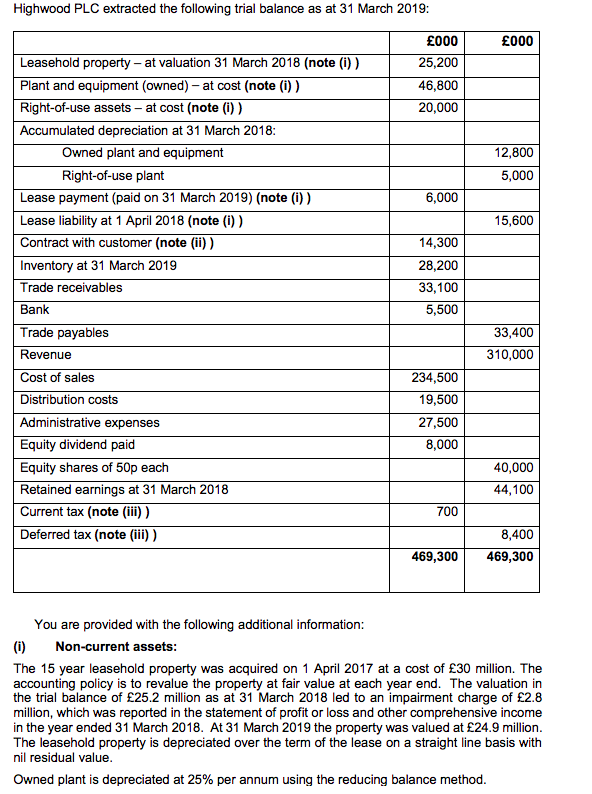

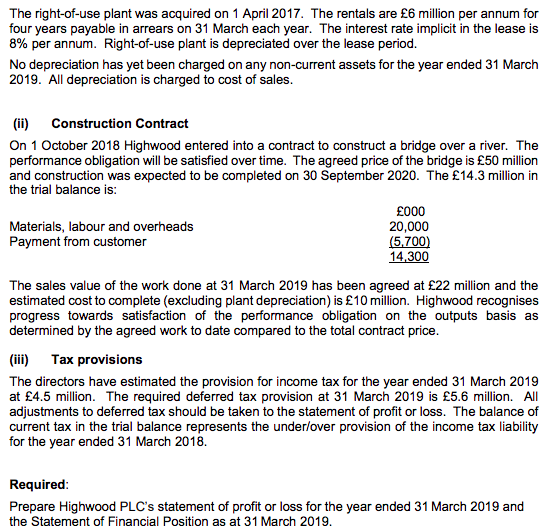

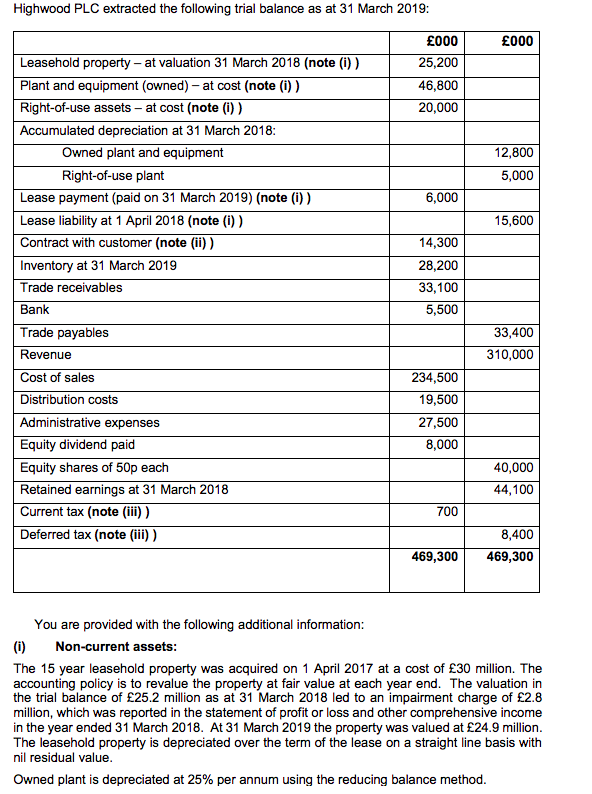

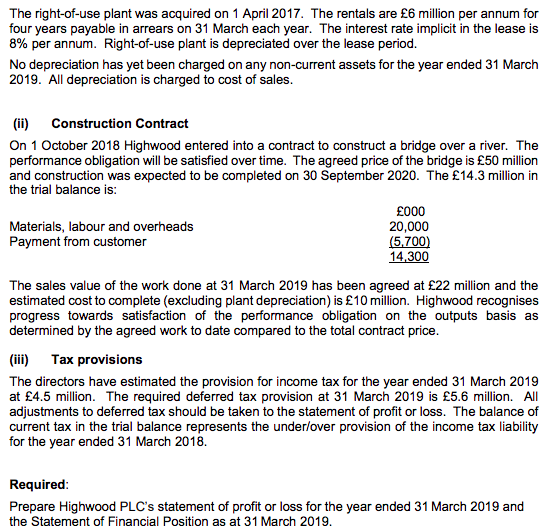

Highwood PLC extracted the following trial balance as at 31 March 2019: 000 000 25,200 46,800 20,000 12,800 5,000 Leasehold property-at valuation 31 March 2018 (note (1)) Plant and equipment (owned) - at cost (note (i)) Right-of-use assets - at cost (note (i)) Accumulated depreciation at 31 March 2018: Owned plant and equipment Right-of-use plant Lease payment (paid on 31 March 2019) (note ()) Lease liability at 1 April 2018 (note (0) ) Contract with customer (note (ii)) Inventory at 31 March 2019 Trade receivables Bank 6,000 15,600 14,300 28,200 33,100 5,500 Trade payables Revenue 33,400 310,000 234,500 19,500 27,500 8,000 Cost of sales Distribution costs Administrative expenses Equity dividend paid Equity shares of 50p each Retained earnings at 31 March 2018 Current tax (note (iii)) Deferred tax (note (iii)) 40,000 44,100 700 8,400 469,300 469,300 You are provided with the following additional information: (i) Non-current assets: The 15 year leasehold property was acquired on 1 April 2017 at a cost of 30 million. The accounting policy is to revalue the property at fair value at each year end. The valuation in the trial balance of 25.2 million as at 31 March 2018 led to an impairment charge of 2.8 million, which was reported in the statement of profit or loss and other comprehensive income in the year ended 31 March 2018. At 31 March 2019 the property was valued at 24.9 million. The leasehold property is depreciated over the term of the lease on a straight line basis with nil residual value. Owned plant is depreciated at 25% per annum using the reducing balance method. The right-of-use plant was acquired on 1 April 2017. The rentals are 6 million per annum for four years payable in arrears on 31 March each year. The interest rate implicit in the lease is 8% per annum. Right-of-use plant is depreciated over the lease period. No depreciation has yet been charged on any non-current assets for the year ended 31 March 2019. All depreciation is charged to cost of sales. (ii) Construction Contract On 1 October 2018 Highwood entered into a contract to construct a bridge over a river. The performance obligation will be satisfied over time. The agreed price of the bridge is 50 million and construction was expected to be completed on 30 September 2020. The 14.3 million in the trial balance is: 000 Materials, labour and overheads 20,000 Payment from customer (5,700) 14,300 The sales value of the work done at 31 March 2019 has been agreed at 22 million and the estimated cost to complete (excluding plant depreciation) is 10 million. Highwood recognises progress towards satisfaction of the performance obligation on the outputs basis as determined by the agreed work to date compared to the total contract price. (iii) Tax provisions The directors have estimated the provision for income tax for the year ended 31 March 2019 at 4.5 million. The required deferred tax provision at 31 March 2019 is 5.6 million. All adjustments to deferred tax should be taken to the statement of profit or loss. The balance of current tax in the trial balance represents the under/over provision of the income tax liability for the year ended 31 March 2018. Required: Prepare Highwood PLC's statement of profit or loss for the year ended 31 March 2019 and the Statement of Financial Position as at 31 March 2019. Highwood PLC extracted the following trial balance as at 31 March 2019: 000 000 25,200 46,800 20,000 12,800 5,000 Leasehold property-at valuation 31 March 2018 (note (1)) Plant and equipment (owned) - at cost (note (i)) Right-of-use assets - at cost (note (i)) Accumulated depreciation at 31 March 2018: Owned plant and equipment Right-of-use plant Lease payment (paid on 31 March 2019) (note ()) Lease liability at 1 April 2018 (note (0) ) Contract with customer (note (ii)) Inventory at 31 March 2019 Trade receivables Bank 6,000 15,600 14,300 28,200 33,100 5,500 Trade payables Revenue 33,400 310,000 234,500 19,500 27,500 8,000 Cost of sales Distribution costs Administrative expenses Equity dividend paid Equity shares of 50p each Retained earnings at 31 March 2018 Current tax (note (iii)) Deferred tax (note (iii)) 40,000 44,100 700 8,400 469,300 469,300 You are provided with the following additional information: (i) Non-current assets: The 15 year leasehold property was acquired on 1 April 2017 at a cost of 30 million. The accounting policy is to revalue the property at fair value at each year end. The valuation in the trial balance of 25.2 million as at 31 March 2018 led to an impairment charge of 2.8 million, which was reported in the statement of profit or loss and other comprehensive income in the year ended 31 March 2018. At 31 March 2019 the property was valued at 24.9 million. The leasehold property is depreciated over the term of the lease on a straight line basis with nil residual value. Owned plant is depreciated at 25% per annum using the reducing balance method. The right-of-use plant was acquired on 1 April 2017. The rentals are 6 million per annum for four years payable in arrears on 31 March each year. The interest rate implicit in the lease is 8% per annum. Right-of-use plant is depreciated over the lease period. No depreciation has yet been charged on any non-current assets for the year ended 31 March 2019. All depreciation is charged to cost of sales. (ii) Construction Contract On 1 October 2018 Highwood entered into a contract to construct a bridge over a river. The performance obligation will be satisfied over time. The agreed price of the bridge is 50 million and construction was expected to be completed on 30 September 2020. The 14.3 million in the trial balance is: 000 Materials, labour and overheads 20,000 Payment from customer (5,700) 14,300 The sales value of the work done at 31 March 2019 has been agreed at 22 million and the estimated cost to complete (excluding plant depreciation) is 10 million. Highwood recognises progress towards satisfaction of the performance obligation on the outputs basis as determined by the agreed work to date compared to the total contract price. (iii) Tax provisions The directors have estimated the provision for income tax for the year ended 31 March 2019 at 4.5 million. The required deferred tax provision at 31 March 2019 is 5.6 million. All adjustments to deferred tax should be taken to the statement of profit or loss. The balance of current tax in the trial balance represents the under/over provision of the income tax liability for the year ended 31 March 2018. Required: Prepare Highwood PLC's statement of profit or loss for the year ended 31 March 2019 and the Statement of Financial Position as at 31 March 2019