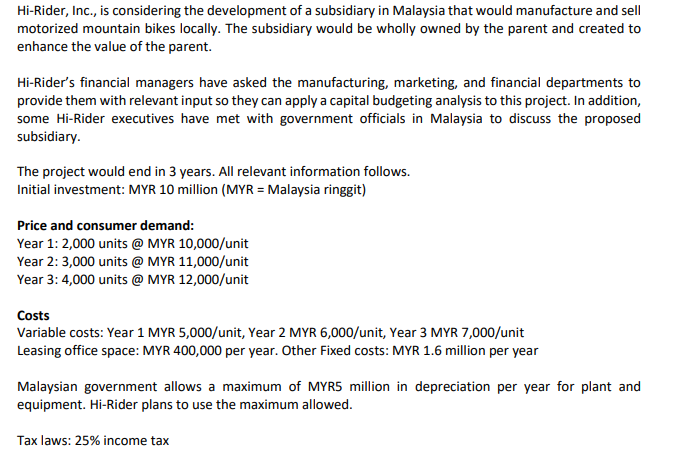

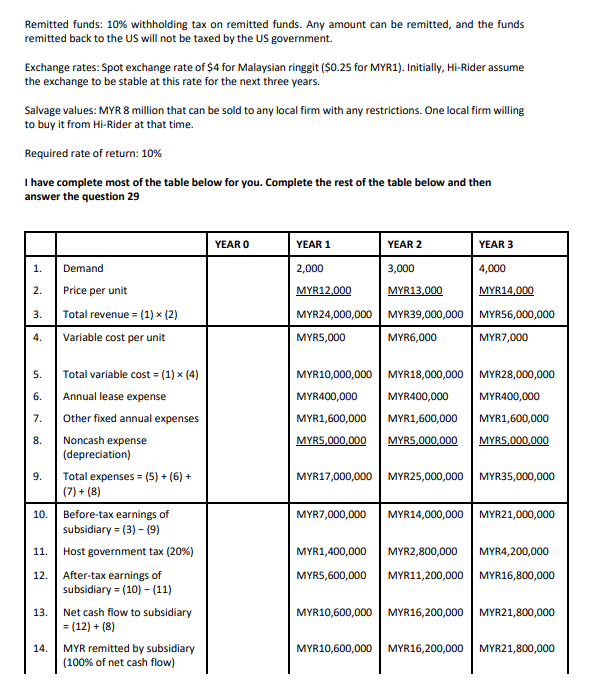

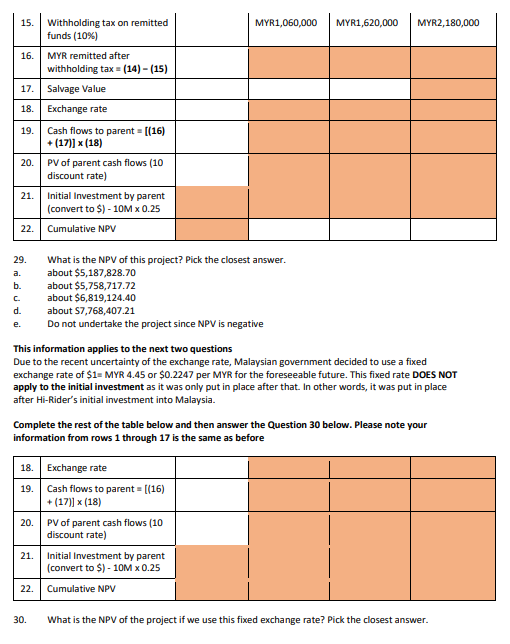

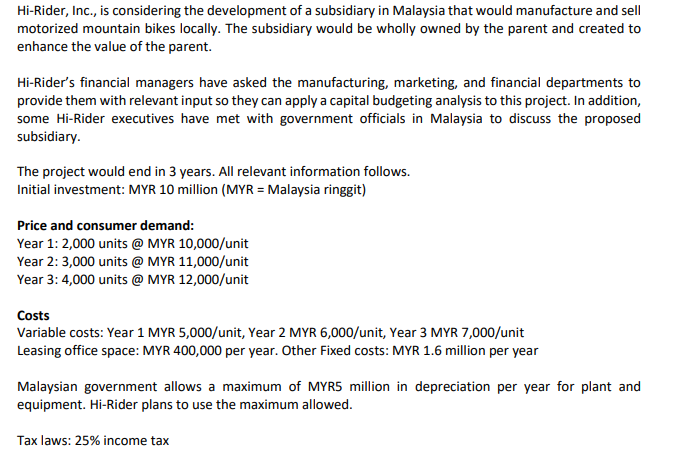

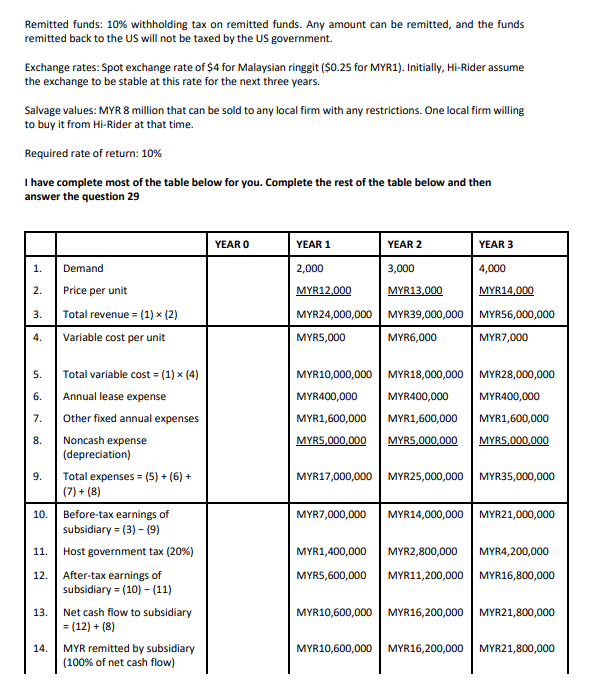

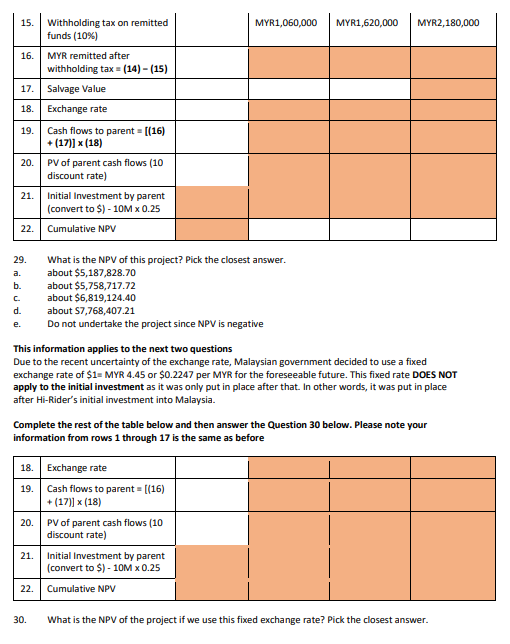

Hi-Rider, Inc., is considering the development of a subsidiary in Malaysia that would manufacture and sell motorized mountain bikes locally. The subsidiary would be wholly owned by the parent and created to enhance the value of the parent. Hi-Rider's financial managers have asked the manufacturing, marketing, and financial departments to provide them with relevant input so they can apply a capital budgeting analysis to this project. In addition, some Hi-Rider executives have met with government officials in Malaysia to discuss the proposed subsidiary. The project would end in 3 years. All relevant information follows. Initial investment: MYR 10 million (MYR = Malaysia ringgit) Price and consumer demand: Year 1:2,000 units @ MYR 10,000/unit Year 2: 3,000 units @ MYR 11,000/unit Year 3: 4,000 units @ MYR 12,000/unit Costs Variable costs: Year 1 MYR 5,000/unit, Year 2 MYR 6,000/unit, Year 3 MYR 7,000/unit Leasing office space: MYR 400,000 per year. Other Fixed costs: MYR 1.6 million per year Malaysian government allows a maximum of MYR5 million in depreciation per year for plant and equipment. Hi-Rider plans to use the maximum allowed. Tax laws: 25% income tax Remitted funds: 10% withholding tax on remitted funds. Any amount can be remitted, and the funds remitted back to the US will not be taxed by the US government. Exchange rates: Spot exchange rate of $4 for Malaysian ringgit ($0.25 for MYR1). Initially, Hi-Rider assume the exchange to be stable at this rate for the next three years. Salvage values: MYR 8 million that can be sold to any local firm with any restrictions. One local firm willing to buy it from Hi-Rider at that time. Required rate of return: 10% I have complete most of the table below for you. Complete the rest of the table below and then answer the question 29 YEAR O YEAR 1 YEAR 2 YEAR 3 1. Demand 2. 2,000 3,000 4,000 MYR12,000 MYR13,000 MYR14,000 MYR24,000,000 MYR39,000,000 MYRS6,000,000 MYR5,000 MYR6,000 MYR7,000 3. Price per unit Total revenue - (1) (2) Variable cost per unit 4. 5. 6. MYR10,000,000 MYR18,000,000 MYR28,000,000 MYR400,000 MYR400,000 MYR400,000 MYR1,600,000 MYR1,600,000 MYR1,600,000 MYR5,000,000 MYR5,000,000 MYR5,000,000 7. 8. 9. MYR17,000,000 MYR25,000,000 MYR35,000,000 10. Total variable cost = (1) (4) Annual lease expense Other fixed annual expenses Noncash expense (depreciation) Total expenses = (5) + (6) + (7) + (8) Before-tax earnings of subsidiary = (3) - (9) Host government tax (20%) After-tax earnings of subsidiary = (10) - (11) Net cash flow to subsidiary = (12) + (8) MYR remitted by subsidiary (100% of net cash flow) MYR7,000,000 MYR14,000,000 MYR21,000,000 11. MYR1,400,000 MYR5,600,000 MYR2,800,000 MYR4,200,000 MYR11,200,000 MYR16,800,000 12. 13. MYR10,600,000 MYR16,200,000 MYR21,800,000 14. MYR10,600,000 MYR16,200,000 MYR21,800,000 15. MYR1,060,000 MYR1,620,000 MYR2,180,000 8. Withholding tax on remitted funds (10%) 16. MYR remitted after withholding tax - (14) - (15) 17. Salvage Value Exchange rate 19. Cash flows to parent = [(16) + (17)] x (18) 20. PV of parent cash flows (10 discount rate) 21. Initial Investment by parent (convert to $) - 10M X 0.25 22. Cumulative NPV 29. a. b. C. d. e. What is the NPV of this project? Pick the closest answer. about $5,187,828.70 about $5,758,717.72 about $6,819,124.40 about 87,768,407.21 Do not undertake the project since NPV is negative This information applies to the next two questions Due to the recent uncertainty of the exchange rate, Malaysian government decided to use a fixed exchange rate of $1= MYR 4.45 or $0.2247 per MYR for the foreseeable future. This fixed rate DOES NOT apply to the initial investment as it was only put in place after that. In other words, it was put in place after Hi-Rider's initial investment into Malaysia. Complete the rest of the table below and then answer the question 30 below. Please note your information from rows 1 through 17 is the same as before 18. Exchange rate 19. Cash flows to parent = [(16) + (17)] (18) 20. PV of parent cash flows (10 discount rate) 21. Initial Investment by parent (convert to $) - 10M 0.25 22. Cumulative NPV 30. What is the NPV of the project if we use this fixed exchange rate? Pick the closest answer. Hi-Rider, Inc., is considering the development of a subsidiary in Malaysia that would manufacture and sell motorized mountain bikes locally. The subsidiary would be wholly owned by the parent and created to enhance the value of the parent. Hi-Rider's financial managers have asked the manufacturing, marketing, and financial departments to provide them with relevant input so they can apply a capital budgeting analysis to this project. In addition, some Hi-Rider executives have met with government officials in Malaysia to discuss the proposed subsidiary. The project would end in 3 years. All relevant information follows. Initial investment: MYR 10 million (MYR = Malaysia ringgit) Price and consumer demand: Year 1:2,000 units @ MYR 10,000/unit Year 2: 3,000 units @ MYR 11,000/unit Year 3: 4,000 units @ MYR 12,000/unit Costs Variable costs: Year 1 MYR 5,000/unit, Year 2 MYR 6,000/unit, Year 3 MYR 7,000/unit Leasing office space: MYR 400,000 per year. Other Fixed costs: MYR 1.6 million per year Malaysian government allows a maximum of MYR5 million in depreciation per year for plant and equipment. Hi-Rider plans to use the maximum allowed. Tax laws: 25% income tax Remitted funds: 10% withholding tax on remitted funds. Any amount can be remitted, and the funds remitted back to the US will not be taxed by the US government. Exchange rates: Spot exchange rate of $4 for Malaysian ringgit ($0.25 for MYR1). Initially, Hi-Rider assume the exchange to be stable at this rate for the next three years. Salvage values: MYR 8 million that can be sold to any local firm with any restrictions. One local firm willing to buy it from Hi-Rider at that time. Required rate of return: 10% I have complete most of the table below for you. Complete the rest of the table below and then answer the question 29 YEAR O YEAR 1 YEAR 2 YEAR 3 1. Demand 2. 2,000 3,000 4,000 MYR12,000 MYR13,000 MYR14,000 MYR24,000,000 MYR39,000,000 MYRS6,000,000 MYR5,000 MYR6,000 MYR7,000 3. Price per unit Total revenue - (1) (2) Variable cost per unit 4. 5. 6. MYR10,000,000 MYR18,000,000 MYR28,000,000 MYR400,000 MYR400,000 MYR400,000 MYR1,600,000 MYR1,600,000 MYR1,600,000 MYR5,000,000 MYR5,000,000 MYR5,000,000 7. 8. 9. MYR17,000,000 MYR25,000,000 MYR35,000,000 10. Total variable cost = (1) (4) Annual lease expense Other fixed annual expenses Noncash expense (depreciation) Total expenses = (5) + (6) + (7) + (8) Before-tax earnings of subsidiary = (3) - (9) Host government tax (20%) After-tax earnings of subsidiary = (10) - (11) Net cash flow to subsidiary = (12) + (8) MYR remitted by subsidiary (100% of net cash flow) MYR7,000,000 MYR14,000,000 MYR21,000,000 11. MYR1,400,000 MYR5,600,000 MYR2,800,000 MYR4,200,000 MYR11,200,000 MYR16,800,000 12. 13. MYR10,600,000 MYR16,200,000 MYR21,800,000 14. MYR10,600,000 MYR16,200,000 MYR21,800,000 15. MYR1,060,000 MYR1,620,000 MYR2,180,000 8. Withholding tax on remitted funds (10%) 16. MYR remitted after withholding tax - (14) - (15) 17. Salvage Value Exchange rate 19. Cash flows to parent = [(16) + (17)] x (18) 20. PV of parent cash flows (10 discount rate) 21. Initial Investment by parent (convert to $) - 10M X 0.25 22. Cumulative NPV 29. a. b. C. d. e. What is the NPV of this project? Pick the closest answer. about $5,187,828.70 about $5,758,717.72 about $6,819,124.40 about 87,768,407.21 Do not undertake the project since NPV is negative This information applies to the next two questions Due to the recent uncertainty of the exchange rate, Malaysian government decided to use a fixed exchange rate of $1= MYR 4.45 or $0.2247 per MYR for the foreseeable future. This fixed rate DOES NOT apply to the initial investment as it was only put in place after that. In other words, it was put in place after Hi-Rider's initial investment into Malaysia. Complete the rest of the table below and then answer the question 30 below. Please note your information from rows 1 through 17 is the same as before 18. Exchange rate 19. Cash flows to parent = [(16) + (17)] (18) 20. PV of parent cash flows (10 discount rate) 21. Initial Investment by parent (convert to $) - 10M 0.25 22. Cumulative NPV 30. What is the NPV of the project if we use this fixed exchange rate? Pick the closest