higher or lower

will or will not

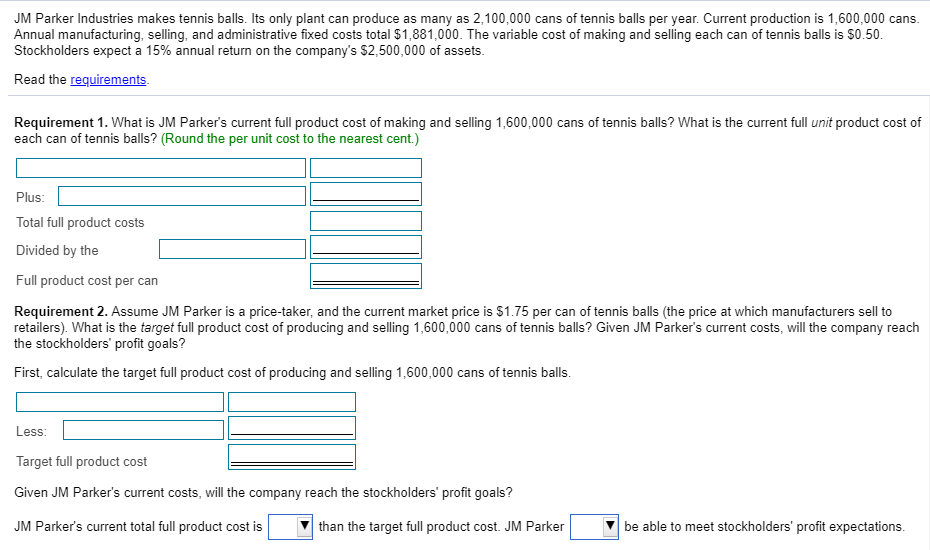

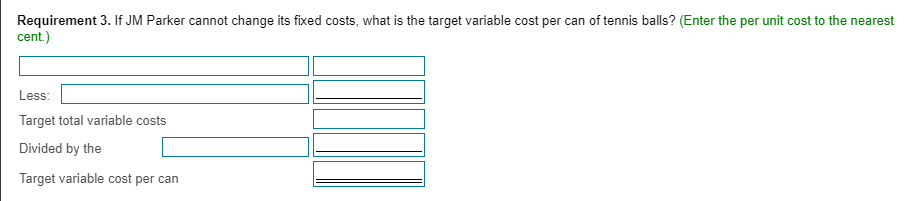

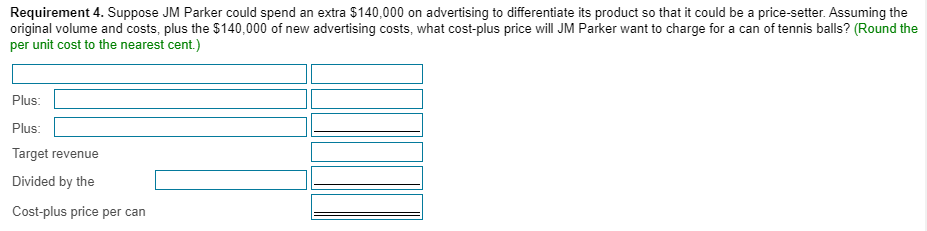

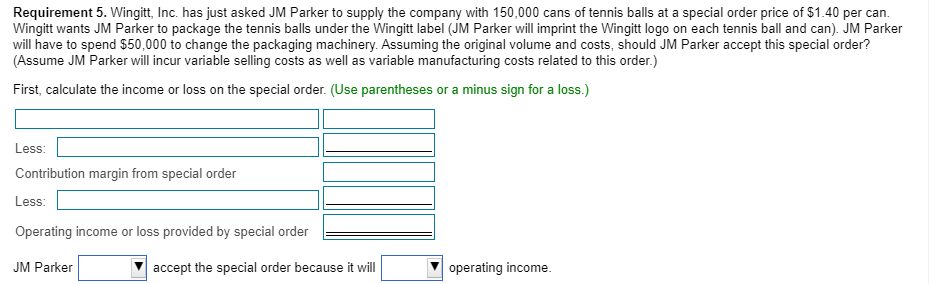

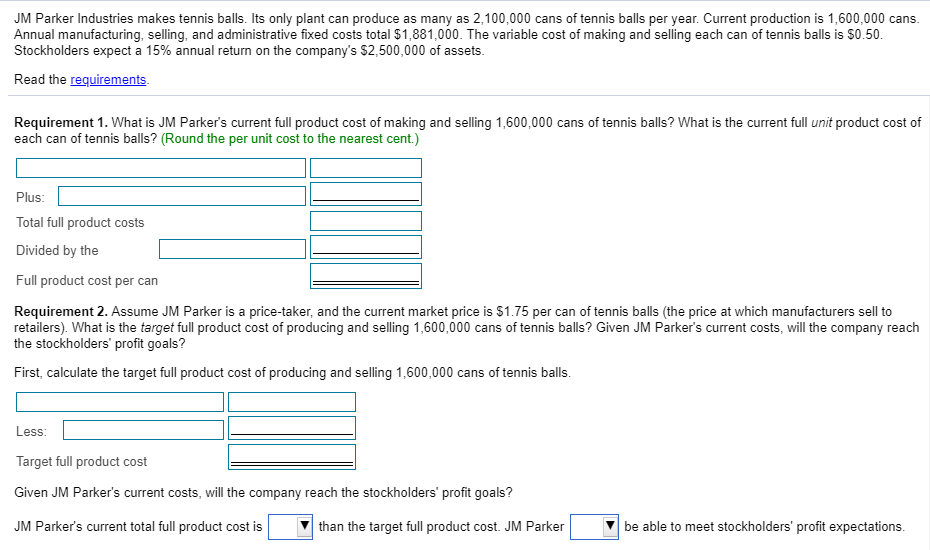

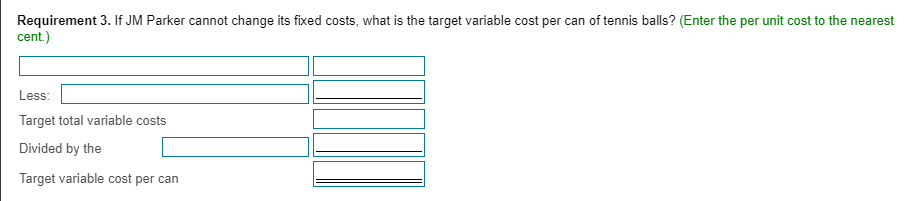

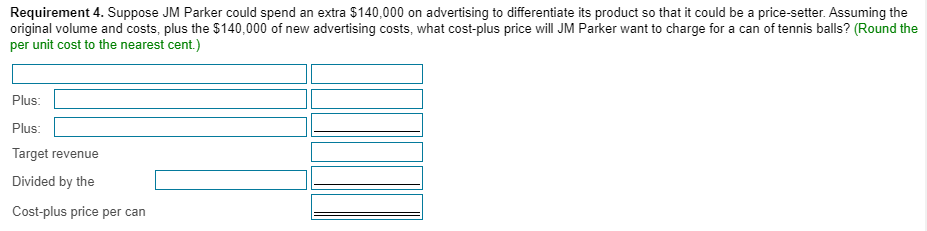

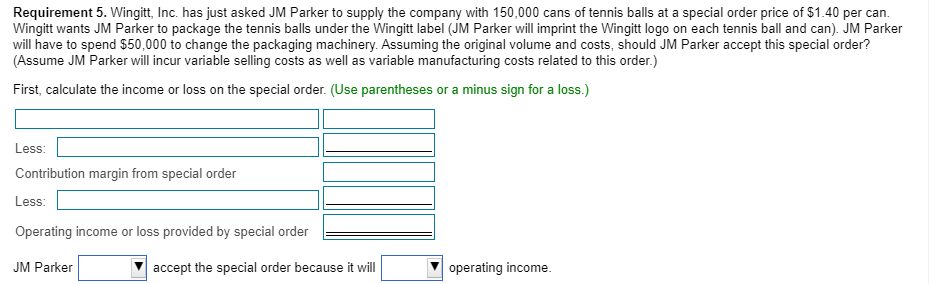

JM Parker Industries makes tennis balls. Its only plant can produce as many as 2,100,000 cans of tennis balls per year. Current production is 1,600,000 cans. Annual manufacturing, selling, and administrative fixed costs total $1,881,000. The variable cost of making and selling each can of tennis balls is $0.50. Stockholders expect a 15% annual return on the company's $2,500,000 of assets. Read the requirements. Requirement 1. What is JM Parker's current full product cost of making and selling 1,600,000 cans of tennis balls? What is the current full unit product cost of each can of tennis balls? (Round the per unit cost to the nearest cent.) Plus: Total full product costs Divided by the Full product cost per can Requirement 2. Assume JM Parker is a price-taker, and the current market price is $1.75 per can of tennis balls (the price at which manufacturers sell to retailers). What is the target full product cost of producing and selling 1,600,000 cans of tennis balls? Given JM Parker's current costs, will the company reach the stockholders' profit goals? First, calculate the target full product cost of producing and selling 1,600,000 cans of tennis balls. Less: Target full product cost Given JM Parker's current costs, will the company reach the stockholders' profit goals? JM Parker's current total full product cost is than the target full product cost. JM Parker be able to meet stockholders' profit expectations. Requirement 3. If JM Parker cannot change its fixed costs, what is the target variable cost per can of tennis balls? (Enter the per unit cost to the nearest cent.) Less: Target total variable costs Divided by the Target variable cost per can Requirement 4. Suppose JM Parker could spend an extra $140,000 on advertising to differentiate its product so that it could be a price-setter. Assuming the original volume and costs, plus the $140,000 of new advertising costs, what cost-plus price will JM Parker want to charge for a can of tennis balls? (Round the per unit cost to the nearest cent.) Plus: Plus: Target revenue Divided by the Cost-plus price per can Requirement 5. Wingitt, Inc. has just asked JM Parker to supply the company with 150,000 cans of tennis balls at a special order price of $1.40 per can. Wingitt wants JM Parker to package the tennis balls under the Wingitt label (JM Parker will imprint the Wingitt logo on each tennis ball and can). JM Parker will have to spend $50,000 to change the packaging machinery. Assuming the original volume and costs, should JM Parker accept this special order? (Assume JM Parker will incur variable selling costs as well as variable manufacturing costs related to this order.) First, calculate the income or loss on the special order. (Use parentheses or a minus sign for a loss.) Less: Contribution margin from special order Less: Operating income or loss provided by special order JM Parker accept the special order because it will operating income