Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXAMPLES ON COST OF CAPITAL 1. Cost of Capital is A. The minimum rate of return which the firm must earn on the equity

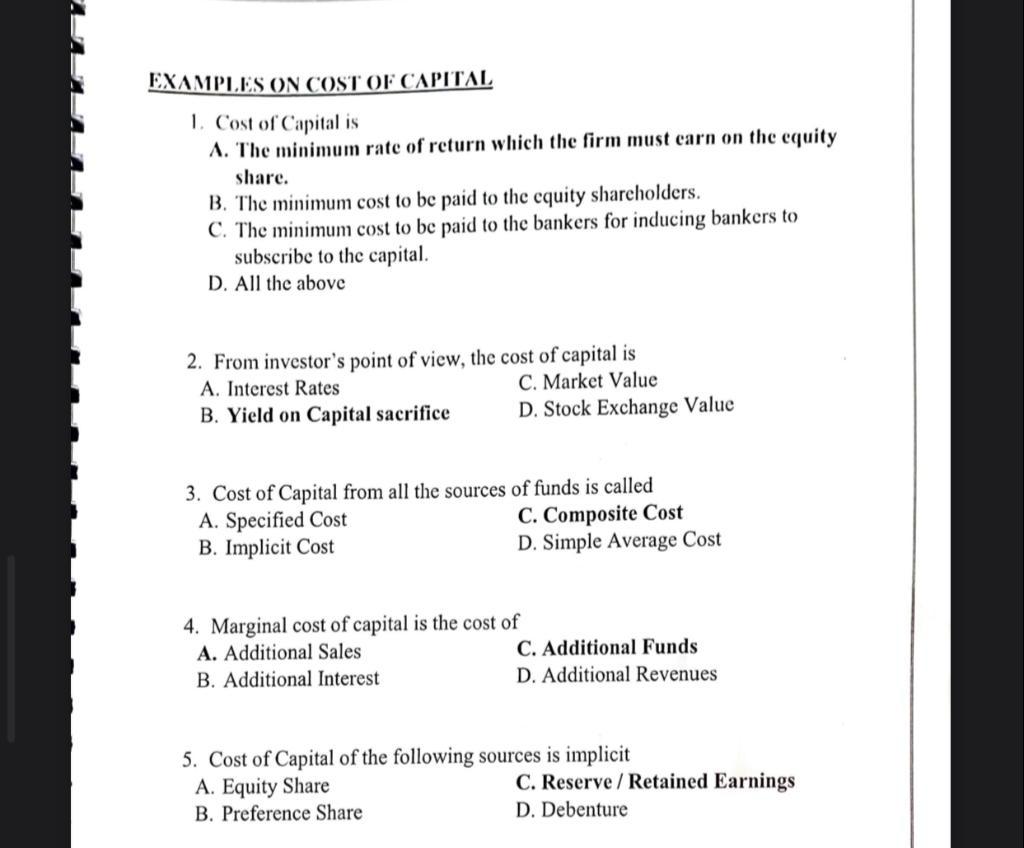

EXAMPLES ON COST OF CAPITAL 1. Cost of Capital is A. The minimum rate of return which the firm must earn on the equity share. B. The minimum cost to be paid to the equity shareholders. C. The minimum cost to be paid to the bankers for inducing bankers to subscribe to the capital. D. All the above 2. From investor's point of view, the cost of capital is A. Interest Rates C. Market Value B. Yield on Capital sacrifice D. Stock Exchange Value 3. Cost of Capital from all the sources of funds is called A. Specified Cost B. Implicit Cost C. Composite Cost D. Simple Average Cost 4. Marginal cost of capital is the cost of A. Additional Sales B. Additional Interest C. Additional Funds D. Additional Revenues 5. Cost of Capital of the following sources is implicit A. Equity Share B. Preference Share C. Reserve/ Retained Earnings D. Debenture

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Answer D All the above Cost of capital is the cost that a company incurs when it raises funds to finance its operations It is essentially ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started