Hints: Problem 2: Find the arbitrage first in Exhibit 2. Then use Exhibit 1 to start with dollars, convert them, and perform the arbitrage. Problem 4: As the case explains a "dollar discount" is a situation where the U.S. dollar trades at a forward discount against another currency. See Exhibits 1-3

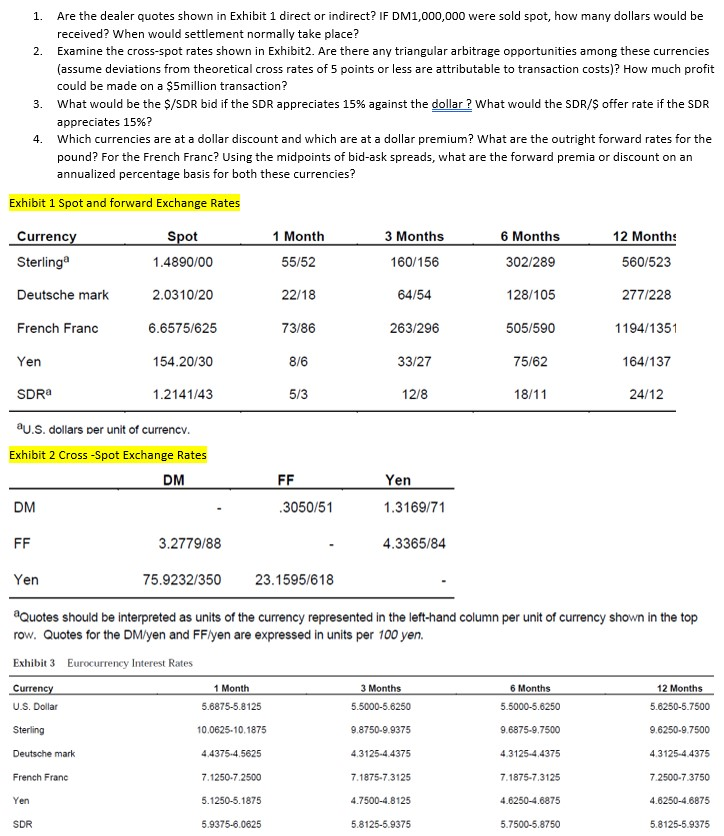

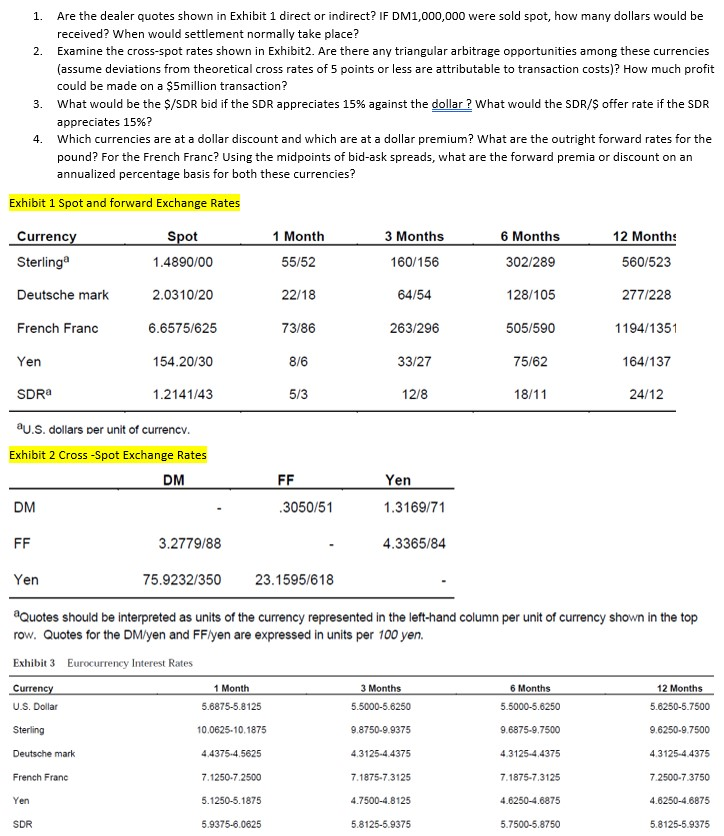

- Are the dealer quotes shown in Exhibit 1 direct or indirect? IF DM1,000,000 were sold spot, how many dollars would be received? When would settlement normally take place?

- Examine the cross-spot rates shown in Exhibit Are there any triangular arbitrage opportunities among these currencies (assume deviations from theoretical cross rates of 5 points or less are attributable to transaction costs)? How much profit could be made on a $5million transaction?

- What would be the $/SDR bid if the SDR appreciates 15% against the dollar ? What would the SDR/$ offer rate if the SDR appreciates 15%?

- Which currencies are at a dollar discount and which are at a dollar premium? What are the outright forward rates for the pound? For the French Franc? Using the midpoints of bid-ask spreads, what are the forward premia or discount on an annualized percentage basis for both these currencies?

1. Are the dealer quotes shown in Exhibit 1 direct or indirect? IF DM1,000,000 were sold spot, how many dollars would be received? When would settlement normally take place? 2. Examine the cross-spot rates shown in Exhibit2. Are there any triangular arbitrage opportunities among these currencies (assume deviations from theoretical cross rates of 5 points or less are attributable to transaction costs)? How much profit could be made on a $5million transaction? 3. What would be the $/SDR bid if the SDR appreciates 15% against the dollar? What would the SDR/S offer rate if the SDR appreciates 15%? Which currencies are at a dollar discount and which are at a dollar premium? What are the outright forward rates for the pound? For the French Franc? Using the midpoints of bid-ask spreads, what are the forward premia or discount on an annualized percentage basis for both these currencies? Exhibit 1 Spot and forward Exchange Rates 4. Currency Sterling Spot 1.4890/00 1 Month 55/52 3 Months 160/156 6 Months 302/289 12 Month: 560/523 Deutsche mark 2.0310/20 22/18 64/54 128/105 277/228 French Franc 6.6575/625 73/86 263/296 505/590 1194/1351 Yen 154.20/30 8/6 33/27 75/62 164/137 SDR 1.2141/43 5/3 12/8 18/11 24/12 au.S. dollars per unit of currency. Exhibit 2 Cross-Spot Exchange Rates DM FF Yen 1.3169/71 DM .3050/51 FF 3.2779/88 4.3365/84 Yen 75.9232/350 23.1595/618 6 Months aQuotes should be interpreted as units of the currency represented in the left-hand column per unit of currency shown in the top row. Quotes for the DM/yen and FF/yen are expressed in units per 100 yen. Exhibit 3 Eurocurrency Interest Rates Currency 1 Month 3 Months 5.6875-5.8125 5.5000-5.6250 5.5000-5.6250 Sterling 10.0625.10.1875 9.8750-9.9375 9.6875-9.7500 Deutsche mark 4.3125-4.4375 7.1875-7.3125 12 Months 5.6250-5.7500 U.S. Dollar 9.6250-9.7500 4.4375.4.5625 4.3125-4,4375 4.3125-4.4375 French Franc 7.1250-7.2500 7.1875-7.3125 7.2500-7.3750 Yen 5.1250-5.1875 4.7500-4.8125 4.6250-4.6875 4.6250-4.6875 SDR 5.9375-6.0625 5.8125-5.9375 5.7500-5.8750 5.8125-5.9375 1. Are the dealer quotes shown in Exhibit 1 direct or indirect? IF DM1,000,000 were sold spot, how many dollars would be received? When would settlement normally take place? 2. Examine the cross-spot rates shown in Exhibit2. Are there any triangular arbitrage opportunities among these currencies (assume deviations from theoretical cross rates of 5 points or less are attributable to transaction costs)? How much profit could be made on a $5million transaction? 3. What would be the $/SDR bid if the SDR appreciates 15% against the dollar? What would the SDR/S offer rate if the SDR appreciates 15%? Which currencies are at a dollar discount and which are at a dollar premium? What are the outright forward rates for the pound? For the French Franc? Using the midpoints of bid-ask spreads, what are the forward premia or discount on an annualized percentage basis for both these currencies? Exhibit 1 Spot and forward Exchange Rates 4. Currency Sterling Spot 1.4890/00 1 Month 55/52 3 Months 160/156 6 Months 302/289 12 Month: 560/523 Deutsche mark 2.0310/20 22/18 64/54 128/105 277/228 French Franc 6.6575/625 73/86 263/296 505/590 1194/1351 Yen 154.20/30 8/6 33/27 75/62 164/137 SDR 1.2141/43 5/3 12/8 18/11 24/12 au.S. dollars per unit of currency. Exhibit 2 Cross-Spot Exchange Rates DM FF Yen 1.3169/71 DM .3050/51 FF 3.2779/88 4.3365/84 Yen 75.9232/350 23.1595/618 6 Months aQuotes should be interpreted as units of the currency represented in the left-hand column per unit of currency shown in the top row. Quotes for the DM/yen and FF/yen are expressed in units per 100 yen. Exhibit 3 Eurocurrency Interest Rates Currency 1 Month 3 Months 5.6875-5.8125 5.5000-5.6250 5.5000-5.6250 Sterling 10.0625.10.1875 9.8750-9.9375 9.6875-9.7500 Deutsche mark 4.3125-4.4375 7.1875-7.3125 12 Months 5.6250-5.7500 U.S. Dollar 9.6250-9.7500 4.4375.4.5625 4.3125-4,4375 4.3125-4.4375 French Franc 7.1250-7.2500 7.1875-7.3125 7.2500-7.3750 Yen 5.1250-5.1875 4.7500-4.8125 4.6250-4.6875 4.6250-4.6875 SDR 5.9375-6.0625 5.8125-5.9375 5.7500-5.8750 5.8125-5.9375