Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Highland Industries Inc. makes investments in available-for-sale securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected

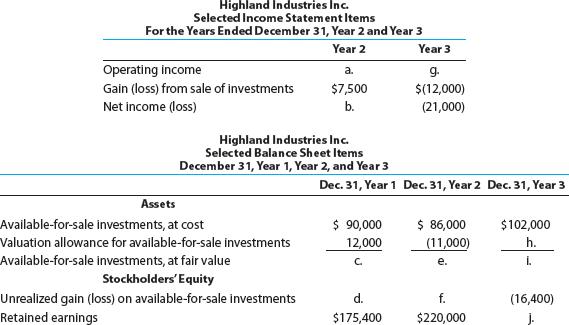

Highland Industries Inc. makes investments in available-for-sale securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected items from comparative balance sheets, are as follows:

There were no dividends.

Determine the missing lettered items.

Highland Industries Inc. Selected Income Statement Items For the Years Ended December 31, Year 2 and Year 3 Year 2 Year 3 Operating income a. g. Gain (loss) from sale of investments Net income (loss) $7,500 $(12,000) b. (21,000) Highland Industries Inc. Selected Balance Sheet Items December 31, Year 1, Year 2, and Year 3 Dec. 31, Year 1 Dec. 31, Year 2 Dec. 31, Year 3 Assets $ 90,000 12,000 $ 86,000 (11,000) Available-for-sale investments, at cost $102,000 Valuation allowance for available-for-sale investments h. Available-for-sale investments, at fair value Stockholders'Equity C. . i. f. Unrealized gain (loss) on available-for-sale investments Retained earnings (16,400) $175,400 $220,000

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Compl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dd327dd148_179179.pdf

180 KBs PDF File

635dd327dd148_179179.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started