Answered step by step

Verified Expert Solution

Question

1 Approved Answer

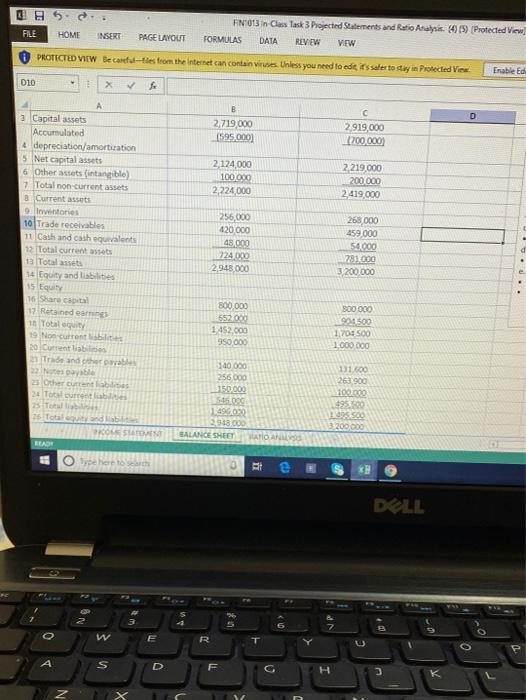

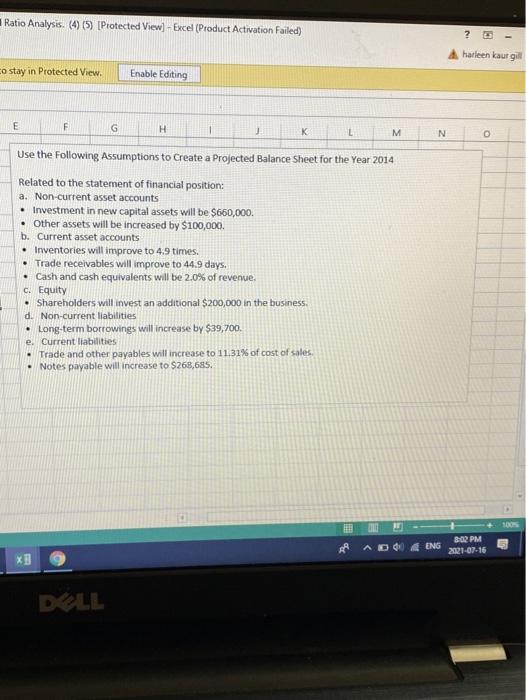

HNUS in-class lask 3 Projected Statements and Ratio Analysis. 1990) Protected View FORMULAS DATA REVIEW VIEW FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW Be careful-Files

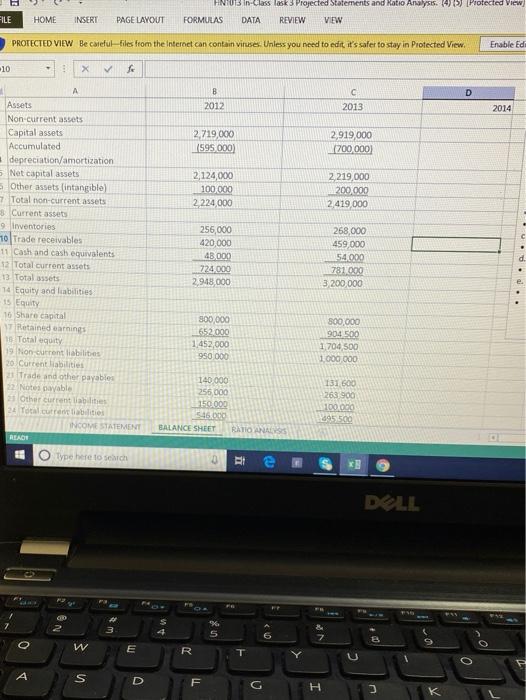

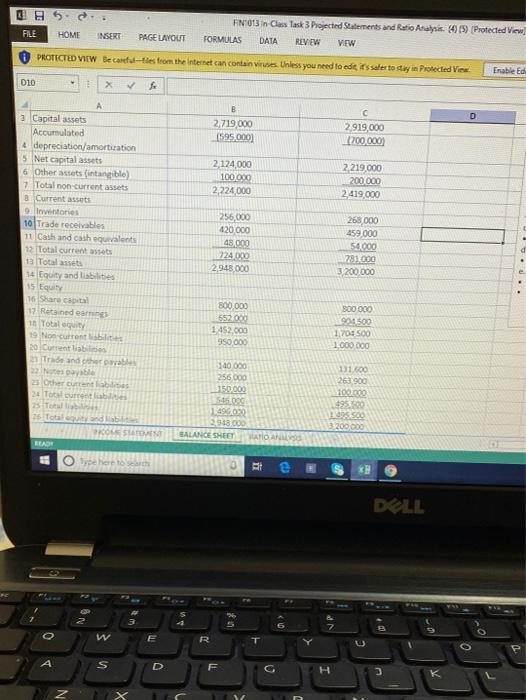

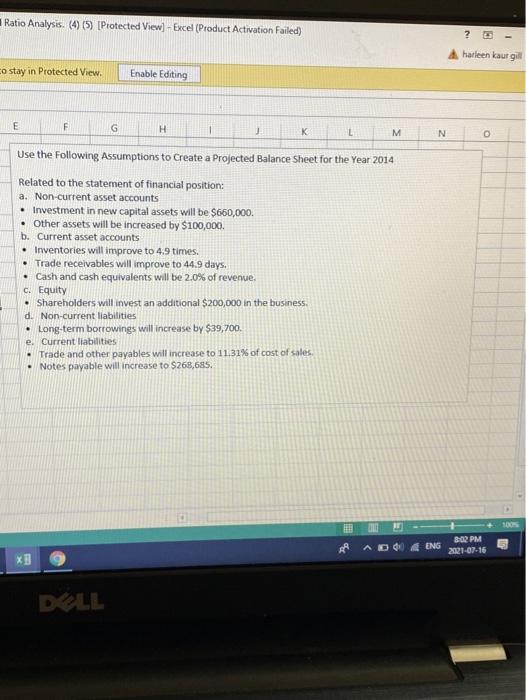

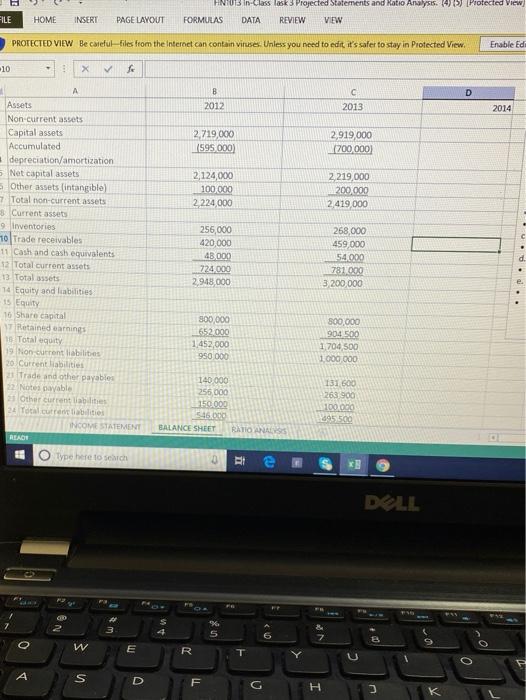

HNUS in-class lask 3 Projected Statements and Ratio Analysis. 1990) Protected View FORMULAS DATA REVIEW VIEW FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW Be careful-Files from the Interoe can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Ed 10 X fe B c 2013 2012 2014 2.719,000 1595 000) 2,919,000 (700 000 2,124,000 100 000 2224,000 2219,000 200,000 2.419.000 Assets Non current assets Capital assets Accumulated depreciation/amortization 5. Net capital assets Other assets intangible) 7 Total non-current assets Current asset 9 Inventories 10 Trade receivables 11 Cash and cash equivalents 12 Total current assets 13 Total assets 14 Equity and liabilities 15 Equity 16 Share capital Retained earnings 1 Total equity 19 Non current liabilities 20. Current liabilities Trade and other payables 22 Notes payable Other current abilities 24 Total.curabite INCOME STATEMENT READS 256,000 420,000 48.000 724.000 2.948.000 268,000 459.000 54.000 781000 3200,000 I.... 300,000 552.000 1.452.000 950 000 800,000 904500 1.704,500 1 000 000 140.000 256 000 10.000 516000 BALANCE SHEET RATIO ANALYS 131.600 263 900 100.000 9550 Type here to search BI DELL TNE O Un 6 W E R S D F G H 3 FILE HOME FN3 in Class Task 3 Projected Statements and Ratio Analysis. 1919) Protected View FORMULAS DATA REVIEW VIEW INSERT PAGE LAYOUT PROTECTED VIEW Be candles from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Ed DLO X D B 2,719.000 1595.000) 2.919.000 200.000 2,174,000 100.000 2,224 000 2.219.000 200.000 2419,000 A a Capital assets Accumulated 4 depreciation/amortization 5 Net capital assets 6 Other assets intangible) 7 Total non-current assets & Current assets 9 Inventories 10 Trade receivables 11 Cases and cash valents 12 Total current assets 13 Total asset 14 Equity and liabilities 15 Equity 16 Share Capital 17 Rated eang 1 Total equity 19 Non-current bles 20 Currenties Trade and other peab 22 23 Other current liabilises 20 Total current 25 Total 15 Tot cut and COSATUEN 256,000 420.000 45,000 224.000 2,948.000 268,000 459.000 50.000 1281.000 3.200.000 d 300.000 552000 1 452.000 950.000 800 000 901 500 1.704500 1 000 000 140.000 256 000 350.000 16.00 149.000 2.318.000 BALANCE SHEET VATIONS 131.600 262 900 . $95.00 1995.50 3.200.000 o Sype here to RI DELL 5 U W E R V S F C H X Ratio Analysis. (4) (5) Protected View] - Excel (Product Activation Failed) ? harleen Kaur g o stay in Protected View Enable Editing E F G H 1 K L M N o Use the following Assumptions to Create a Projected Balance Sheet for the Year 2014 Related to the statement of financial position: a. Non-current asset accounts Investment in new capital assets will be $660,000. Other assets will be increased by $100,000. b. Current asset accounts Inventories will improve to 4.9 times. Trade receivables will improve to 44.9 days. Cash and cash equivalents will be 2.0% of revenue. C. Equity Shareholders will invest an additional $200,000 in the business d. Non-current liabilities Long-term borrowings will increase by $39,700. e. Current liabilities Trade and other payables will increase to 11.31% of cost of sales Notes payable will increase to $268,685. RAAD ENG 8:02 PM 2021-07-16 *3 DOLL HNUS in-class lask 3 Projected Statements and Ratio Analysis. 1990) Protected View FORMULAS DATA REVIEW VIEW FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW Be careful-Files from the Interoe can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Ed 10 X fe B c 2013 2012 2014 2.719,000 1595 000) 2,919,000 (700 000 2,124,000 100 000 2224,000 2219,000 200,000 2.419.000 Assets Non current assets Capital assets Accumulated depreciation/amortization 5. Net capital assets Other assets intangible) 7 Total non-current assets Current asset 9 Inventories 10 Trade receivables 11 Cash and cash equivalents 12 Total current assets 13 Total assets 14 Equity and liabilities 15 Equity 16 Share capital Retained earnings 1 Total equity 19 Non current liabilities 20. Current liabilities Trade and other payables 22 Notes payable Other current abilities 24 Total.curabite INCOME STATEMENT READS 256,000 420,000 48.000 724.000 2.948.000 268,000 459.000 54.000 781000 3200,000 I.... 300,000 552.000 1.452.000 950 000 800,000 904500 1.704,500 1 000 000 140.000 256 000 10.000 516000 BALANCE SHEET RATIO ANALYS 131.600 263 900 100.000 9550 Type here to search BI DELL TNE O Un 6 W E R S D F G H 3 FILE HOME FN3 in Class Task 3 Projected Statements and Ratio Analysis. 1919) Protected View FORMULAS DATA REVIEW VIEW INSERT PAGE LAYOUT PROTECTED VIEW Be candles from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Ed DLO X D B 2,719.000 1595.000) 2.919.000 200.000 2,174,000 100.000 2,224 000 2.219.000 200.000 2419,000 A a Capital assets Accumulated 4 depreciation/amortization 5 Net capital assets 6 Other assets intangible) 7 Total non-current assets & Current assets 9 Inventories 10 Trade receivables 11 Cases and cash valents 12 Total current assets 13 Total asset 14 Equity and liabilities 15 Equity 16 Share Capital 17 Rated eang 1 Total equity 19 Non-current bles 20 Currenties Trade and other peab 22 23 Other current liabilises 20 Total current 25 Total 15 Tot cut and COSATUEN 256,000 420.000 45,000 224.000 2,948.000 268,000 459.000 50.000 1281.000 3.200.000 d 300.000 552000 1 452.000 950.000 800 000 901 500 1.704500 1 000 000 140.000 256 000 350.000 16.00 149.000 2.318.000 BALANCE SHEET VATIONS 131.600 262 900 . $95.00 1995.50 3.200.000 o Sype here to RI DELL 5 U W E R V S F C H X Ratio Analysis. (4) (5) Protected View] - Excel (Product Activation Failed) ? harleen Kaur g o stay in Protected View Enable Editing E F G H 1 K L M N o Use the following Assumptions to Create a Projected Balance Sheet for the Year 2014 Related to the statement of financial position: a. Non-current asset accounts Investment in new capital assets will be $660,000. Other assets will be increased by $100,000. b. Current asset accounts Inventories will improve to 4.9 times. Trade receivables will improve to 44.9 days. Cash and cash equivalents will be 2.0% of revenue. C. Equity Shareholders will invest an additional $200,000 in the business d. Non-current liabilities Long-term borrowings will increase by $39,700. e. Current liabilities Trade and other payables will increase to 11.31% of cost of sales Notes payable will increase to $268,685. RAAD ENG 8:02 PM 2021-07-16 *3 DOLL

HNUS in-class lask 3 Projected Statements and Ratio Analysis. 1990) Protected View FORMULAS DATA REVIEW VIEW FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW Be careful-Files from the Interoe can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Ed 10 X fe B c 2013 2012 2014 2.719,000 1595 000) 2,919,000 (700 000 2,124,000 100 000 2224,000 2219,000 200,000 2.419.000 Assets Non current assets Capital assets Accumulated depreciation/amortization 5. Net capital assets Other assets intangible) 7 Total non-current assets Current asset 9 Inventories 10 Trade receivables 11 Cash and cash equivalents 12 Total current assets 13 Total assets 14 Equity and liabilities 15 Equity 16 Share capital Retained earnings 1 Total equity 19 Non current liabilities 20. Current liabilities Trade and other payables 22 Notes payable Other current abilities 24 Total.curabite INCOME STATEMENT READS 256,000 420,000 48.000 724.000 2.948.000 268,000 459.000 54.000 781000 3200,000 I.... 300,000 552.000 1.452.000 950 000 800,000 904500 1.704,500 1 000 000 140.000 256 000 10.000 516000 BALANCE SHEET RATIO ANALYS 131.600 263 900 100.000 9550 Type here to search BI DELL TNE O Un 6 W E R S D F G H 3 FILE HOME FN3 in Class Task 3 Projected Statements and Ratio Analysis. 1919) Protected View FORMULAS DATA REVIEW VIEW INSERT PAGE LAYOUT PROTECTED VIEW Be candles from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Ed DLO X D B 2,719.000 1595.000) 2.919.000 200.000 2,174,000 100.000 2,224 000 2.219.000 200.000 2419,000 A a Capital assets Accumulated 4 depreciation/amortization 5 Net capital assets 6 Other assets intangible) 7 Total non-current assets & Current assets 9 Inventories 10 Trade receivables 11 Cases and cash valents 12 Total current assets 13 Total asset 14 Equity and liabilities 15 Equity 16 Share Capital 17 Rated eang 1 Total equity 19 Non-current bles 20 Currenties Trade and other peab 22 23 Other current liabilises 20 Total current 25 Total 15 Tot cut and COSATUEN 256,000 420.000 45,000 224.000 2,948.000 268,000 459.000 50.000 1281.000 3.200.000 d 300.000 552000 1 452.000 950.000 800 000 901 500 1.704500 1 000 000 140.000 256 000 350.000 16.00 149.000 2.318.000 BALANCE SHEET VATIONS 131.600 262 900 . $95.00 1995.50 3.200.000 o Sype here to RI DELL 5 U W E R V S F C H X Ratio Analysis. (4) (5) Protected View] - Excel (Product Activation Failed) ? harleen Kaur g o stay in Protected View Enable Editing E F G H 1 K L M N o Use the following Assumptions to Create a Projected Balance Sheet for the Year 2014 Related to the statement of financial position: a. Non-current asset accounts Investment in new capital assets will be $660,000. Other assets will be increased by $100,000. b. Current asset accounts Inventories will improve to 4.9 times. Trade receivables will improve to 44.9 days. Cash and cash equivalents will be 2.0% of revenue. C. Equity Shareholders will invest an additional $200,000 in the business d. Non-current liabilities Long-term borrowings will increase by $39,700. e. Current liabilities Trade and other payables will increase to 11.31% of cost of sales Notes payable will increase to $268,685. RAAD ENG 8:02 PM 2021-07-16 *3 DOLL HNUS in-class lask 3 Projected Statements and Ratio Analysis. 1990) Protected View FORMULAS DATA REVIEW VIEW FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW Be careful-Files from the Interoe can contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Ed 10 X fe B c 2013 2012 2014 2.719,000 1595 000) 2,919,000 (700 000 2,124,000 100 000 2224,000 2219,000 200,000 2.419.000 Assets Non current assets Capital assets Accumulated depreciation/amortization 5. Net capital assets Other assets intangible) 7 Total non-current assets Current asset 9 Inventories 10 Trade receivables 11 Cash and cash equivalents 12 Total current assets 13 Total assets 14 Equity and liabilities 15 Equity 16 Share capital Retained earnings 1 Total equity 19 Non current liabilities 20. Current liabilities Trade and other payables 22 Notes payable Other current abilities 24 Total.curabite INCOME STATEMENT READS 256,000 420,000 48.000 724.000 2.948.000 268,000 459.000 54.000 781000 3200,000 I.... 300,000 552.000 1.452.000 950 000 800,000 904500 1.704,500 1 000 000 140.000 256 000 10.000 516000 BALANCE SHEET RATIO ANALYS 131.600 263 900 100.000 9550 Type here to search BI DELL TNE O Un 6 W E R S D F G H 3 FILE HOME FN3 in Class Task 3 Projected Statements and Ratio Analysis. 1919) Protected View FORMULAS DATA REVIEW VIEW INSERT PAGE LAYOUT PROTECTED VIEW Be candles from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Ed DLO X D B 2,719.000 1595.000) 2.919.000 200.000 2,174,000 100.000 2,224 000 2.219.000 200.000 2419,000 A a Capital assets Accumulated 4 depreciation/amortization 5 Net capital assets 6 Other assets intangible) 7 Total non-current assets & Current assets 9 Inventories 10 Trade receivables 11 Cases and cash valents 12 Total current assets 13 Total asset 14 Equity and liabilities 15 Equity 16 Share Capital 17 Rated eang 1 Total equity 19 Non-current bles 20 Currenties Trade and other peab 22 23 Other current liabilises 20 Total current 25 Total 15 Tot cut and COSATUEN 256,000 420.000 45,000 224.000 2,948.000 268,000 459.000 50.000 1281.000 3.200.000 d 300.000 552000 1 452.000 950.000 800 000 901 500 1.704500 1 000 000 140.000 256 000 350.000 16.00 149.000 2.318.000 BALANCE SHEET VATIONS 131.600 262 900 . $95.00 1995.50 3.200.000 o Sype here to RI DELL 5 U W E R V S F C H X Ratio Analysis. (4) (5) Protected View] - Excel (Product Activation Failed) ? harleen Kaur g o stay in Protected View Enable Editing E F G H 1 K L M N o Use the following Assumptions to Create a Projected Balance Sheet for the Year 2014 Related to the statement of financial position: a. Non-current asset accounts Investment in new capital assets will be $660,000. Other assets will be increased by $100,000. b. Current asset accounts Inventories will improve to 4.9 times. Trade receivables will improve to 44.9 days. Cash and cash equivalents will be 2.0% of revenue. C. Equity Shareholders will invest an additional $200,000 in the business d. Non-current liabilities Long-term borrowings will increase by $39,700. e. Current liabilities Trade and other payables will increase to 11.31% of cost of sales Notes payable will increase to $268,685. RAAD ENG 8:02 PM 2021-07-16 *3 DOLL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started