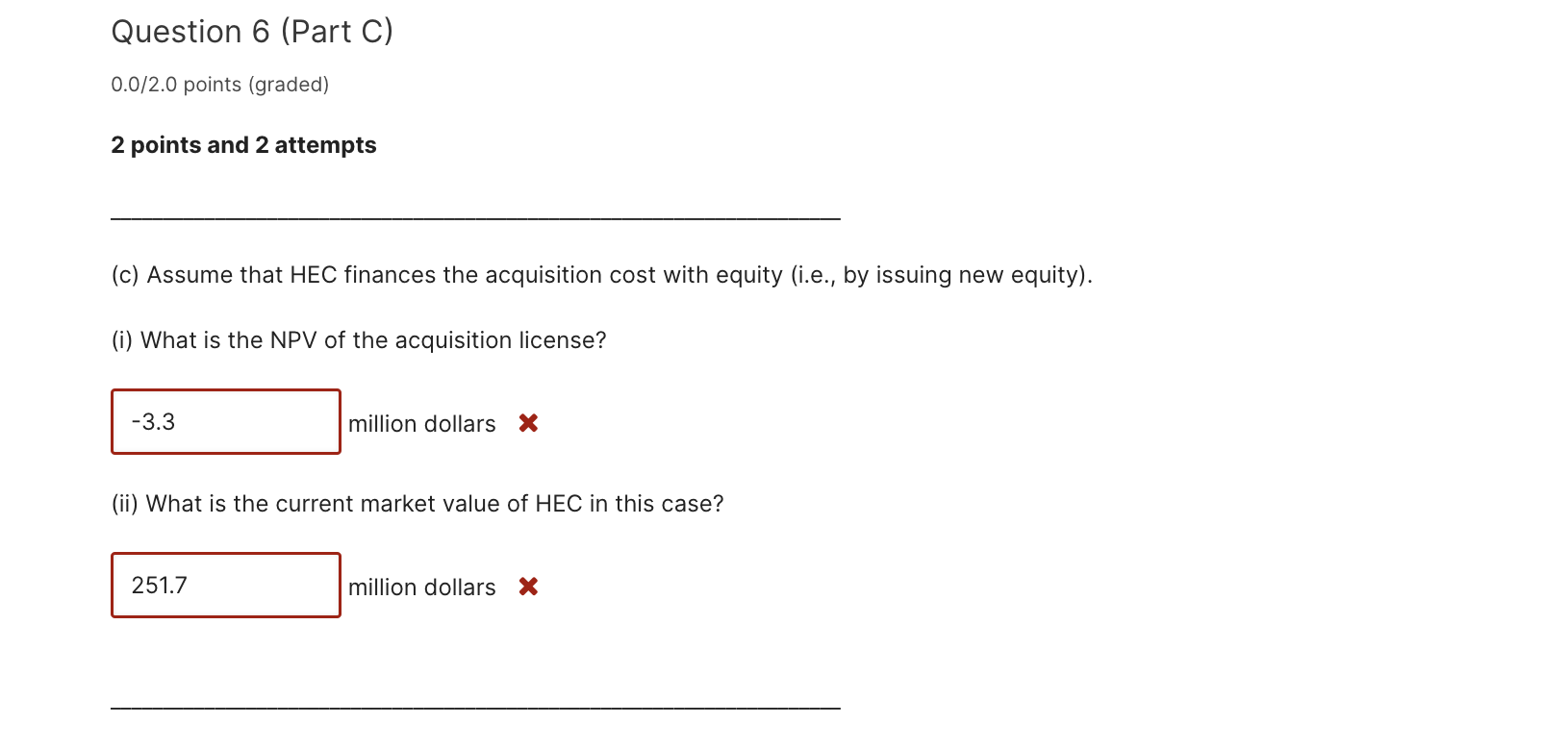

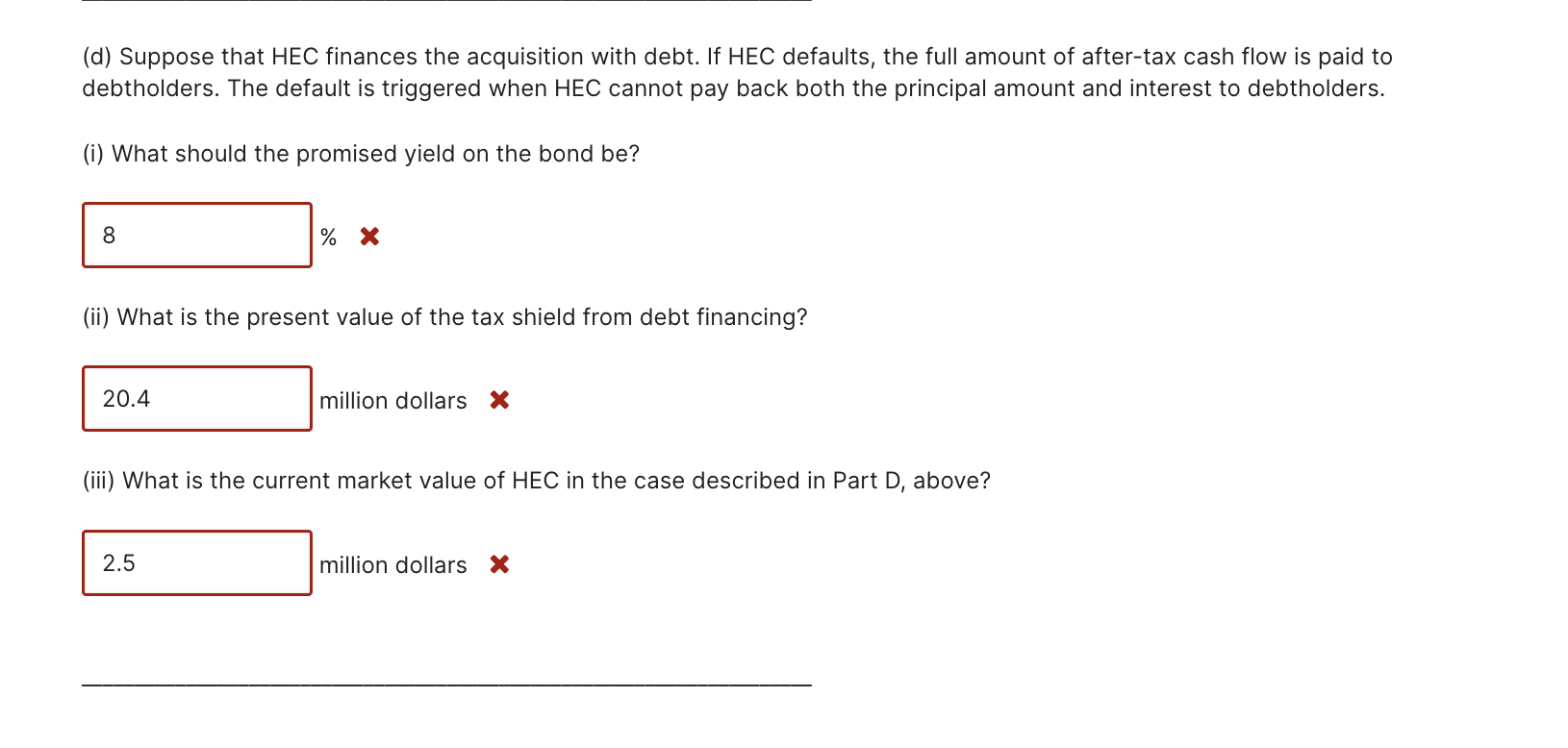

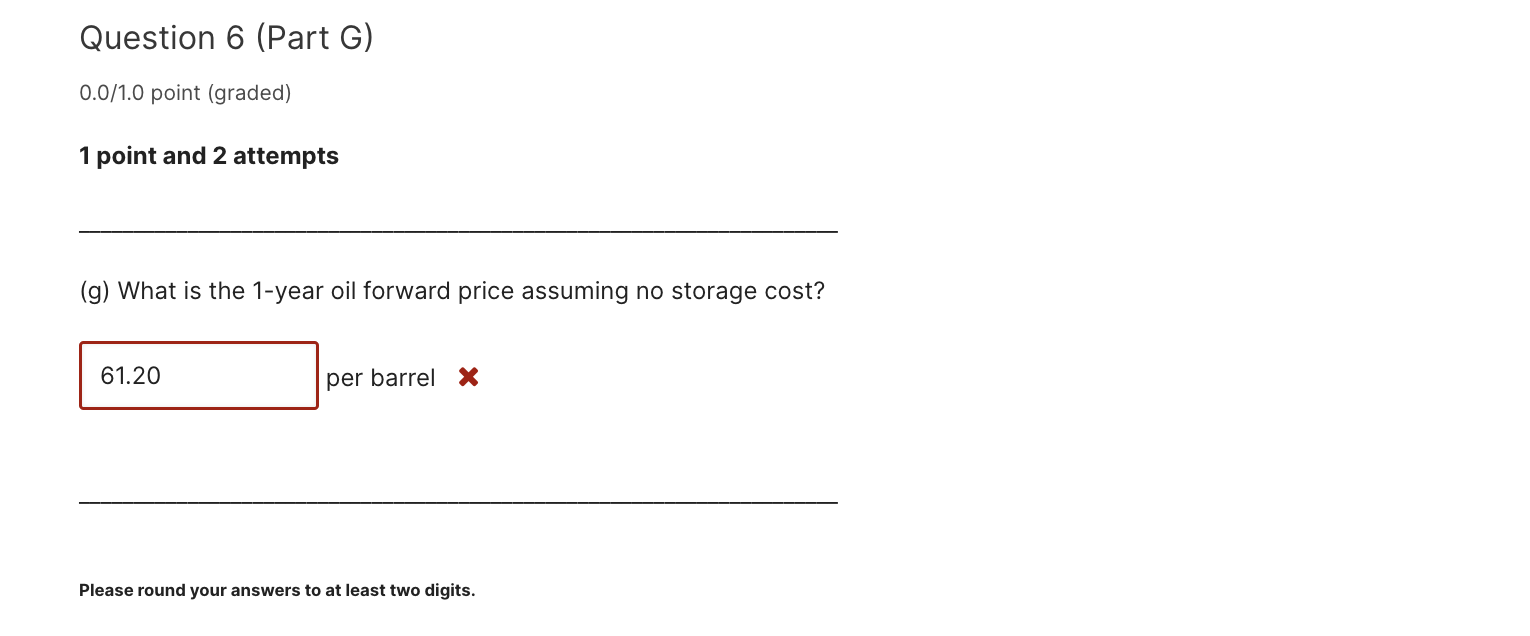

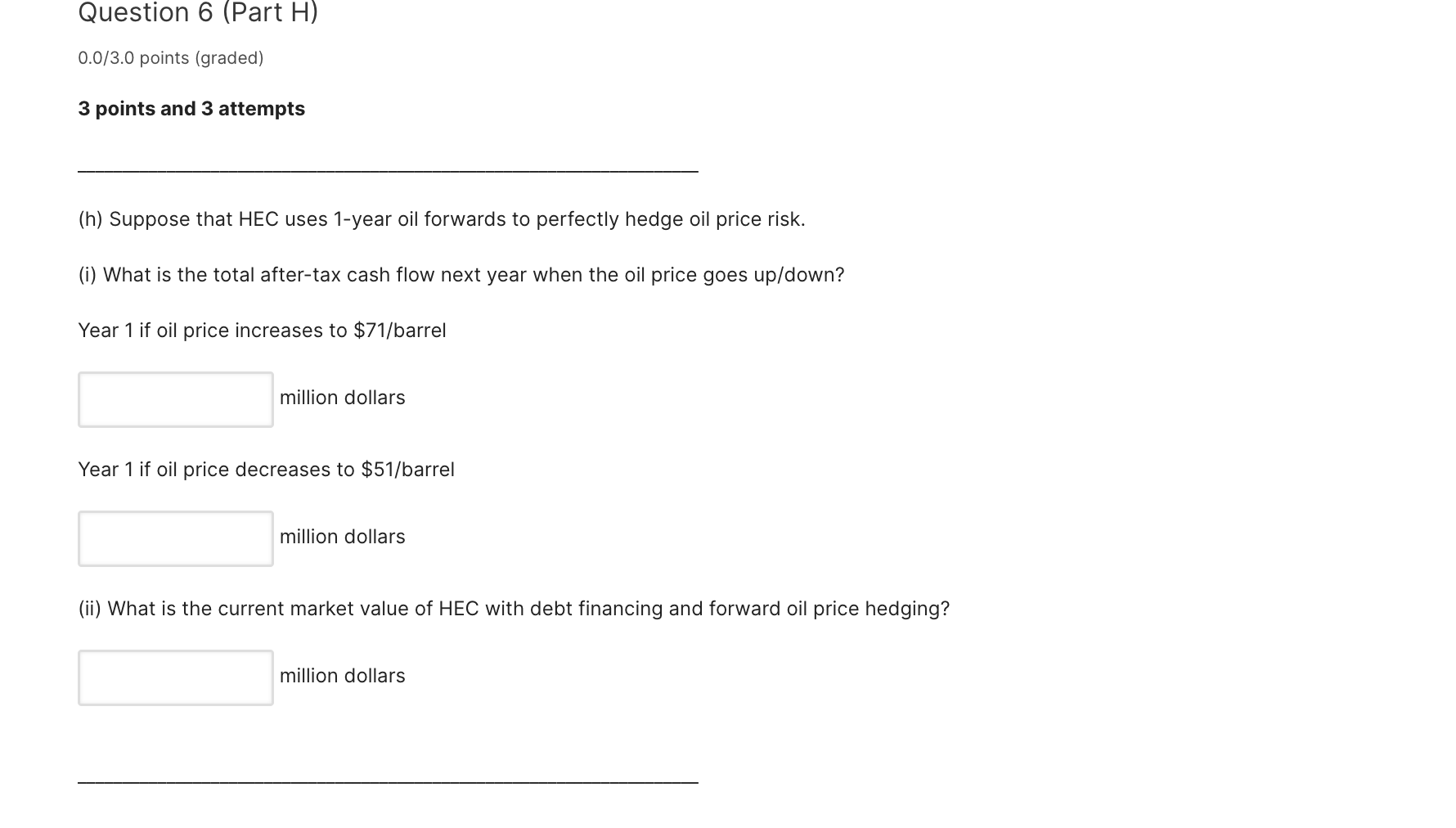

High Energy Company (HEC) is currently 100% equity financed. Its only asset is a license to buy an oil field where it can extract 5 million barrels of oil this year (Year 0). The license expires after this year. The acquisition cost is $255 million. For simplicity, assume that extraction cost is zero. The extraction time is Year 0 . That is, if HEC decides to purchase the oil field and extract oil now (Year 0), it can sell the oil next year in the market (Year 1). The oil price is now $60 /barrel and can be $71 /barrel or $51 /barrel next year with equal probability. Assume no convenience yield or storage costs. The risk-free interest rate is 3%. HEC's tax rate is 15%. Assume all costs are incurred at the start of Year 0 and all sales are made at the start of Year 1. 2 points and 2 attempts (a) If HEC extracts oil today, what are the after-tax cash flows in Years 0 and 1, respectively? (Note: Negative cash flows do not generate tax credits if net cash flows in that period are negative.) (i) Year 0 million dollars X (ii) Year 1 , if oil price increases to $71/ barrel million dollars (iii) Year 1, if oil price decreases to $51 /barrel. million dollars Question 6 (Part C) 0.0/2.0 points (graded) 2 points and 2 attempts (c) Assume that HEC finances the acquisition cost with equity (i.e., by issuing new equity). (i) What is the NPV of the acquisition license? -3.3 million dollars x (ii) What is the current market value of HEC in this case? 251.7 million dollars (d) Suppose that HEC finances the acquisition with debt. If HEC defaults, the full amount of after-tax cash flow is paid to debtholders. The default is triggered when HEC cannot pay back both the principal amount and interest to debtholders. (i) What should the promised yield on the bond be? % (ii) What is the present value of the tax shield from debt financing? milliondollarsx (iii) What is the current market value of HEC in the case described in Part D, above? million dollars x (e) Suppose that in the case of debt financing as described in Part D, when HEC defaults it incurs additional costs of $11 million. These costs reduce the value of existing assets. For simplicity, assume that defaults costs do not affect the promised yield on debt computed in Part D. What is the market value of the firm if it finances the acquisition with debt? million dollars Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12 .1 .1 will be marked as incorrect! 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g. % ) When submitting your answer, make sure you do not leave empty blanks. Do not use % and $ signs. You have used 0 of 2 attempts Save Question 6 (Part F) 0.0/1.0 point (graded) 1 point and 1 attempt (f) Suppose that oil forwards with 1-year maturity are traded in the market. If HEC uses the forwards to hedge the oil price risk, what should it do? Sell forward Buy forward (g) What is the 1-year oil forward price assuming no storage cost? per barrel x Please round your answers to at least two digits. (h) Suppose that HEC uses 1-year oil forwards to perfectly hedge oil price risk. (i) What is the total after-tax cash flow next year when the oil price goes up/down? Year 1 if oil price increases to $71/ barrel million dollars Year 1 if oil price decreases to $51/ barrel million dollars (ii) What is the current market value of HEC with debt financing and forward oil price hedging? million dollars High Energy Company (HEC) is currently 100% equity financed. Its only asset is a license to buy an oil field where it can extract 5 million barrels of oil this year (Year 0). The license expires after this year. The acquisition cost is $255 million. For simplicity, assume that extraction cost is zero. The extraction time is Year 0 . That is, if HEC decides to purchase the oil field and extract oil now (Year 0), it can sell the oil next year in the market (Year 1). The oil price is now $60 /barrel and can be $71 /barrel or $51 /barrel next year with equal probability. Assume no convenience yield or storage costs. The risk-free interest rate is 3%. HEC's tax rate is 15%. Assume all costs are incurred at the start of Year 0 and all sales are made at the start of Year 1. 2 points and 2 attempts (a) If HEC extracts oil today, what are the after-tax cash flows in Years 0 and 1, respectively? (Note: Negative cash flows do not generate tax credits if net cash flows in that period are negative.) (i) Year 0 million dollars X (ii) Year 1 , if oil price increases to $71/ barrel million dollars (iii) Year 1, if oil price decreases to $51 /barrel. million dollars Question 6 (Part C) 0.0/2.0 points (graded) 2 points and 2 attempts (c) Assume that HEC finances the acquisition cost with equity (i.e., by issuing new equity). (i) What is the NPV of the acquisition license? -3.3 million dollars x (ii) What is the current market value of HEC in this case? 251.7 million dollars (d) Suppose that HEC finances the acquisition with debt. If HEC defaults, the full amount of after-tax cash flow is paid to debtholders. The default is triggered when HEC cannot pay back both the principal amount and interest to debtholders. (i) What should the promised yield on the bond be? % (ii) What is the present value of the tax shield from debt financing? milliondollarsx (iii) What is the current market value of HEC in the case described in Part D, above? million dollars x (e) Suppose that in the case of debt financing as described in Part D, when HEC defaults it incurs additional costs of $11 million. These costs reduce the value of existing assets. For simplicity, assume that defaults costs do not affect the promised yield on debt computed in Part D. What is the market value of the firm if it finances the acquisition with debt? million dollars Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12 .1 .1 will be marked as incorrect! 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g. % ) When submitting your answer, make sure you do not leave empty blanks. Do not use % and $ signs. You have used 0 of 2 attempts Save Question 6 (Part F) 0.0/1.0 point (graded) 1 point and 1 attempt (f) Suppose that oil forwards with 1-year maturity are traded in the market. If HEC uses the forwards to hedge the oil price risk, what should it do? Sell forward Buy forward (g) What is the 1-year oil forward price assuming no storage cost? per barrel x Please round your answers to at least two digits. (h) Suppose that HEC uses 1-year oil forwards to perfectly hedge oil price risk. (i) What is the total after-tax cash flow next year when the oil price goes up/down? Year 1 if oil price increases to $71/ barrel million dollars Year 1 if oil price decreases to $51/ barrel million dollars (ii) What is the current market value of HEC with debt financing and forward oil price hedging? million dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started