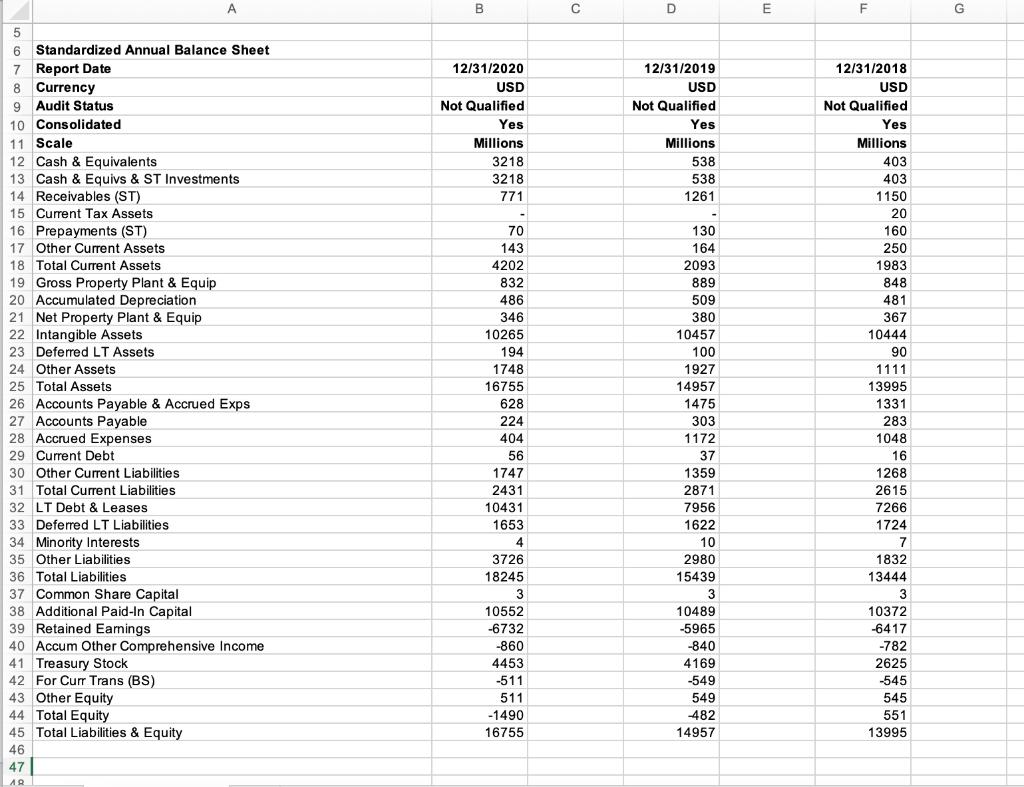

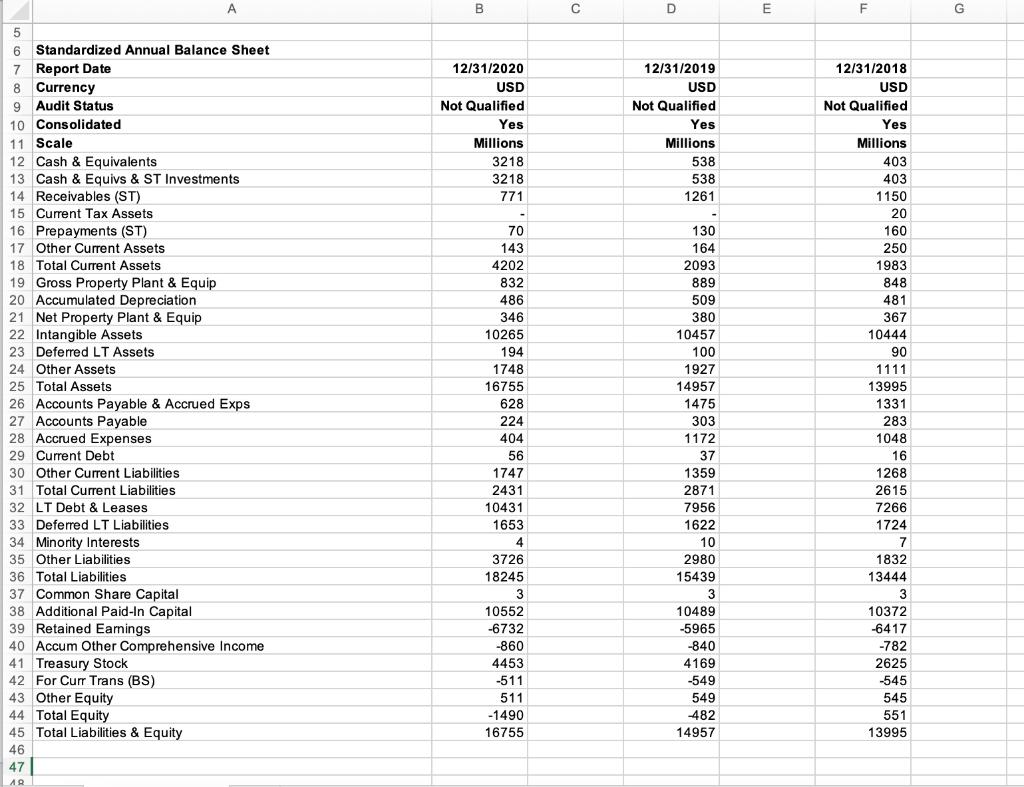

Hilton Worldwide Holdings Inc. for 2018, 2019, 2020

Question:

Total Assets = Total Liabilities + equity for all years. Scenario analyses completed with discussion Sensitivity analyses completed with discussion

A B D E F G 12/31/2020 USD Not Qualified Yes Millions 3218 3218 771 12/31/2019 USD Not Qualified Yes Millions 538 538 1261 5 6 Standardized Annual Balance Sheet 7 Report Date 8 Currency 9 Audit Status 10 Consolidated 11 Scale 12 Cash & Equivalents 13 Cash & Equivs & ST Investments 14 Receivables (ST) 15 Current Tax Assets 16 Prepayments (ST) 17 Other Current Assets 18 Total Current Assets 19 Gross Property Plant & Equip 20 Accumulated Depreciation 21 Net Property Plant & Equip 22 Intangible Assets 23 Deferred LT Assets 24 Other Assets 25 Total Assets 26 Accounts Payable & Accrued Exps 27 Accounts Payable 28 Accrued Expenses 29 Current Debt 30 Other Current Liabilities 31 Total Current Liabilities 32 LT Debt & Leases 33 Deferred LT Liabilities 34 Minority Interests 35 Other Liabilities 36 Total Liabilities 37 Common Share Capital 38 Additional Paid-In Capital 39 Retained Earnings 40 Accum Other Comprehensive Income 41 Treasury Stock 42 For Curr Trans (BS) 43 Other Equity 44 Total Equity 45 Total Liabilities & Equity 46 47 AR 70 143 4202 832 486 346 10265 194 1748 16755 628 224 404 56 1747 2431 10431 1653 4 3726 18245 3 10552 -6732 -860 4453 -511 511 -1490 16755 130 164 2093 889 509 380 10457 100 1927 14957 1475 303 1172 37 1359 2871 7956 1622 10 2980 15439 3 10489 -5965 -840 4169 -549 549 482 14957 12/31/2018 USD Not Qualified Yes Millions 403 403 1150 20 160 250 1983 848 481 367 10444 90 1111 13995 1331 283 1048 16 1268 2615 7266 1724 7 1832 13444 3 10372 -6417 -782 2625 -545 545 551 13995 A B D E F G 12/31/2020 USD Not Qualified Yes Millions 3218 3218 771 12/31/2019 USD Not Qualified Yes Millions 538 538 1261 5 6 Standardized Annual Balance Sheet 7 Report Date 8 Currency 9 Audit Status 10 Consolidated 11 Scale 12 Cash & Equivalents 13 Cash & Equivs & ST Investments 14 Receivables (ST) 15 Current Tax Assets 16 Prepayments (ST) 17 Other Current Assets 18 Total Current Assets 19 Gross Property Plant & Equip 20 Accumulated Depreciation 21 Net Property Plant & Equip 22 Intangible Assets 23 Deferred LT Assets 24 Other Assets 25 Total Assets 26 Accounts Payable & Accrued Exps 27 Accounts Payable 28 Accrued Expenses 29 Current Debt 30 Other Current Liabilities 31 Total Current Liabilities 32 LT Debt & Leases 33 Deferred LT Liabilities 34 Minority Interests 35 Other Liabilities 36 Total Liabilities 37 Common Share Capital 38 Additional Paid-In Capital 39 Retained Earnings 40 Accum Other Comprehensive Income 41 Treasury Stock 42 For Curr Trans (BS) 43 Other Equity 44 Total Equity 45 Total Liabilities & Equity 46 47 AR 70 143 4202 832 486 346 10265 194 1748 16755 628 224 404 56 1747 2431 10431 1653 4 3726 18245 3 10552 -6732 -860 4453 -511 511 -1490 16755 130 164 2093 889 509 380 10457 100 1927 14957 1475 303 1172 37 1359 2871 7956 1622 10 2980 15439 3 10489 -5965 -840 4169 -549 549 482 14957 12/31/2018 USD Not Qualified Yes Millions 403 403 1150 20 160 250 1983 848 481 367 10444 90 1111 13995 1331 283 1048 16 1268 2615 7266 1724 7 1832 13444 3 10372 -6417 -782 2625 -545 545 551 13995