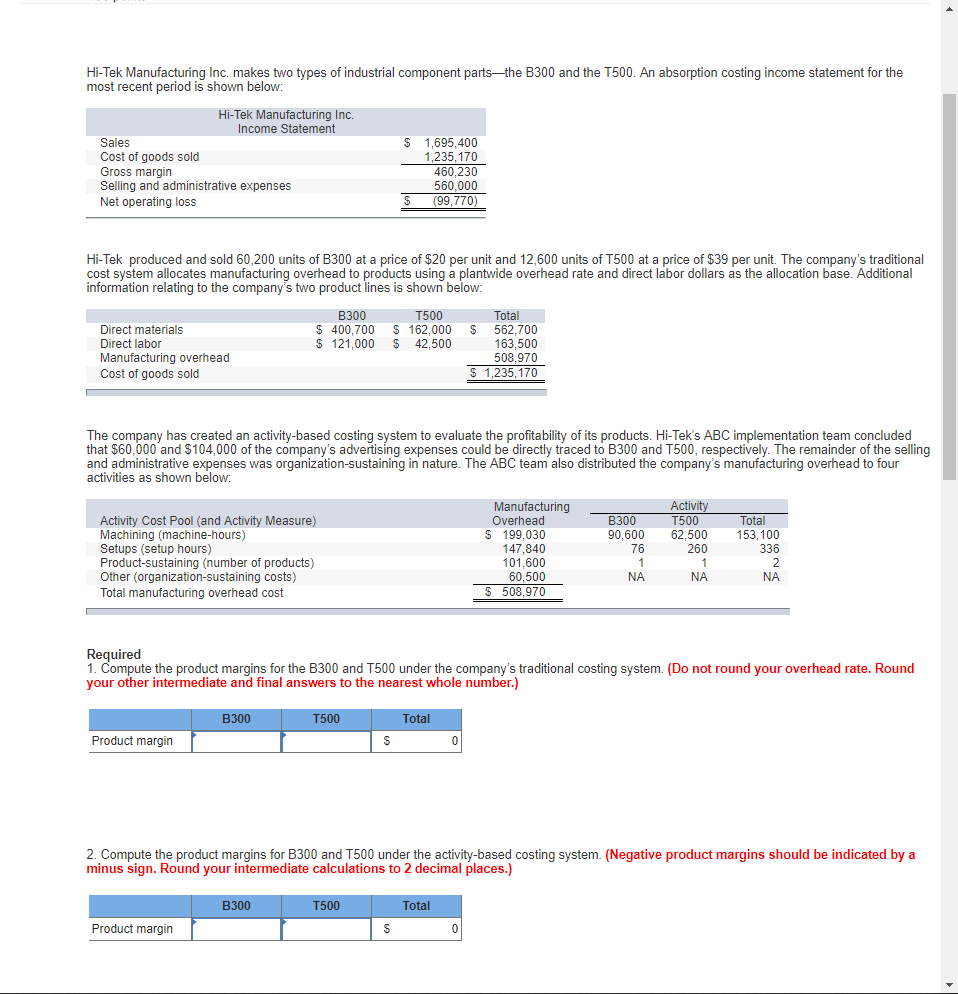

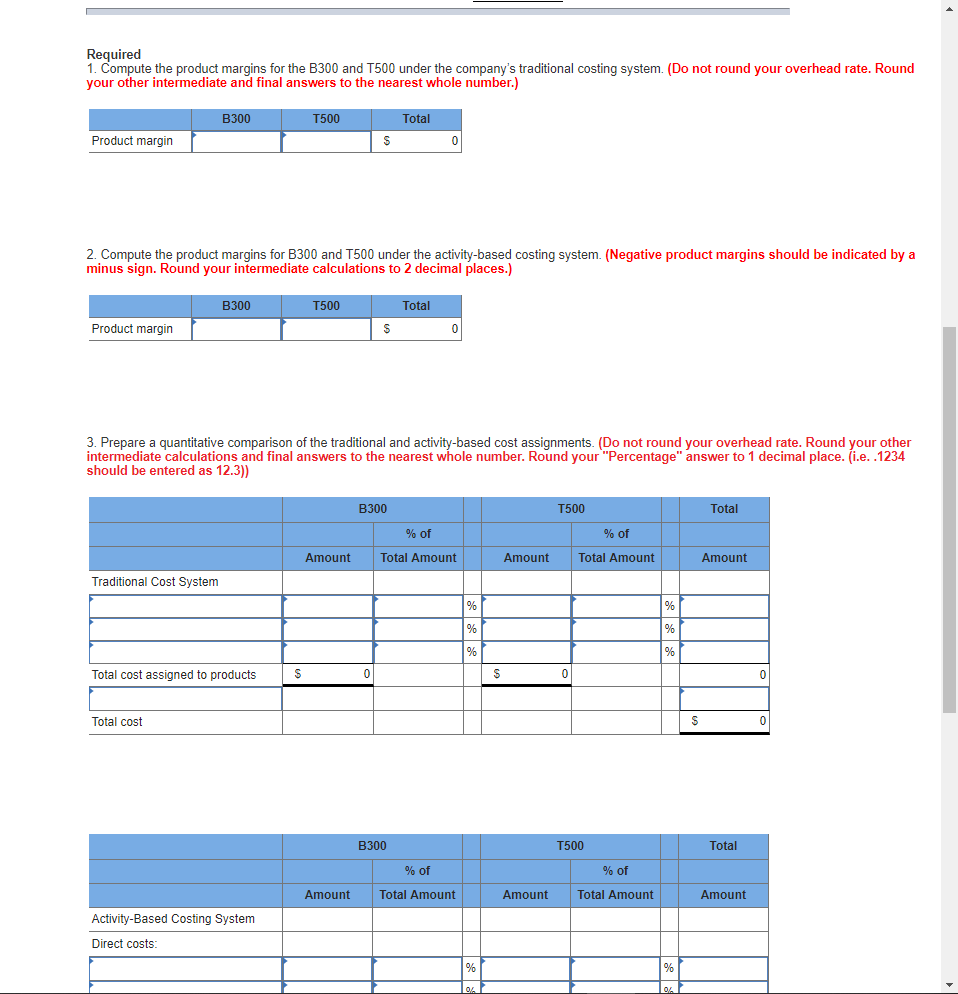

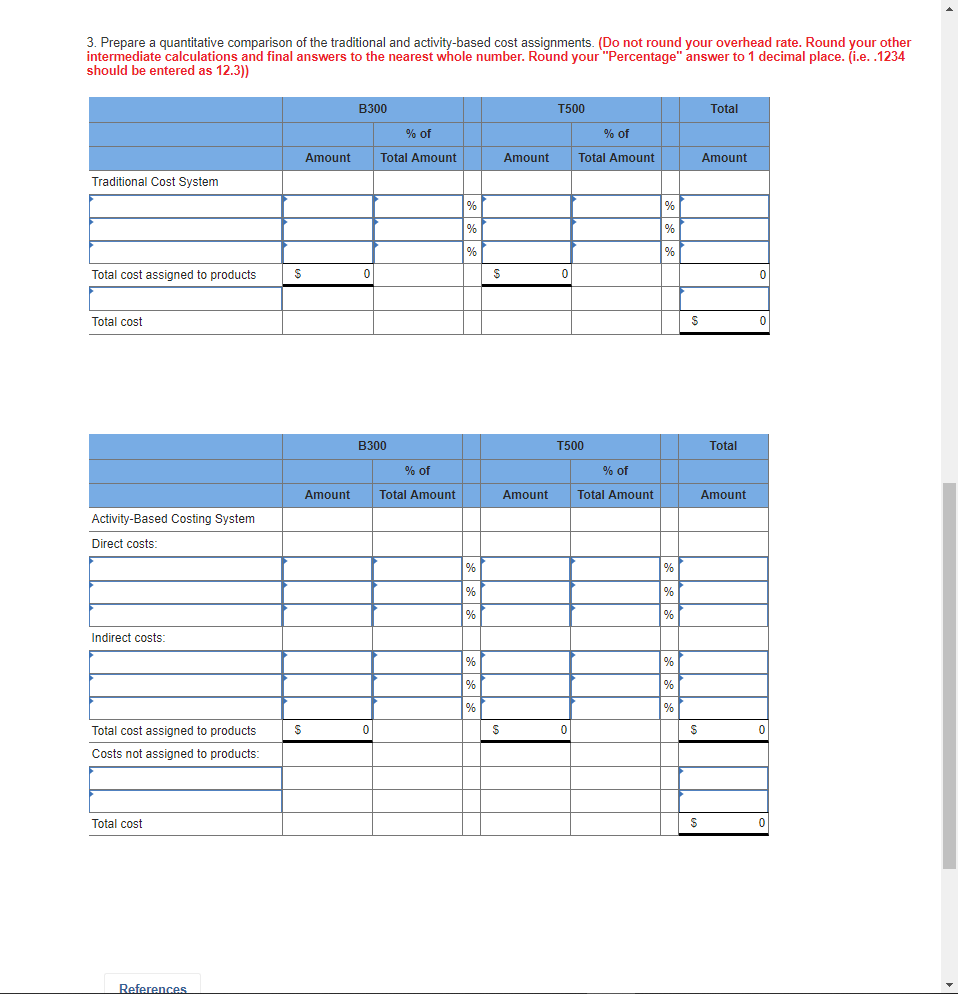

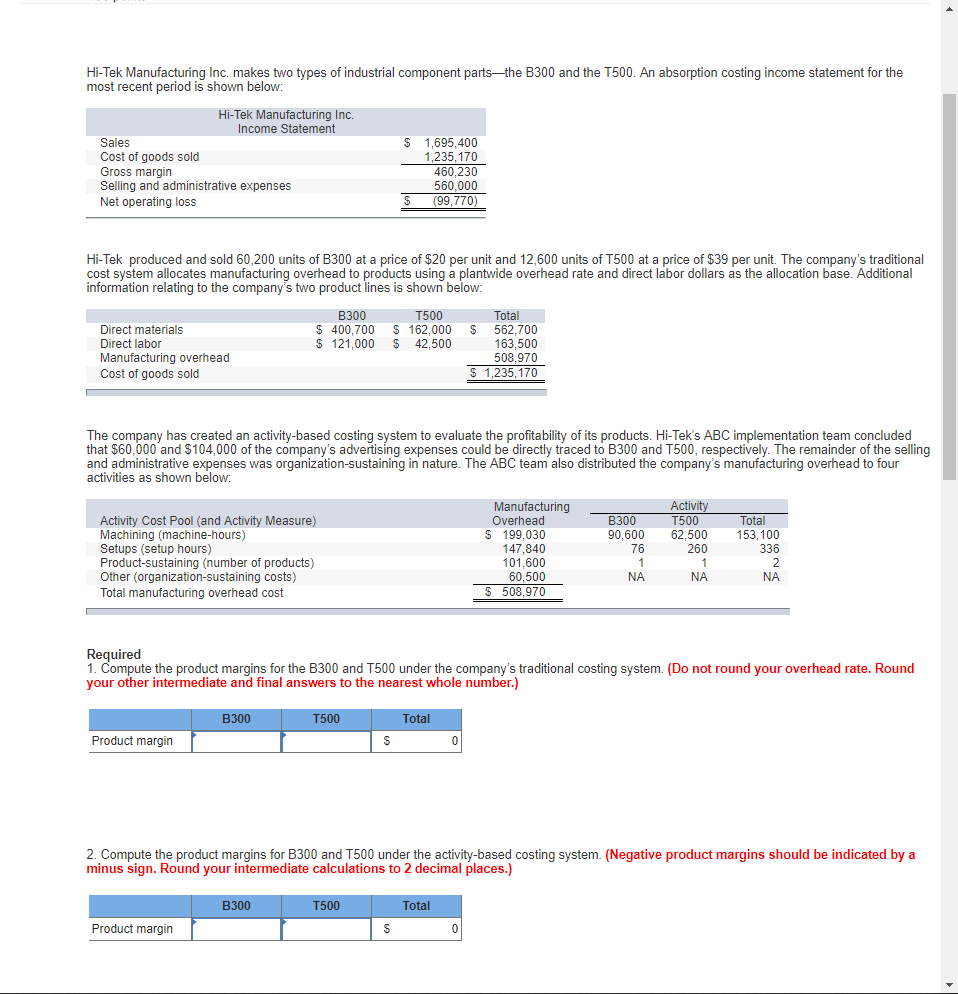

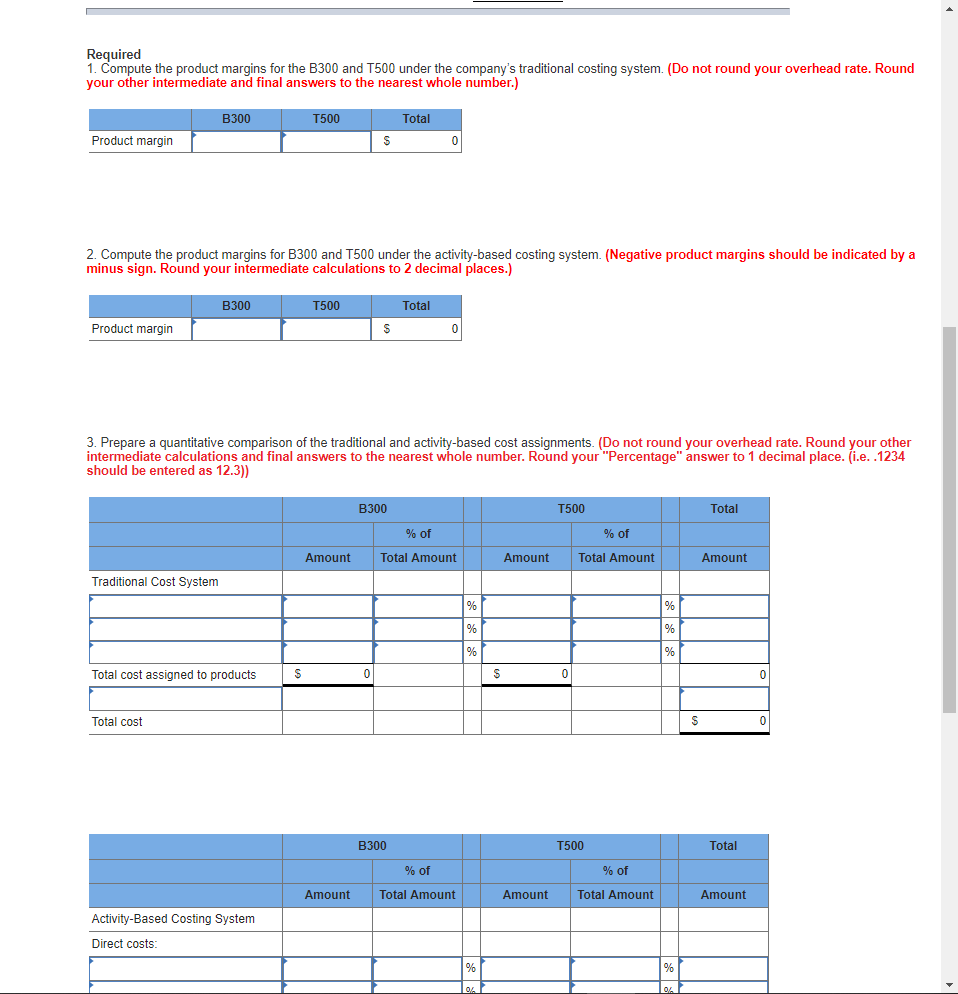

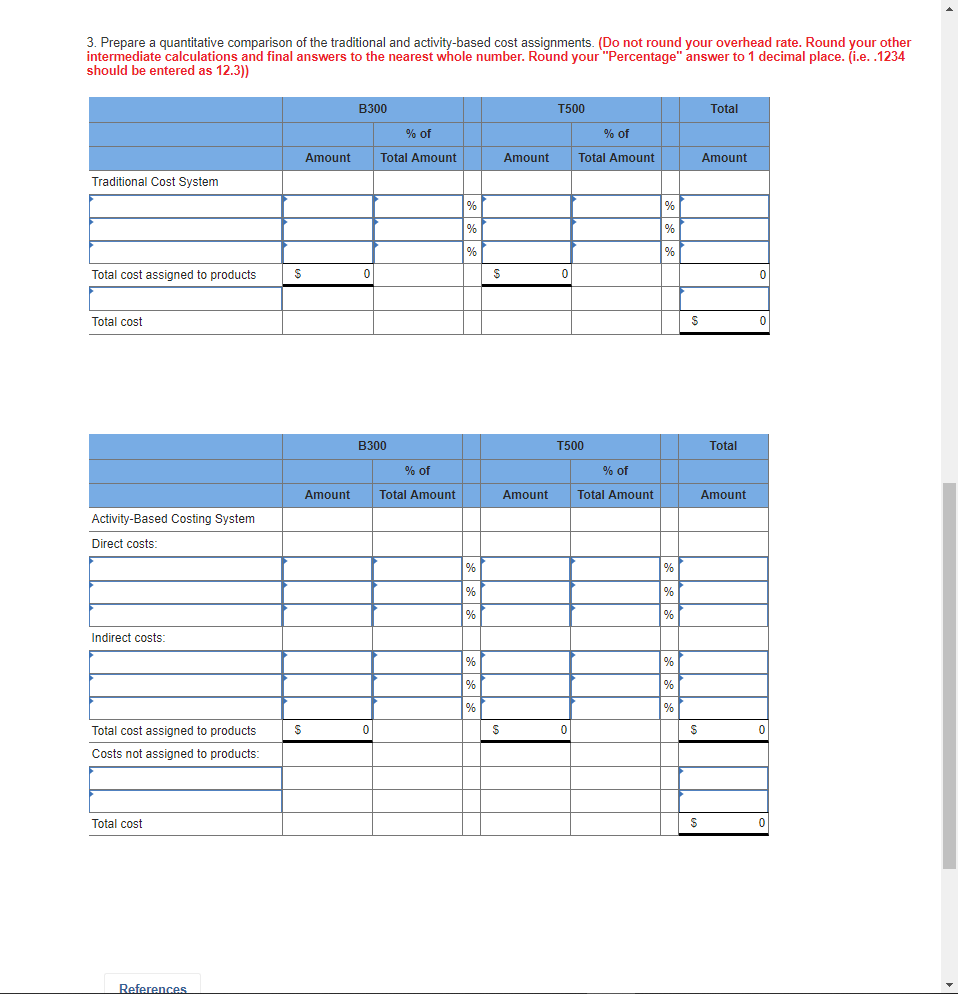

Hi-Tek Manufacturing Inc. makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown below: Hi-Tek Manufacturing Inc. Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss S 1,695,400 1,235,170 460,230 560,000 S (99.770 Hi-Tek produced and sold 60,200 units of B300 at a price of $20 per unit and 12,600 units of T500 at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two pro duct lines is shown below: 300 T500 Total Direct materials Direct labor Manufacturing overhead Cost of goods sold S 400,700 S 162,000 S 562,700 163,500 508,970 S 1,235,170 S 121,000 S 42,500 The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Teks ABC implementation team concluded that $60,000 and $104,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below Activit T500 Manufacturing Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) Total manufacturing overhead cost Overhead S 199,030 147,840 101,600 60,500 S 508,970 B300 Total 90,600 62.500 260 153,100 336 76 NA NA NA Required 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. (Do not round your overhead rate. Round your other intermediate and final answers to the nearest whole number.) 300 T500 Total Product margin 2. Compute the product margins for B300 and T500 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) 300 T500 Total Product margin Required 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. (Do not round your overhead rate. Round your other intermediate and final answers to the nearest whole number.) 300 T500 Total Product margin 2. Compute the product margins for B300 and T500 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) 300 T500 Total Product margin 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. (Do not round your overhead rate. Round your other intermediate calculations and final answers to the nearest whole number. Round your "Percentage" answer to 1 decimal place. (i.e. .1234 should be entered as 12.3)) B300 T500 Total %of %of Amount Total Amount Amount Total Amount Amount Traditional Cost System Total cost assigned to products Total cost B300 T500 Total %of %of Amount Total Amount Amount Total Amount Amount Activity-Based Costing System Direct costs 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. (Do not round your overhead rate. Round your other intermediate calculations and final answers to the nearest whole number. Round your "Percentage" answer to 1 decimal place. (i.e. .1234 should be entered as 12.3)) B300 T500 Total %of %of Amount Total Amount Amount Total Amount Amount Traditional Cost System Total cost assigned to products Total cost 300 T500 Total %of %of Amount Total Amount Amount Total Amount Amount Activity-Based Costing System Direct costs Indirect costs Total cost assigned to products Costs not assigned to products Total cost