Question

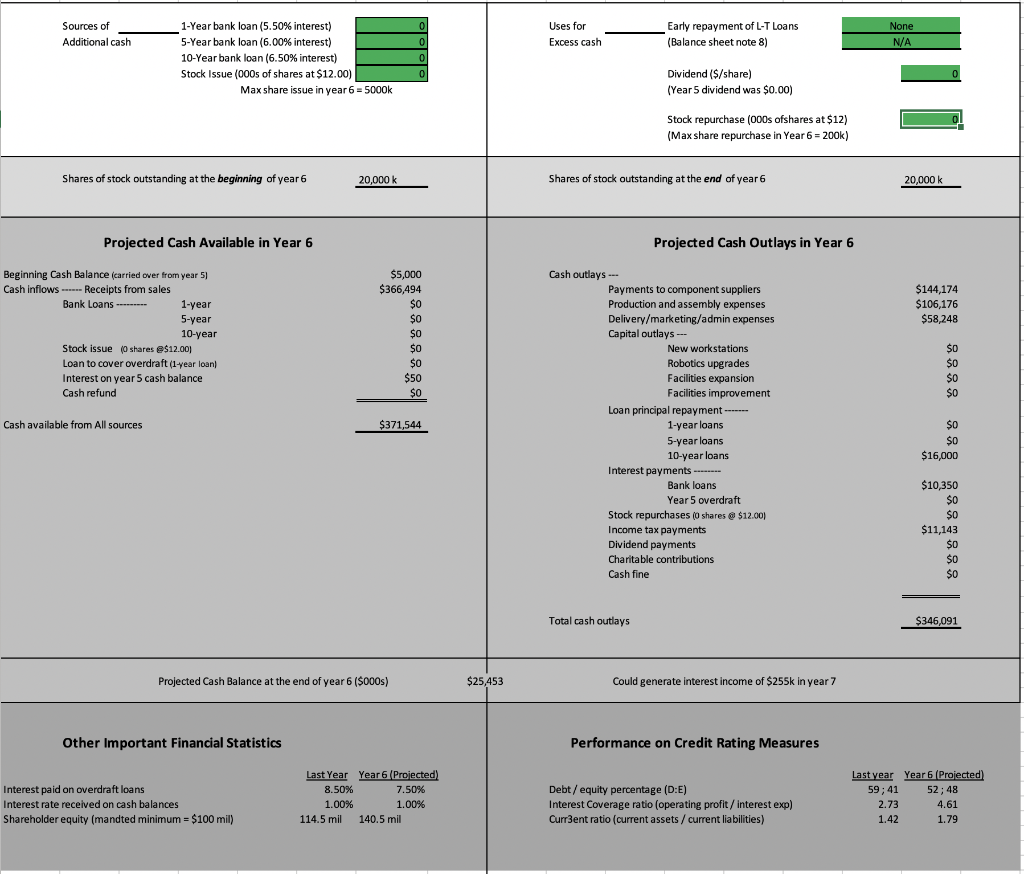

Highlighted in GREEN (the only entries that need to be changed) are: The eight finance-related decision entries revolve around the following issues: Borrowing money To

Highlighted in GREEN (the only entries that need to be changed) are: The eight finance-related decision entries revolve around the following issues:

Borrowing moneyTo finance operations the company may take out loans with 1-year, 5- years, and/or 10-year terms. One-year loans are granted at interest rates corresponding to the companys current credit rating; 5-year loans carry an additional 0.50% and 10-year loans carry a full 1% interest rate adder. In addition to a lower interest rate, a 1-year loan has the advantage of quicker debt pay-down and smaller total interest costs, but also has the disadvantage of having to re-finance the debt in the following year at perhaps less favorable interest rates should cash flows not be sufficient to fully fund a 1-year loan repayment. Longer 5 or 10-year loans have the advantages of locking in what may be an attractive long-term interest rate and lowering annual principal payments; however, 5-year or 10-year loans, in addition to their higher interest rates, have the further disadvantage of paying out bigger sums for interest over the life of the loan (which, in turn, depresses the companys interest coverage ratio over a longer period of time).

- Issuing shares of stockAdditional capital may be raised by issuing new shares of common stock. New issues of common stock have the effect of diluting earnings per share and ROE and should be done cautiously. From time to time, you may determine that the company needs to raise additional equity capital to (1) help pay down a portion of the outstanding loans (because of burdensome interest costs or because lowering debt is the best way to improve the companys credit rating) or (2) help pay for added assembly capacity and/or robotics upgrades. The companys board of directors has established a 40-million share maximum on the total number of shares outstanding and theres an on-screen calculation showing the maximum number of shares that can be issued in any one year (given the companys financial condition). The company cannot issue new shares in the same year that it elects to buy back (retire) outstanding shares. At the end of Year 5 the company had 20 million shares outstanding. Each time you make an entry specifying how many shares are to be issued, there are accompanying calculations showing the total amount of new equity capital raised (see the cash inflows section) and the price at which investors will agree to buy the newly-issued shares (the price declines as more shares are issued because additional shares dilute earnings per share). In deciding how many shares to issue, you can try several what if entries and check out the effects on earnings per share, return on equity, and the amount of money raised.

- Early repayment of long-term bank loansYou may accelerate debt retirement (or refinance high interest debt) by using excess cash on hand, new issues of stock, or proceeds from new loans to pay off the outstanding principal on up to 2 of the outstanding 5 and 10-year loans. This is accomplished by simply selecting the number of the loan you want to pay off (loan numbers are indicated in Note 8 to your companys balance sheet). All such loan repayments are considered end-of-year repayments; thus, the company will still make the current-year annual principal payment and interest payment on any long-term loan that is repaid early.

- Paying dividendsThe company paid no dividend to shareholders in Year 5. You have the authority to declare a dividend, subject to certain conditions. The maximum allowable dividend entry is 2 times projected earnings per share; moreover, projected total shareholder equity must always remain at or above $100 million after any and all dividend payments. No dividend can be paid should projected total shareholder equity fall below the $100 million minimum established by the companys board of directors (a policy that won the enthusiastic approval of credit rating agencies). Higher dividends are welcomed by shareholders and have a positive effect on the companys stock price (unless dividend payments exceed earnings per share and cant be sustained at present levels).

- Repurchasing shares of stockUsing cash on hand to repurchase and retire outstanding shares has the advantage of increasing earnings per share, returns on equity investment, and the companys stock price. While you have the authority to initiate stock repurchases, the Board of Directors has reserved the right to limit the number of shares repurchased in any given yearsuch limits vary from year to year and are shown on the Finance Decisions page just below the stock repurchase entry field. The company must maintain a minimum of 15 million shares outstanding and a minimum total shareholder equity of $100 million. The company cannot repurchase outstanding shares in the same year that it elects to issue new shares. Each time you enter a number for share repurchases, you are provided calculations showing the total cost of the repurchased shares (see the cash outlays listings) and the price at which investors will agree to sell the shares you want to buy back (the price rises as more shares are repurchased because of the upward impact on earnings per share and the bigger fraction of ownership that fewer shares represent).

NOTE:

Options for "Uses for EXCESS CASH ______ Early Repayment of L-T" : None

- #1 $30,000k @ 7.5%

- #2 $16,000k @ 8.5%

- #3 $64,000k @ 8.5%

FOR NA :

One of:

- #1 $30,000k @ 7.5%

- #2 $16,000k @ 8.5%

- #3 $64,000k @ 8.5%

BUT, whichever one was used for NONE will no longer be an option for N/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started