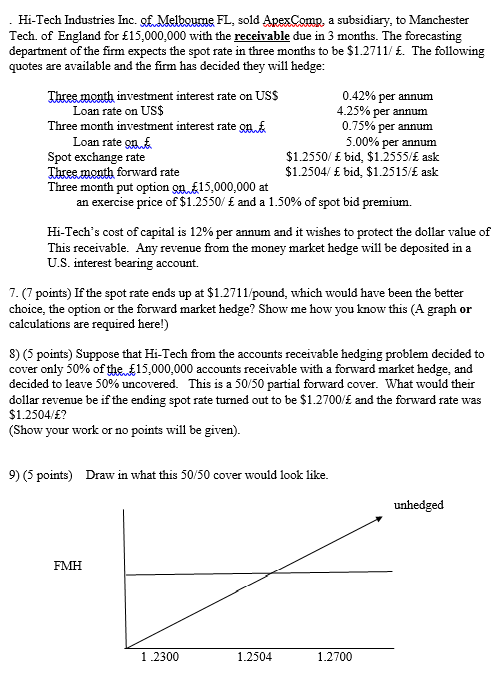

Hi-Tech Industries Inc. of Melbourne FL, sold Apex Comp, a subsidiary, to Manchester Tech. of England for 15,000,000 with the receivable due in 3 months. The forecasting department of the firm expects the spot rate in three months to be $1.2711/ . The following quotes are available and the firm has decided they will hedge: Three month investment interest rate on USS 0.42% per annum Loan rate on US$ 4.25% per annum Three month investment interest rate on 0.75% per annum Loan rate sa 5.00% per annum Spot exchange rate $1.2550/bid, $1.2555/ ask Three month forward rate $1.2504 bid, $1.2515/ ask Three month put option gs. 15,000,000 at an exercise price of $1.2550/ and a 1.50% of spot bid premium. Hi-Tech's cost of capital is 12% per annum and it wishes to protect the dollar value of This receivable. Any revenue from the money market hedge will be deposited in a U.S. interest bearing account. 7. (7 points) If the spot rate ends up at $1.2711/pound, which would have been the better choice, the option or the forward market hedge? Show me how you know this (A graph or calculations are required here!) 8) (5 points) Suppose that Hi-Tech from the accounts receivable hedging problem decided to cover only 50% of the 15,000,000 accounts receivable with a forward market hedge, and decided to leave 50% uncovered. This is a 50/50 partial forward cover. What would their dollar revenue be if the ending spot rate turned out to be $1.2700/ and the forward rate was $1.2504/? (Show your work or no points will be given). 9) (5 points) Draw in what this 50/50 cover would look like. unhedged FMH 1.2300 1.2504 1.2700 Hi-Tech Industries Inc. of Melbourne FL, sold Apex Comp, a subsidiary, to Manchester Tech. of England for 15,000,000 with the receivable due in 3 months. The forecasting department of the firm expects the spot rate in three months to be $1.2711/ . The following quotes are available and the firm has decided they will hedge: Three month investment interest rate on USS 0.42% per annum Loan rate on US$ 4.25% per annum Three month investment interest rate on 0.75% per annum Loan rate sa 5.00% per annum Spot exchange rate $1.2550/bid, $1.2555/ ask Three month forward rate $1.2504 bid, $1.2515/ ask Three month put option gs. 15,000,000 at an exercise price of $1.2550/ and a 1.50% of spot bid premium. Hi-Tech's cost of capital is 12% per annum and it wishes to protect the dollar value of This receivable. Any revenue from the money market hedge will be deposited in a U.S. interest bearing account. 7. (7 points) If the spot rate ends up at $1.2711/pound, which would have been the better choice, the option or the forward market hedge? Show me how you know this (A graph or calculations are required here!) 8) (5 points) Suppose that Hi-Tech from the accounts receivable hedging problem decided to cover only 50% of the 15,000,000 accounts receivable with a forward market hedge, and decided to leave 50% uncovered. This is a 50/50 partial forward cover. What would their dollar revenue be if the ending spot rate turned out to be $1.2700/ and the forward rate was $1.2504/? (Show your work or no points will be given). 9) (5 points) Draw in what this 50/50 cover would look like. unhedged FMH 1.2300 1.2504 1.2700