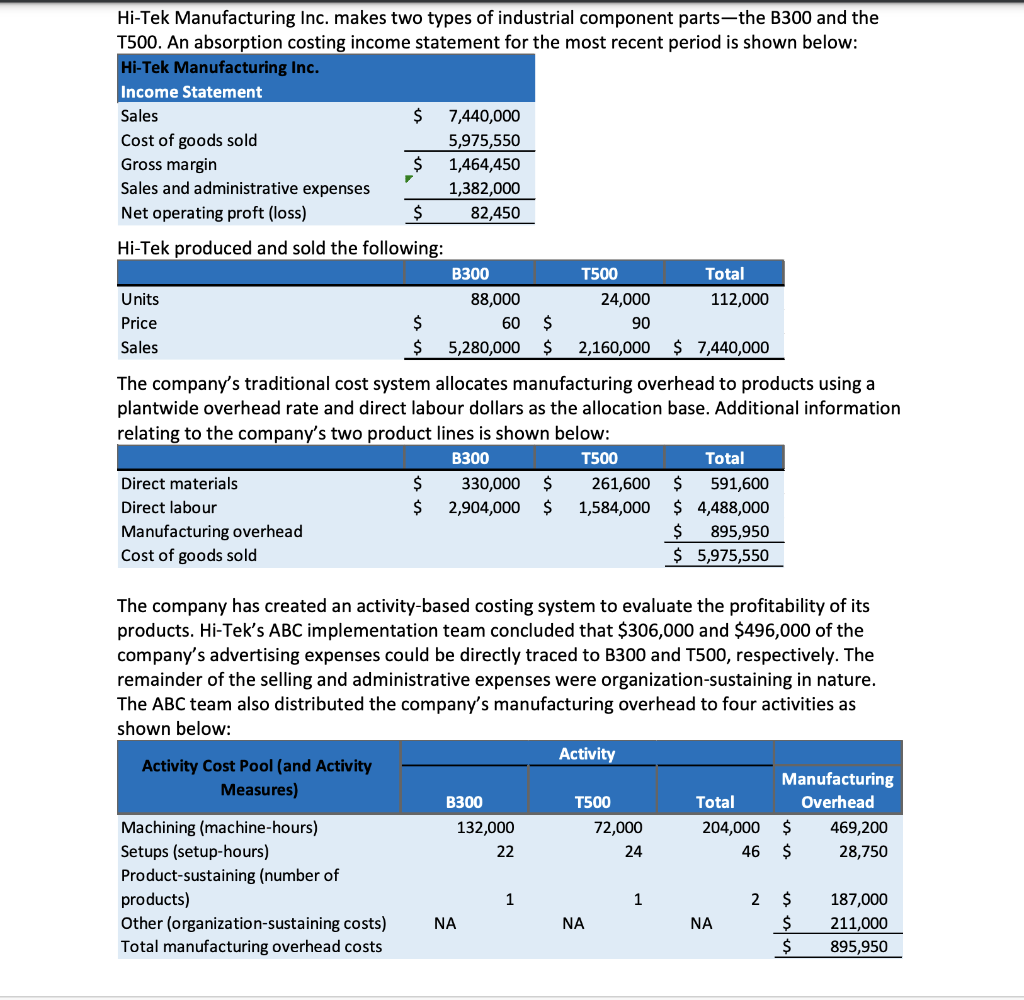

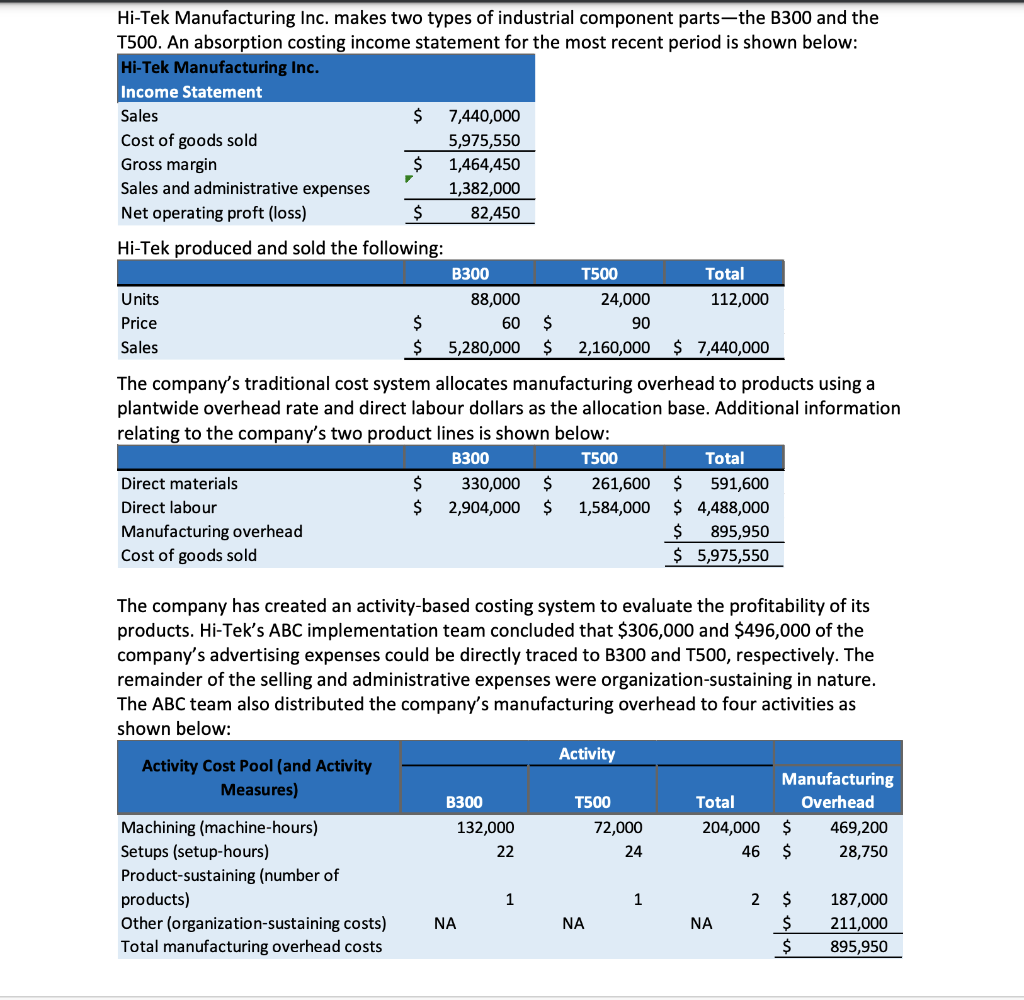

Hi-Tek Manufacturing Inc. makes two types of industrial component partsthe B300 and the T500. An absorption costing income statement for the most recent period is shown below: Hi-Tek Manufacturing Inc. Income Statement Sales $ 7,440,000 Cost of goods sold 5,975,550 Gross margin $ 1,464,450 Sales and administrative expenses 1,382,000 Net operating proft (loss) $ 82,450 Hi-Tek produced and sold the following: B300 T500 Total Units 88,000 24,000 112,000 Price $ 60 $ 90 Sales $ 5,280,000 $ 2,160,000 $ 7,440,000 The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labour dollars as the allocation base. Additional information relating to the company's two product lines is shown below: B300 T500 Total Direct materials $ 330,000 $ 261,600 $ 591,600 Direct labour $ 2,904,000 $ 1,584,000 $ 4,488,000 Manufacturing overhead $ 895,950 Cost of goods sold $ 5,975,550 The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team concluded that $306,000 and $496,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses were organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Activity Activity Cost Pool (and Activity Measures) Manufacturing B300 T500 Total Overhead Machining (machine-hours) 132,000 72,000 204,000 $ 469,200 Setups (setup-hours) 22 24 46 $ 28,750 Product-sustaining (number of products) 1 1 2 $ 187,000 Other (organization-sustaining costs) NA NA NA $ 211,000 Total manufacturing overhead costs $ 895,950 Required: 1. Using Exhibit 714 as a guide, compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Using Exhibit 712 as a guide, compute the product margins for B300 and T500 under the activity-based costing system. 3. Using Exhibit 715 as a guide, prepare a quantitative comparison of the traditional and activity-based cost assignments. 4. Using activity based costing, what would you suggest to management about the viability of each of its current products assuming that Hi-Tek is a price taker and has no market power over its pricing