Answered step by step

Verified Expert Solution

Question

1 Approved Answer

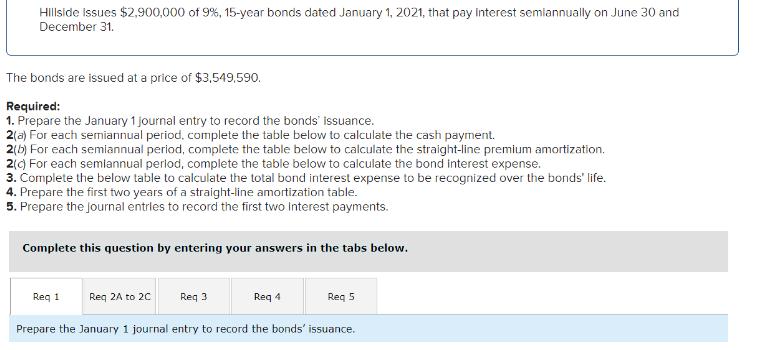

Hillside Issues $2,900,000 of 9%, 15-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31. The bonds are

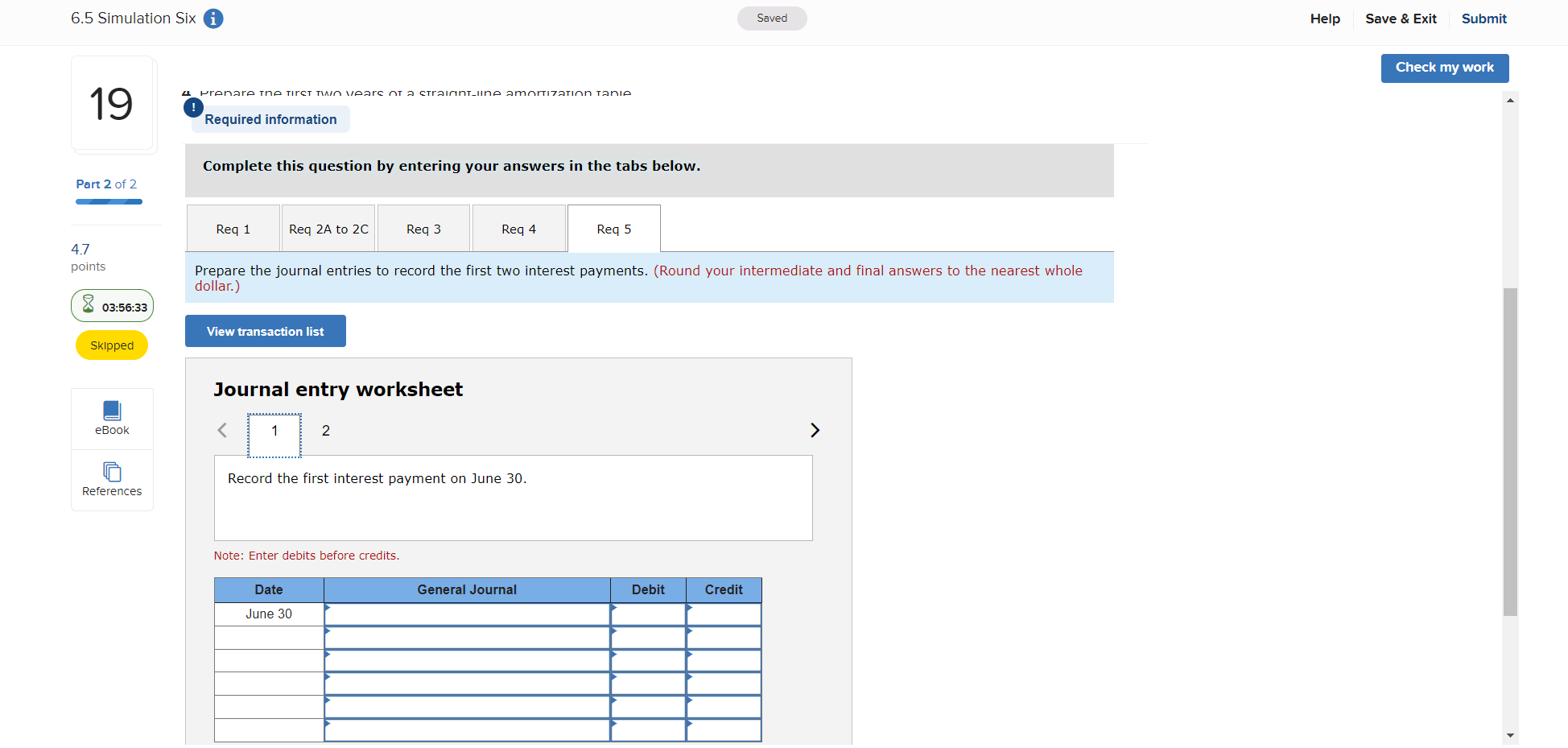

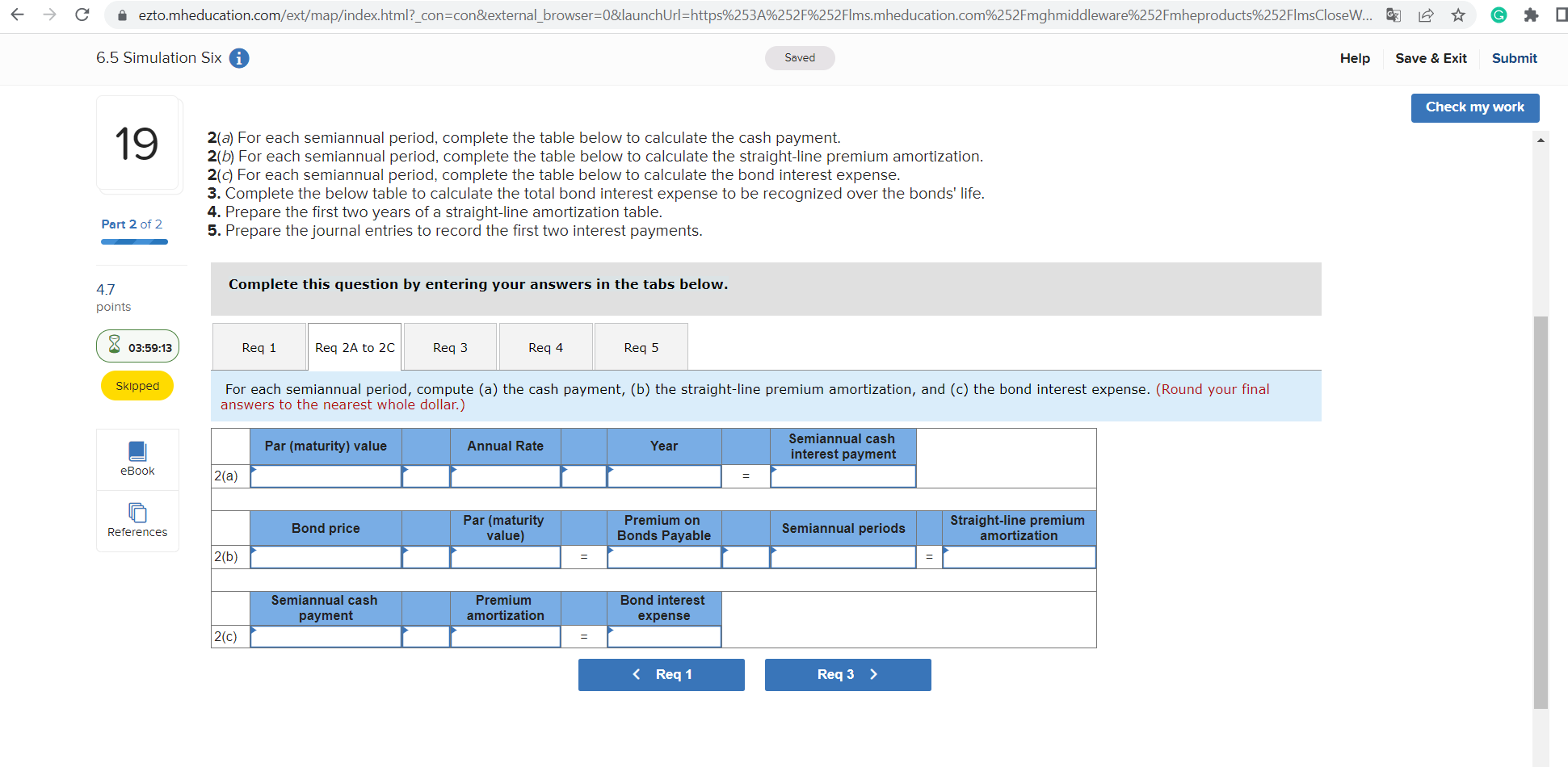

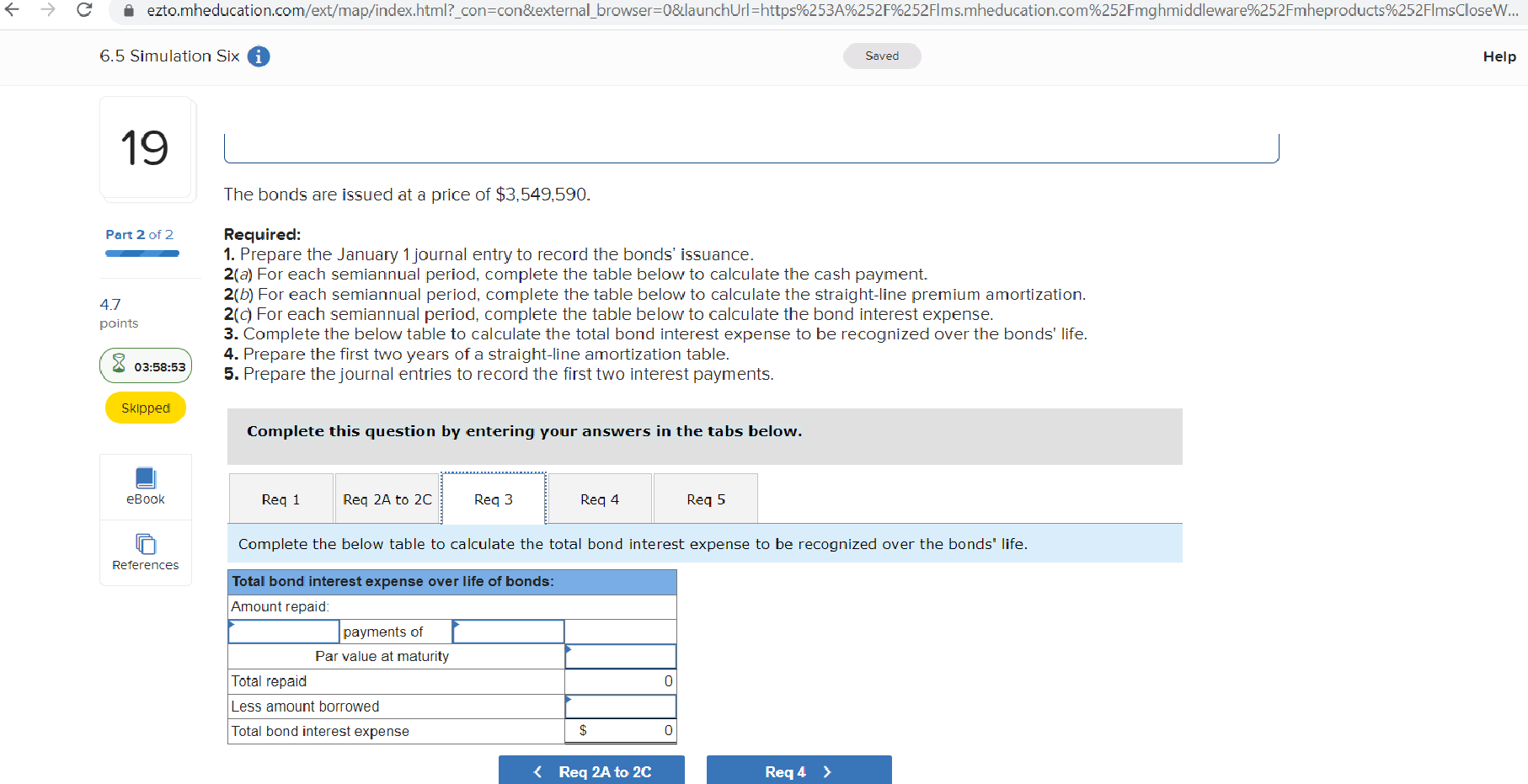

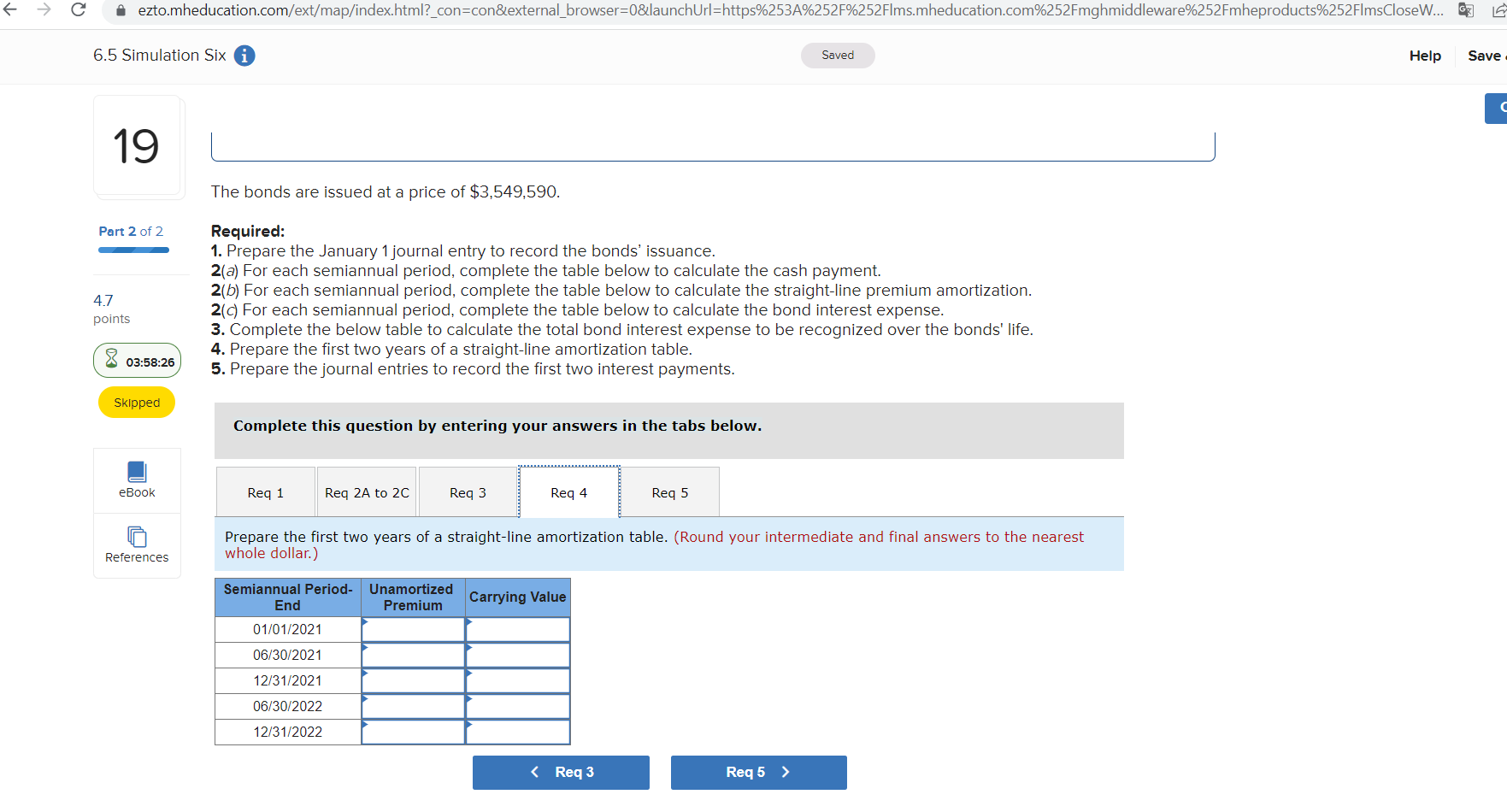

Hillside Issues $2,900,000 of 9%, 15-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $3,549,590. Required: 1. Prepare the January 1 journal entry to record the bonds' Issuance. 2(a) For each semiannual period, complete the table below to calculate the cash payment. 2(b) For each semiannual period, complete the table below to calculate the straight-line premium amortization. 2(c) For each semiannual period, complete the table below to calculate the bond interest expense. 3. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 4. Prepare the first two years of a straight-line amortization table. 5. Prepare the journal entries to record the first two Interest payments. Complete this question by entering your answers in the tabs below. Req 1 Req 2A to 2C Req 3 Req 4 Req 5 Prepare the January 1 journal entry to record the bonds' issuance. 6.5 Simulation Six 19 Part 2 of 2 4.7 points 03:56:33 Skipped eBook References Prenare the first two years of a straight-line amortization Tanie Required information Complete this question by entering your answers in the tabs below. Req 1 Req 2A to 2C Req 3 Req 4 Req 5 Saved Prepare the journal entries to record the first two interest payments. (Round your intermediate and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 Record the first interest payment on June 30. Note: Enter debits before credits. Date June 30 General Journal Debit Credit > Help Save & Exit Submit Check my work ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fmheproducts%252FlmsClose W... 6.5 Simulation Six Saved Help Save & Exit Submit 19 Part 2 of 2 2(a) For each semiannual period, complete the table below to calculate the cash payment. 2(b) For each semiannual period, complete the table below to calculate the straight-line premium amortization. 2(c) For each semiannual period, complete the table below to calculate the bond interest expense. 3. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 4. Prepare the first two years of a straight-line amortization table. 5. Prepare the journal entries to record the first two interest payments. 4.7 points Complete this question by entering your answers in the tabs below. 03:59:13 Req 1 Req 2A to 2C Req 3 Req 4 Req 5 Skipped For each semiannual period, compute (a) the cash payment, (b) the straight-line premium amortization, and (c) the bond interest expense. (Round your final answers to the nearest whole dollar.) Par (maturity) value eBook 2(a) References Annual Rate Year Semiannual cash interest payment Bond price Par (maturity value) Premium on Bonds Payable Semiannual periods 2(b) Semiannual cash payment Premium amortization 2(c) = Bond interest expense < Req 1 Req 3 > = Straight-line premium amortization Check my work ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fmheproducts%252FlmsCloseW... 6.5 Simulation Six i Saved 19 Part 2 of 2 4.7 points 03:58:53 The bonds are issued at a price of $3,549,590. Required: 1. Prepare the January 1 journal entry to record the bonds' issuance. 2(a) For each semiannual period, complete the table below to calculate the cash payment. 2(b) For each semiannual period, complete the table below to calculate the straight-line premium amortization. 2(c) For each semiannual period, complete the table below to calculate the bond interest expense. 3. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 4. Prepare the first two years of a straight-line amortization table. 5. Prepare the journal entries to record the first two interest payments. Skipped Complete this question by entering your answers in the tabs below. eBook Req 1 Req 2A to 2C Reg 3 Req 4 Req 5 References Complete the below table to calculate the total bond interest expense to be recognized over the bonds" life. Total bond interest expense over life of bonds: Amount repaid: Total repaid payments of Par value at maturity Less amount borrowed Total bond interest expense $ < Req 2A to 2C 0 0 Req 4 > Help C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fmheproducts%252FlmsClose W... 6.5 Simulation Six Saved Help Save 19 Part 2 of 2 4.7 points 03:58:26 The bonds are issued at a price of $3,549,590. Required: 1. Prepare the January 1 journal entry to record the bonds' issuance. 2(a) For each semiannual period, complete the table below to calculate the cash payment. 2(b) For each semiannual period, complete the table below to calculate the straight-line premium amortization. 2(c) For each semiannual period, complete the table below to calculate the bond interest expense. 3. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 4. Prepare the first two years of a straight-line amortization table. 5. Prepare the journal entries to record the first two interest payments. Skipped Complete this question by entering your answers in the tabs below. eBook Req 1 Req 2A to 2C Req 3 Req 4 Req 5 References Prepare the first two years of a straight-line amortization table. (Round your intermediate and final answers to the nearest whole dollar.) Semiannual Period- Unamortized Carrying Value Premium End 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 < Req 3 Req 5 > C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started