Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hilton earned $80,000 each year from the booking activities (main operation) and $30,000 from the laundry section. The total recognized operational expenses for the

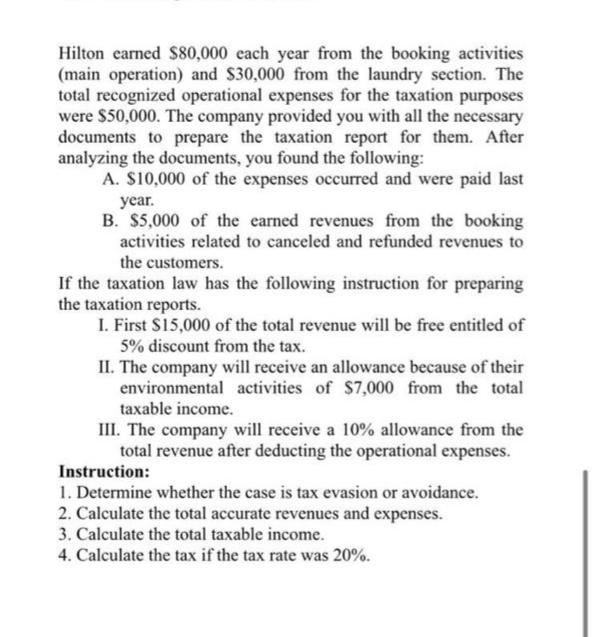

Hilton earned $80,000 each year from the booking activities (main operation) and $30,000 from the laundry section. The total recognized operational expenses for the taxation purposes were $50,000. The company provided you with all the necessary documents to prepare the taxation report for them. After analyzing the documents, you found the following: A. $10,000 of the expenses occurred and were paid last year. B. $5,000 of the earned revenues from the booking activities related to canceled and refunded revenues to the customers. If the taxation law has the following instruction for preparing the taxation reports. I. First $15,000 of the total revenue will be free entitled of 5% discount from the tax. II. The company will receive an allowance because of their environmental activities of $7,000 from the total taxable income. III. The company will receive a 10% allowance from the total revenue after deducting the operational expenses. Instruction: 1. Determine whether the case is tax evasion or avoidance. 2. Calculate the total accurate revenues and expenses. 3. Calculate the total taxable income. 4. Calculate the tax if the tax rate was 20%.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 This is not tax evasion or avoidance 2 The total acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started