Answered step by step

Verified Expert Solution

Question

1 Approved Answer

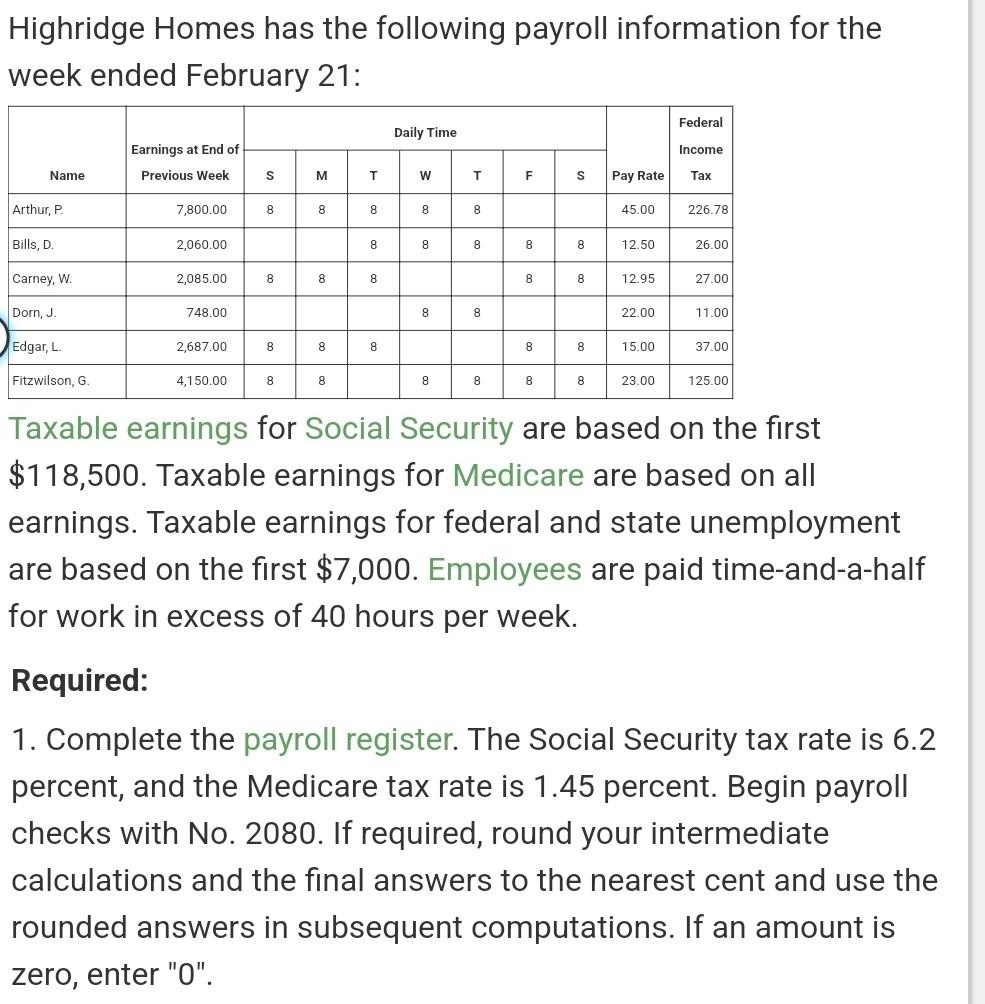

Highridge Homes has the following payroll information for the week ended February 21: Taxable earnings for Social Security are based on the first $118,500. Taxable

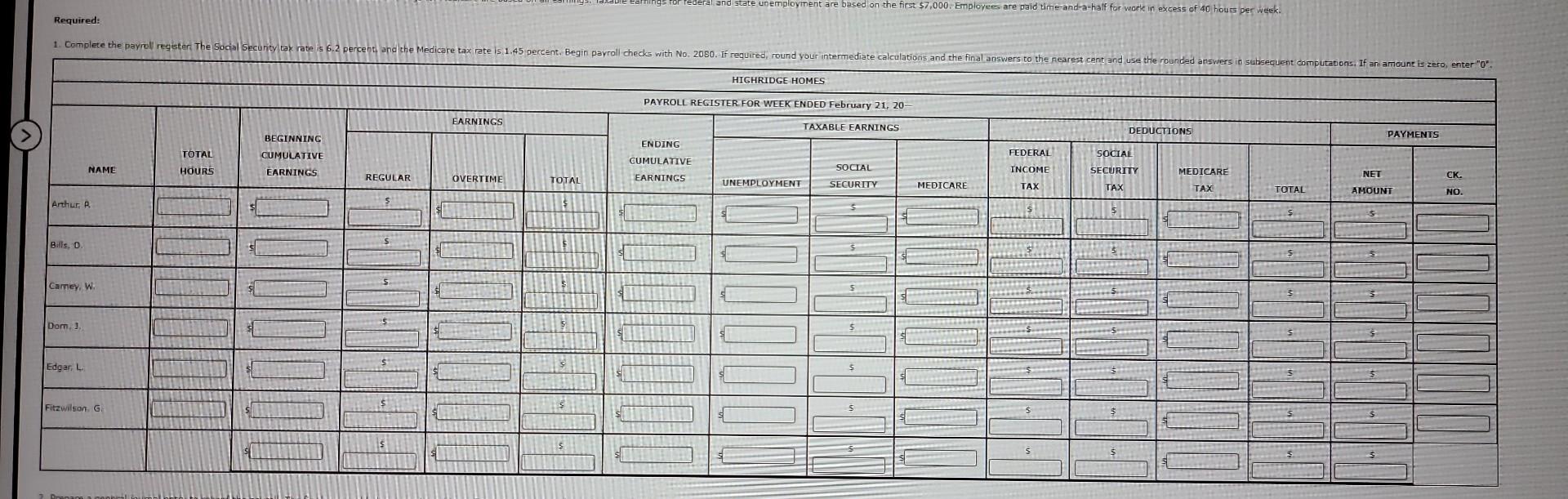

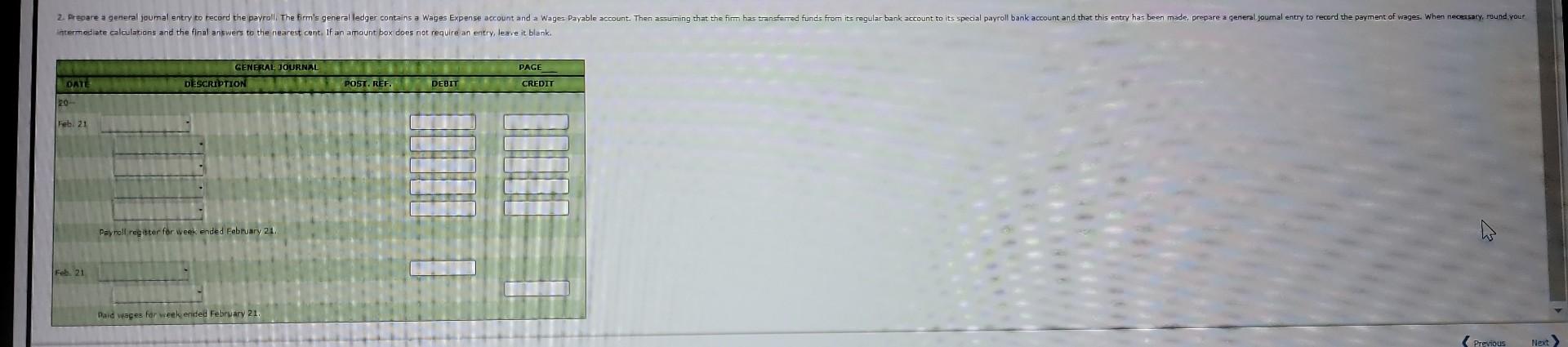

Highridge Homes has the following payroll information for the week ended February 21: Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week. Required: 1. Complete the payroll register. The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Begin payroll checks with No. 2080. If required, round your intermediate calculations and the final answers to the nearest cent and use the rounded answers in subsequent computations. If an amount is zero, enter "0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started