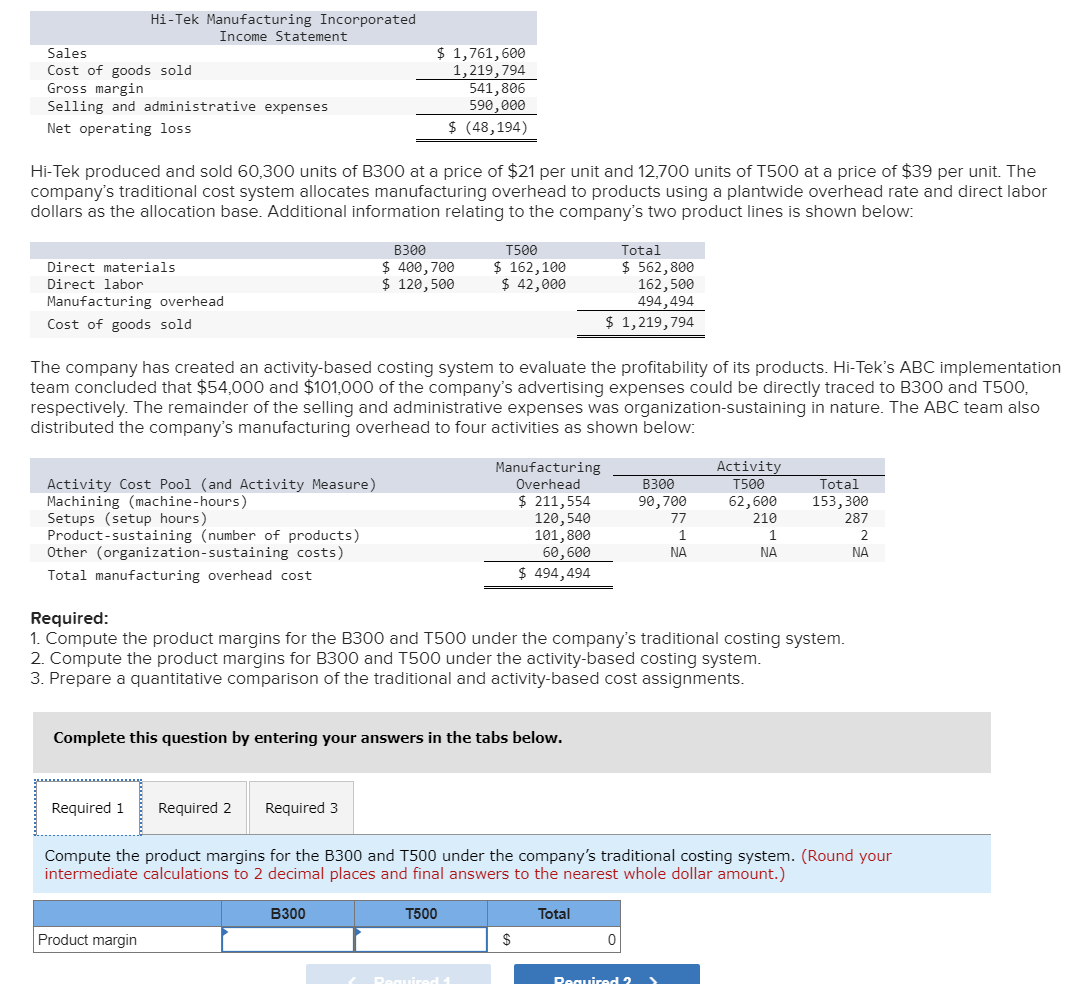

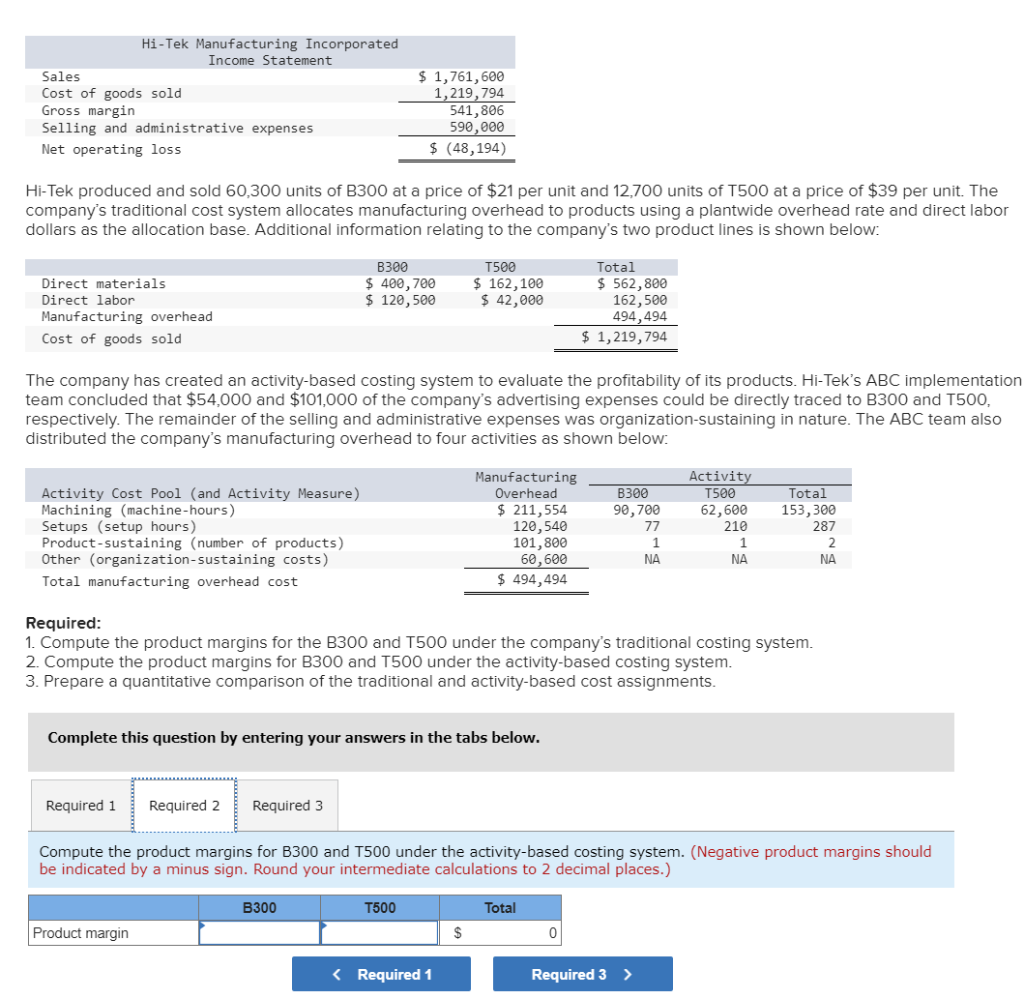

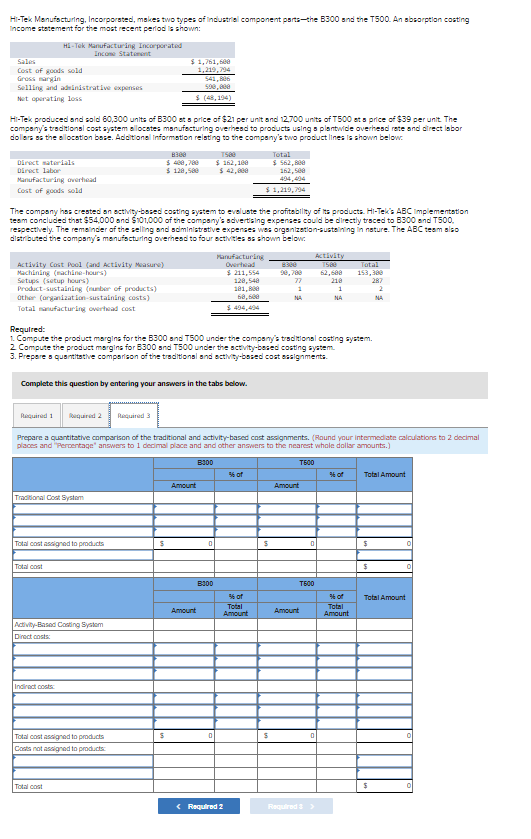

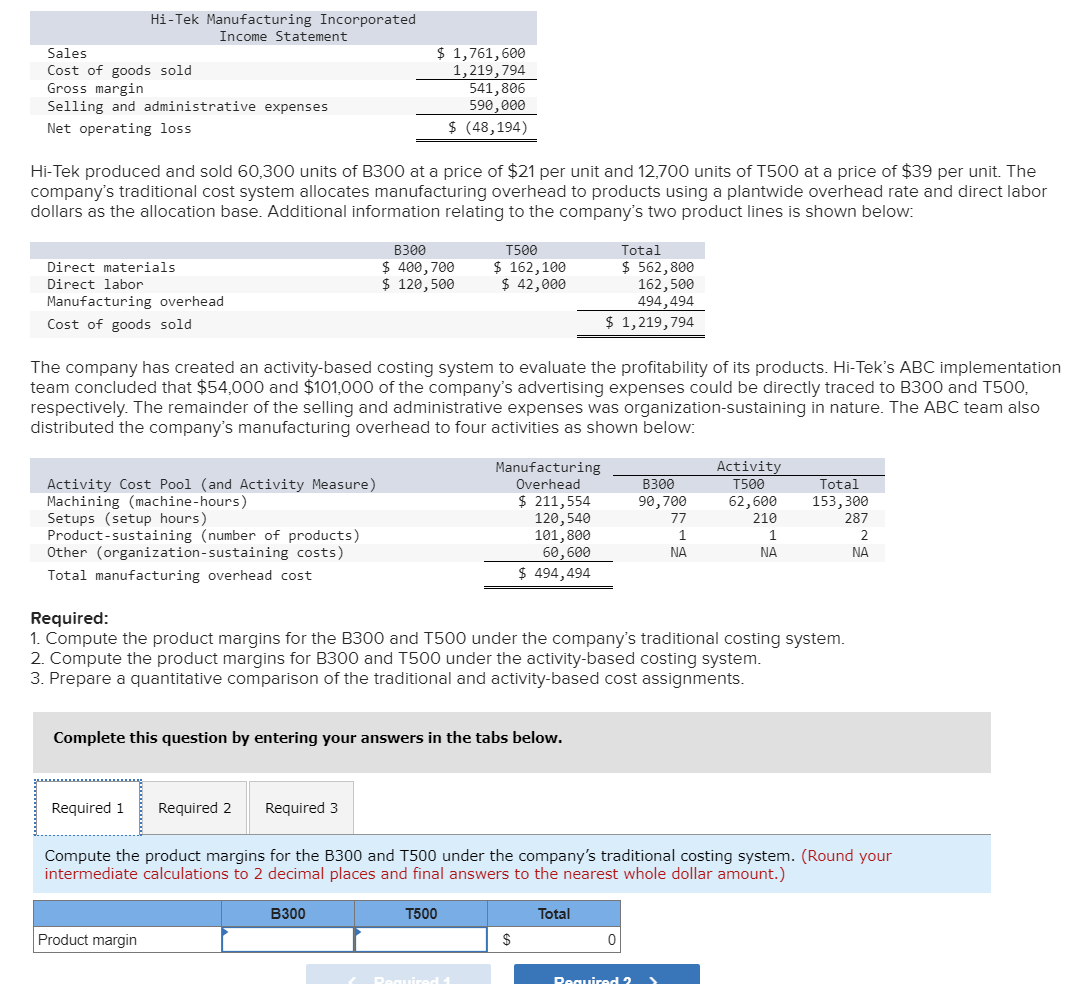

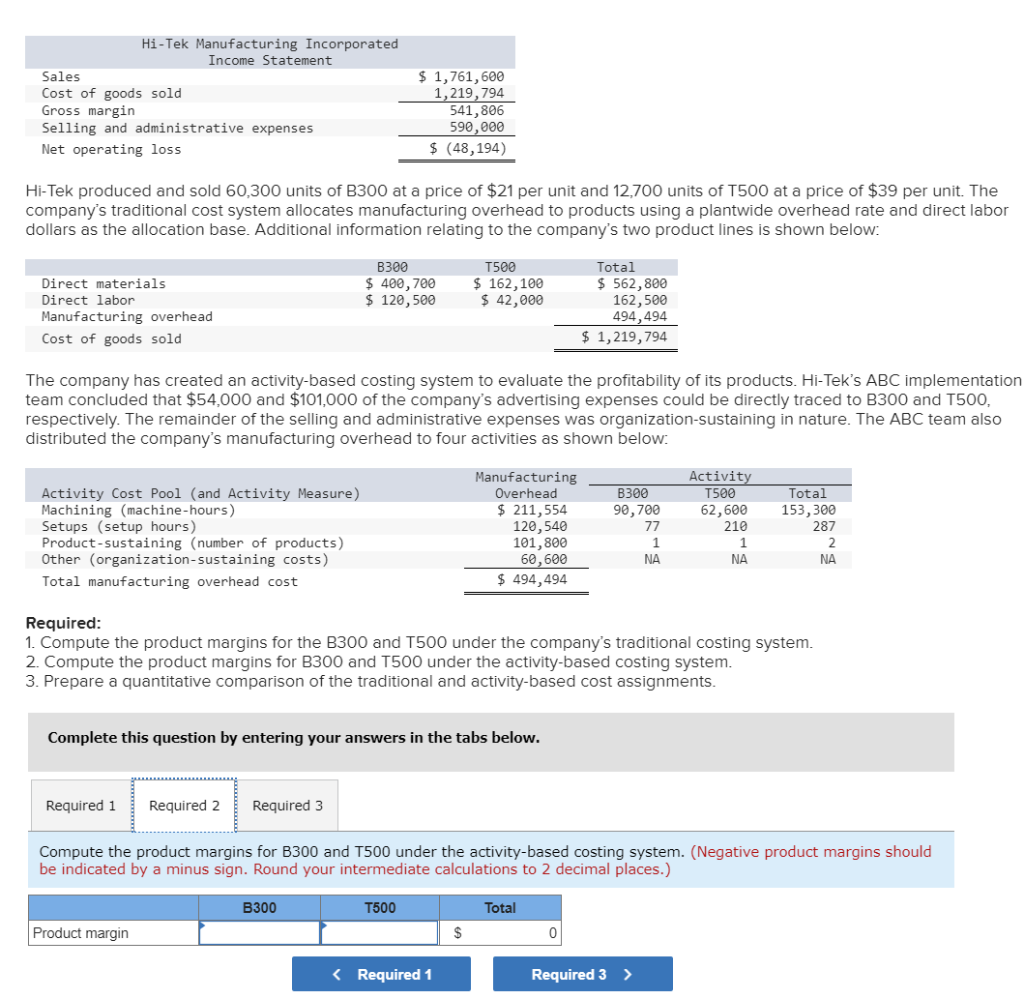

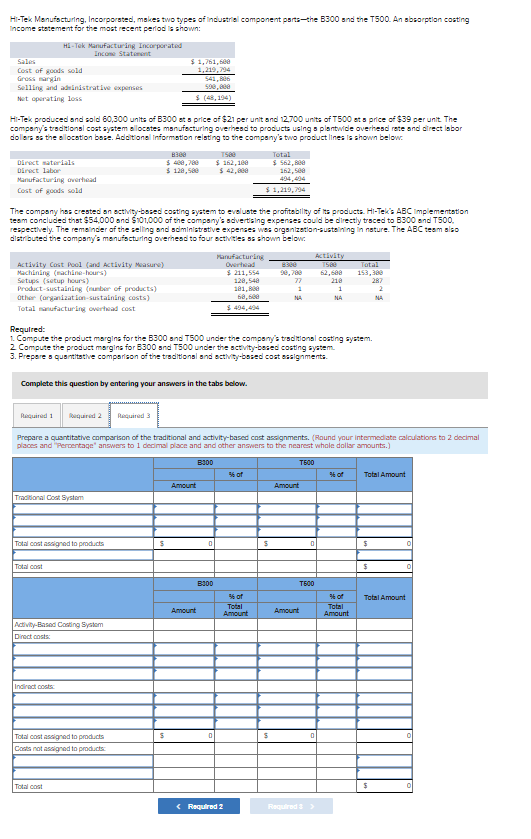

Hi-Tek produced and sold 60,300 units of B300 at a price of $21 per unit and 12,700 units of T500 at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team concluded that $54,000 and $101,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Compute the product margins for the B300 and T500 under the company's traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Hi-Tek produced and sold 60,300 units of B300 at a price of $21 per unit and 12,700 units of T500 at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team concluded that $54,000 and $101,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Compute the product margins for B300 and T500 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) Hi-Tek Menufacturing, Incorporsted, makes two types af Industrial component psits-the B500 and the T500. An absarptian costing income statement far the mast recent period is shown: Hi-Tek produced and sald 60,300 units of B300 et s price of $21 per unit and 12,700 unitz of T500 at s price of $39 per unit The compony's tradtionsl cost sygtem olocate: msnufecturing overhesed to proclucts using s plantwide overhesd rate and alrect labor dolers as the olocstion bose. Adaltionel information relsting to the campony's two product lines is shown below: The compony has crested an ectiviy-bobed costing syatem to eveluste the profitability of ha producta. HI-Tek's ABC implementation teem concluded that $54,000 and $101,000 of the compony's advert'sing expenses could be dlrectly trsced to B500 ond T500, respectively. The remainder of the selling and solministrstive expenses wes organization-susteining in nature. The ABC teom also distr buted the compsny's menuficturing overhesd to four ectivites ss shown below: Required: 1. Compute the produst margins for the B300 sne T500 under the compony's tradtiongl coating syntem. 2 Compute the product margins for 8300 snd T500 under the sctily besed costing syatem. 3. Prepore s qusintitative comporison of the traditionsl snd ectivity-bssed cost essighments. Complete this question by entering your answers in the tabs below. Prepare a quantitative comporison of the traditional and sctivity-based cost asalgnments. (Round your intermod ate calculations to 2 docimal places and "Ferrentage" answers to 1 decimal ploce and and other answers to the nearest whole dollar amounts.)