Answered step by step

Verified Expert Solution

Question

1 Approved Answer

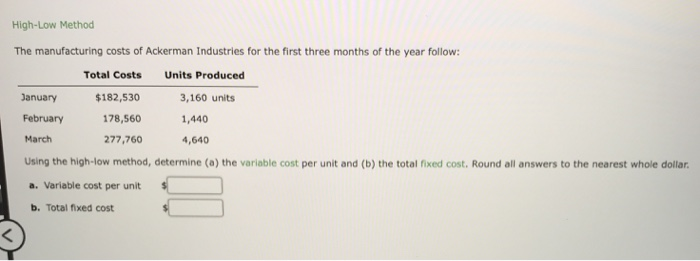

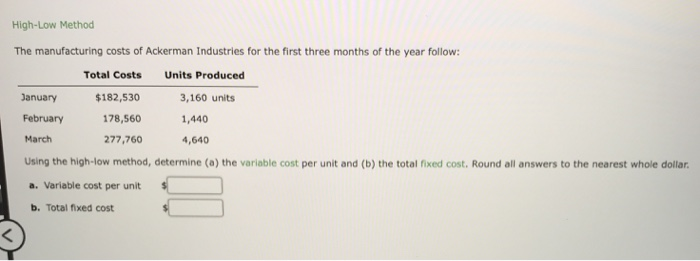

High-Low Method The manufacturing costs of Ackerman Industries for the first three months of the year follow Total Costs anuary$182,530 February 178,560 277,760 Units Produced

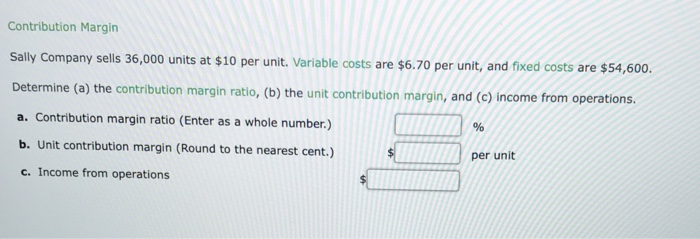

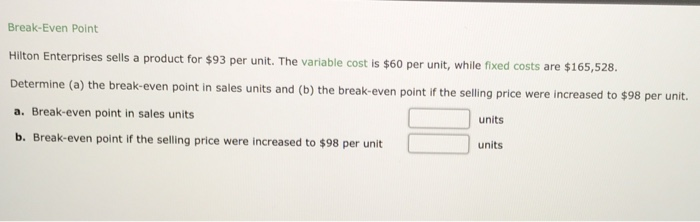

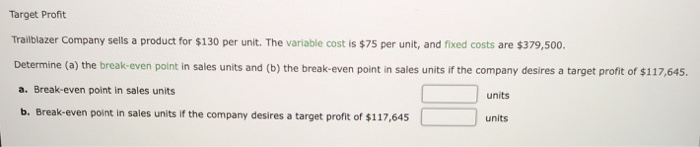

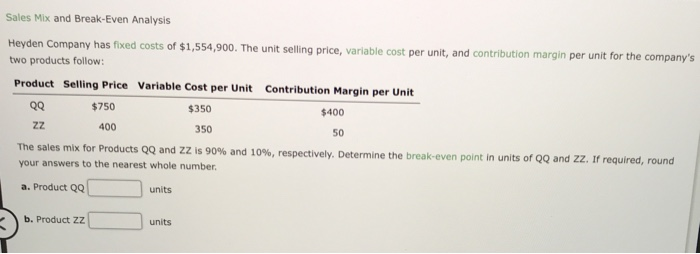

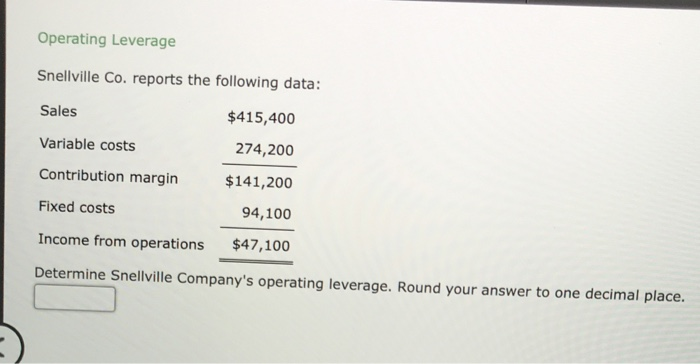

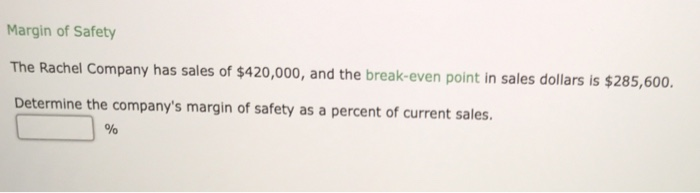

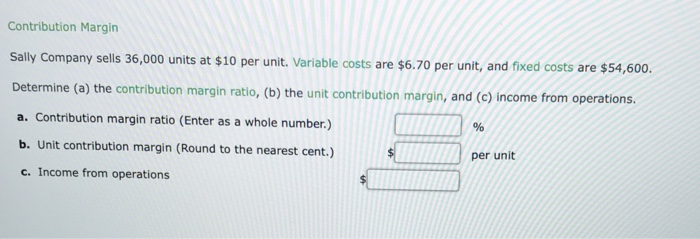

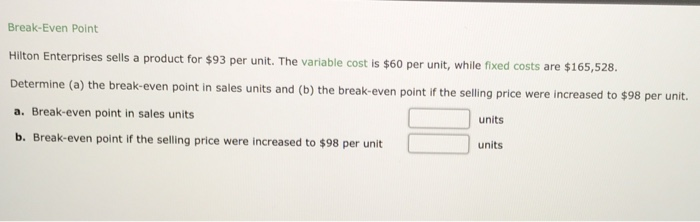

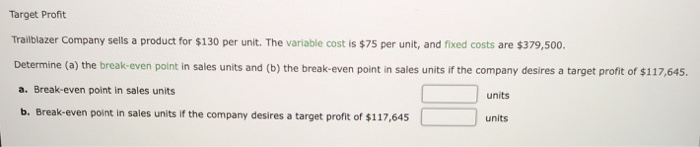

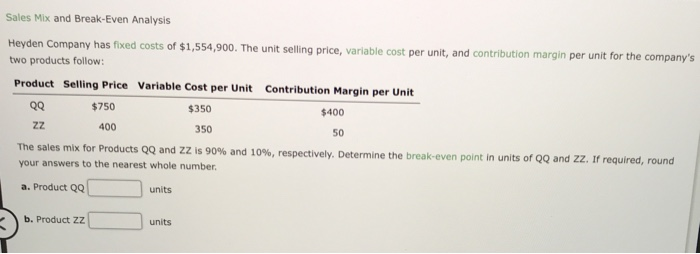

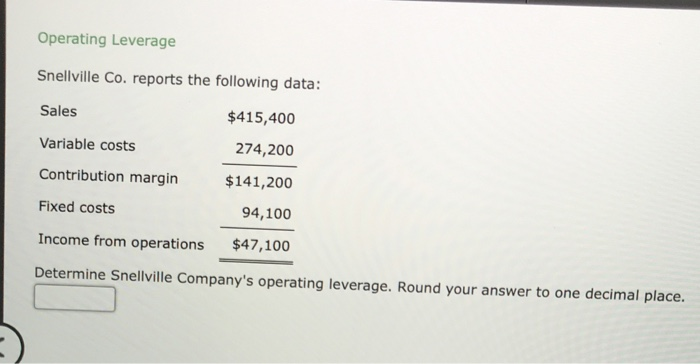

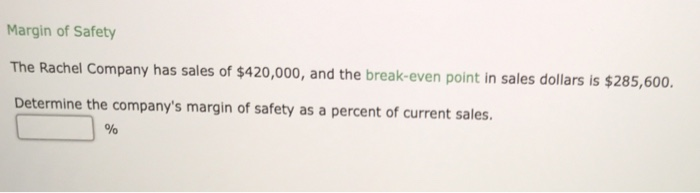

High-Low Method The manufacturing costs of Ackerman Industries for the first three months of the year follow Total Costs anuary$182,530 February 178,560 277,760 Units Produced 3,160 units 1,440 4,640 March Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. Round all answers to the nearest whole dollar a. Variable cost per unit b. Total fixed cost Contribution Margin Sally Company sells 36,000 units at $10 per unit. Variable costs are $6.70 per unit, and fixed Determ costs are $54,600. ine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations. a. Contribution margin ratio (Enter as a whole number.) b. Unit contribution margin (Round to the nearest cent.) c. Income from operations per unit Break-Even Point Hilton Enterprises Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $98 per unit. a. Break-even point in sales units sells a product for $93 per unit. The variable cost is $60 per unit, while fixed costs are $165,528. units b. Break-even point if the selling price were increased to $98 per unit units Target Profit Trailblazer Company sells a product for $130 per unit. The variable cost is $75 per unit, and fixed costs are $379,500. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $117,645. a. Break-even point in sales units units b. Break-even point in sales units if the company desires a target profit of $117,645 units Sales Mix and Break-Even Analysis of $1,554,900. The unit selling price, variable cost per unit, and contribution margin per unit for the company's Heyden Company has fixed costs two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit Q0 $750 $350 $400 zZ The sales mix for Products QQ and ZZ is 90% and 10%, respectively. Determine the break-even point in units of QQ and your answers to the nearest whole number a. Product QQ 400 350 50 Zz. If required, round units b. Product ZZ units Operating Leverage Snellville Co. reports the following data: Sales Variable costs Contribution margin 141,200 Fixed costs Income from operations $47,100 Determine Snellville Company's operating leverage. Round your answer to one decimal place. $415,400 274,200 94,100 Margin of Safety The Rachel Company has sales of $420,000, and the break-even point in sales dollars is $285,600. Determine the company's margin of safety as a percent of current sales

High-Low Method The manufacturing costs of Ackerman Industries for the first three months of the year follow Total Costs anuary$182,530 February 178,560 277,760 Units Produced 3,160 units 1,440 4,640 March Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. Round all answers to the nearest whole dollar a. Variable cost per unit b. Total fixed cost Contribution Margin Sally Company sells 36,000 units at $10 per unit. Variable costs are $6.70 per unit, and fixed Determ costs are $54,600. ine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations. a. Contribution margin ratio (Enter as a whole number.) b. Unit contribution margin (Round to the nearest cent.) c. Income from operations per unit Break-Even Point Hilton Enterprises Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $98 per unit. a. Break-even point in sales units sells a product for $93 per unit. The variable cost is $60 per unit, while fixed costs are $165,528. units b. Break-even point if the selling price were increased to $98 per unit units Target Profit Trailblazer Company sells a product for $130 per unit. The variable cost is $75 per unit, and fixed costs are $379,500. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $117,645. a. Break-even point in sales units units b. Break-even point in sales units if the company desires a target profit of $117,645 units Sales Mix and Break-Even Analysis of $1,554,900. The unit selling price, variable cost per unit, and contribution margin per unit for the company's Heyden Company has fixed costs two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit Q0 $750 $350 $400 zZ The sales mix for Products QQ and ZZ is 90% and 10%, respectively. Determine the break-even point in units of QQ and your answers to the nearest whole number a. Product QQ 400 350 50 Zz. If required, round units b. Product ZZ units Operating Leverage Snellville Co. reports the following data: Sales Variable costs Contribution margin 141,200 Fixed costs Income from operations $47,100 Determine Snellville Company's operating leverage. Round your answer to one decimal place. $415,400 274,200 94,100 Margin of Safety The Rachel Company has sales of $420,000, and the break-even point in sales dollars is $285,600. Determine the company's margin of safety as a percent of current sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started