Hint: Cash balance will be $18,605 in unadjusted trial balance.

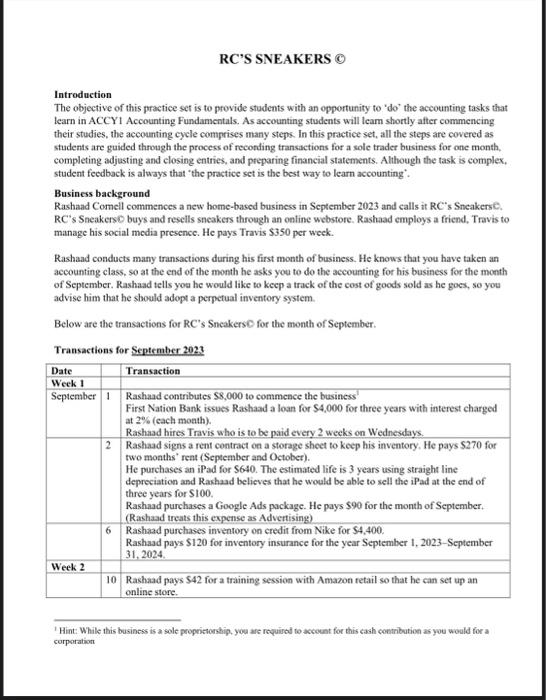

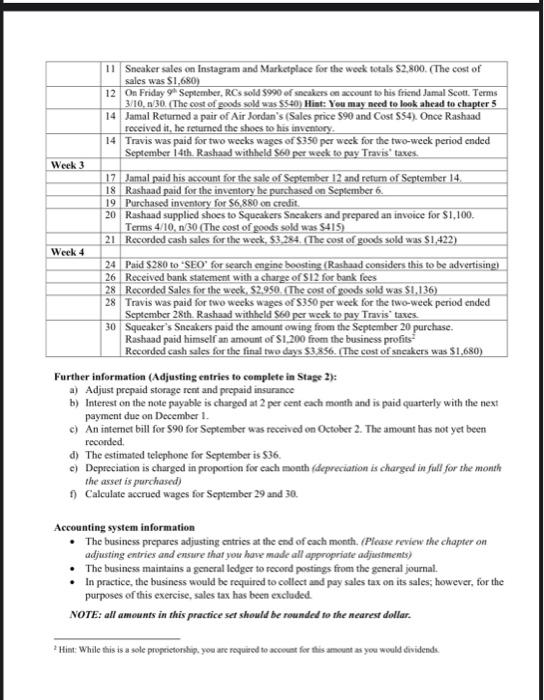

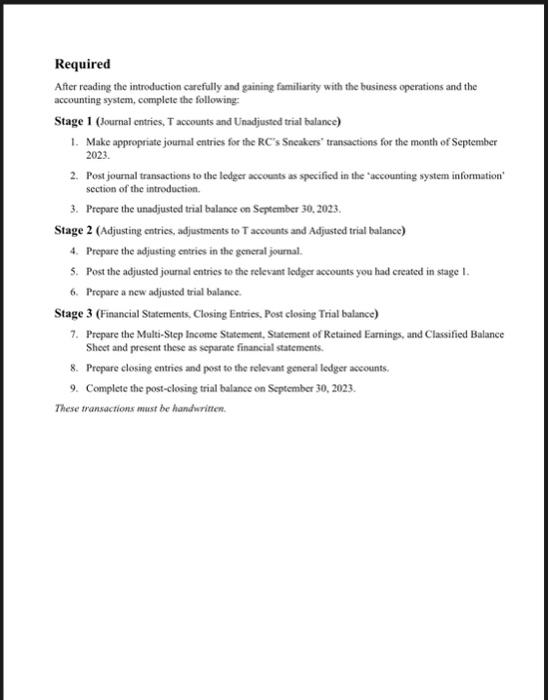

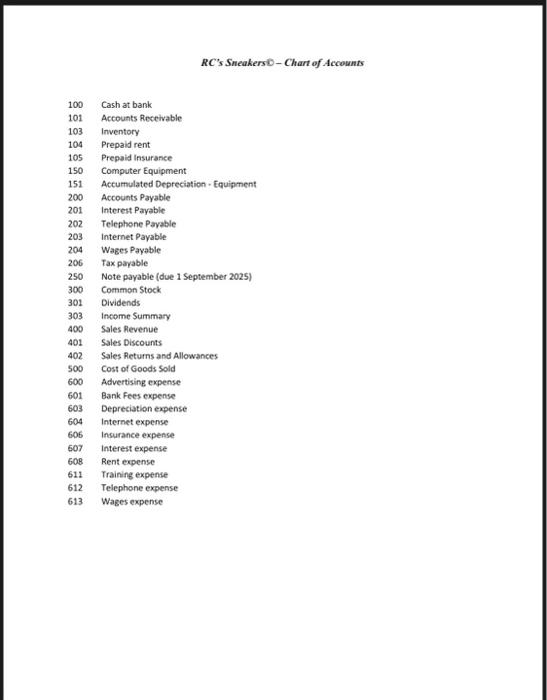

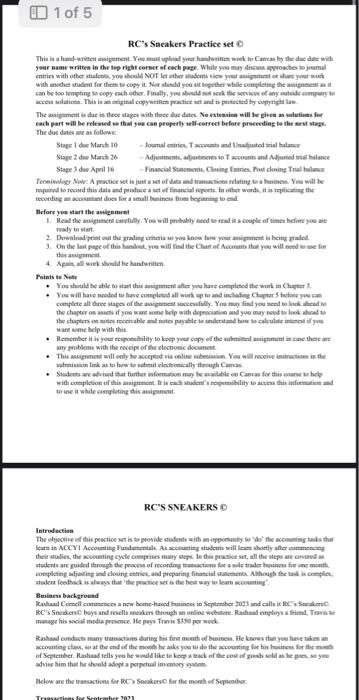

RC's Sneakers Practice set 0 each part will be rekened w ibat yea cas property sett-cerrect before procerding to the arut stage. The due daies ane an follinux: Acfore yew start the asignmant resaly io start. this awignament. 4. Apah, all werk shodala be handuritien. Feints is Keatr - Yos will have neded to have completid all werk op to and insluding Clupter 5 tedioer yes cas wan wene laip with thit. any problens with the noceips of ille clectlesic documet to ne it while sonyleting this asipanat. RC'S SNEAKERS O Introdectian The ebootive of this pesctice set is te provide students with a ofporanily to 'do' the acconanting tasks that Beniness backgroend manage his secial modia presence, 16 pays Trevis 5260 por work. accontiag claw, se at the end of the mende he aiks yoe ie de the accounting for his hesinest for the mend of Septenter. Ranhaad iells yeu be medilike te kecp a mack of tece ceit of zowab sold as he pack, ar yoe advise him that he thould adopt a perpctual imiendor watem Below are the mansactions fier RR- sesakers for the monlh ef Sepmenber. Introduction The objective of this practice set is to provide students with an opportunity to 'do' the accounting tasks that learn in ACCY1 Accounting Fundamentals. As accounting students will leam shortly after commencing their studies, the accounting cycle comprises many steps. In this practice set, all the steps are covered as students are guided through the process of reconding transactions for a sole trader business for one month, completing adjusting and closing entries, and preparing financial statements. Although the task is complex. student feedback is always that "the practice set is the best way to learn accounting". Business background Rashaad Comell commences a new home-based business in September 2023 and calls it RC's SncakersC. RC s Sneakerse buys and resells sneakers through an online webstore. Rashaad employs a friend. Travis to manage his social media presence. He pays Travis $350 per week. Rashaad conducts many transactions during his first month of business. He knows that you have taken an accounting class, so at the end of the month he asks you to do the accounting for his business for the month of September. Rashaad tells you he would like to keep a track of the cost of goods sold as he goes, so you advise him that he sbould adopt a perpetual inventory system. Below are the transactions for RC 's Sncakers C for the month of September. Transactions for September 2023 'Hint: While this business is a sole propoietorship, you are required to account for this cach contribution as you would for a corporationt Further information (Adjusting entries to complete in Stage 2): a) Adjust prepaid storage rent and prepaid insurance b) Interest on the note payable is charged at 2 per cent each month and is paid cuarterly with the next payment due on December 1. c) An internet bill for $90 for September was received on October 2. The amount has not yet been recorded. d) The estimated teiephone for September is $36. e) Depreciation is charged in propontion for each moath (deprecianion is charged in full for the month the asset is purchased) f) Calculate acerued wages for September 29 and 30. Accounting system information - The business prepares adjusting entries at the end of cach month. (Pleuse review the chapter on adjusting entries and ensure that you have made all appropriafe adjastments) - The business maintains a general ledger to record postings from the general journal. - In practice, the business would be required to collect and pay sales tax on its sales; however, for the purposes of this exercise, sales tax has been excluded. Required After reading the introduction carefully and gaining familiarity with the business operations and the accounting system, complete the following: Stage 1 (Journal cntries, T accounts and Unadjusted trial balance) 1. Make appropriate joumal entries for the RC's Sneakers" transactions for the month of September 2023. 2. Post joumal transactions to the ledger accounts as specified in the 'accounting system information' section of the introductien. 3. Prepure the unadjusted trial balance on September 30. 2023. Stage 2 (Adjusting entries, adjustments to T accounts and Adjusted trial balance) 4. Prepare the adjusting entries in the general journal. 5. Post the adjusted journal entries to the relesant ledger accounts you had created in stage I. 6. Prepare a new adjusted trial balance. Stage 3 (Financial Statements. Closing Entries. Post closing Trial balance) 7. Prepare the Multi-Step Income Statement, Statement of Retained Earnings, and Classified Balance Sheet and present these as separate financial statements. 8. Prepare closing entries and post to the relevant general ledger ascounts. 9. Complete the post-closing trial balance on September 30, 2023. These transactions must be handwritten. RC's Sneakers - Chart of Accounts RC's Sneakers Practice set 0 each part will be rekened w ibat yea cas property sett-cerrect before procerding to the arut stage. The due daies ane an follinux: Acfore yew start the asignmant resaly io start. this awignament. 4. Apah, all werk shodala be handuritien. Feints is Keatr - Yos will have neded to have completid all werk op to and insluding Clupter 5 tedioer yes cas wan wene laip with thit. any problens with the noceips of ille clectlesic documet to ne it while sonyleting this asipanat. RC'S SNEAKERS O Introdectian The ebootive of this pesctice set is te provide students with a ofporanily to 'do' the acconanting tasks that Beniness backgroend manage his secial modia presence, 16 pays Trevis 5260 por work. accontiag claw, se at the end of the mende he aiks yoe ie de the accounting for his hesinest for the mend of Septenter. Ranhaad iells yeu be medilike te kecp a mack of tece ceit of zowab sold as he pack, ar yoe advise him that he thould adopt a perpctual imiendor watem Below are the mansactions fier RR- sesakers for the monlh ef Sepmenber. Introduction The objective of this practice set is to provide students with an opportunity to 'do' the accounting tasks that learn in ACCY1 Accounting Fundamentals. As accounting students will leam shortly after commencing their studies, the accounting cycle comprises many steps. In this practice set, all the steps are covered as students are guided through the process of reconding transactions for a sole trader business for one month, completing adjusting and closing entries, and preparing financial statements. Although the task is complex. student feedback is always that "the practice set is the best way to learn accounting". Business background Rashaad Comell commences a new home-based business in September 2023 and calls it RC's SncakersC. RC s Sneakerse buys and resells sneakers through an online webstore. Rashaad employs a friend. Travis to manage his social media presence. He pays Travis $350 per week. Rashaad conducts many transactions during his first month of business. He knows that you have taken an accounting class, so at the end of the month he asks you to do the accounting for his business for the month of September. Rashaad tells you he would like to keep a track of the cost of goods sold as he goes, so you advise him that he sbould adopt a perpetual inventory system. Below are the transactions for RC 's Sncakers C for the month of September. Transactions for September 2023 'Hint: While this business is a sole propoietorship, you are required to account for this cach contribution as you would for a corporationt Further information (Adjusting entries to complete in Stage 2): a) Adjust prepaid storage rent and prepaid insurance b) Interest on the note payable is charged at 2 per cent each month and is paid cuarterly with the next payment due on December 1. c) An internet bill for $90 for September was received on October 2. The amount has not yet been recorded. d) The estimated teiephone for September is $36. e) Depreciation is charged in propontion for each moath (deprecianion is charged in full for the month the asset is purchased) f) Calculate acerued wages for September 29 and 30. Accounting system information - The business prepares adjusting entries at the end of cach month. (Pleuse review the chapter on adjusting entries and ensure that you have made all appropriafe adjastments) - The business maintains a general ledger to record postings from the general journal. - In practice, the business would be required to collect and pay sales tax on its sales; however, for the purposes of this exercise, sales tax has been excluded. Required After reading the introduction carefully and gaining familiarity with the business operations and the accounting system, complete the following: Stage 1 (Journal cntries, T accounts and Unadjusted trial balance) 1. Make appropriate joumal entries for the RC's Sneakers" transactions for the month of September 2023. 2. Post joumal transactions to the ledger accounts as specified in the 'accounting system information' section of the introductien. 3. Prepure the unadjusted trial balance on September 30. 2023. Stage 2 (Adjusting entries, adjustments to T accounts and Adjusted trial balance) 4. Prepare the adjusting entries in the general journal. 5. Post the adjusted journal entries to the relesant ledger accounts you had created in stage I. 6. Prepare a new adjusted trial balance. Stage 3 (Financial Statements. Closing Entries. Post closing Trial balance) 7. Prepare the Multi-Step Income Statement, Statement of Retained Earnings, and Classified Balance Sheet and present these as separate financial statements. 8. Prepare closing entries and post to the relevant general ledger ascounts. 9. Complete the post-closing trial balance on September 30, 2023. These transactions must be handwritten. RC's Sneakers - Chart of Accounts