Answered step by step

Verified Expert Solution

Question

1 Approved Answer

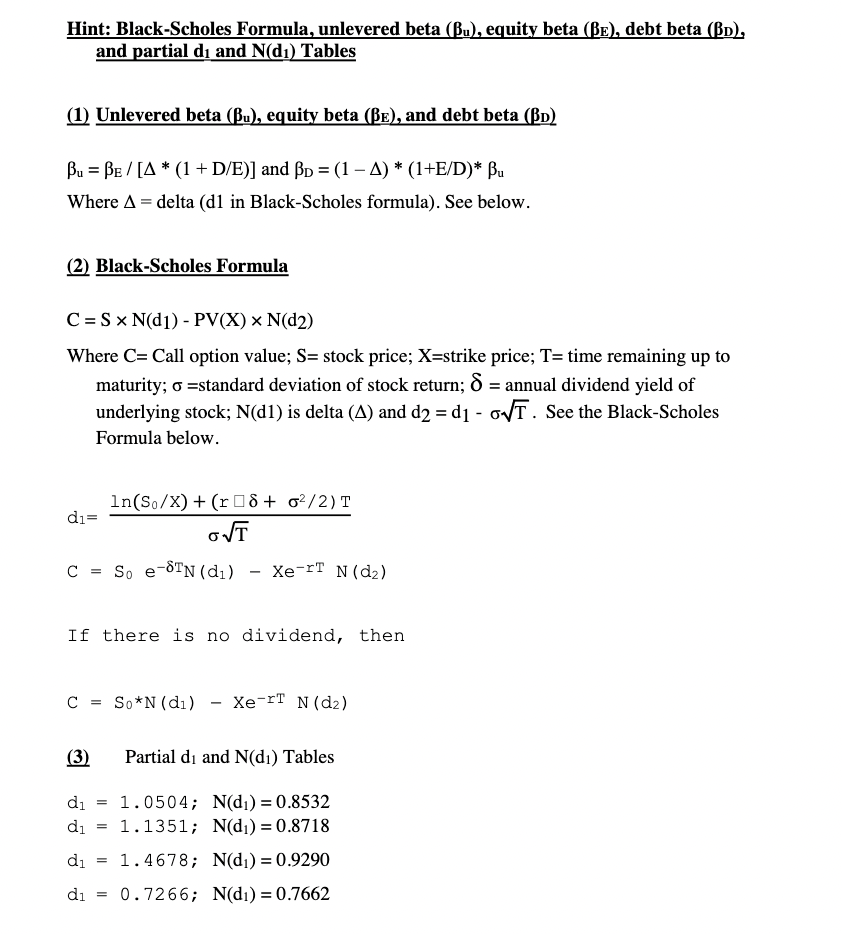

Hint: Black-Scholes Formula, unlevered beta (Bu), equity beta (BE), debt beta (BD), and partial di and N(d) Tables (1) Unlevered beta (u), equity beta (BE),

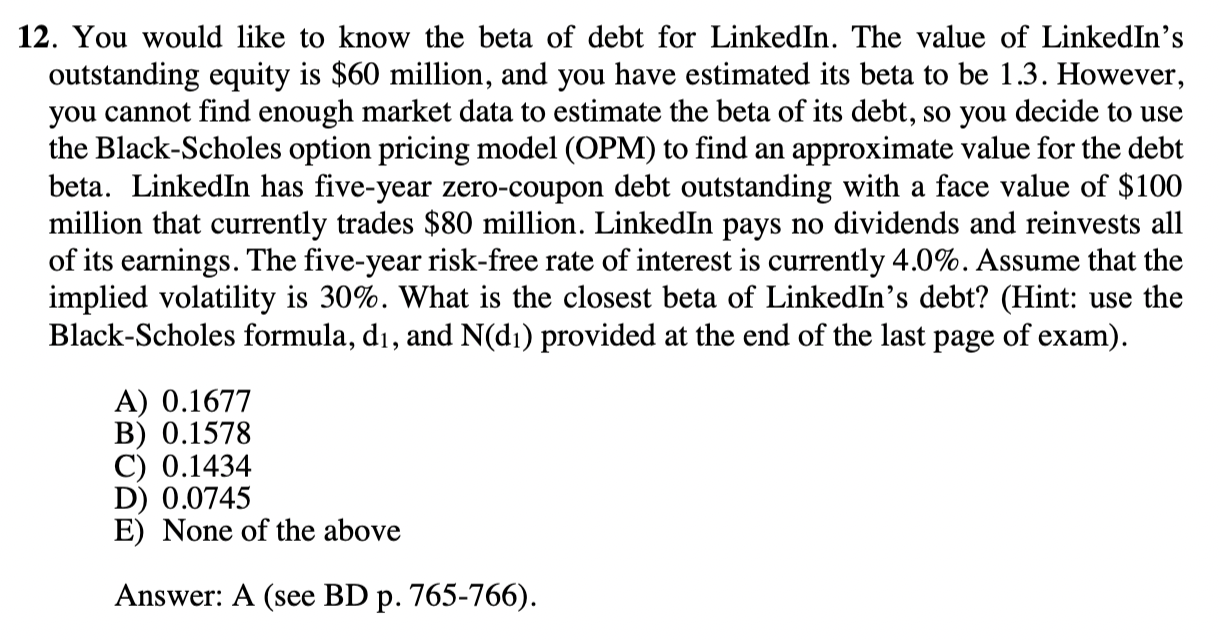

Hint: Black-Scholes Formula, unlevered beta (Bu), equity beta (BE), debt beta (BD), and partial di and N(d) Tables (1) Unlevered beta (u), equity beta (BE), and debt beta (BD) Bu = BE / [A*(1 + D/E)] and D = (1 A) * (1+E/D)* Bu Where A = delta (d1 in Black-Scholes formula). See below. (2) Black-Scholes Formula C = Sx N(d1) - PV(X) = N(d2) Where C= Call option value; S= stock price; X=strike price; T= time remaining up to maturity; 6 =standard deviation of stock return; 8 = annual dividend yield of underlying stock; N(d1) is delta (A) and d2=d - oT. See the Black-Scholes Formula below. In(So/X) + (r8+ 0/2) T d= OT C = So e-8TN (d) Xe-rT N (d) If there is no dividend, then C = So*N (d) Xe-rT N (d) (3) Partial di and N(d) Tables d = 1.0504; N(d) = 0.8532 d = 1.1351; N(d) = 0.8718 d = 1.4678; N(d) = 0.9290 d = 0.7266; N(d) = 0.7662 12. You would like to know the beta of debt for LinkedIn. The value of LinkedIn's outstanding equity is $60 million, and you have estimated its beta to be 1.3. However, you cannot find enough market data to estimate the beta of its debt, so you decide to use the Black-Scholes option pricing model (OPM) to find an approximate value for the debt beta. LinkedIn has five-year zero-coupon debt outstanding with a face value of $100 million that currently trades $80 million. LinkedIn pays no dividends and reinvests all of its earnings. The five-year risk-free rate of interest is currently 4.0%. Assume that the implied volatility is 30%. What is the closest beta of LinkedIn's debt? (Hint: use the Black-Scholes formula, d, and N(d) provided at the end of the last page of exam). A) 0.1677 B) 0.1578 C) 0.1434 D) 0.0745 E) None of the above Answer: A (see BD p. 765-766). Hint: Black-Scholes Formula, unlevered beta (Bu), equity beta (BE), debt beta (BD), and partial di and N(d) Tables (1) Unlevered beta (u), equity beta (BE), and debt beta (BD) Bu = BE / [A*(1 + D/E)] and D = (1 A) * (1+E/D)* Bu Where A = delta (d1 in Black-Scholes formula). See below. (2) Black-Scholes Formula C = Sx N(d1) - PV(X) = N(d2) Where C= Call option value; S= stock price; X=strike price; T= time remaining up to maturity; 6 =standard deviation of stock return; 8 = annual dividend yield of underlying stock; N(d1) is delta (A) and d2=d - oT. See the Black-Scholes Formula below. In(So/X) + (r8+ 0/2) T d= OT C = So e-8TN (d) Xe-rT N (d) If there is no dividend, then C = So*N (d) Xe-rT N (d) (3) Partial di and N(d) Tables d = 1.0504; N(d) = 0.8532 d = 1.1351; N(d) = 0.8718 d = 1.4678; N(d) = 0.9290 d = 0.7266; N(d) = 0.7662 12. You would like to know the beta of debt for LinkedIn. The value of LinkedIn's outstanding equity is $60 million, and you have estimated its beta to be 1.3. However, you cannot find enough market data to estimate the beta of its debt, so you decide to use the Black-Scholes option pricing model (OPM) to find an approximate value for the debt beta. LinkedIn has five-year zero-coupon debt outstanding with a face value of $100 million that currently trades $80 million. LinkedIn pays no dividends and reinvests all of its earnings. The five-year risk-free rate of interest is currently 4.0%. Assume that the implied volatility is 30%. What is the closest beta of LinkedIn's debt? (Hint: use the Black-Scholes formula, d, and N(d) provided at the end of the last page of exam). A) 0.1677 B) 0.1578 C) 0.1434 D) 0.0745 E) None of the above Answer: A (see BD p. 765-766)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started