Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hillary's Trumpets is a business situated on Rondebosch Main Road which sells trumpets and other musical instruments to music students studying at UCT. The

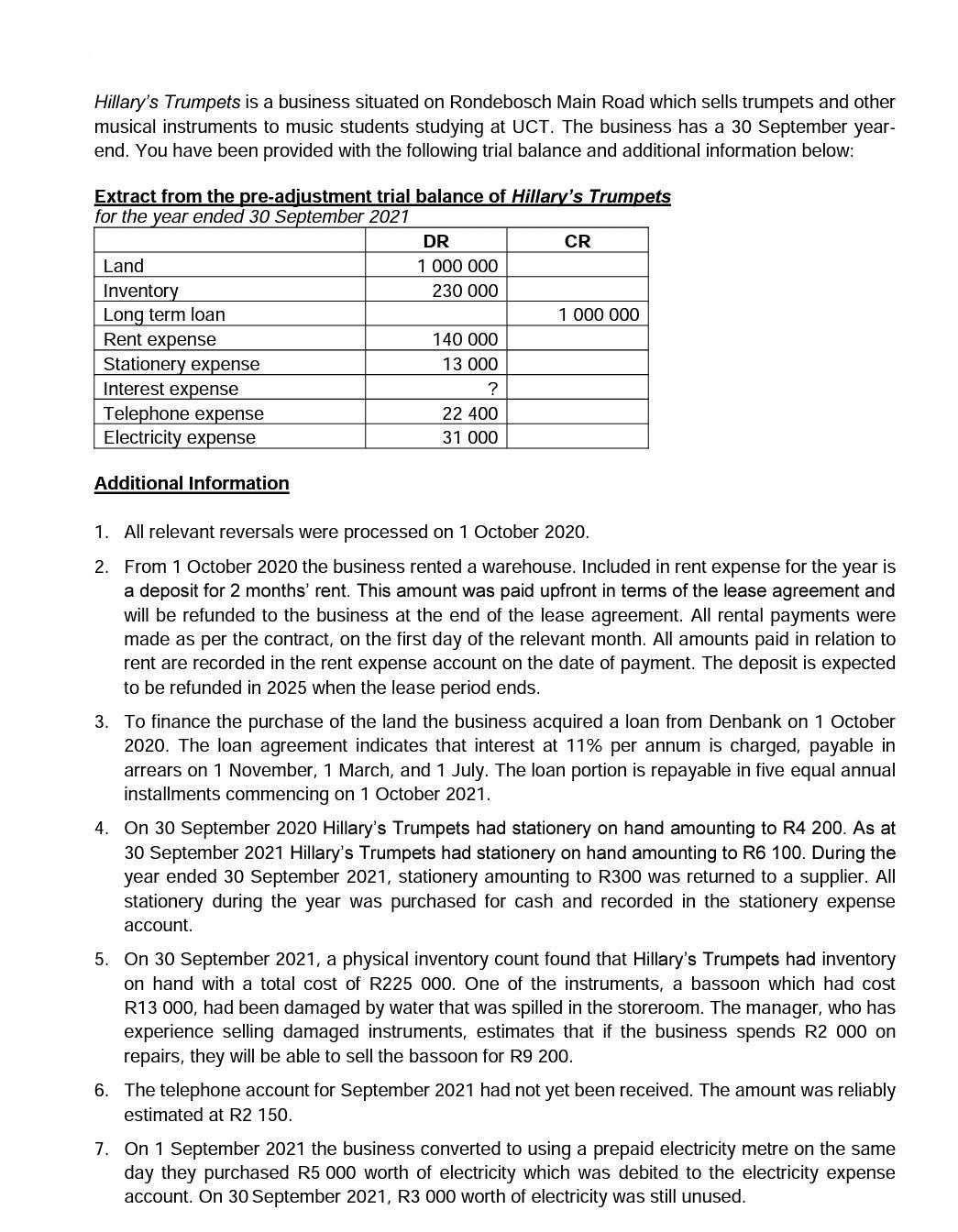

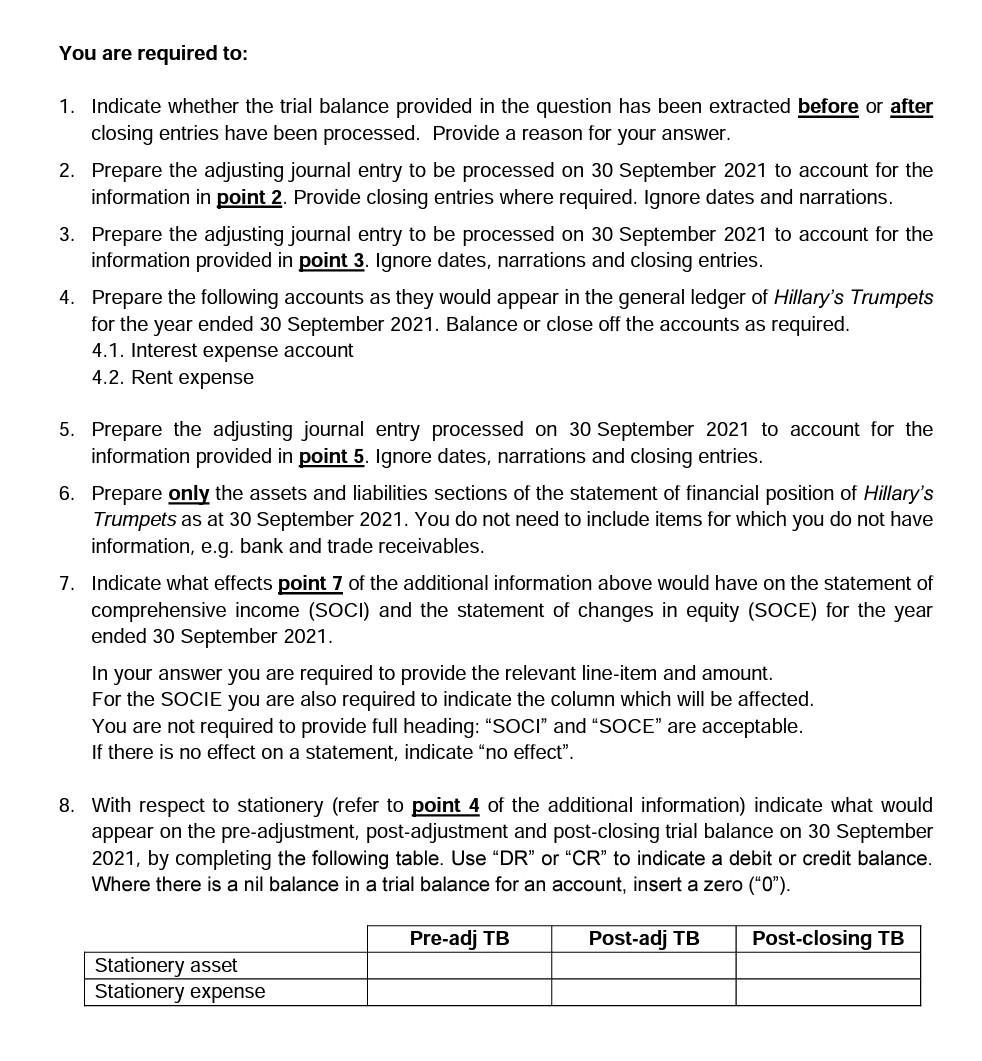

Hillary's Trumpets is a business situated on Rondebosch Main Road which sells trumpets and other musical instruments to music students studying at UCT. The business has a 30 September year- end. You have been provided with the following trial balance and additional information below: Extract from the pre-adjustment trial balance of Hillary's Trumpets for the year ended 30 September 2021 DR CR Land 1 000 000 Inventory Long term loan Rent expense Stationery expense Interest expense Telephone expense Electricity expense 230 000 1 000 000 140 000 13 000 22 400 31 000 Additional Information 1. All relevant reversals were processed on 1 October 2020. 2. From 1 October 2020 the business rented a warehouse. Included in rent expense for the year is a deposit for 2 months' rent. This amount was paid upfront in terms of the lease agreement and will be refunded to the business at the end of the lease agreement. All rental payments were made as per the contract, on the first day of the relevant month. All amounts paid in relation to rent are recorded in the rent expense account on the date of payment. The deposit is expected to be refunded in 2025 when the lease period ends. 3. To finance the purchase of the land the business acquired a loan from Denbank on 1 October 2020. The loan agreement indicates that interest at 11% per annum is charged, payable in arrears on 1 November, 1 March, and 1 July. The loan portion is repayable in five equal annual installments commencing on 1 October 2021. 4. On 30 September 2020 Hillary's Trumpets had stationery on hand amounting to R4 200. As at 30 September 2021 Hillary's Trumpets had stationery on hand amounting to R6 100. During the year ended 30 September 2021, stationery amounting to R300 was returned to a supplier. All stationery during the year was purchased for cash and recorded in the stationery expense account. 5. On 30 September 2021, a physical inventory count found that Hillary's Trumpets had inventory on hand with a total cost of R225 000. One of the instruments, a bassoon which had cost R13 000, had been damaged by water that was spilled in the storeroom. The manager, who has experience selling damaged instruments, estimates that if the business spends R2 000 on repairs, they will be able to sell the bassoon for R9 200. 6. The telephone account for September 2021 had not yet been received. The amount was reliably estimated at R2 150. 7. On 1 September 2021 the business converted to using a prepaid electricity metre on the same day they purchased R5 000 worth of electricity which was debited to the electricity expense account. On 30 September 2021, R3 000 worth of electricity was still unused. You are required to: 1. Indicate whether the trial balance provided in the question has been extracted before or after closing entries have been processed. Provide a reason for your answer. 2. Prepare the adjusting journal entry to be processed on 30 September 2021 to account for the information in point 2. Provide closing entries where required. Ignore dates and narrations. 3. Prepare the adjusting journal entry to be processed on 30 September 2021 to account for the information provided in point 3. Ignore dates, narrations and closing entries. 4. Prepare the following accounts as they would appear in the general ledger of Hillary's Trumpets for the year ended 30 September 2021. Balance or close off the accounts as required. 4.1. Interest expense account 4.2. Rent expense 5. Prepare the adjusting journal entry processed on 30 September 2021 to account for the information provided in point 5. Ignore dates, narrations and closing entries. 6. Prepare only the assets and liabilities sections of the statement of financial position of Hillary's Trumpets as at 30 September 2021. You do not need to include items for which you do not have information, e.g. bank and trade receivables. 7. Indicate what effects point 7 of the additional information above would have on the statement of comprehensive income (SOCI) and the statement of changes in equity (SOCE) for the year ended 30 September 2021. In your answer you are required to provide the relevant line-item and amount. For the SOCIE you are also required to indicate the column which will be affected. You are not required to provide full heading: "SOCI" and "SOCE" are acceptable. If there is no effect on a statement, indicate "no effect". 8. With respect to stationery (refer to point 4 of the additional information) indicate what would appear on the pre-adjustment, post-adjustment and post-closing trial balance on 30 September 2021, by completing the following table. Use "DR" or "CR" to indicate a debit or credit balance. Where there is a nil balance in a trial balance for an account, insert a zero ("0"). Pre-adj TB Post-adj TB Post-closing TB Stationery asset Stationery expense Hillary's Trumpets is a business situated on Rondebosch Main Road which sells trumpets and other musical instruments to music students studying at UCT. The business has a 30 September year- end. You have been provided with the following trial balance and additional information below: Extract from the pre-adjustment trial balance of Hillary's Trumpets for the year ended 30 September 2021 DR CR Land 1 000 000 Inventory Long term loan Rent expense Stationery expense Interest expense Telephone expense Electricity expense 230 000 1 000 000 140 000 13 000 22 400 31 000 Additional Information 1. All relevant reversals were processed on 1 October 2020. 2. From 1 October 2020 the business rented a warehouse. Included in rent expense for the year is a deposit for 2 months' rent. This amount was paid upfront in terms of the lease agreement and will be refunded to the business at the end of the lease agreement. All rental payments were made as per the contract, on the first day of the relevant month. All amounts paid in relation to rent are recorded in the rent expense account on the date of payment. The deposit is expected to be refunded in 2025 when the lease period ends. 3. To finance the purchase of the land the business acquired a loan from Denbank on 1 October 2020. The loan agreement indicates that interest at 11% per annum is charged, payable in arrears on 1 November, 1 March, and 1 July. The loan portion is repayable in five equal annual installments commencing on 1 October 2021. 4. On 30 September 2020 Hillary's Trumpets had stationery on hand amounting to R4 200. As at 30 September 2021 Hillary's Trumpets had stationery on hand amounting to R6 100. During the year ended 30 September 2021, stationery amounting to R300 was returned to a supplier. All stationery during the year was purchased for cash and recorded in the stationery expense account. 5. On 30 September 2021, a physical inventory count found that Hillary's Trumpets had inventory on hand with a total cost of R225 000. One of the instruments, a bassoon which had cost R13 000, had been damaged by water that was spilled in the storeroom. The manager, who has experience selling damaged instruments, estimates that if the business spends R2 000 on repairs, they will be able to sell the bassoon for R9 200. 6. The telephone account for September 2021 had not yet been received. The amount was reliably estimated at R2 150. 7. On 1 September 2021 the business converted to using a prepaid electricity metre on the same day they purchased R5 000 worth of electricity which was debited to the electricity expense account. On 30 September 2021, R3 000 worth of electricity was still unused. You are required to: 1. Indicate whether the trial balance provided in the question has been extracted before or after closing entries have been processed. Provide a reason for your answer. 2. Prepare the adjusting journal entry to be processed on 30 September 2021 to account for the information in point 2. Provide closing entries where required. Ignore dates and narrations. 3. Prepare the adjusting journal entry to be processed on 30 September 2021 to account for the information provided in point 3. Ignore dates, narrations and closing entries. 4. Prepare the following accounts as they would appear in the general ledger of Hillary's Trumpets for the year ended 30 September 2021. Balance or close off the accounts as required. 4.1. Interest expense account 4.2. Rent expense 5. Prepare the adjusting journal entry processed on 30 September 2021 to account for the information provided in point 5. Ignore dates, narrations and closing entries. 6. Prepare only the assets and liabilities sections of the statement of financial position of Hillary's Trumpets as at 30 September 2021. You do not need to include items for which you do not have information, e.g. bank and trade receivables. 7. Indicate what effects point 7 of the additional information above would have on the statement of comprehensive income (SOCI) and the statement of changes in equity (SOCE) for the year ended 30 September 2021. In your answer you are required to provide the relevant line-item and amount. For the SOCIE you are also required to indicate the column which will be affected. You are not required to provide full heading: "SOCI" and "SOCE" are acceptable. If there is no effect on a statement, indicate "no effect". 8. With respect to stationery (refer to point 4 of the additional information) indicate what would appear on the pre-adjustment, post-adjustment and post-closing trial balance on 30 September 2021, by completing the following table. Use "DR" or "CR" to indicate a debit or credit balance. Where there is a nil balance in a trial balance for an account, insert a zero ("0"). Pre-adj TB Post-adj TB Post-closing TB Stationery asset Stationery expense Hillary's Trumpets is a business situated on Rondebosch Main Road which sells trumpets and other musical instruments to music students studying at UCT. The business has a 30 September year- end. You have been provided with the following trial balance and additional information below: Extract from the pre-adjustment trial balance of Hillary's Trumpets for the year ended 30 September 2021 DR CR Land 1 000 000 Inventory Long term loan Rent expense Stationery expense Interest expense Telephone expense Electricity expense 230 000 1 000 000 140 000 13 000 22 400 31 000 Additional Information 1. All relevant reversals were processed on 1 October 2020. 2. From 1 October 2020 the business rented a warehouse. Included in rent expense for the year is a deposit for 2 months' rent. This amount was paid upfront in terms of the lease agreement and will be refunded to the business at the end of the lease agreement. All rental payments were made as per the contract, on the first day of the relevant month. All amounts paid in relation to rent are recorded in the rent expense account on the date of payment. The deposit is expected to be refunded in 2025 when the lease period ends. 3. To finance the purchase of the land the business acquired a loan from Denbank on 1 October 2020. The loan agreement indicates that interest at 11% per annum is charged, payable in arrears on 1 November, 1 March, and 1 July. The loan portion is repayable in five equal annual installments commencing on 1 October 2021. 4. On 30 September 2020 Hillary's Trumpets had stationery on hand amounting to R4 200. As at 30 September 2021 Hillary's Trumpets had stationery on hand amounting to R6 100. During the year ended 30 September 2021, stationery amounting to R300 was returned to a supplier. All stationery during the year was purchased for cash and recorded in the stationery expense account. 5. On 30 September 2021, a physical inventory count found that Hillary's Trumpets had inventory on hand with a total cost of R225 000. One of the instruments, a bassoon which had cost R13 000, had been damaged by water that was spilled in the storeroom. The manager, who has experience selling damaged instruments, estimates that if the business spends R2 000 on repairs, they will be able to sell the bassoon for R9 200. 6. The telephone account for September 2021 had not yet been received. The amount was reliably estimated at R2 150. 7. On 1 September 2021 the business converted to using a prepaid electricity metre on the same day they purchased R5 000 worth of electricity which was debited to the electricity expense account. On 30 September 2021, R3 000 worth of electricity was still unused. You are required to: 1. Indicate whether the trial balance provided in the question has been extracted before or after closing entries have been processed. Provide a reason for your answer. 2. Prepare the adjusting journal entry to be processed on 30 September 2021 to account for the information in point 2. Provide closing entries where required. Ignore dates and narrations. 3. Prepare the adjusting journal entry to be processed on 30 September 2021 to account for the information provided in point 3. Ignore dates, narrations and closing entries. 4. Prepare the following accounts as they would appear in the general ledger of Hillary's Trumpets for the year ended 30 September 2021. Balance or close off the accounts as required. 4.1. Interest expense account 4.2. Rent expense 5. Prepare the adjusting journal entry processed on 30 September 2021 to account for the information provided in point 5. Ignore dates, narrations and closing entries. 6. Prepare only the assets and liabilities sections of the statement of financial position of Hillary's Trumpets as at 30 September 2021. You do not need to include items for which you do not have information, e.g. bank and trade receivables. 7. Indicate what effects point 7 of the additional information above would have on the statement of comprehensive income (SOCI) and the statement of changes in equity (SOCE) for the year ended 30 September 2021. In your answer you are required to provide the relevant line-item and amount. For the SOCIE you are also required to indicate the column which will be affected. You are not required to provide full heading: "SOCI" and "SOCE" are acceptable. If there is no effect on a statement, indicate "no effect". 8. With respect to stationery (refer to point 4 of the additional information) indicate what would appear on the pre-adjustment, post-adjustment and post-closing trial balance on 30 September 2021, by completing the following table. Use "DR" or "CR" to indicate a debit or credit balance. Where there is a nil balance in a trial balance for an account, insert a zero ("0"). Pre-adj TB Post-adj TB Post-closing TB Stationery asset Stationery expense

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Ans1 In a Post Closing Trial Balance there are no lines relating to Nominal items revenue and expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started