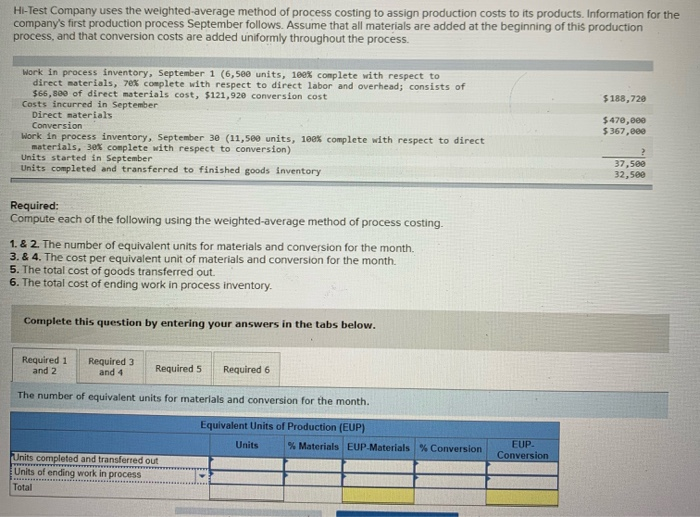

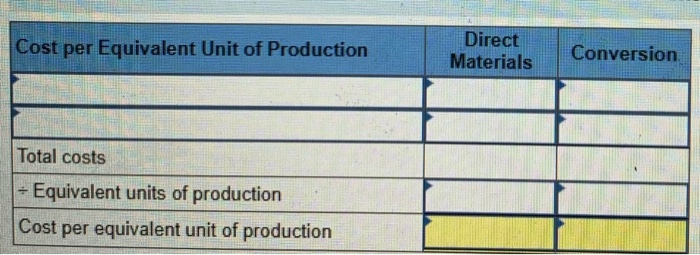

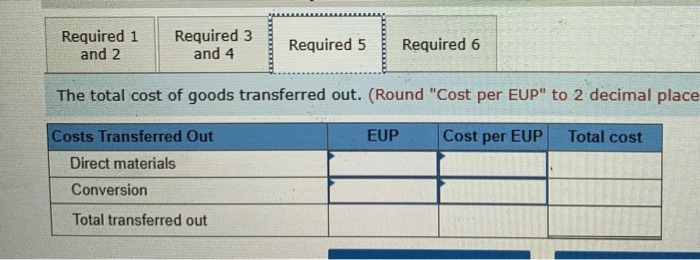

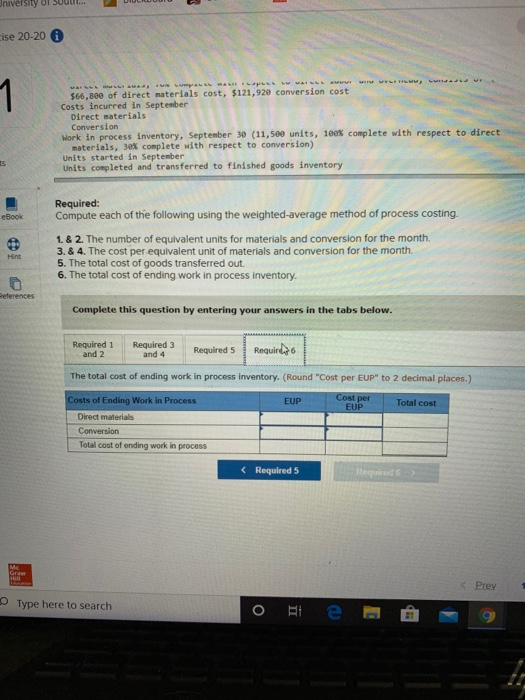

Hi-Test Company uses the weighted average method of process costing to assign production costs to its products. Information for the company's first production process September follows. Assume that all materials are added at the beginning of this production process, and that conversion costs are added uniformly throughout the process $ 188,720 Work in process inventory, September 1 (6,500 units, 100% complete with respect to direct materials, 70% complete with respect to direct labor and overhead; consists of $66,8ee of direct materials cost, $121,920 conversion cost Costs incurred in September Direct materials Conversion Work in process Inventory, September 30 (11,500 units, 100% complete with respect to direct materials, 30% complete with respect to conversion) Units started in September Units completed and transferred to finished goods Inventory 5470,000 $367,000 37.50 32.58 Required: Compute each of the following using the weighted average method of process costing. 1. & 2. The number of equivalent units for materials and conversion for the month. 3. & 4. The cost per equivalent unit of materials and conversion for the month. 5. The total cost of goods transferred out. 6. The total cost of ending work in process inventory. Complete this question by entering your answers in the tabs below. Required 1 and 2 Required 3 Required 5 Required 6 and 4 The number of equivalent units for materials and conversion for the month. Equivalent Units of Production (EUP) Units % Materials EUP-Materials % Conversion EUP Conversion Units completed and transferred out Units of ending work in process Total Cost per Equivalent Unit of Production Direct Materials Conversion Total costs + Equivalent units of production Cost per equivalent unit of production Required 1 and 2 Required 33 Required 5 and 4 Required 6 The total cost of goods transferred out. (Round "Cost per EUP" to 2 decimal place EUP Cost per EUP Total cost Costs Transferred Out Direct materials Conversion SZEL Total transferred out L University UT SUUU... DUUUUU cise 20-20 A $66,8ee of direct materials cost, $121,920 conversion cost Costs incurred in September Direct materials Conversion Work in process inventory, September 30 (11,500 units, 100% complete with respect to direct materials, 30% complete with respect to conversion) Units started in September Units completed and transferred to finished goods inventory Required: Compute each of the following using the weighted average method of process costing 1. & 2. The number of equivalent units for materials and conversion for the month. 3.& 4. The cost per equivalent unit of materials and conversion for the month. 5. The total cost of goods transferred out. 6. The total cost of ending work in process inventory. References Complete this question by entering your answers in the tabs below. Required 1 and 2 Required 3 and 4 Required 5 Required) The total cost of ending work in process inventory. (Round "Cost per EUP" to 2 decimal places.) Costs of Ending Work in Process EUP Cost per Total cost Direct materials Conversion Total cost of ending work in process