Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hn Degree of operating leverage (DOL), 360, shows the degree to which fixed costs are used to obtain a higher percent change in profits as

hn

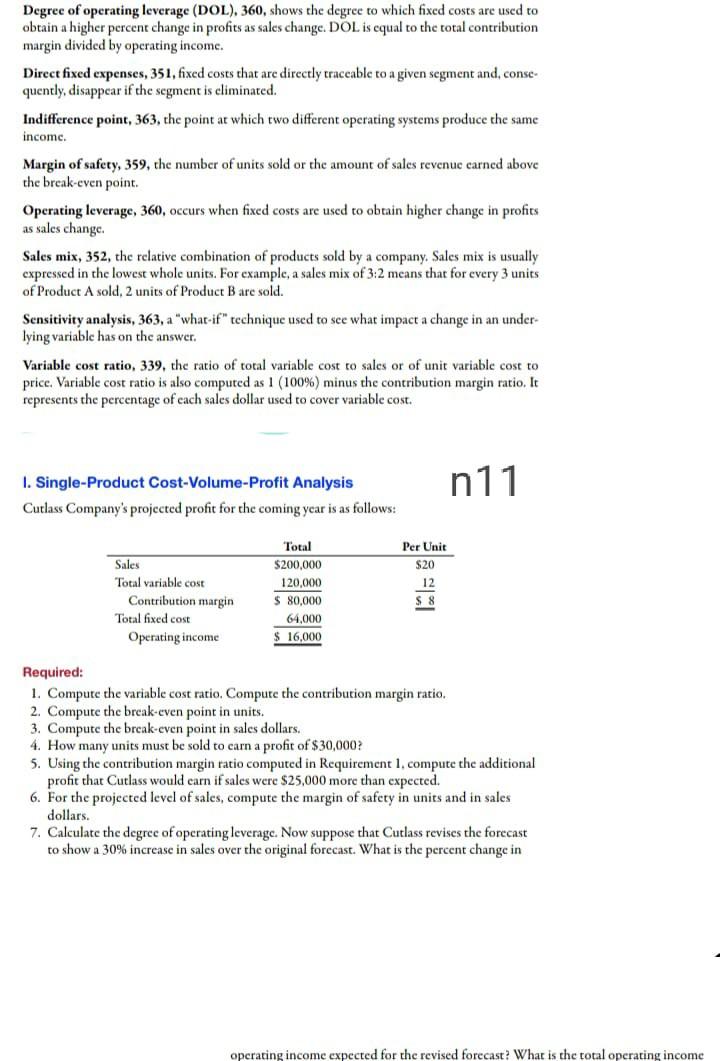

Degree of operating leverage (DOL), 360, shows the degree to which fixed costs are used to obtain a higher percent change in profits as sales change. DOL is equal to the total contribution margin divided by operating income. Direct fixed expenses, 351, fixed costs that are directly traceable to a given segment and, conse- quently, disappear if the segment is eliminated. Indifference point, 363, the point at which two different operating systems produce the same income. Margin of safety, 359, the number of units sold or the amount of sales revenue carned above the break-even point. Operating leverage, 360, occurs when fixed costs are used to obtain higher change in profits as sales change Sales mix, 352, the relative combination of products sold by a company, Sales mix is usually expressed in the lowest whole units. For example, a sales mix of 3:2 means that for every 3 units of Product A sold, 2 units of Product Bare sold. Sensitivity analysis, 363, a "what-if" technique used to see what impact a change in an under- lying variable has on the answer. Variable cost ratio, 339, the ratio of total variable cost to sales or of unit variable cost to price. Variable cost ratio is also computed as 1 (100%) minus the contribution margin ratio. It represents the percentage of each sales dollar used to cover variable cost. 1. Single-Product Cost-Volume-Profit Analysis Cutlass Company's projected profit for the coming year is as follows: n11 Sales Total variable cost Contribution margin Total fixed cost Operating income Total $200,000 120,000 $ 80,000 64,000 16,000 Per Unit $20 12 $8 [ Required: 1. Compute the variable cost ratio. Compute the contribution margin ratio. 2. Compute the break-even point in units. 3. Compute the break-even point in sales dollars. 4. How many units must be sold to carn a profit of $30,000? 5. Using the contribution margin ratio computed in Requirement 1, compute the additional profit that Cutlass would earn if sales were $25,000 more than expected. 6. For the projected level of sales, compute the margin of safety in units and in sales dollars. 7. Calculate the degree of operating leverage. Now suppose that Cutlass revises the forecast to show a 30% increase in sales over the original forecast. What is the percent change in operating income expected for the revised forecast? What is the total operating incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started