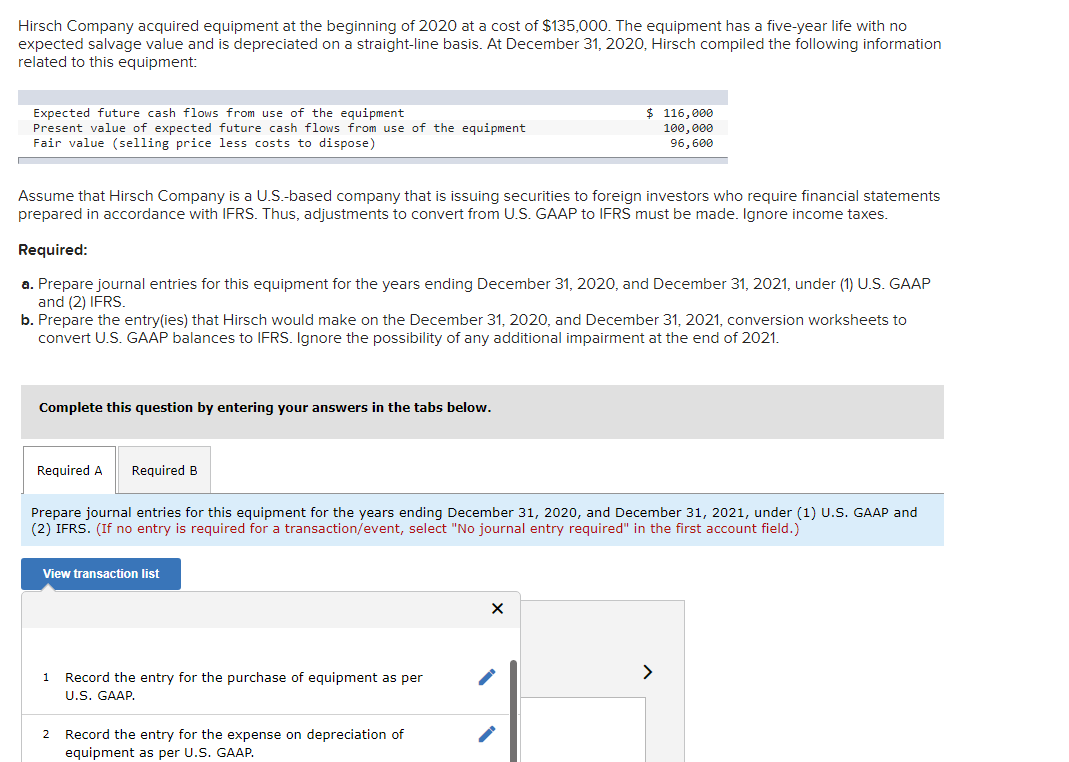

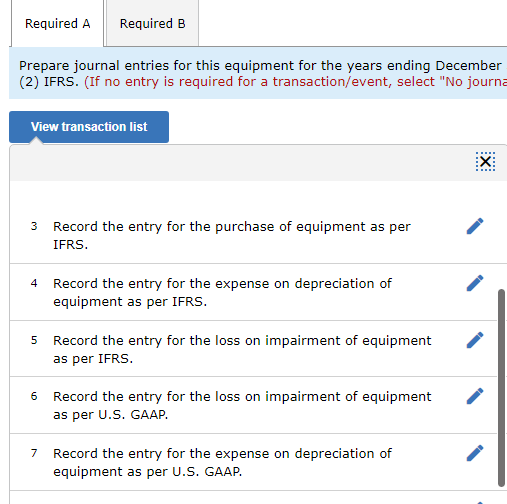

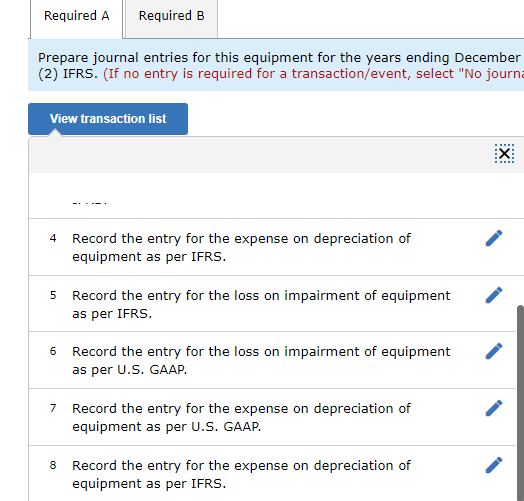

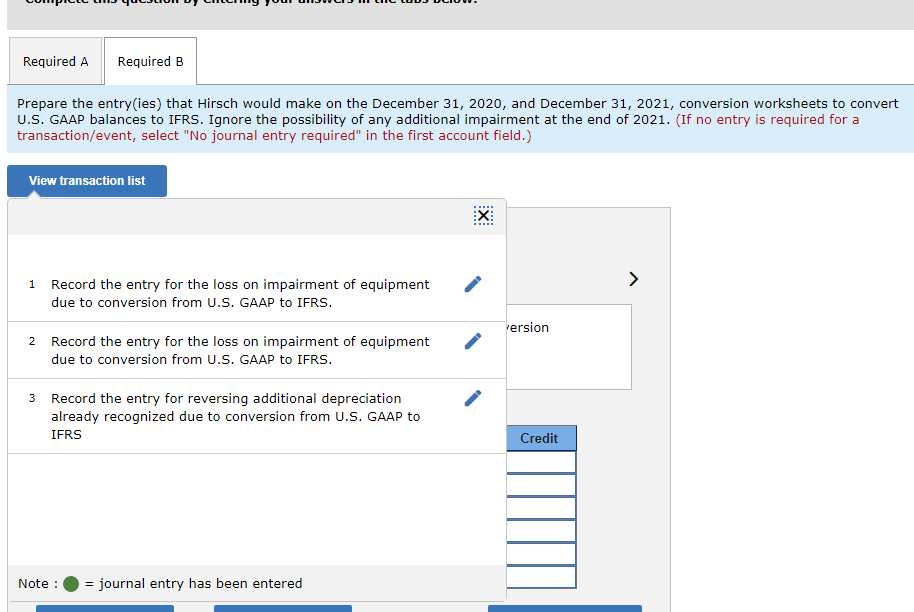

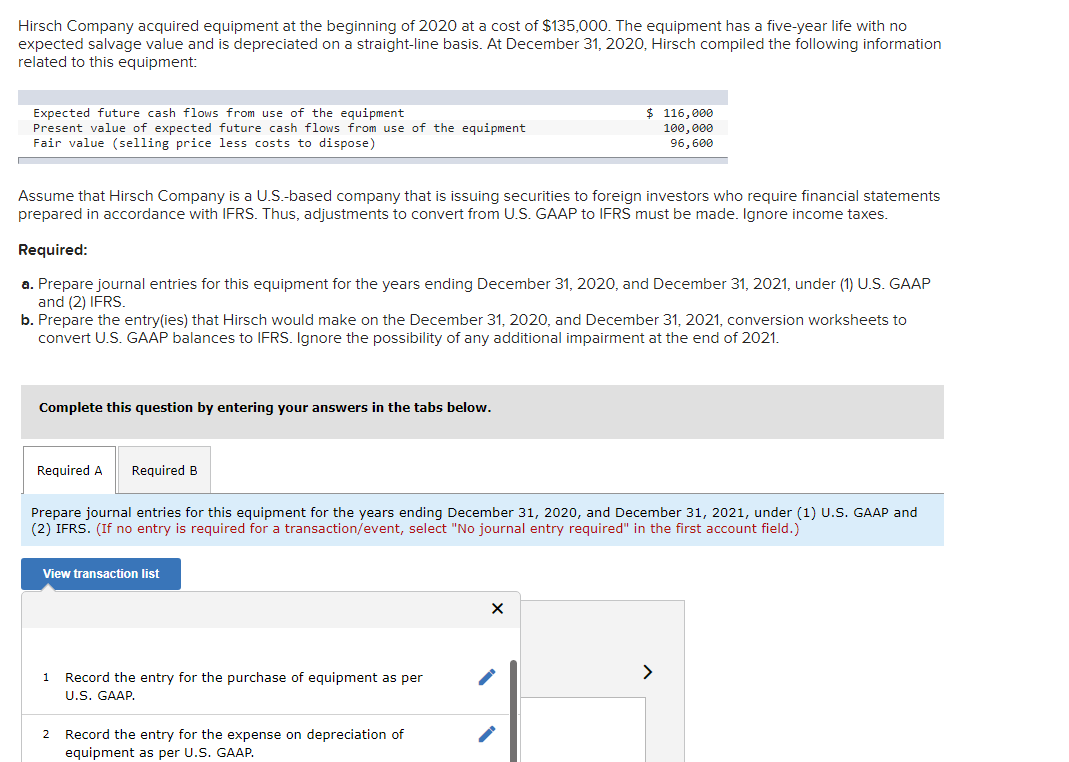

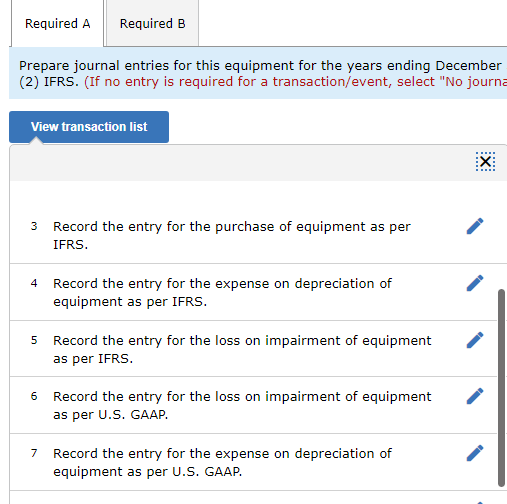

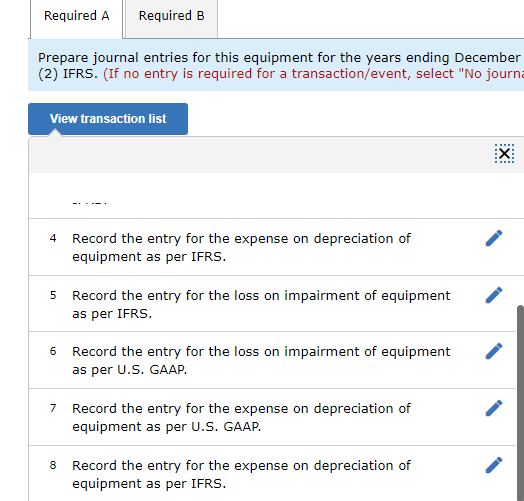

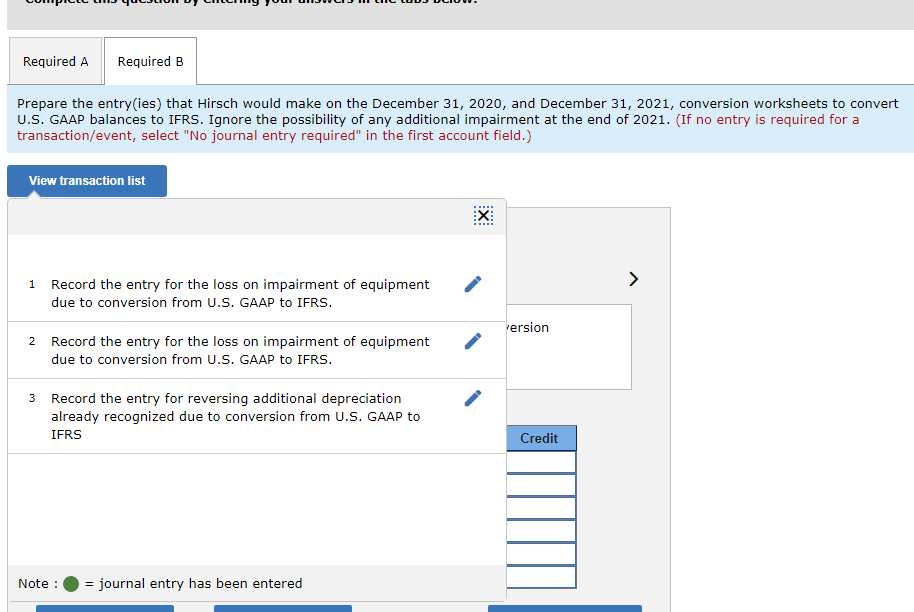

Hirsch Company acquired equipment at the beginning of 2020 at a cost of $135,000. The equipment has a five-year life with no expected salvage value and is depreciated on a straight-line basis. At December 31, 2020, Hirsch compiled the following information related to this equipment: Expected future cash flows from use of the equipment Present value of expected future cash flows from use of the equipment Fair value (selling price less costs to dispose) $ 116,000 100,000 96,600 Assume that Hirsch Company is a U.S.-based company that is issuing securities to foreign investors who require financial statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income taxes. Required: a. Prepare journal entries for this equipment for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP and (2) IFRS. b. Prepare the entry(ies) that Hirsch would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert U.S. GAAP balances to IFRS. Ignore the possibility of any additional impairment at the end of 2021. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for this equipment for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP and (2) IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list 1 > Record the entry for the purchase of equipment as per U.S. GAAP. 2 Record the entry for the expense on depreciation of equipment as per U.S. GAAP. Required A Required B Prepare journal entries for this equipment for the years ending December (2) IFRS. (If no entry is required for a transaction/event, select "No journa View transaction list X: 3 Record the entry for the purchase of equipment as per IFRS. 4 Record the entry for the expense on depreciation of equipment as per IFRS. 5 Record the entry for the loss on impairment of equipment as per IFRS. 6 Record the entry for the loss on impairment of equipment as per U.S. GAAP. 7 Record the entry for the expense on depreciation of equipment as per U.S. GAAP. Required A Required B Prepare journal entries for this equipment for the years ending December (2) IFRS. (If no entry is required for a transaction/event, select "No journa View transaction list 4 Record the entry for the expense on depreciation of equipment as per IFRS. 5 Record the entry for the loss on impairment of equipment as per IFRS. 6 Record the entry for the loss on impairment of equipment as per U.S. GAAP. 7 Record the entry for the expense on depreciation of equipment as per U.S. GAAP. 8 Record the entry for the expense on depreciation of equipment as per IFRS. Required A Required B Prepare the entry(ies) that Hirsch would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert U.S. GAAP balances to IFRS. Ignore the possibility of any additional impairment at the end of 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X: 1 Record the entry for the loss on impairment of equipment due to conversion from U.S. GAAP to IFRS. Version 2 Record the entry for the loss on impairment of equipment due to conversion from U.S. GAAP to IFRS. 3 Record the entry for reversing additional depreciation already recognized due to conversion from U.S. GAAP to IFRS Credit Note : = journal entry has been entered Hirsch Company acquired equipment at the beginning of 2020 at a cost of $135,000. The equipment has a five-year life with no expected salvage value and is depreciated on a straight-line basis. At December 31, 2020, Hirsch compiled the following information related to this equipment: Expected future cash flows from use of the equipment Present value of expected future cash flows from use of the equipment Fair value (selling price less costs to dispose) $ 116,000 100,000 96,600 Assume that Hirsch Company is a U.S.-based company that is issuing securities to foreign investors who require financial statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income taxes. Required: a. Prepare journal entries for this equipment for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP and (2) IFRS. b. Prepare the entry(ies) that Hirsch would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert U.S. GAAP balances to IFRS. Ignore the possibility of any additional impairment at the end of 2021. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for this equipment for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP and (2) IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list 1 > Record the entry for the purchase of equipment as per U.S. GAAP. 2 Record the entry for the expense on depreciation of equipment as per U.S. GAAP. Required A Required B Prepare journal entries for this equipment for the years ending December (2) IFRS. (If no entry is required for a transaction/event, select "No journa View transaction list X: 3 Record the entry for the purchase of equipment as per IFRS. 4 Record the entry for the expense on depreciation of equipment as per IFRS. 5 Record the entry for the loss on impairment of equipment as per IFRS. 6 Record the entry for the loss on impairment of equipment as per U.S. GAAP. 7 Record the entry for the expense on depreciation of equipment as per U.S. GAAP. Required A Required B Prepare journal entries for this equipment for the years ending December (2) IFRS. (If no entry is required for a transaction/event, select "No journa View transaction list 4 Record the entry for the expense on depreciation of equipment as per IFRS. 5 Record the entry for the loss on impairment of equipment as per IFRS. 6 Record the entry for the loss on impairment of equipment as per U.S. GAAP. 7 Record the entry for the expense on depreciation of equipment as per U.S. GAAP. 8 Record the entry for the expense on depreciation of equipment as per IFRS. Required A Required B Prepare the entry(ies) that Hirsch would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert U.S. GAAP balances to IFRS. Ignore the possibility of any additional impairment at the end of 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X: 1 Record the entry for the loss on impairment of equipment due to conversion from U.S. GAAP to IFRS. Version 2 Record the entry for the loss on impairment of equipment due to conversion from U.S. GAAP to IFRS. 3 Record the entry for reversing additional depreciation already recognized due to conversion from U.S. GAAP to IFRS Credit Note : = journal entry has been entered