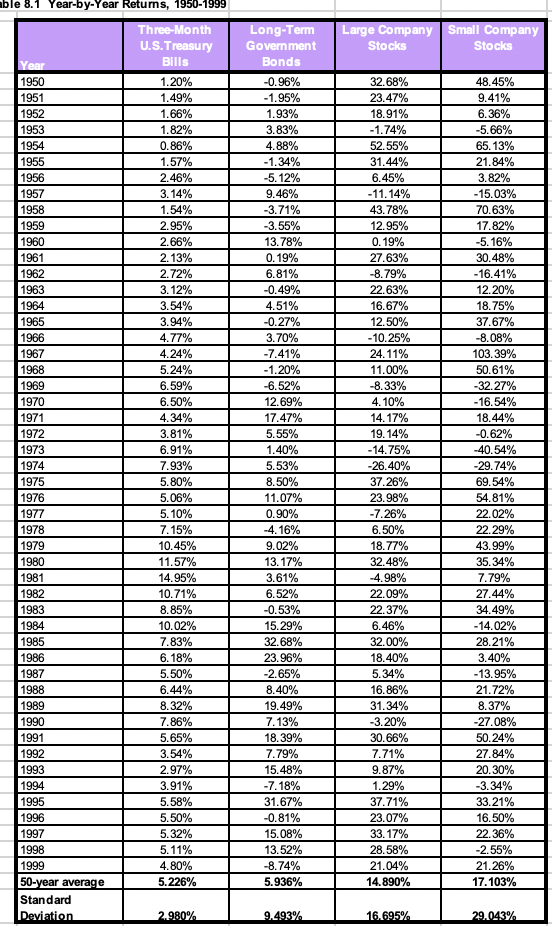

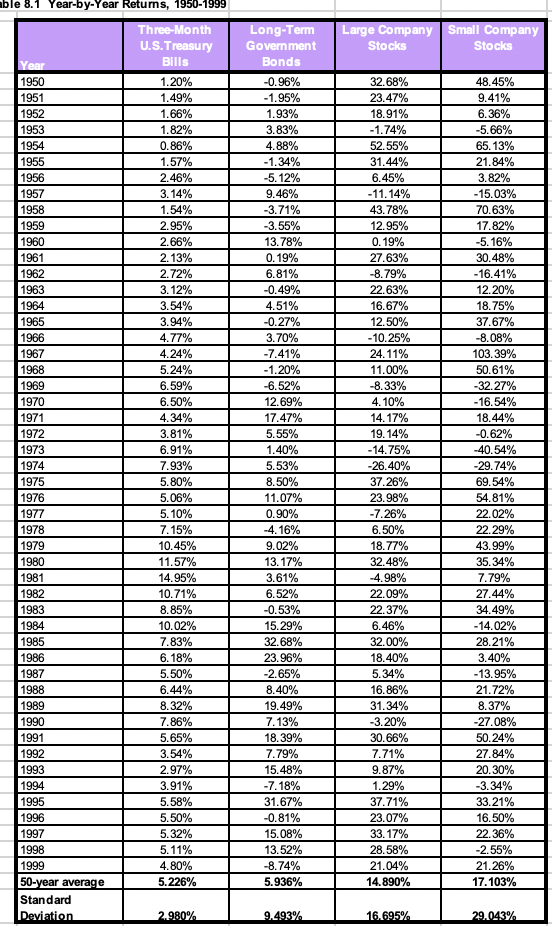

Historical returns. Calculate the arithmetic average return of U.S. Treasury bills, long-term government bonds, and large-company stocks for 1986 to 1995. Which had the highest return? Which had the lowest return? On the left side, click on the Spreadsheet Learning Aid to see Table 8.1Year-by-Year Returns, 1950-1999. What is the average return of U.S. Treasury bills for 1986 to 1995? 5.23 % (Round to two decimal places.) Long-Term Government Bonds Large Company Small Company Stocks Stocks able 8.1 Year-by-Year Returns, 1950-1999 Three-Month U.S.Treasury Year Bills 1950 1.20% 1951 1.49% 1952 1.66% 1953 1.82% 1954 0.86% 1955 1.57% 1956 2.46% 1957 3.14% 1958 1.54% 1959 2.95% 1960 2.66% 1961 2. 13% 1962 2.72% 1963 3.12% 1964 3.54% 1965 3.94% 1966 4.77% 1967 4.24% 1968 5.24% 1969 6.59% 1970 6.50% 1971 4.34% 1972 3.81% 1973 6.91% 1974 7.93% 1975 5.80% 1976 5.06% 1977 5. 10% 1978 7.15% 1979 10.45% 1980 11.57% 1981 14.95% 1982 10.71% 1983 8.85% 1984 10.02% 1985 7.83% 1986 6.18% 1987 5.50% 1988 6.44% 1989 8.32% 1990 7.86% 1991 5.65% 1992 3.54% 1993 2.97% 1994 3.91% 1995 5.58% 1996 5.50% 1997 5.32% 1998 5.11% 1999 4.80% 50-year average 5.226% Standard Deviation 2.980% -0.96% -1.95% 1.93% 3.83% 4.88% -1.34% -5.12% 9.46% -3.71% -3.55% 13.78% 0.19% 6.81% -0.49% 4.51% -0.27% 3.70% -7.41% -1.20% -6.52% 12.69% 17.47% 5.55% 1.40% 5.53% 8.50% 11.07% 0.90% -4.16% 9.02% 13. 17% 3.61% 6.52% -0.53% 15.29% 32.68% 23.96% -2.65% 8.40% 19.49% 7.13% 18.39% 7.79% 15.48% -7.18% 31.67% -0.81% 15.08% 13.52% -8.74% 5.936% 32.68% 23.47% 18.91% -1.74% 52.55% 31.44% 6.45% -11.14% 43.78% 12.95% 0.19% 27.63% -8.79% 22.63% 16.67% 12.50% - 10.25% 24.11% 11.00% -8.33% 4.10% 14.17% 19.14% -14.75% -26.40% 37.26% 23.98% -7.26% 6.50% 18.77% 32.48% -4.98% 22.09% 22.37% 6.46% 32.00% 18.40% 5.34% 16.86% 31.34% -3.20% 30.66% 7.71% 9.87% 1.29% 37.71% 23.07% 33.17% 28.58% 21.04% 14.890% 48.45% 9.41% 6.36% -5.66% 65.13% 21.84% 3.82% -15.03% 70.63% 17.82% -5.16% 30.48% -16.41% 12. 20% 18.75% 37.67% -8.08% 103.39% 50.61% -32.27% -16.54% 18.44% -0.62% -40.54% -29.74% 69.54% 54.81% 22.02% 22.29% 43.99% 35.34% 7.79% 27.44% 34.49% -14.02% 28.21% 3.40% -13.95% 21.72% 8.37% -27.08% 50.24% 27.84% 20.30% -3.34% 33.21% 16.50% 22.36% 5% 21.26% 17.103% 9.493% 16.695% 29.043%