Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hmmm WAR (We Are Rich) has been in business since 1989. WAR is an accrual-method sole proprietorship that deats in the manufacturing and wholesaling of

hmmm

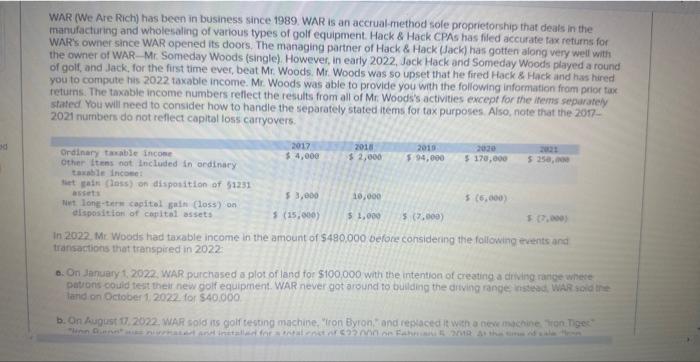

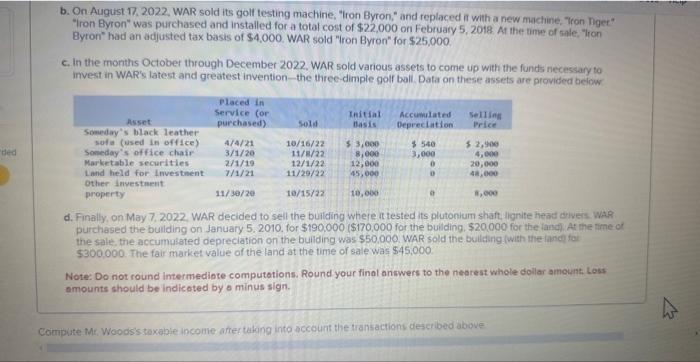

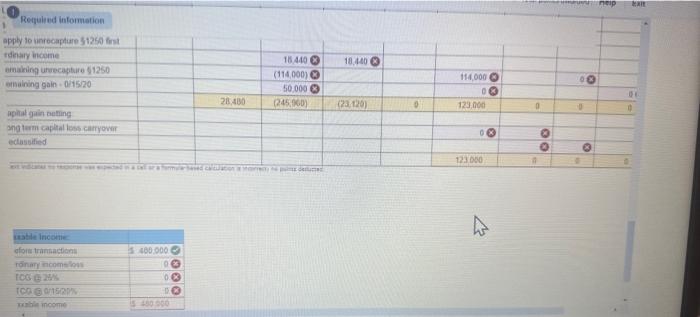

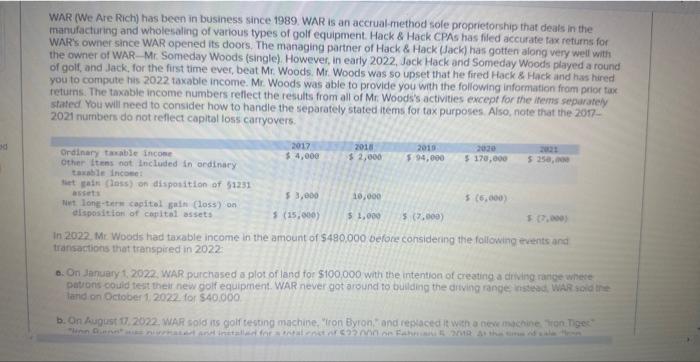

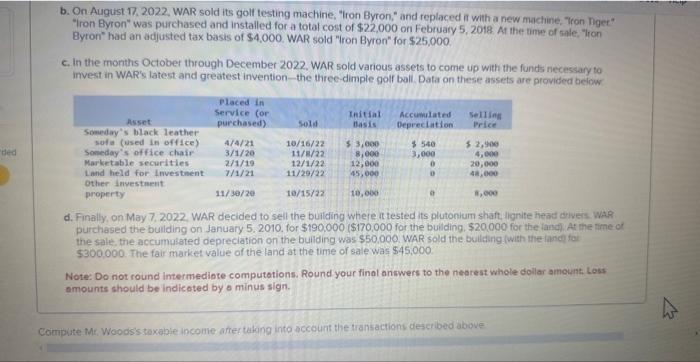

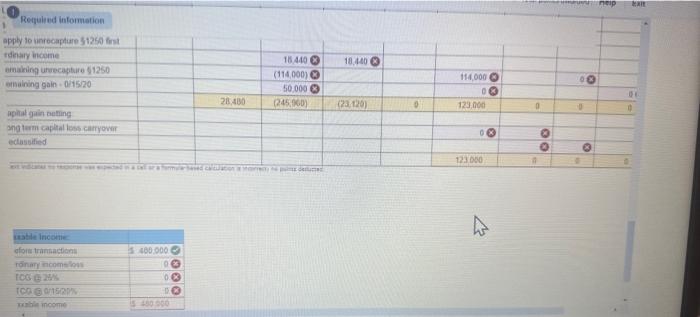

WAR (We Are Rich) has been in business since 1989. WAR is an accrual-method sole proprietorship that deats in the manufacturing and wholesaling of various types of golf equipment. Hack \& Hack CPAs has filed accurate tax returns for WAR \& owner since WAR opened its doors. The managing parther of Hack \& Hack (fack) has gotten along very well with the owner of WAR-Mr. Someday Woods (single). However, in early 2022, Jack Hack and Someday Woods played a round of goif, and Jack, for the first time ever, beat Mr. Woods. Mr. Woods was so upset that he fired Hack \& Hack and has hired you to compute his 2022 taxable income. Mr. Woods was able to provide you with the following information from prior faxk returns. The taxable income numbers reflect the results from all of Mr. Woods's activities except for the ihems separately stated You will need to consider how to handle the separately stated items for tax purposes. Also, note that the 20172021 numbers do not reflect capital loss carryovers. In 2022 Mr Woods had taxable income in the amount of $490,000 before considering the following erents and transartions that transpired in 2022 0. On lanuery 1, 2022. WAR purciased a plot of land for $100,000 with the intention of creating a diving range where patwons could test theil new golf equipment. WAR never got around to bullding the diking range nstead WAR \&cid tipe latid on Pctober 12022 tor 540,000 b. On August 17, 2022 WAR sold its golf testing machine, "Iron Byron," and replaced if with a new machine, "Iron ngec" "Iron Byron" was purchased and installed for a total cost of \$22,000 on Februaty 5, 2018. At the unie of sale, "ron Byron" had an adjusted tax basis of $4,000. WAR sold "Iron Byron" for $25,000 c. In the months October through December 2022. WAR sold various assets to come up with the funds necessary to invest in WAR's latest and greatest invention - the three-dimple golf bull. Data on these assets are provided below d. Finally, on May 7, 2022. WAR decided to sell the building where it tested its plutonium shaft ligrite head divers. Wa. purchased the building on January 5, 2010, for $190,000($170,000 for the buliding. $20,000 for the landi . At the fime of the sale, the accumulated depreciation on the buliding was $50,000 WAR sold the bollding. with the landol far $300,000. The fair market value of the land at the time of sale was $45,000 Note: Do not round intermediote computotions. Round your finol antwers to the nearest whole dollar amount Loss amounts should be indicoted by o minus sign. Complite Mr. Woods's saxabie income afrer takong into account the transactions described above: Reculred information Renulod informiation appy 90 incecapdiare 5125 s frst tdecaly income omaking unecagtire 41250 emaining gain +0/1520 Mpital gi aeftine ahg erm caplal loss caryower ectasbitied WAR (We Are Rich) has been in business since 1989. WAR is an accrual-method sole proprietorship that deats in the manufacturing and wholesaling of various types of golf equipment. Hack \& Hack CPAs has filed accurate tax returns for WAR \& owner since WAR opened its doors. The managing parther of Hack \& Hack (fack) has gotten along very well with the owner of WAR-Mr. Someday Woods (single). However, in early 2022, Jack Hack and Someday Woods played a round of goif, and Jack, for the first time ever, beat Mr. Woods. Mr. Woods was so upset that he fired Hack \& Hack and has hired you to compute his 2022 taxable income. Mr. Woods was able to provide you with the following information from prior faxk returns. The taxable income numbers reflect the results from all of Mr. Woods's activities except for the ihems separately stated You will need to consider how to handle the separately stated items for tax purposes. Also, note that the 20172021 numbers do not reflect capital loss carryovers. In 2022 Mr Woods had taxable income in the amount of $490,000 before considering the following erents and transartions that transpired in 2022 0. On lanuery 1, 2022. WAR purciased a plot of land for $100,000 with the intention of creating a diving range where patwons could test theil new golf equipment. WAR never got around to bullding the diking range nstead WAR \&cid tipe latid on Pctober 12022 tor 540,000 b. On August 17, 2022 WAR sold its golf testing machine, "Iron Byron," and replaced if with a new machine, "Iron ngec" "Iron Byron" was purchased and installed for a total cost of \$22,000 on Februaty 5, 2018. At the unie of sale, "ron Byron" had an adjusted tax basis of $4,000. WAR sold "Iron Byron" for $25,000 c. In the months October through December 2022. WAR sold various assets to come up with the funds necessary to invest in WAR's latest and greatest invention - the three-dimple golf bull. Data on these assets are provided below d. Finally, on May 7, 2022. WAR decided to sell the building where it tested its plutonium shaft ligrite head divers. Wa. purchased the building on January 5, 2010, for $190,000($170,000 for the buliding. $20,000 for the landi . At the fime of the sale, the accumulated depreciation on the buliding was $50,000 WAR sold the bollding. with the landol far $300,000. The fair market value of the land at the time of sale was $45,000 Note: Do not round intermediote computotions. Round your finol antwers to the nearest whole dollar amount Loss amounts should be indicoted by o minus sign. Complite Mr. Woods's saxabie income afrer takong into account the transactions described above: Reculred information Renulod informiation appy 90 incecapdiare 5125 s frst tdecaly income omaking unecagtire 41250 emaining gain +0/1520 Mpital gi aeftine ahg erm caplal loss caryower ectasbitied

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started