Answered step by step

Verified Expert Solution

Question

1 Approved Answer

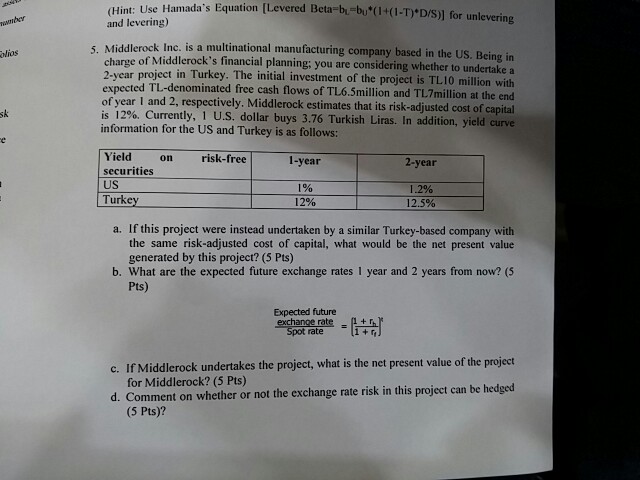

(Hint: Use Hanada's Equation [Levered Beta-bu-bu(I+(1-T)D/S)] for unlevering ber and levering) dlerock Inc. is a multinational manufacturing company based in the US. Being in Middlerock's

(Hint: Use Hanada's Equation [Levered Beta-bu-bu"(I+(1-T)"D/S)] for unlevering ber and levering) dlerock Inc. is a multinational manufacturing company based in the US. Being in Middlerock's financial planning; you are considering whether to undertake a project in Turkey. The initial investment of the project is TL10 million with ws of TL6.5million and TL7million at the end olios charge of 2-year expected TL-denominated free cash flo year I and 2, respectively. Middlerock estimates that its risk-adjusted cost of capital is 12%. Currently, 1 US. dollar buys 3.76 Turkish Liras. In addition, yield curve information for the US and Turkey is as follows: sk Yield on risk-free1-year securities US Turkey 2-year 190 12% 1.2% , i 12.5% a. If this project were instead undertaken by a similar Turkey-based company with the same risk-adjusted cost of capital, what would be the net present value generated by this project? (5 Pts) b. What are the expected future exchange rates 1 year and 2 years from now? (5 Pts) Expected future Spot rate c. If Middlerock undertakes the project, what is the net present value of the project for Middlerock? (5 Pts) d. Comment on whether or not the exchange rate risk in this project can be hedged (5 Pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started