Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Historical VaR Rational Investment, is estimating VaR using the historical simulation method at the 9 8 % confidence level, for its fixed income portfolio currently

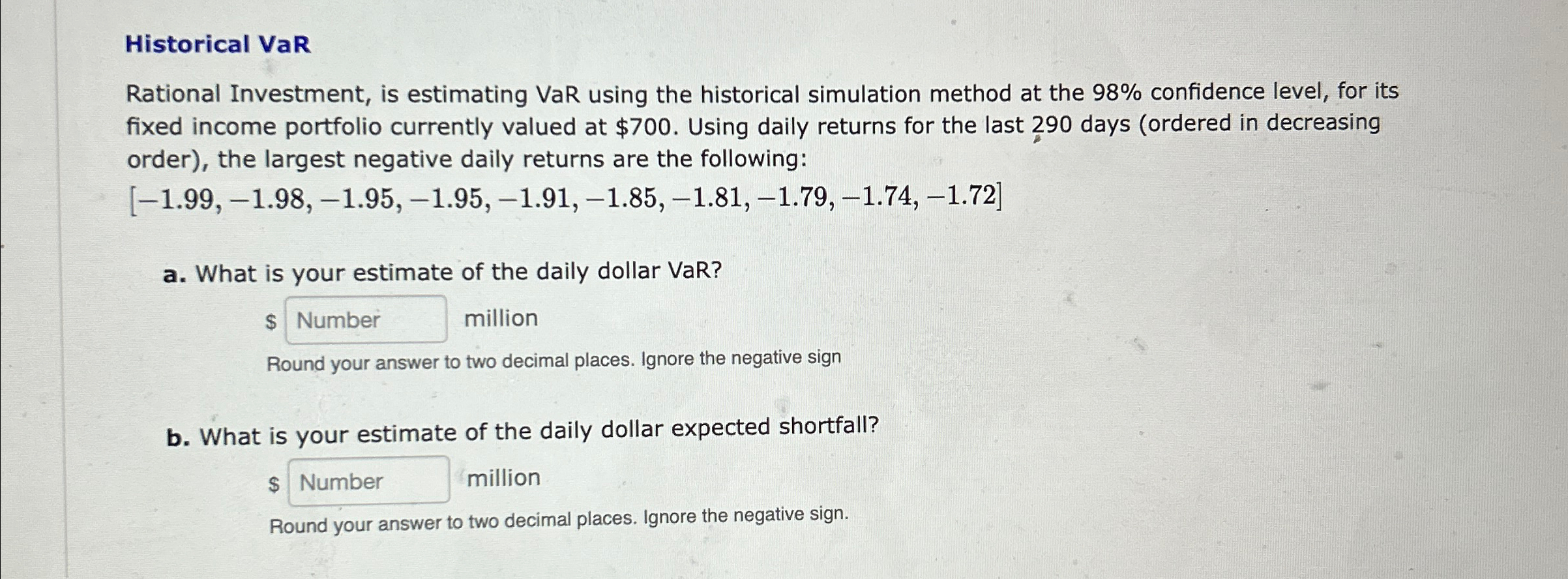

Historical VaR

Rational Investment, is estimating VaR using the historical simulation method at the confidence level, for its fixed income portfolio currently valued at $ Using daily returns for the last days ordered in decreasing order the largest negative daily returns are the following:

a What is your estimate of the daily dollar VaR?

$ million

Round your answer to two decimal places. Ignore the negative sign

b What is your estimate of the daily dollar expected shortfall?

$ million

Round your answer to two decimal places. Ignore the negative sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started