Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hit to page Page view QUESTION 1 25 MARKS You are a qualified engineer and recently graduated from Wits Business School with a Postgraduate Diploma

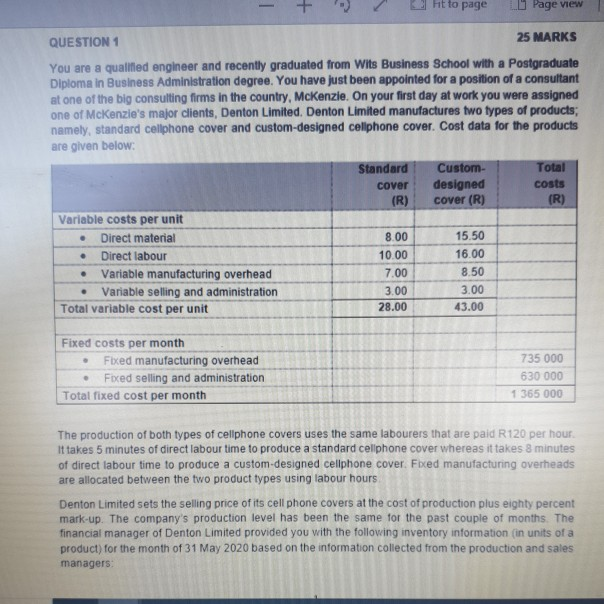

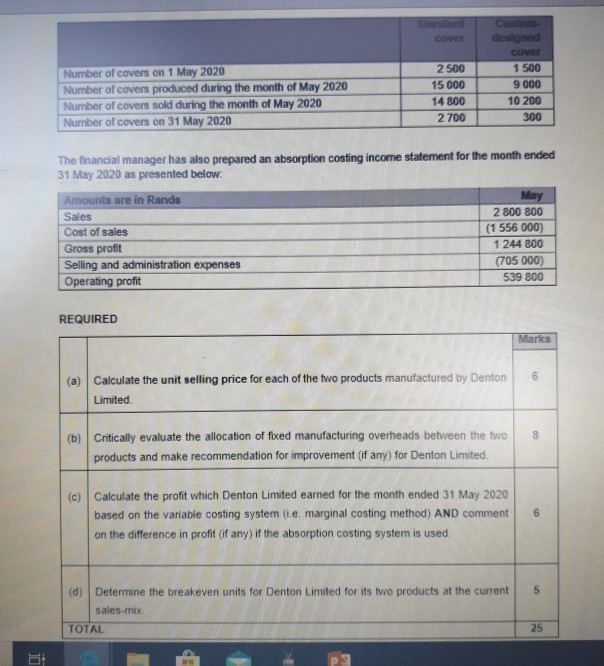

Hit to page Page view QUESTION 1 25 MARKS You are a qualified engineer and recently graduated from Wits Business School with a Postgraduate Diploma in Business Administration degree. You have just been appointed for a position of a consultant at one of the big consulting firms in the country, McKenzie. On your first day at work you were assigned one of McKenzie's major clients, Denton Limited. Denton Limited manufactures two types of products, namely, standard cellphone cover and custom-designed cellphone cover. Cost data for the products are given below: Standard Custom- Total cover designed costs (R) cover (R) (R) Variable costs per unit Direct material 8.00 15.50 Direct labour 10.00 16.00 Variable manufacturing overhead 7.00 8.50 Variable selling and administration 3.00 3.00 Total variable cost per unit 28.00 43.00 . . . . Fixed costs per month Fixed manufacturing overhead Fixed selling and administration Total fixed cost per month . 735 000 630 000 1 365 000 The production of both types of cellphone covers uses the same labourers that are paid R120 per hour. It takes 5 minutes of direct labour time to produce a standard cellphone cover whereas it takes 8 minutes of direct labour time to produce a custom-designed cellphone cover. Fixed manufacturing overheads are allocated between the two product types using labour hours Denton Limited sets the selling price of its cell phone covers at the cost of production plus eighty percent mark-up. The company's production level has been the same for the past couple of months. The financial manager of Denton Limited provided you with the following inventory information (in units of a product) for the month of 31 May 2020 based on the information collected from the production and sales managers designed Number of covers on 1 May 2020 Number of covers produced during the month of May 2020 Number of covers sold during the month of May 2020 Number of covers on 31 May 2020 2 500 15 000 14 800 2 700 1 500 9 000 10 200 300 The financial manager has also prepared an absorption costing income statement for the month ended 31 May 2020 as presented below: Amounts are in Rands May Sales 2 800 800 Cost of sales (1 556 000) Gross profit 1 244 800 Selling and administration expenses (705 000) Operating profit 539 800 REQUIRED Marks (a) Calculate the unit selling price for each of the two products manufactured by Denton 6 Limited 8 (b) Critically the allocation of fixed manufacturing overheads between the two products and make recommendation for improvement (if any) for Denton Limited (c) Calculate the profit which Denton Limited earned for the month ended 31 May 2020 based on the variable costing system (ie, marginal costing method) AND comment on the difference in profit (if any) if the absorption costing system is used, 6 5 (d) Determine the breakeven units for Denton Limited for its two products at the current sales-mix TOTAL 25 BE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started