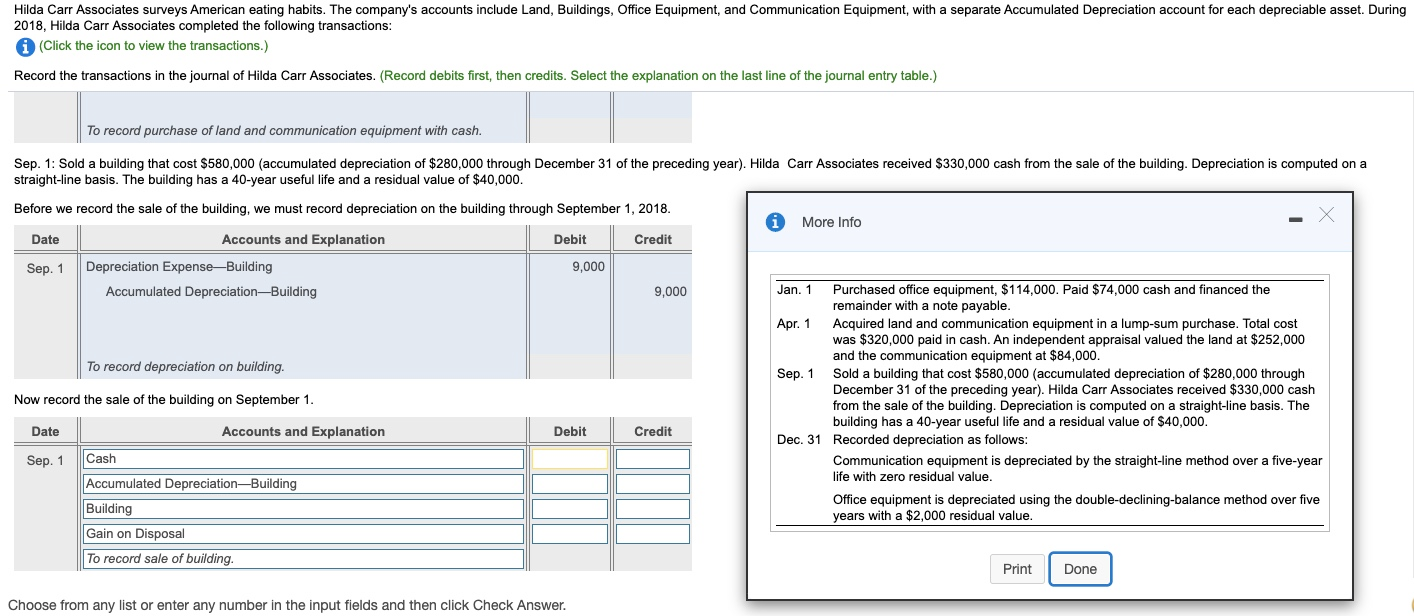

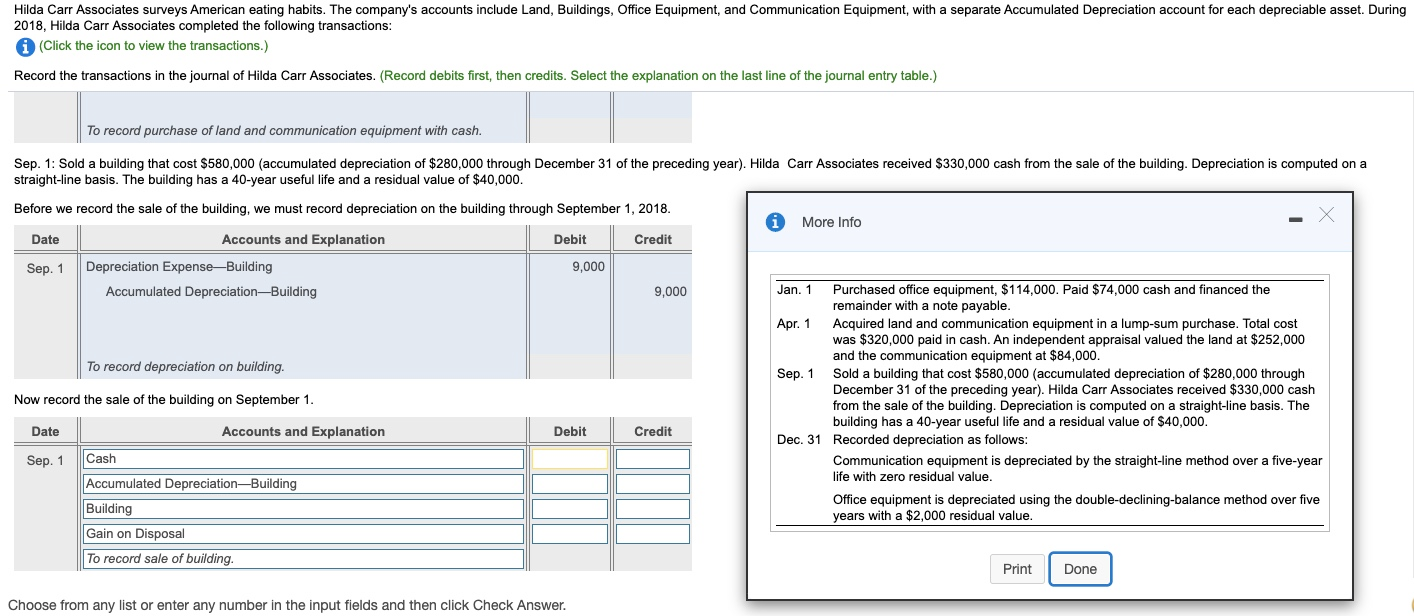

Hilda Carr Associates surveys American eating habits. The company's accounts include Land, Buildings, Office Equipment, and Communication Equipment, with a separate Accumulated Depreciation account for each depreciable asset. During 2018, Hilda Carr Associates completed the following transactions: (Click the icon to view the transactions.) Record the transactions in the journal of Hilda Carr Associates. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) To record purchase of land and communication equipment with cash. Sep. 1: Sold a building that cost $580,000 (accumulated depreciation of $280,000 through December 31 of the preceding year). Hilda Carr Associates received $330,000 cash from the sale of the building. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $40,000. i More Info Before we record the sale of the building, we must record depreciation on the building through September 1, 2018. Date Accounts and Explanation Debit Credit Sep. 1 Depreciation Expense-Building 9,000 Accumulated Depreciation Building 9,000 To record depreciation on building. Now record the sale of the building on September 1. Jan. 1 Purchased office equipment, $114,000. Paid $74,000 cash and financed the remainder with a note payable. Apr. 1 Acquired land and communication equipment in a lump-sum purchase. Total cost was $320.000 paid in cash. An in aid in cash. An independent appraisal valued the land at $252,000 and the communication equipment at $84,000. Sep. 1 Sold a building that cost $580,000 (accumulated depreciation of $280,000 through December 31 of the preceding year). Hilda Carr Associates received $330,000 cash from the sale of the building. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $40,000. Dec. 31 Recorded depreciation as follows: Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value. Office equipment is depreciated using the double-declining-balance method over five years with a $2,000 residual value. Date Accounts and Explanation Debit Credit Sep. 1 Cash Accumulated DepreciationBuilding Building Gain on Disposal To record sale of building. Print Done Choose from any list or enter any number in the input fields and then click Check