Answered step by step

Verified Expert Solution

Question

1 Approved Answer

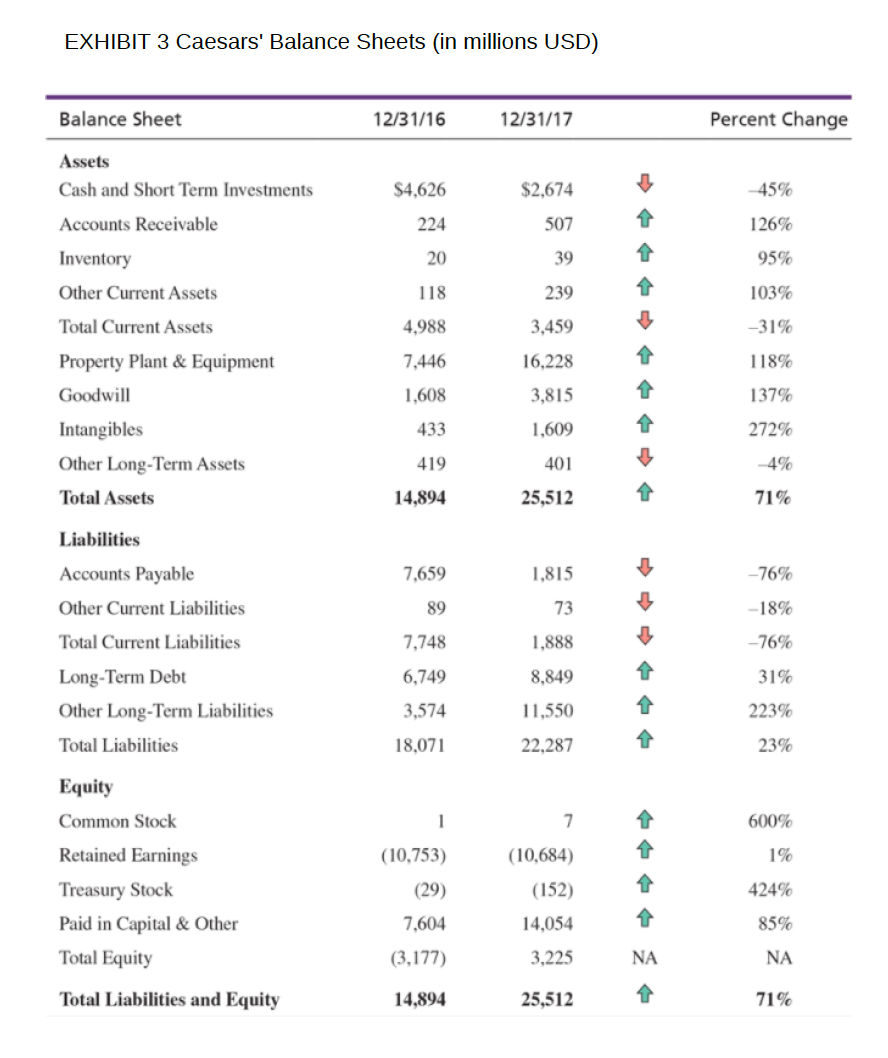

Historical Ratios 12/31/16 12/31/17 Current Ratio Quick Ratio Total Debt to Total Assets Ratio Times Interest Earned Ratio

Historical Ratios | ||

| 12/31/16 | 12/31/17 | |

Current Ratio | ||

Quick Ratio | ||

Total Debt to Total Assets Ratio | ||

Times Interest Earned Ratio | ||

Inventory Turnover |

|

|

Fixed Assets Turnover |

|

|

Total Assets Turnover |

|

|

Accounts Receivable Turnover |

|

|

Average Collection Period |

|

|

Gross Profit Margin % |

|

|

Operating Profit Margin % |

|

|

ROA% |

|

|

ROE% |

|

|

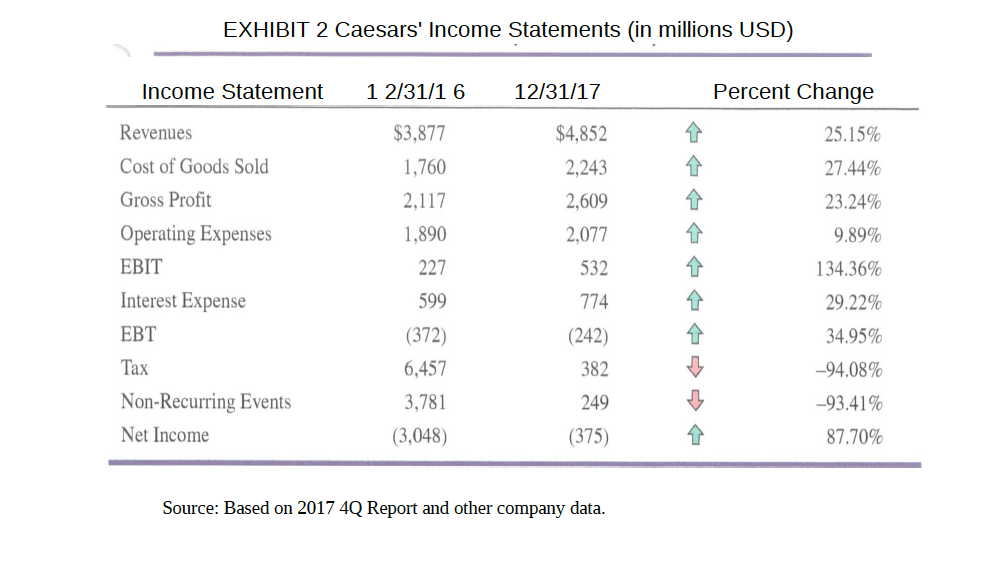

EXHIBIT 2 Caesars' Income Statements (in millions USD) Income Statement 1 2/31/1 6 12/31/17 Percent Change Revenues $3,877 $4,852 25.15% Cost of Goods Sold 1,760 2,243 27.44% Gross Profit 2,117 2,609 23.24% Operating Expenses 1,890 2,077 9.89% EBIT 227 532 134.36% Interest Expense 599 774 29.22% EBT (372) (242) 34.95% Tax 6,457 382 -94.08% Non-Recurring Events 3,781 249 -93.41% Net Income (3,048) (375) 87.70% Source: Based on 2017 4Q Report and other company data.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started