Hinckley Corp Statement of Cash Flows problem. Complete the worksheet for Hinckley Corp Statement of Cash Flows.

The bottom 2 photos are examples of how the problem is formatted. Please don't handwrite the answer it makes it hard to read.

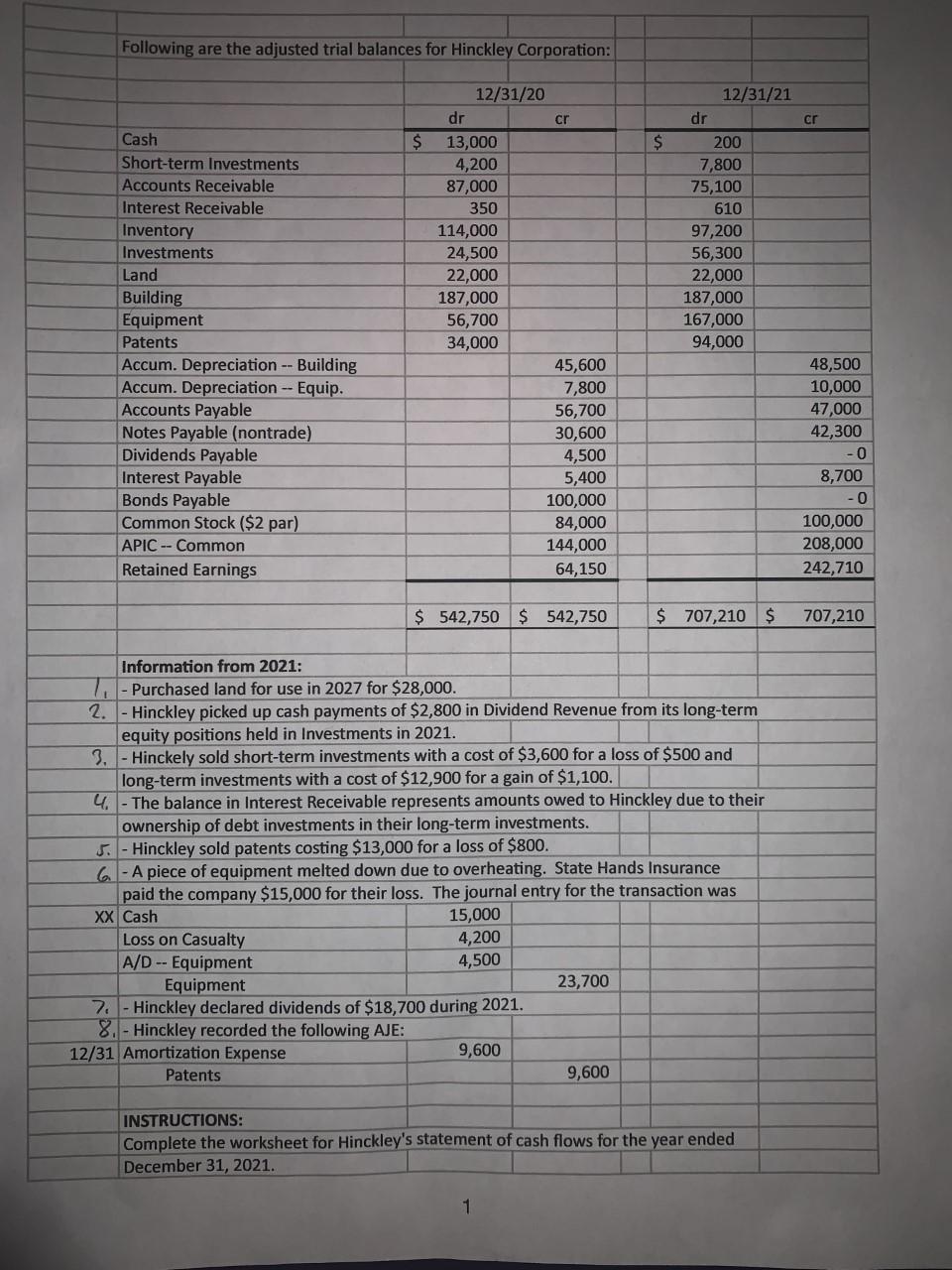

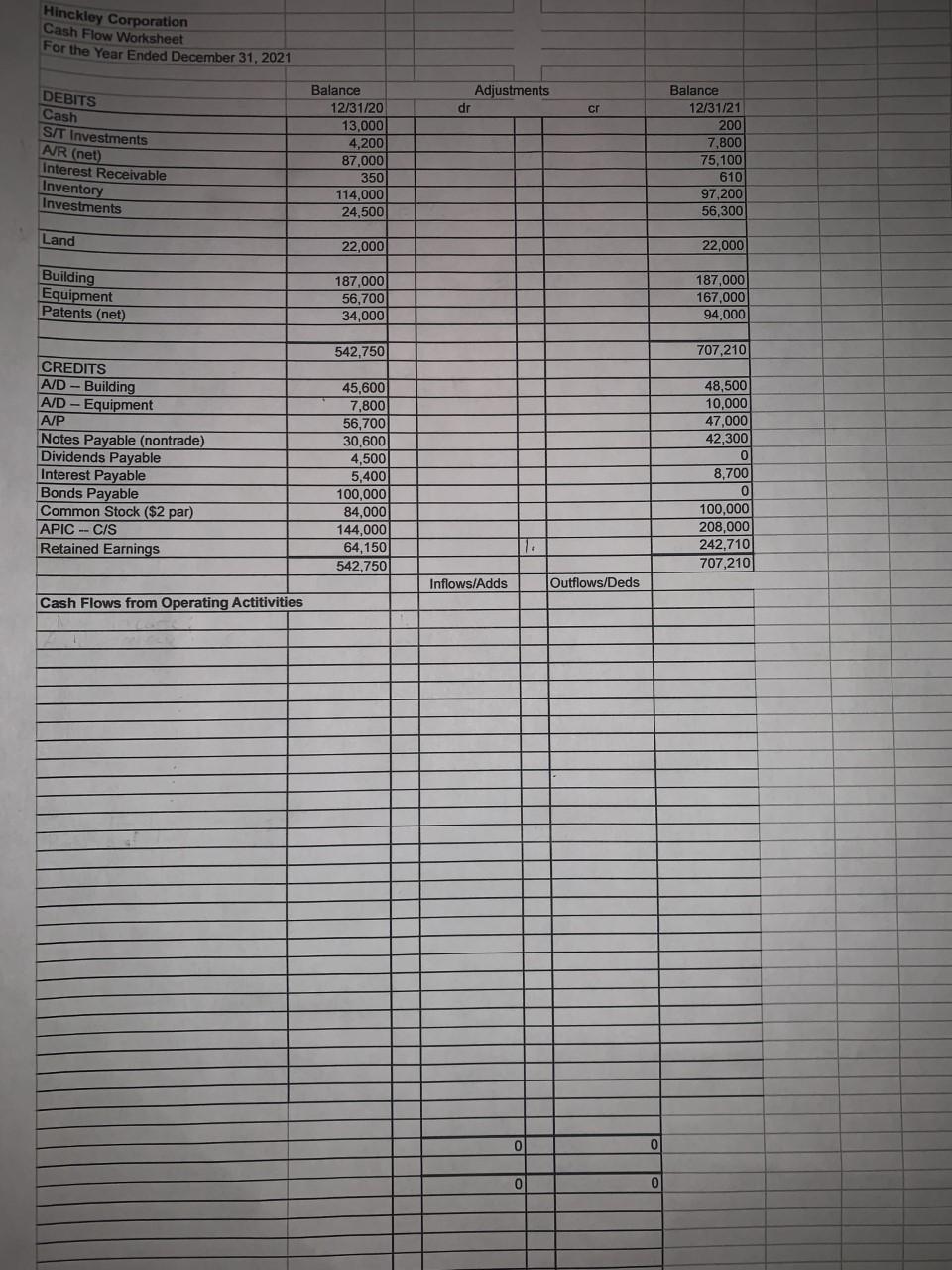

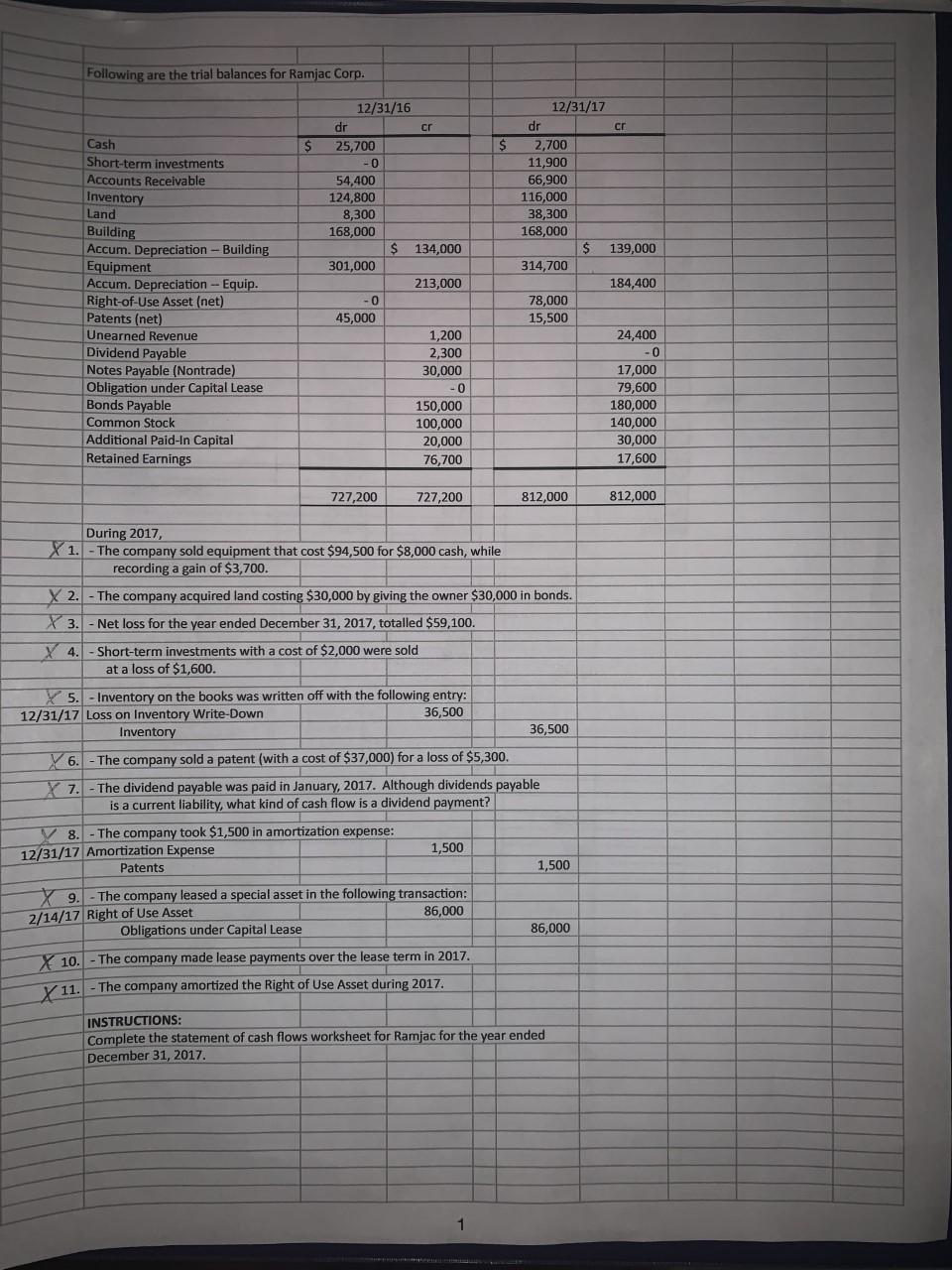

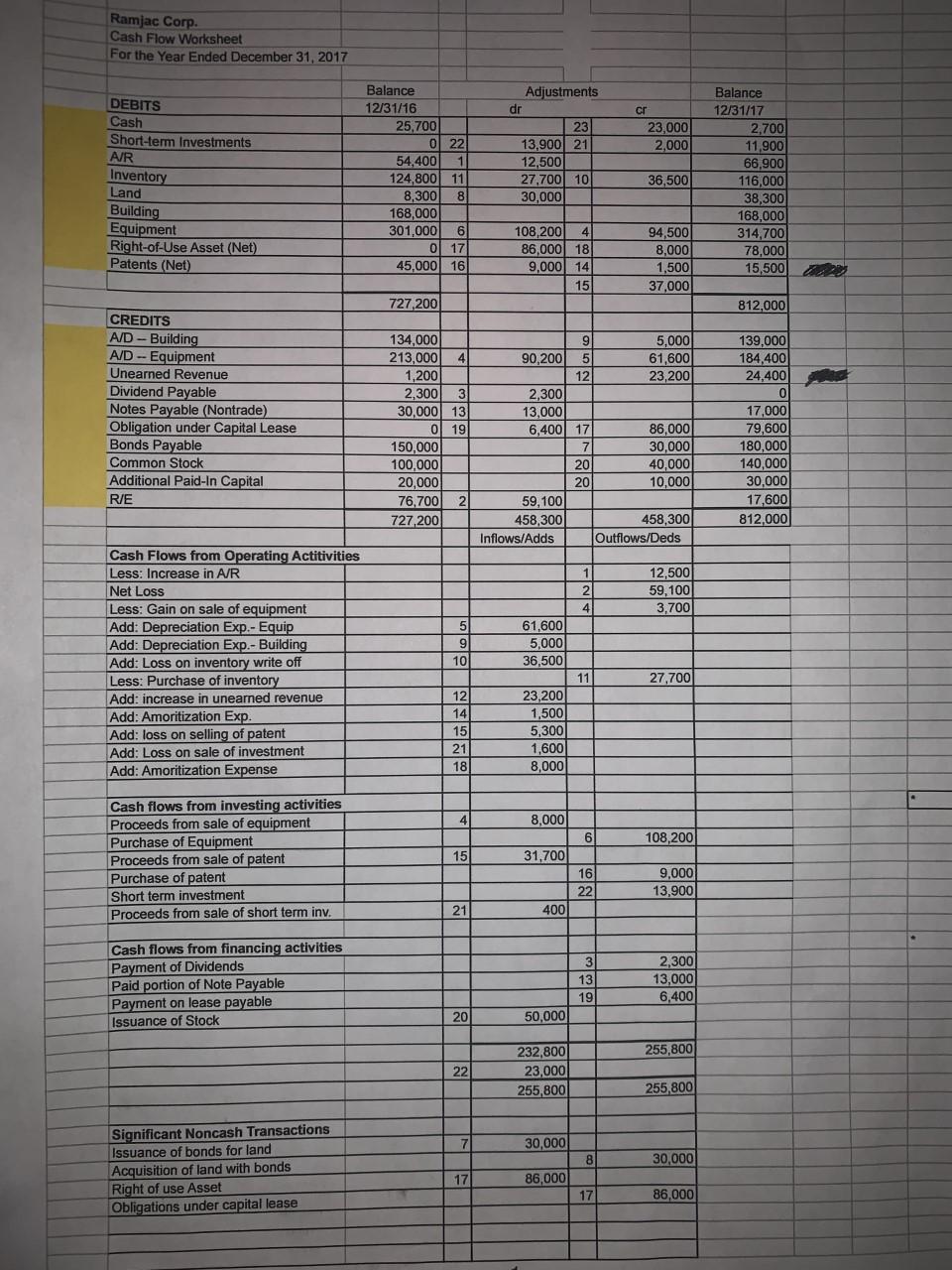

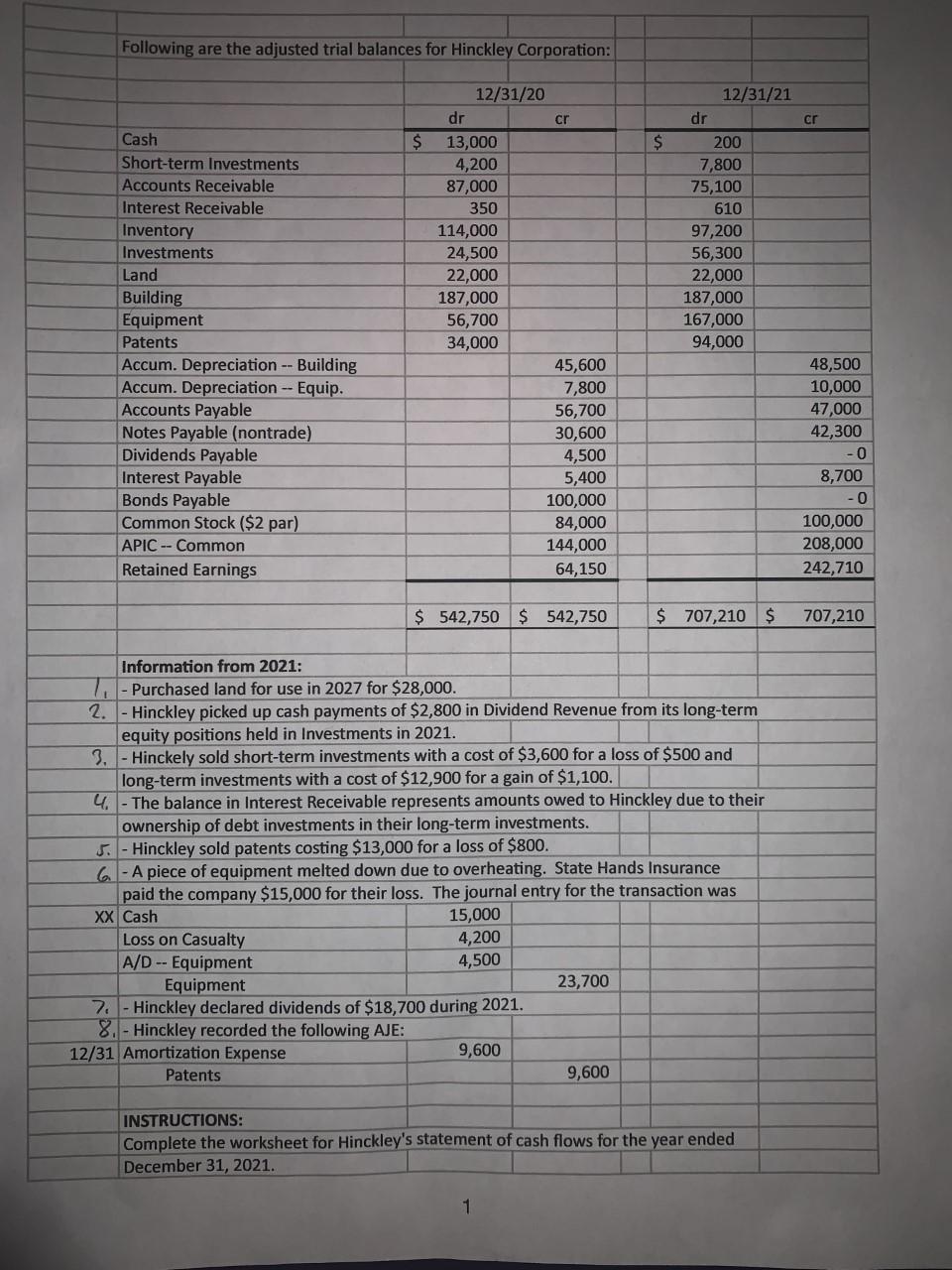

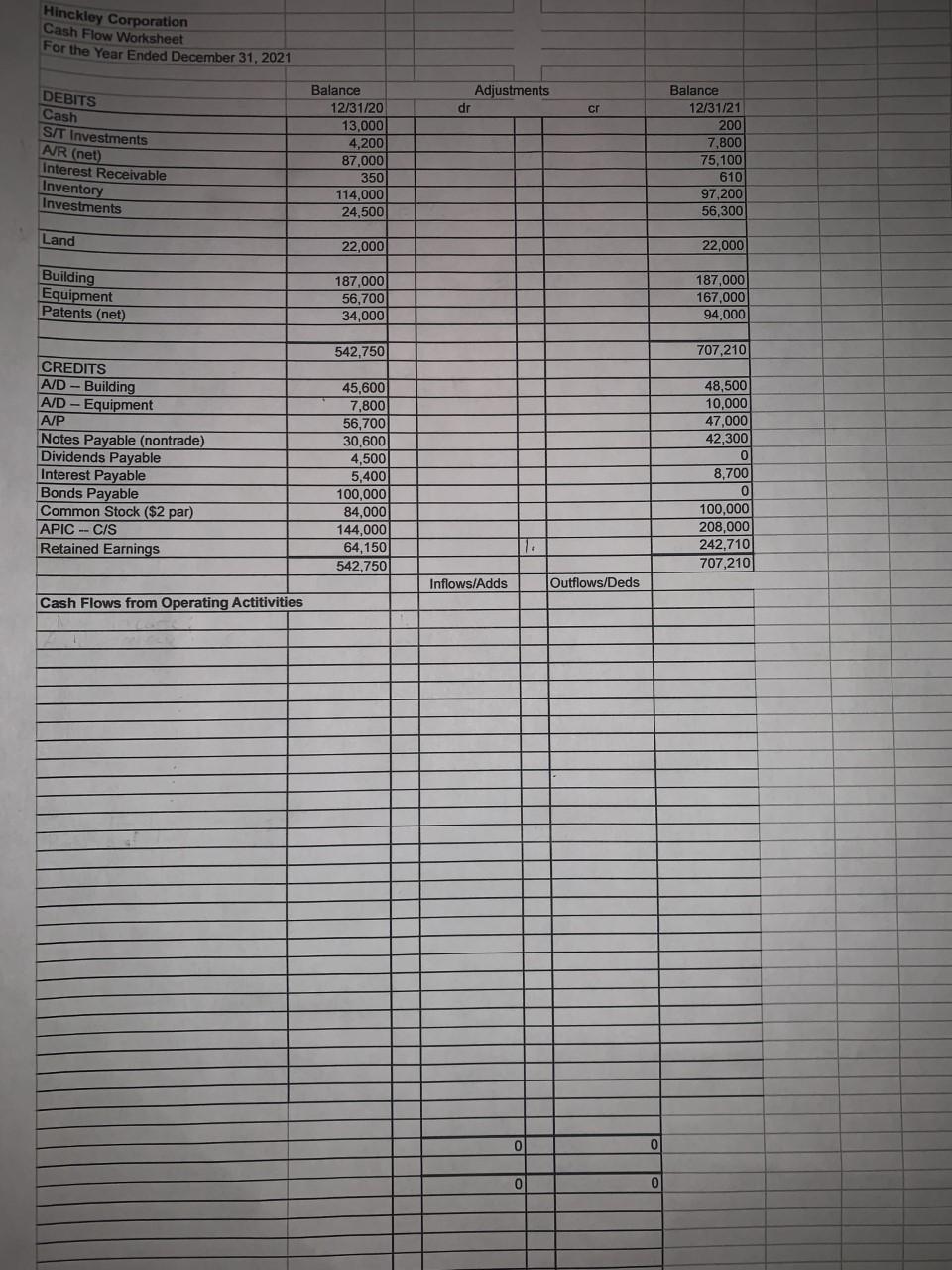

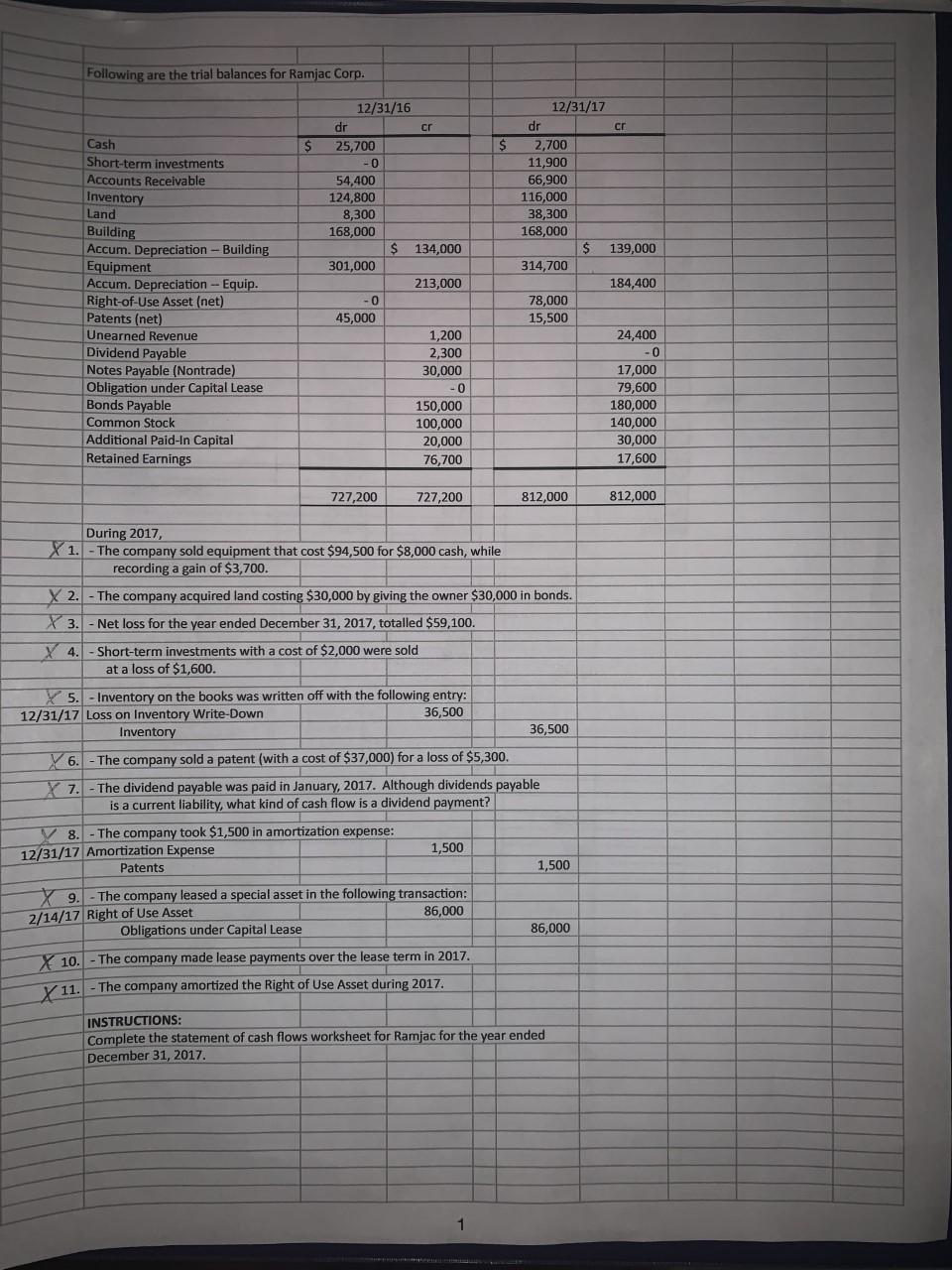

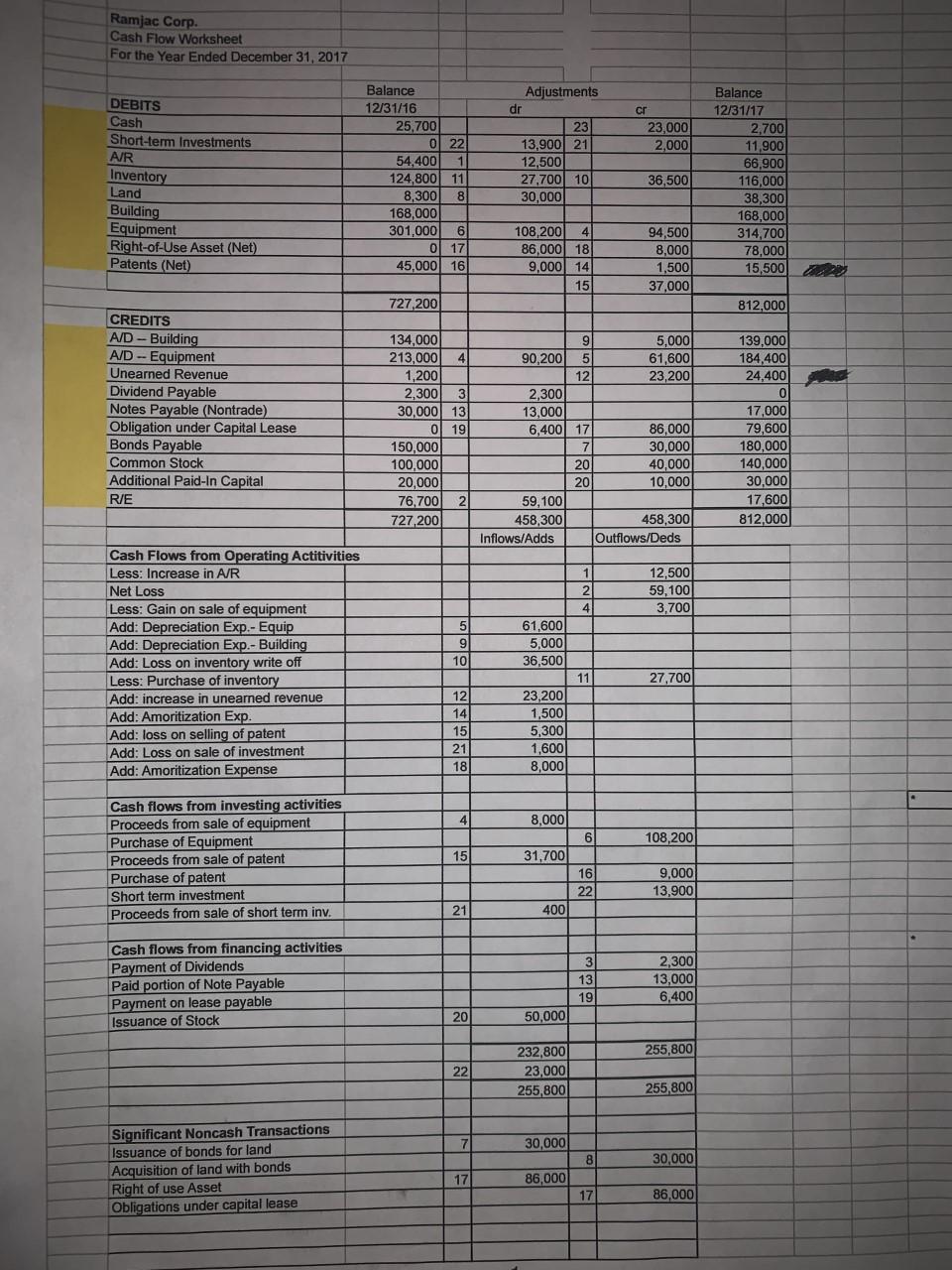

Following are the adjusted trial balances for Hinckley Corporation: 12/31/21 dr cr $ $ 12/31/20 dr cr 13,000 4,200 87,000 350 114,000 24,500 22,000 187,000 56,700 34,000 45,600 7,800 56,700 30,600 4,500 5,400 100,000 84,000 144,000 64,150 Cash Short-term Investments Accounts Receivable Interest Receivable Inventory Investments Land Building Equipment Patents Accum. Depreciation -- Building Accum. Depreciation -- Equip. Accounts Payable Notes Payable (nontrade) Dividends Payable Interest Payable Bonds Payable Common Stock ($2 par) APIC -- Common Retained Earnings 200 7,800 75,100 610 97,200 56,300 22,000 187,000 167,000 94,000 48,500 10,000 47,000 42,300 -0 8,700 -0 100,000 208,000 242,710 $ 542,750 $ 542,750 $ 707,210 $ 707,210 Information from 2021: T Purchased land for use in 2027 for $28,000. 2. - Hinckley picked up cash payments of $2,800 in Dividend Revenue from its long-term equity positions held in Investments in 2021. 3. - Hinckely sold short-term investments with a cost of $3,600 for a loss of $500 and long-term investments with a cost of $12,900 for a gain of $1,100. 4. - The balance in Interest Receivable represents amounts owed to Hinckley due to their ownership of debt investments in their long-term investments. 5. - Hinckley sold patents costing $13,000 for a loss of $800. 6 - A piece of equipment melted down due to overheating. State Hands Insurance paid the company $15,000 for their loss. The journal entry for the transaction was XX Cash Loss on Casualty A/D -- Equipment 4,500 Equipment 23,700 7. Hinckley declared dividends of $18,700 during 2021. 8. - Hinckley recorded the following AJE: 12/31 Amortization Expense 9,600 Patents 9,600 15,000 4,200 INSTRUCTIONS: Complete the worksheet for Hinckley's statement of cash flows for the year ended December 31, 2021. Hinckley Corporation Cash Flow Worksheet For the Year Ended December 31, 2021 Adjustments dr cr DEBITS Cash SIT Investments AVR (net) Interest Receivable Inventory Investments Balance 12/31/20 13,000 4,200 87,000 350 114,000 24,500 Balance 12/31/21 200 7,800 75,100 610 97,200 56,300 Land 22,000 22,000 Building Equipment Patents (net) 187,000 56,700 34,000 187,000 167,000 94,000 542,750 707,210 CREDITS A/D Building A/D Equipment AVP Notes Payable (nontrade) Dividends Payable Interest Payable Bonds Payable Common Stock ($2 par) APIC --C/S Retained Earnings 45,600 7,800 56,700 30,600 4,500 5,400 100,000 84,000 144,000 64,150 542,750 48,500 10,000 47,000 42,300 0 8,700 0 100,000 208,000 242,7101 707,210 Inflows/Adds Outflows/Deds Cash Flows from Operating Actitivities 0 0 0 0 Following are the trial balances for Ramjac Corp. cr Cash $ $ 12/31/17 dr 2,700 11,900 66,900 116,000 38,300 168,000 $ 139,000 314,700 12/31/16 dr cr 25,700 -0 54,400 124,800 8,300 168,000 $ 134,000 301,000 213,000 0 45,000 1,200 2,300 30,000 -0 150,000 100,000 20,000 76,700 Short-term investments Accounts Receivable Inventory Land Building Accum. Depreciation - Building Equipment Accum. Depreciation -- Equip. Right-of-Use Asset (net) Patents (net) Unearned Revenue Dividend Payable Notes Payable (Nontrade) Obligation under Capital Lease Bonds Payable Common Stock Additional Paid-In Capital Retained Earnings 184,400 78,000 15,500 24,400 -0 17,000 79,600 180,000 140,000 30,000 17,600 727,200 727,200 812,000 812,000 During 2017, X1. - The company sold equipment that cost $94,500 for $8,000 cash, while recording a gain of $3,700. X 2. - The company acquired land costing $30,000 by giving the owner $30,000 in bonds. X 3. - Net loss for the year ended December 31, 2017, totalled $59,100. X 4. -Short-term investments with a cost of $2,000 were sold at a loss of $1,600. Y 5. - Inventory on the books was written off with the following entry: 12/31/17 Loss on Inventory Write-Down 36,500 Inventory 36,500 6. The company sold a patent (with a cost of $37,000) for a loss of $5,300 X 7. The dividend payable was paid in January, 2017. Although dividends payable is a current liability, what kind of cash flow is a dividend payment? V 8. - The company took $1,500 in amortization expense: 12/31/17 Amortization Expense 1,500 Patents 1,500 X 9. The company leased a special asset in the following transaction: 2/14/17 Right of Use Asset 86,000 Obligations under Capital Lease 86,000 X 10. The company made lease payments over the lease term in 2017. The company amortized the Right of Use Asset during 2017, X 11. INSTRUCTIONS: Complete the statement of cash flows worksheet for Ramjac for the year ended December 31, 2017. 1 Ramjac Corp. Cash Flow Worksheet For the Year Ended December 31, 2017 DEBITS Cash Short-term Investments A/R Inventory Land Building Equipment Right-of-Use Asset (Net) Patents (Net) cr 23,000 2,000 Balance 12/31/16 25,700 0 22 54,400 1 124,800 11 8,300 8 168,000 301,000 6 0 45,000 16 Adjustments dr 23 13,900 21 12,500 27,700 10 30,000 36,500 Balance 12/31/17 2,700 11,900 66.900 116,000 38,300 168,000 314,700 78,000 15,500 DO 108,200 4 86,000 18 9,000 14 15 94,500 8,000 1,500 37,000 727,200 812.000 CREDITS A/D - Building A/D - Equipment Unearned Revenue Dividend Payable Notes Payable (Nontrade) Obligation under Capital Lease Bonds Payable Common Stock Additional Paid-In Capital RE 134,000 213,000 4 1,200 2,300 3 30,000 13 0 19 150,000 100,000 20,000 76,700 727,200 9 5,000 90,200 5 61,600 12 23,200 2,300 13,000 6,400 17 86,000 7 30,000 20 40,000 20 10,000 59,100 458,300 458,300 Inflows/Adds Outflows/Deds 139.000 184.400 24,400 0 17,000 79,600 180,000 140,000 30,000 17,600 812,000 1 2 12,500 59,100 3,700 5 9 Cash Flows from Operating Actitivities Less: Increase in A/R Net Loss Less: Gain on sale of equipment Add: Depreciation Exp.- Equip Add: Depreciation Exp.- Building Add: Loss on inventory write off Less: Purchase of inventory Add: increase in unearned revenue Add: Amoritization Exp Add: loss on selling of patent Add: Loss on sale of investment Add: Amoritization Expense 61,600 5,000 36,500 10 11 27,700 12 14 15 21 18 23,200 1,500 5,300 1,600 8,000 4 8,000 6 108,200 Cash flows from investing activities Proceeds from sale of equipment Purchase of Equipment Proceeds from sale of patent Purchase of patent Short term investment Proceeds from sale of short term inv. 15 31,700 16 22 9,000 13,900 21 400 3 13 Cash flows from financing activities Payment of Dividends Paid portion of Note Payable Payment on lease payable Issuance of Stock 2,300 13,000 6,400 19 50,000 20 255,800 22 232,800 23,000 255,800 255,800 7 30,000 30,000 Significant Noncash Transactions Issuance of bonds for land Acquisition of land with bonds Right of use Asset Obligations under capital lease 17 86,000 17 86,000 Following are the adjusted trial balances for Hinckley Corporation: 12/31/21 dr cr $ $ 12/31/20 dr cr 13,000 4,200 87,000 350 114,000 24,500 22,000 187,000 56,700 34,000 45,600 7,800 56,700 30,600 4,500 5,400 100,000 84,000 144,000 64,150 Cash Short-term Investments Accounts Receivable Interest Receivable Inventory Investments Land Building Equipment Patents Accum. Depreciation -- Building Accum. Depreciation -- Equip. Accounts Payable Notes Payable (nontrade) Dividends Payable Interest Payable Bonds Payable Common Stock ($2 par) APIC -- Common Retained Earnings 200 7,800 75,100 610 97,200 56,300 22,000 187,000 167,000 94,000 48,500 10,000 47,000 42,300 -0 8,700 -0 100,000 208,000 242,710 $ 542,750 $ 542,750 $ 707,210 $ 707,210 Information from 2021: T Purchased land for use in 2027 for $28,000. 2. - Hinckley picked up cash payments of $2,800 in Dividend Revenue from its long-term equity positions held in Investments in 2021. 3. - Hinckely sold short-term investments with a cost of $3,600 for a loss of $500 and long-term investments with a cost of $12,900 for a gain of $1,100. 4. - The balance in Interest Receivable represents amounts owed to Hinckley due to their ownership of debt investments in their long-term investments. 5. - Hinckley sold patents costing $13,000 for a loss of $800. 6 - A piece of equipment melted down due to overheating. State Hands Insurance paid the company $15,000 for their loss. The journal entry for the transaction was XX Cash Loss on Casualty A/D -- Equipment 4,500 Equipment 23,700 7. Hinckley declared dividends of $18,700 during 2021. 8. - Hinckley recorded the following AJE: 12/31 Amortization Expense 9,600 Patents 9,600 15,000 4,200 INSTRUCTIONS: Complete the worksheet for Hinckley's statement of cash flows for the year ended December 31, 2021. Hinckley Corporation Cash Flow Worksheet For the Year Ended December 31, 2021 Adjustments dr cr DEBITS Cash SIT Investments AVR (net) Interest Receivable Inventory Investments Balance 12/31/20 13,000 4,200 87,000 350 114,000 24,500 Balance 12/31/21 200 7,800 75,100 610 97,200 56,300 Land 22,000 22,000 Building Equipment Patents (net) 187,000 56,700 34,000 187,000 167,000 94,000 542,750 707,210 CREDITS A/D Building A/D Equipment AVP Notes Payable (nontrade) Dividends Payable Interest Payable Bonds Payable Common Stock ($2 par) APIC --C/S Retained Earnings 45,600 7,800 56,700 30,600 4,500 5,400 100,000 84,000 144,000 64,150 542,750 48,500 10,000 47,000 42,300 0 8,700 0 100,000 208,000 242,7101 707,210 Inflows/Adds Outflows/Deds Cash Flows from Operating Actitivities 0 0 0 0 Following are the trial balances for Ramjac Corp. cr Cash $ $ 12/31/17 dr 2,700 11,900 66,900 116,000 38,300 168,000 $ 139,000 314,700 12/31/16 dr cr 25,700 -0 54,400 124,800 8,300 168,000 $ 134,000 301,000 213,000 0 45,000 1,200 2,300 30,000 -0 150,000 100,000 20,000 76,700 Short-term investments Accounts Receivable Inventory Land Building Accum. Depreciation - Building Equipment Accum. Depreciation -- Equip. Right-of-Use Asset (net) Patents (net) Unearned Revenue Dividend Payable Notes Payable (Nontrade) Obligation under Capital Lease Bonds Payable Common Stock Additional Paid-In Capital Retained Earnings 184,400 78,000 15,500 24,400 -0 17,000 79,600 180,000 140,000 30,000 17,600 727,200 727,200 812,000 812,000 During 2017, X1. - The company sold equipment that cost $94,500 for $8,000 cash, while recording a gain of $3,700. X 2. - The company acquired land costing $30,000 by giving the owner $30,000 in bonds. X 3. - Net loss for the year ended December 31, 2017, totalled $59,100. X 4. -Short-term investments with a cost of $2,000 were sold at a loss of $1,600. Y 5. - Inventory on the books was written off with the following entry: 12/31/17 Loss on Inventory Write-Down 36,500 Inventory 36,500 6. The company sold a patent (with a cost of $37,000) for a loss of $5,300 X 7. The dividend payable was paid in January, 2017. Although dividends payable is a current liability, what kind of cash flow is a dividend payment? V 8. - The company took $1,500 in amortization expense: 12/31/17 Amortization Expense 1,500 Patents 1,500 X 9. The company leased a special asset in the following transaction: 2/14/17 Right of Use Asset 86,000 Obligations under Capital Lease 86,000 X 10. The company made lease payments over the lease term in 2017. The company amortized the Right of Use Asset during 2017, X 11. INSTRUCTIONS: Complete the statement of cash flows worksheet for Ramjac for the year ended December 31, 2017. 1 Ramjac Corp. Cash Flow Worksheet For the Year Ended December 31, 2017 DEBITS Cash Short-term Investments A/R Inventory Land Building Equipment Right-of-Use Asset (Net) Patents (Net) cr 23,000 2,000 Balance 12/31/16 25,700 0 22 54,400 1 124,800 11 8,300 8 168,000 301,000 6 0 45,000 16 Adjustments dr 23 13,900 21 12,500 27,700 10 30,000 36,500 Balance 12/31/17 2,700 11,900 66.900 116,000 38,300 168,000 314,700 78,000 15,500 DO 108,200 4 86,000 18 9,000 14 15 94,500 8,000 1,500 37,000 727,200 812.000 CREDITS A/D - Building A/D - Equipment Unearned Revenue Dividend Payable Notes Payable (Nontrade) Obligation under Capital Lease Bonds Payable Common Stock Additional Paid-In Capital RE 134,000 213,000 4 1,200 2,300 3 30,000 13 0 19 150,000 100,000 20,000 76,700 727,200 9 5,000 90,200 5 61,600 12 23,200 2,300 13,000 6,400 17 86,000 7 30,000 20 40,000 20 10,000 59,100 458,300 458,300 Inflows/Adds Outflows/Deds 139.000 184.400 24,400 0 17,000 79,600 180,000 140,000 30,000 17,600 812,000 1 2 12,500 59,100 3,700 5 9 Cash Flows from Operating Actitivities Less: Increase in A/R Net Loss Less: Gain on sale of equipment Add: Depreciation Exp.- Equip Add: Depreciation Exp.- Building Add: Loss on inventory write off Less: Purchase of inventory Add: increase in unearned revenue Add: Amoritization Exp Add: loss on selling of patent Add: Loss on sale of investment Add: Amoritization Expense 61,600 5,000 36,500 10 11 27,700 12 14 15 21 18 23,200 1,500 5,300 1,600 8,000 4 8,000 6 108,200 Cash flows from investing activities Proceeds from sale of equipment Purchase of Equipment Proceeds from sale of patent Purchase of patent Short term investment Proceeds from sale of short term inv. 15 31,700 16 22 9,000 13,900 21 400 3 13 Cash flows from financing activities Payment of Dividends Paid portion of Note Payable Payment on lease payable Issuance of Stock 2,300 13,000 6,400 19 50,000 20 255,800 22 232,800 23,000 255,800 255,800 7 30,000 30,000 Significant Noncash Transactions Issuance of bonds for land Acquisition of land with bonds Right of use Asset Obligations under capital lease 17 86,000 17 86,000