Question

What are the three important questions of corporate finance you will need to address in your company? Please briefly explain them and indicate how they

What are the three important questions of corporate finance you will need to address in your company? Please briefly explain them and indicate how they are related to the areas in the balance sheet of your company.

three important questions:

1. What long-term investments should you take on? That is, what lines of business will you be in and what sorts of buildings, machinery, and equipment will you need?

2. Where will you get the long-term financing to pay for your investment? Will you bring in other owners or will you borrow the money?

3. How will you manage your everyday financial activities such as collecting from cus tomers and paying suppliers?

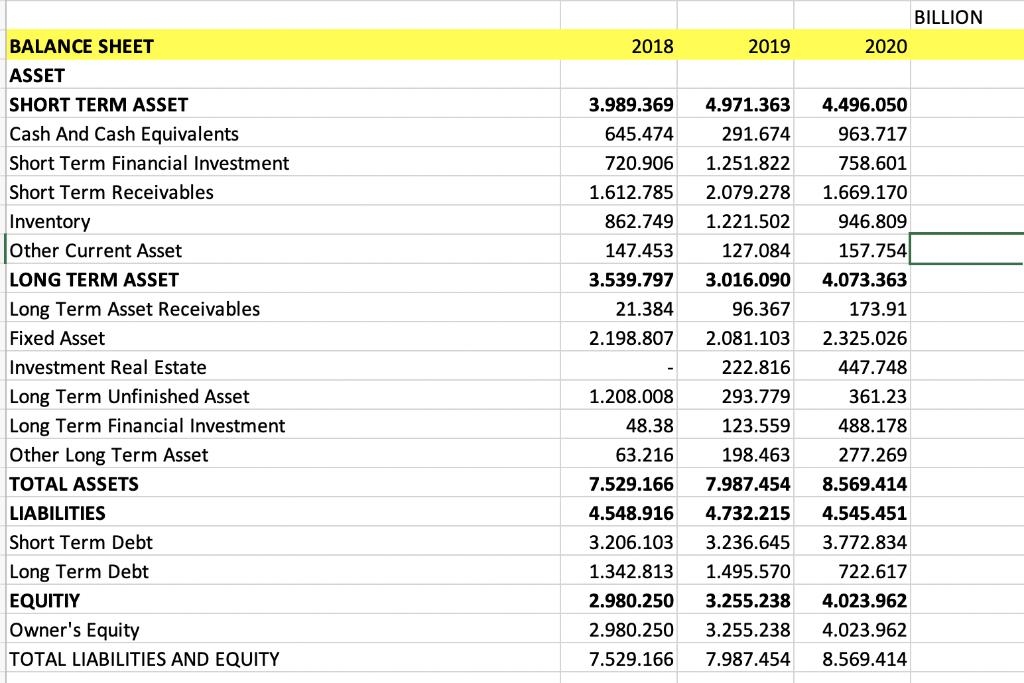

BALANCE SHEET ASSET SHORT TERM ASSET Cash And Cash Equivalents Short Term Financial Investment Short Term Receivables Inventory Other Current Asset LONG TERM ASSET Long Term Asset Receivables Fixed Asset Investment Real Estate Long Term Unfinished Asset Long Term Financial Investment Other Long Term Asset TOTAL ASSETS LIABILITIES Short Term Debt Long Term Debt EQUITIY Owner's Equity TOTAL LIABILITIES AND EQUITY 2018 2019 2020 3.989.369 4.971.363 4.496.050 645.474 291.674 963.717 720.906 1.251.822 758.601 1.612.785 2.079.278 1.669.170 862.749 1.221.502 946.809 147.453 127.084 157.754 3.539.797 3.016.090 4.073.363 21.384 96.367 173.91 2.198.807 2.081.103 2.325.026 222.816 447.748 1.208.008 293.779 361.23 48.38 123.559 488.178 63.216 198.463 277.269 7.529.166 7.987.454 8.569.414 4.548.916 4.732.215 4.545.451 3.206.103 3.236.645 3.772.834 1.342.813 1.495.570 722.617 2.980.250 3.255.238 4.023.962 2.980.250 3.255.238 4.023.962 7.529.166 7.987.454 8.569.414 BILLION

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 What longterm investments should you take on That is what lines of business will you be in and what sorts of buildings machinery and equipment will you need This question of longterm investments is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started