Question

Himalia Ltd, Elara Ltd, and Leda Ltd enter into a contractual agreement on 1 July 2018 to form a joint operation known as OrbiSupply to

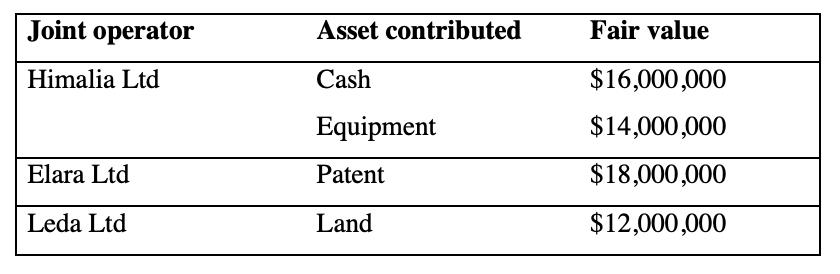

Himalia Ltd, Elara Ltd, and Leda Ltd enter into a contractual agreement on 1 July 2018 to form a joint operation known as OrbiSupply to produce essential parts required to launch commercial satellite into low-earth orbit. The joint operation agreement states that Himalia Ltd, Elara Ltd, and Leda Ltd will share output, contributions and cost in the ratio of 50:30:20 and that Himalia Ltd, Elara Ltd, and Leda Ltd hold the joint operation assets as tenants in common. The initial contribution by the joint operators are listed as follows:

Prior to the establishment of the joint operation, both Himalia Ltd and Elara Ltd used the cost model to recognise non-current assets in their financial statement. Leda Ltd used the revaluation model to recognise non-current assets in its financial statement.

The equipment contributed by Himalia Ltd was recorded in its book at a cost of $30 million and accumulated depreciation of $10 million. All joint operators expect to depreciate the equipment on a straight-line basis at the rate of 20%.

The Patent contributed by Elara Ltd was recorded in its books at its cost of $15 million and accumulated amortisation of $0. All joint operators will amortise the patent using the straight- line method over its expected economic life of 5 years.

The land contributed by Leda Ltd was purchased at the cost of $8 million on 1 January 2016 and then subsequently revalued by Leda Ltd on 30 June 2017 to $12 million. No further revaluation or impairment was recognised by Leda Ltd ever since.

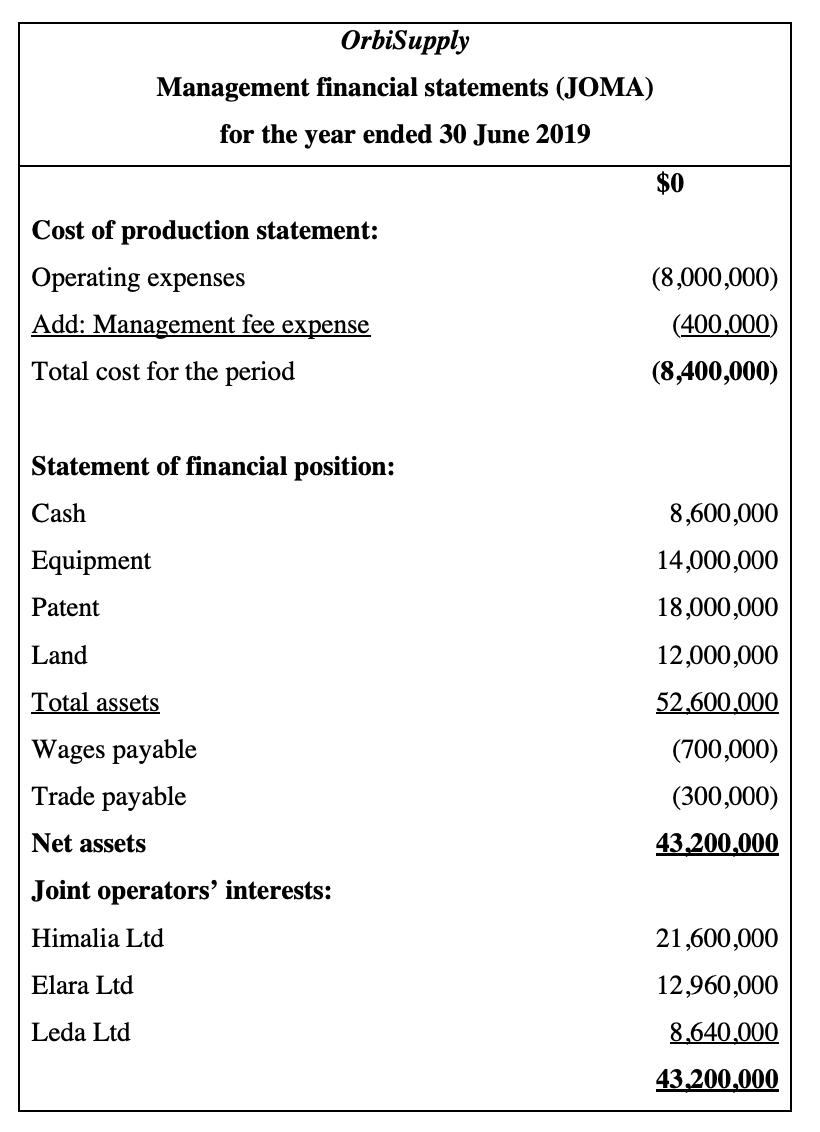

Himalia Ltd manages the joint operation for an annual fee of $400,000. This management fee is treated as a management fee expense in the management financial statement of OrbiSupply.

On 30 June 2019, Himalia Ltd sold 80% of its share of output from OrbiSupply for $15 million cash, whereas Elara Ltd has sold half of its share of output from OrbiSupply for $4 million cash. All of Leda Ltd’s share of the OrbiSupply output is still on hand at 30 June 2019.

The management financial statement of OrbiSupply for the year ended 30 June 2019 is presented in below:

Required:

a) Prepare the journal entries in the books of Himalia Ltd for the financial year commencing on 1 July 2018 and ending on 30 June 2019 in relation to OrbiSupply. Include all workings.

b) Prepare the journal entries in the books of Elara Ltd to record its initial contribution to OrbiSupply on 1 July 2018.

Joint operator Himalia Ltd Elara Ltd Leda Ltd Asset contributed Cash Equipment Patent Land Fair value $16,000,000 $14,000,000 $18,000,000 $12,000,000

Step by Step Solution

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Date Financial year 1st July 18 to 30th June 19 Journal entries in the books of Himalia to Date Part...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started