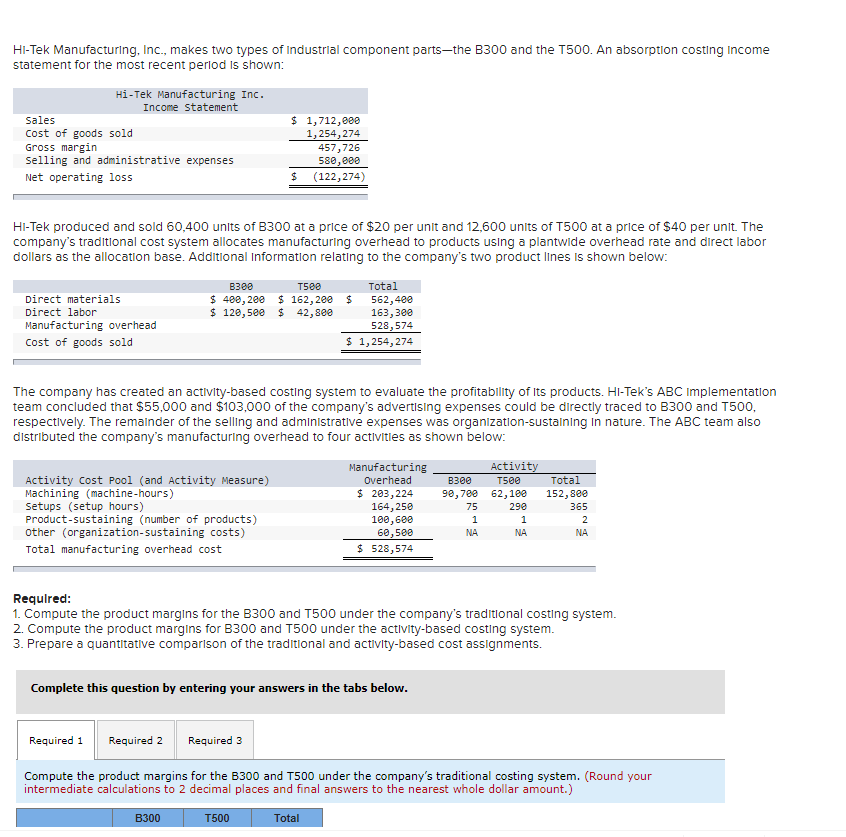

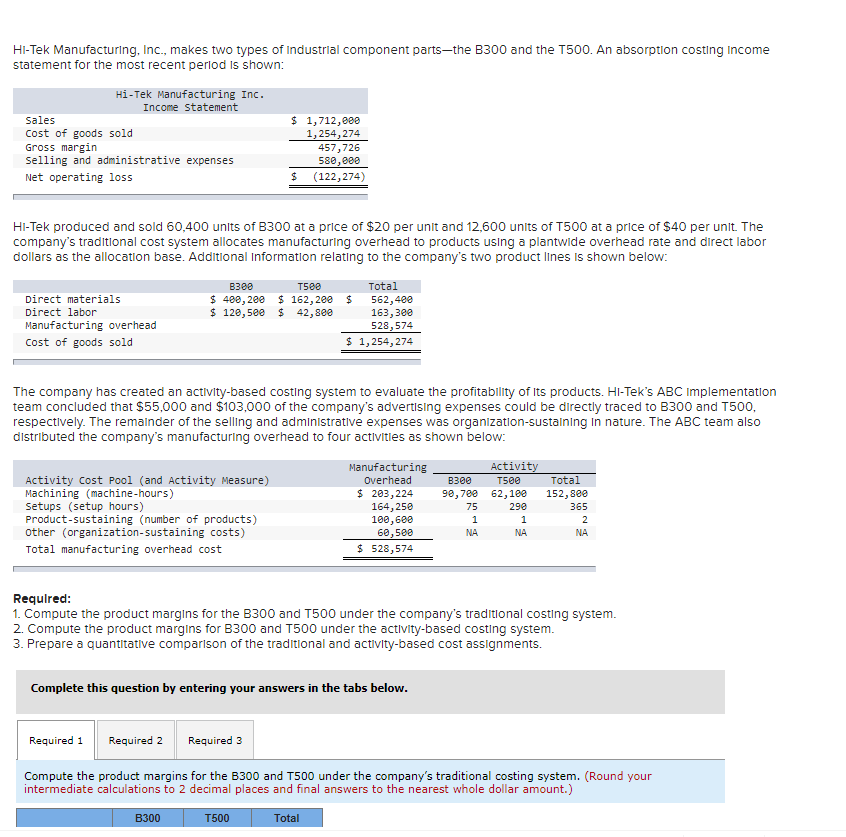

Hi-Tek Manufacturing, Inc., makes two types of Industrial component partsthe B300 and the T500. An absorption costing Income statement for the most recent period is shown: Hi-Tek Manufacturing Inc. Income statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss $ 1,712,000 1,254, 274 457,726 580,000 $ (122,274) Hi-Tek produced and sold 60,400 units of B300 at a price of $20 per unit and 12,600 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional Information relating to the company's two product lines is shown below: B300 $ 480, 2ee $ 120,500 Direct materials Direct labor Manufacturing overhead Cost of goods sold T500 Total $ 162,200 $ 562,400 $ 42,8ee 163,300 528,574 $ 1,254, 274 The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC Implementation team concluded that $55,000 and $103,000 of the company's advertising expenses could be directly traced to B300 and 1500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Activity cost Pool (and Activity Measure) Machining machine-hours) Setups (setup hours) Product-sustaining number of products) other organization-sustaining costs) Total manufacturing overhead cost Manufacturing Overhead $ 203,224 164,250 188,600 60,500 $ 528,574 Activity B300 T500 Total 90,780 62,182 152, see 75 290 365 1 1 2 NA NA NA Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the product margins for the B300 and T500 under the company's traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) B300 T500 Total