Answered step by step

Verified Expert Solution

Question

1 Approved Answer

High-Low Method and Contribution Format Income Statement using Excel's SUM and Basic Math Functions Jay Corporation has provided data from a two-year period to

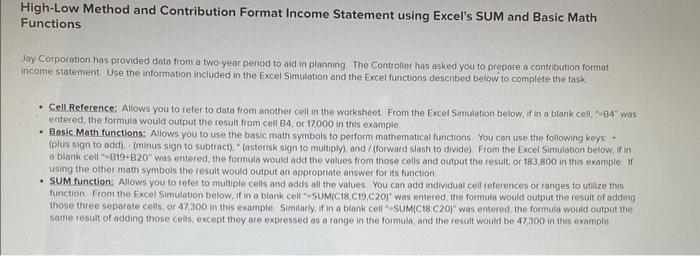

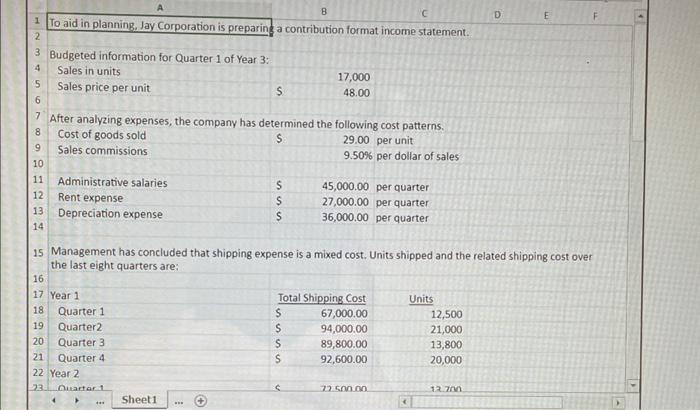

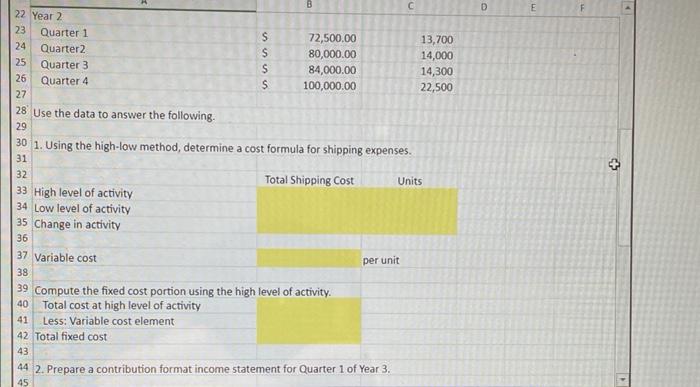

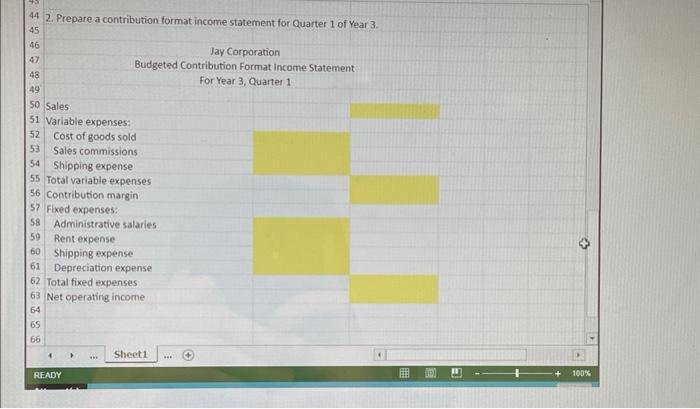

High-Low Method and Contribution Format Income Statement using Excel's SUM and Basic Math Functions Jay Corporation has provided data from a two-year period to aid in planning. The Controller has asked you to prepare a contribution format income statement Use the information included in the Excel Simulation and the Excel functions described below to complete the task Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, B4" was entered, the formula would output the result from cell B4, or 17,000 in this example. Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add). (minus sign to subtract). (asterisk sign to multiply), and /(forward slash to divide). From the Excel Simulation below, if in a blank cell B19-B20 was entered, the formula would add the values from those cells and output the result, or 183,800 in this example. If using the other math symbols the result would output an appropriate answer for its function SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function From the Excel Simulation below, if in a blank cell"-SUM(C18,C19 C20) was entered, the formule would output the result of adding those three separate cells, or 47.300 in this example. Similarly, if in a blank cell -SUM(C18 C20)" was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 47,300 in this example. B C D E 1 To aid in planning, Jay Corporation is preparing a contribution format income statement. 2 3 Budgeted information for Quarter 1 of Year 3: 4 Sales in units 17,000 5 Sales price per unit S 48.00 6 7 After analyzing expenses, the company has determined the following cost patterns. $ 29.00 per unit 8 Cost of goods sold 9 Sales commissions 10 11 Administrative salaries 12 Rent expense 13 Depreciation expense 14 9.50% per dollar of sales SSS 45,000.00 per quarter $ 27,000.00 per quarter $ 36,000.00 per quarter 15 Management has concluded that shipping expense is a mixed cost. Units shipped and the related shipping cost over the last eight quarters are: 16 17 Year 1 18 Quarter 1 19. Quarter2 20 Quarter 3 21 Quarter 4 22 Year 2 23 Quarter 1 Sheet1 Total Shipping Cost Units $ 67,000.00 12,500 $ 94,000.00 21,000 $ 89,800.00 13,800 $ 92,600.00 20,000 72.500.00 13.700 B C 22 Year 2 23 Quarter 1 $ 72,500.00 13,700 24 Quarter2 $ 80,000.00 14,000 25 Quarter 3 $ 84,000.00 14,300 26 Quarter 4 $ 100,000.00 22,500 27 28 Use the data to answer the following. 29 D 30 1. Using the high-low method, determine a cost formula for shipping expenses. 31 32 33 High level of activity 34 Low level of activity 35 Change in activity 36 37 Variable cost 38 Total Shipping Cost Units 39 Compute the fixed cost portion using the high level of activity. 401 Total cost at high level of activity 41 Less: Variable cost element 42 Total fixed cost 43 per unit 44 2. Prepare a contribution format income statement for Quarter 1 of Year 3. 45 E + 44 2. Prepare a contribution format income statement for Quarter 1 of Year 3. 45 46 47 48 49 Jay Corporation Budgeted Contribution Format Income Statement For Year 3, Quarter 1 50 Sales 51 Variable expenses: 52 Cost of goods sold 53 Sales commissions 54 Shipping expense 55 Total variable expenses 56 Contribution margin 57 Fixed expenses: 58 Administrative salaries 59 Rent expense 60 Shipping expense 61 Depreciation expense 62 Total fixed expenses 63 Net operating income 64 65 66 4 Sheet1 READY + 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started