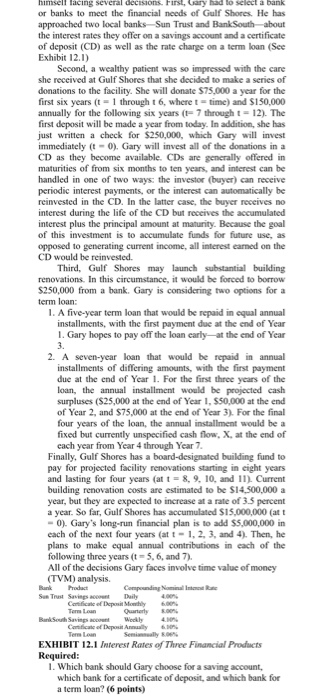

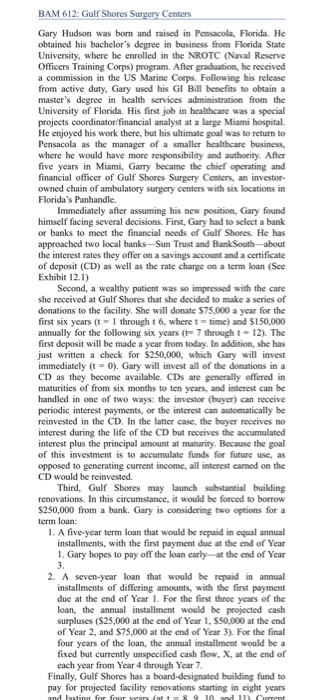

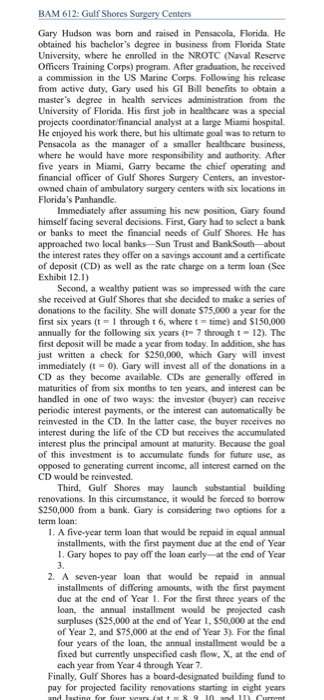

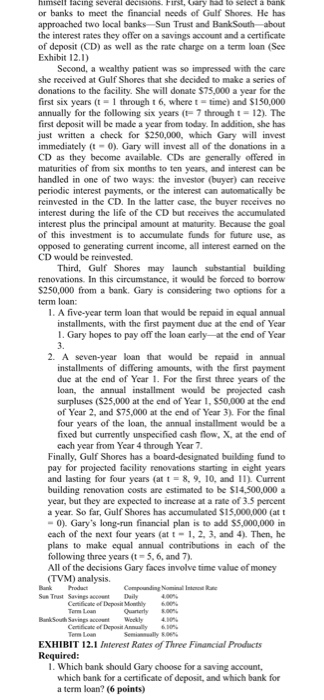

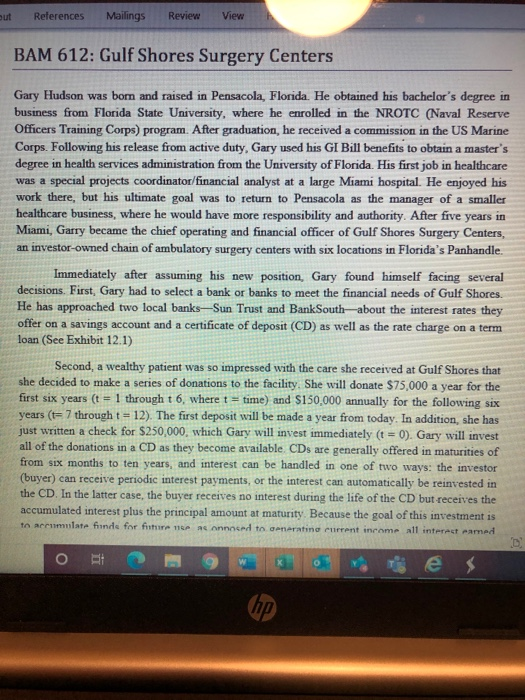

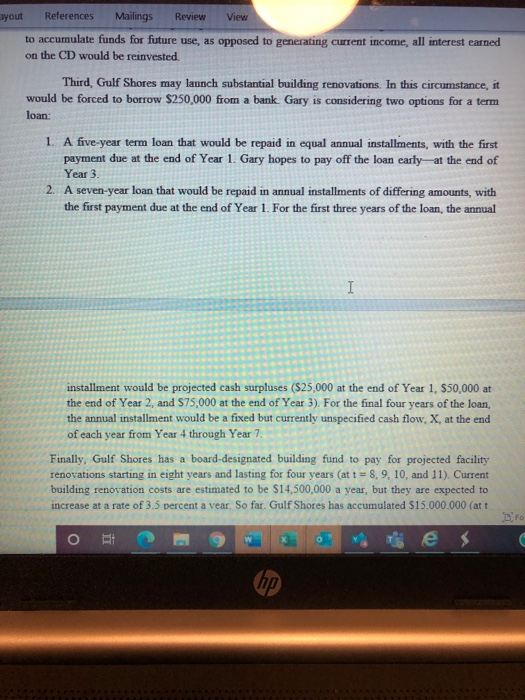

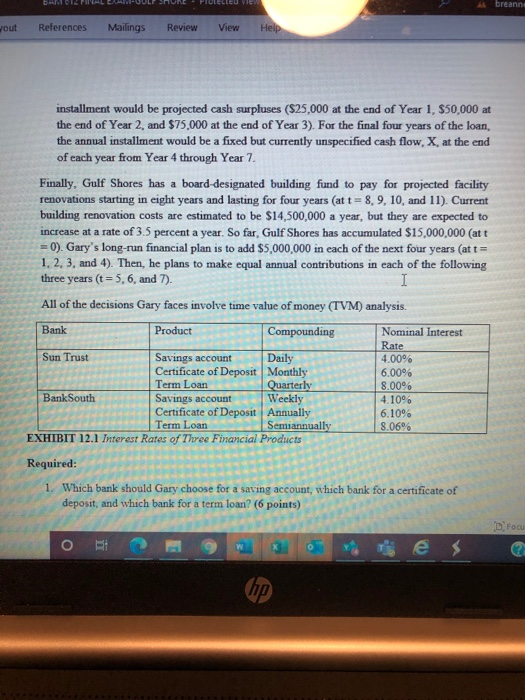

himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75,000 a year for the first six years (t = 1 through t6, where t time) and $150,000 annually for the following six years (E7 through t = 12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately t-0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest eared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan carly at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of cach year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (att - 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a year. So far, Gulf Shores has accumulated $15,000,000 (att - 0). Gary's long-run financial plan is to add $5,000,000 in each of the next four years (at - 1, 2, 3, and 4). Then, he plans to make equal annual contributions in each of the following three years (t = 5, 6, and 7). All of the decisions Gary faces involve time value of money (TVM) analysis Product Compending Nominale Sun Trust Savings con Daily Certificate of Depen Meestly Term Loan Only Bank South Sang Wordly Candicate of Deposit Annually Semily 8.00% EXHIBIT 12.1 Interest Rates of Three Financial Products Required: 1. Which bank should Gary choose for a saving account, which bank for a certificate of deposit, and which bank for a term loan? (6 points) BAM 612: Gulf Shores Surgery Centers Gary Hudson was born and raised in Pensacola, Florida. He obtained his bachelor's degree in business from Florida State University, where he enrolled in the NROTC (Naval Reserve Officers Training Corps) program. After graduation, he received a commission in the US Marine Corps. Following his release from active duty. Gary used his GI Bill benefits to obtain a master's degree in health services administration from the University of Florida. His first job in healthcare was a special projects coordinator financial analyst at a large Miami hospital He enjoyed his work there, but his ultimate goal was to return to Pensacola as the manager of a smaller healthcare business, where he would have more responsibility and authority. After five years in Miami, Garry became the chief operating and financial officer of Gulf Shores Surgery Centers, an investor- owned chain of ambulatory surgery centers with six locations in Florida's Panhandle. Immediately after assuming his new position, Gary found himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75.000 a year for the first six years (t = 1 through t 6, where t = time) and $150,000 annually for the following six years (t-7 through t-12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately (t = 0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest cared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan early at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lastiner for four wars (att-10 duet BAM 612: Gulf Shores Surgery Centers Gary Hudson was born and raised in Pensacola, Florida. He obtained his bachelor's degree in business from Florida State University, where he enrolled in the NROTC (Naval Reserve Officers Training Corps) program. After graduation, he received a commission in the US Marine Corps. Following his release from active duty. Gary used his GI Bill benefits to obtain a master's degree in health services administration from the University of Florida. His first job in healthcare was a special projects coordinator financial analyst at a large Miami hospital He enjoyed his work there, but his ultimate goal was to return to Pensacola as the manager of a smaller healthcare business, where he would have more responsibility and authority. After five years in Miami, Garry became the chief operating and financial officer of Gulf Shores Surgery Centers, an investor- owned chain of ambulatory surgery centers with six locations in Florida's Panhandle. Immediately after assuming his new position, Gary found himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75.000 a year for the first six years (t = 1 through t 6, where t = time) and $150,000 annually for the following six years (t-7 through t-12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately (t = 0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest cared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan early at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lastiner for four wars (att-10 duet himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75,000 a year for the first six years (t = 1 through t6, where t time) and $150,000 annually for the following six years (E7 through t = 12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately t-0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest eared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan carly at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of cach year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (att - 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a year. So far, Gulf Shores has accumulated $15,000,000 (att - 0). Gary's long-run financial plan is to add $5,000,000 in each of the next four years (at - 1, 2, 3, and 4). Then, he plans to make equal annual contributions in each of the following three years (t = 5, 6, and 7). All of the decisions Gary faces involve time value of money (TVM) analysis Product Compending Nominale Sun Trust Savings con Daily Certificate of Depen Meestly Term Loan Only Bank South Sang Wordly Candicate of Deposit Annually Semily 8.00% EXHIBIT 12.1 Interest Rates of Three Financial Products Required: 1. Which bank should Gary choose for a saving account, which bank for a certificate of deposit, and which bank for a term loan? (6 points) out References Mailings Review View BAM 612: Gulf Shores Surgery Centers Gary Hudson was born and raised in Pensacola, Florida. He obtained his bachelor's degree in business from Florida State University, where he enrolled in the NROTC (Naval Reserve Officers Training Corps) program. After graduation, he received a commission in the US Marine Corps. Following his release from active duty, Gary used his GI Bill benefits to obtain a master's degree in health services administration from the University of Florida. His first job in healthcare was a special projects coordinator/financial analyst at a large Miami hospital. He enjoyed his work there, but his ultimate goal was to return to Pensacola as the manager of a smaller healthcare business, where he would have more responsibility and authority. After five years in Miami, Garry became the chief operating and financial officer of Gulf Shores Surgery Centers, an investor-owned chain of ambulatory surgery centers with six locations in Florida's Panhandle. Immediately after assuming his new position, Gary found himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banksSun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75,000 a year for the first six years (t = 1 through t 6, where t = time) and $150,000 annually for the following six years (t=7 through t = 12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately (t = 0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future nu as onnosed to generating current income all interest ramed OP hp ayout References Mailings Review View to accumulate funds for future use, as opposed to generating current income, all interest earned on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan carly at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual I installment would be projected cash surpluses ($25,000 at the end of Year 1, $50,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (at t = 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a vear So far. Gulf Shores has accumulated $15.000.000 (att Bro hp breanni out References Mailings Review View Help I installment would be projected cash surpluses ($25,000 at the end of Year 1, $50,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (at t= 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a year. So far, Gulf Shores has accumulated $15,000,000 (att = 0). Gary's long-run financial plan is to add $5,000,000 in each of the next four years (at t= 1.2.3, and 4). Then, he plans to make equal annual contributions in each of the following three years (t = 5,6, and 7). All of the decisions Gary faces involve time value of money (TVM) analysis. Bank Product Compounding Nominal Interest Rate Sun Trust Savings account Daily 4.00% Certificate of Deposit Monthly 6.00% Term Loan Quarterly 8.00% BankSouth Savings account Weekly 4.10% Certificate of Deposit Annually 6.10% Term Loan Semiannually 8.06% EXHIBIT 12.1 Interest Rates of Three Financial Products Required: 1. Which bank should Gary choose for a saving account, which bank for a certificate of deposit, and which bank for a term loan? (6 points) Focu ORI hp himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75,000 a year for the first six years (t = 1 through t6, where t time) and $150,000 annually for the following six years (E7 through t = 12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately t-0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest eared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan carly at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of cach year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (att - 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a year. So far, Gulf Shores has accumulated $15,000,000 (att - 0). Gary's long-run financial plan is to add $5,000,000 in each of the next four years (at - 1, 2, 3, and 4). Then, he plans to make equal annual contributions in each of the following three years (t = 5, 6, and 7). All of the decisions Gary faces involve time value of money (TVM) analysis Product Compending Nominale Sun Trust Savings con Daily Certificate of Depen Meestly Term Loan Only Bank South Sang Wordly Candicate of Deposit Annually Semily 8.00% EXHIBIT 12.1 Interest Rates of Three Financial Products Required: 1. Which bank should Gary choose for a saving account, which bank for a certificate of deposit, and which bank for a term loan? (6 points) BAM 612: Gulf Shores Surgery Centers Gary Hudson was born and raised in Pensacola, Florida. He obtained his bachelor's degree in business from Florida State University, where he enrolled in the NROTC (Naval Reserve Officers Training Corps) program. After graduation, he received a commission in the US Marine Corps. Following his release from active duty. Gary used his GI Bill benefits to obtain a master's degree in health services administration from the University of Florida. His first job in healthcare was a special projects coordinator financial analyst at a large Miami hospital He enjoyed his work there, but his ultimate goal was to return to Pensacola as the manager of a smaller healthcare business, where he would have more responsibility and authority. After five years in Miami, Garry became the chief operating and financial officer of Gulf Shores Surgery Centers, an investor- owned chain of ambulatory surgery centers with six locations in Florida's Panhandle. Immediately after assuming his new position, Gary found himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75.000 a year for the first six years (t = 1 through t 6, where t = time) and $150,000 annually for the following six years (t-7 through t-12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately (t = 0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest cared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan early at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lastiner for four wars (att-10 duet BAM 612: Gulf Shores Surgery Centers Gary Hudson was born and raised in Pensacola, Florida. He obtained his bachelor's degree in business from Florida State University, where he enrolled in the NROTC (Naval Reserve Officers Training Corps) program. After graduation, he received a commission in the US Marine Corps. Following his release from active duty. Gary used his GI Bill benefits to obtain a master's degree in health services administration from the University of Florida. His first job in healthcare was a special projects coordinator financial analyst at a large Miami hospital He enjoyed his work there, but his ultimate goal was to return to Pensacola as the manager of a smaller healthcare business, where he would have more responsibility and authority. After five years in Miami, Garry became the chief operating and financial officer of Gulf Shores Surgery Centers, an investor- owned chain of ambulatory surgery centers with six locations in Florida's Panhandle. Immediately after assuming his new position, Gary found himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75.000 a year for the first six years (t = 1 through t 6, where t = time) and $150,000 annually for the following six years (t-7 through t-12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately (t = 0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest cared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan early at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lastiner for four wars (att-10 duet himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banks Sun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75,000 a year for the first six years (t = 1 through t6, where t time) and $150,000 annually for the following six years (E7 through t = 12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately t-0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generating current income, all interest eared on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank. Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan carly at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual installment would be projected cash surpluses ($25,000 at the end of Year 1,550,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of cach year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (att - 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a year. So far, Gulf Shores has accumulated $15,000,000 (att - 0). Gary's long-run financial plan is to add $5,000,000 in each of the next four years (at - 1, 2, 3, and 4). Then, he plans to make equal annual contributions in each of the following three years (t = 5, 6, and 7). All of the decisions Gary faces involve time value of money (TVM) analysis Product Compending Nominale Sun Trust Savings con Daily Certificate of Depen Meestly Term Loan Only Bank South Sang Wordly Candicate of Deposit Annually Semily 8.00% EXHIBIT 12.1 Interest Rates of Three Financial Products Required: 1. Which bank should Gary choose for a saving account, which bank for a certificate of deposit, and which bank for a term loan? (6 points) out References Mailings Review View BAM 612: Gulf Shores Surgery Centers Gary Hudson was born and raised in Pensacola, Florida. He obtained his bachelor's degree in business from Florida State University, where he enrolled in the NROTC (Naval Reserve Officers Training Corps) program. After graduation, he received a commission in the US Marine Corps. Following his release from active duty, Gary used his GI Bill benefits to obtain a master's degree in health services administration from the University of Florida. His first job in healthcare was a special projects coordinator/financial analyst at a large Miami hospital. He enjoyed his work there, but his ultimate goal was to return to Pensacola as the manager of a smaller healthcare business, where he would have more responsibility and authority. After five years in Miami, Garry became the chief operating and financial officer of Gulf Shores Surgery Centers, an investor-owned chain of ambulatory surgery centers with six locations in Florida's Panhandle. Immediately after assuming his new position, Gary found himself facing several decisions. First, Gary had to select a bank or banks to meet the financial needs of Gulf Shores. He has approached two local banksSun Trust and BankSouth about the interest rates they offer on a savings account and a certificate of deposit (CD) as well as the rate charge on a term loan (See Exhibit 12.1) Second, a wealthy patient was so impressed with the care she received at Gulf Shores that she decided to make a series of donations to the facility. She will donate $75,000 a year for the first six years (t = 1 through t 6, where t = time) and $150,000 annually for the following six years (t=7 through t = 12). The first deposit will be made a year from today. In addition, she has just written a check for $250,000, which Gary will invest immediately (t = 0). Gary will invest all of the donations in a CD as they become available. CDs are generally offered in maturities of from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments, or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus the principal amount at maturity. Because the goal of this investment is to accumulate funds for future nu as onnosed to generating current income all interest ramed OP hp ayout References Mailings Review View to accumulate funds for future use, as opposed to generating current income, all interest earned on the CD would be reinvested. Third, Gulf Shores may launch substantial building renovations. In this circumstance, it would be forced to borrow $250,000 from a bank Gary is considering two options for a term loan: 1. A five-year term loan that would be repaid in equal annual installments, with the first payment due at the end of Year 1. Gary hopes to pay off the loan carly at the end of Year 3. 2. A seven-year loan that would be repaid in annual installments of differing amounts, with the first payment due at the end of Year 1. For the first three years of the loan, the annual I installment would be projected cash surpluses ($25,000 at the end of Year 1, $50,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board-designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (at t = 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a vear So far. Gulf Shores has accumulated $15.000.000 (att Bro hp breanni out References Mailings Review View Help I installment would be projected cash surpluses ($25,000 at the end of Year 1, $50,000 at the end of Year 2, and $75,000 at the end of Year 3). For the final four years of the loan, the annual installment would be a fixed but currently unspecified cash flow, X at the end of each year from Year 4 through Year 7. Finally, Gulf Shores has a board designated building fund to pay for projected facility renovations starting in eight years and lasting for four years (at t= 8, 9, 10, and 11). Current building renovation costs are estimated to be $14,500,000 a year, but they are expected to increase at a rate of 3.5 percent a year. So far, Gulf Shores has accumulated $15,000,000 (att = 0). Gary's long-run financial plan is to add $5,000,000 in each of the next four years (at t= 1.2.3, and 4). Then, he plans to make equal annual contributions in each of the following three years (t = 5,6, and 7). All of the decisions Gary faces involve time value of money (TVM) analysis. Bank Product Compounding Nominal Interest Rate Sun Trust Savings account Daily 4.00% Certificate of Deposit Monthly 6.00% Term Loan Quarterly 8.00% BankSouth Savings account Weekly 4.10% Certificate of Deposit Annually 6.10% Term Loan Semiannually 8.06% EXHIBIT 12.1 Interest Rates of Three Financial Products Required: 1. Which bank should Gary choose for a saving account, which bank for a certificate of deposit, and which bank for a term loan? (6 points) Focu ORI hp