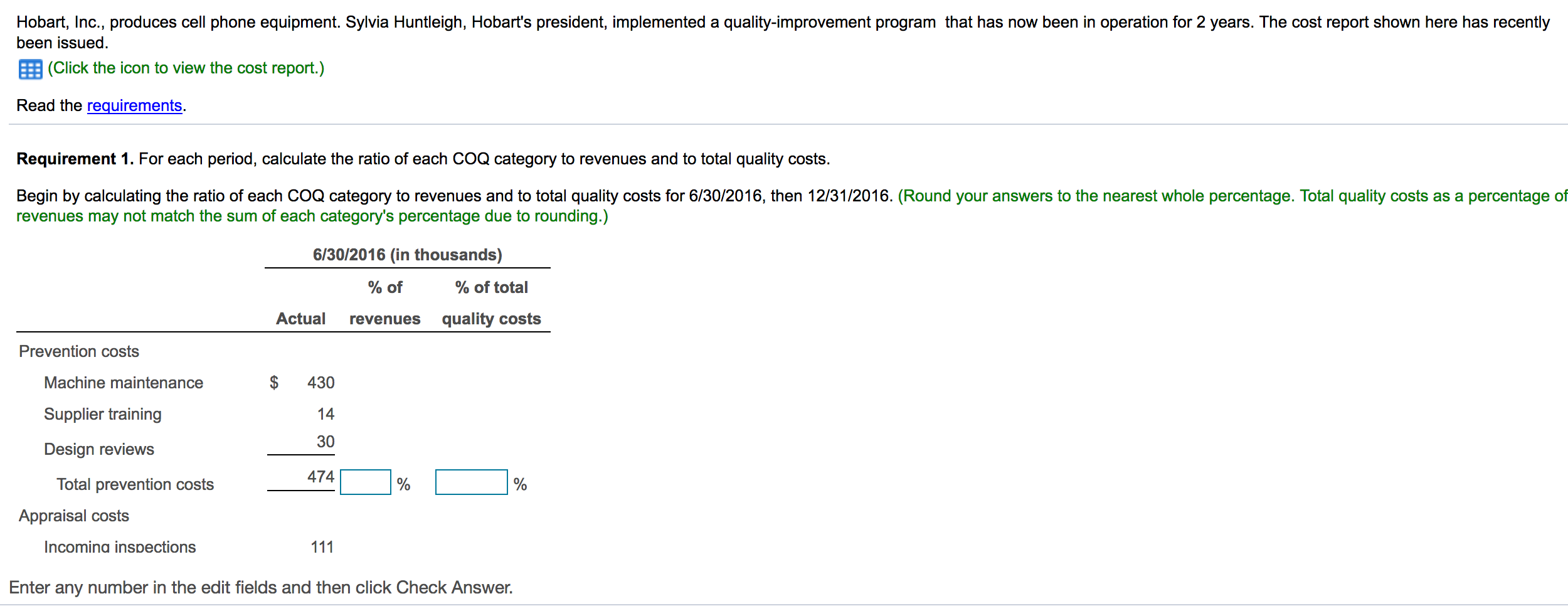

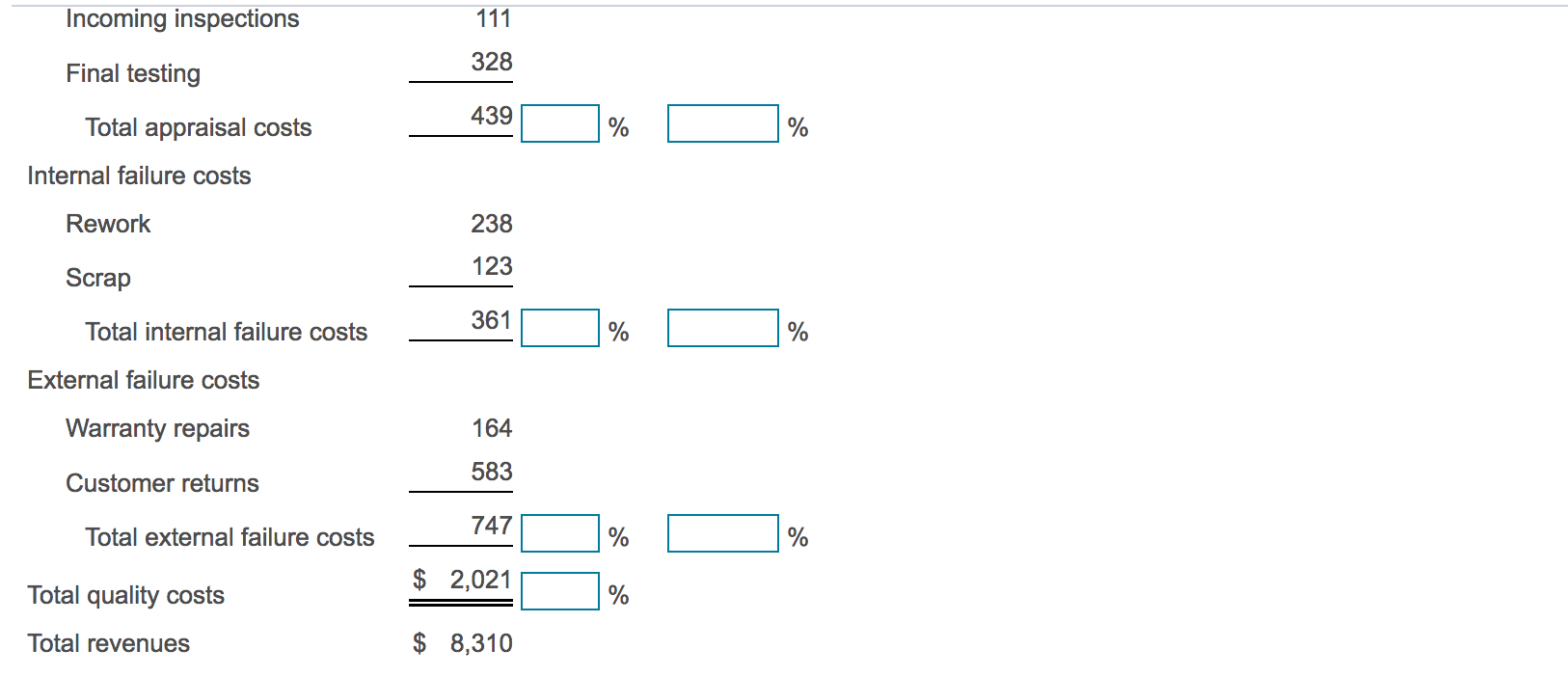

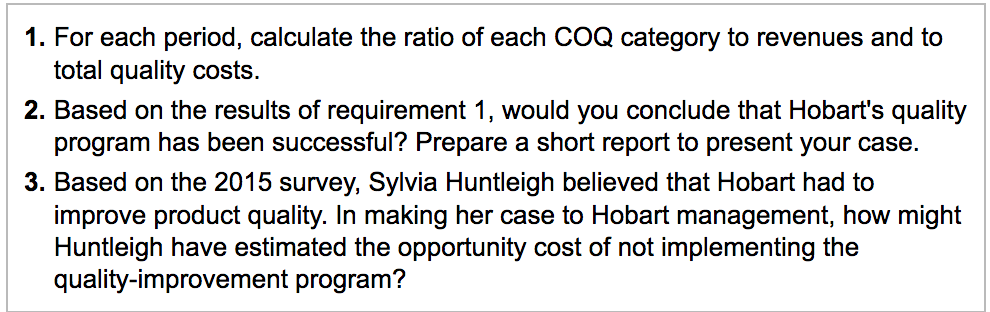

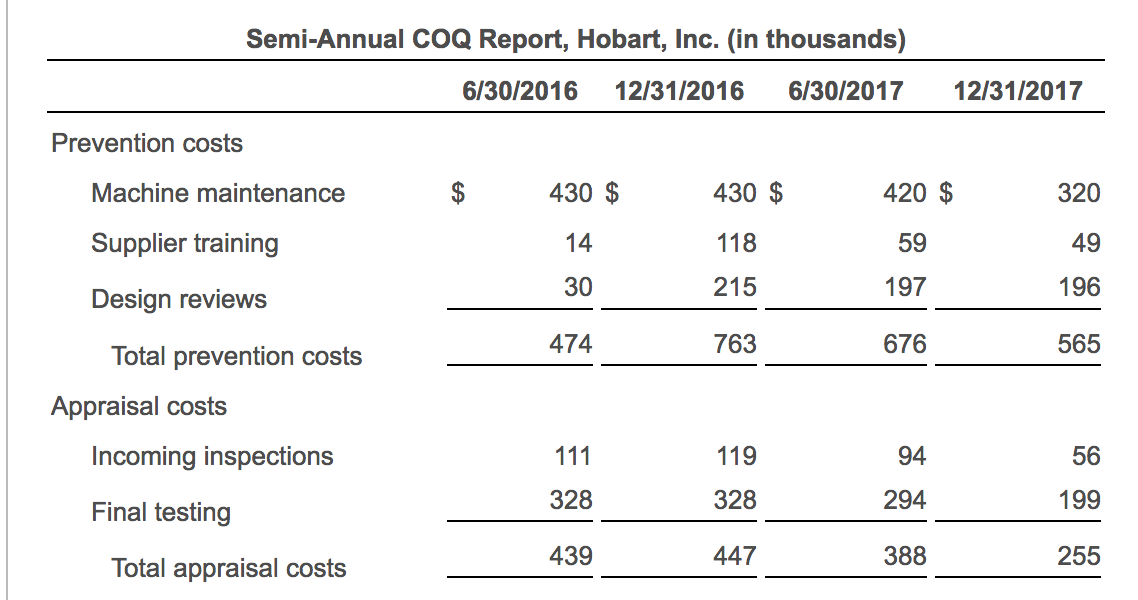

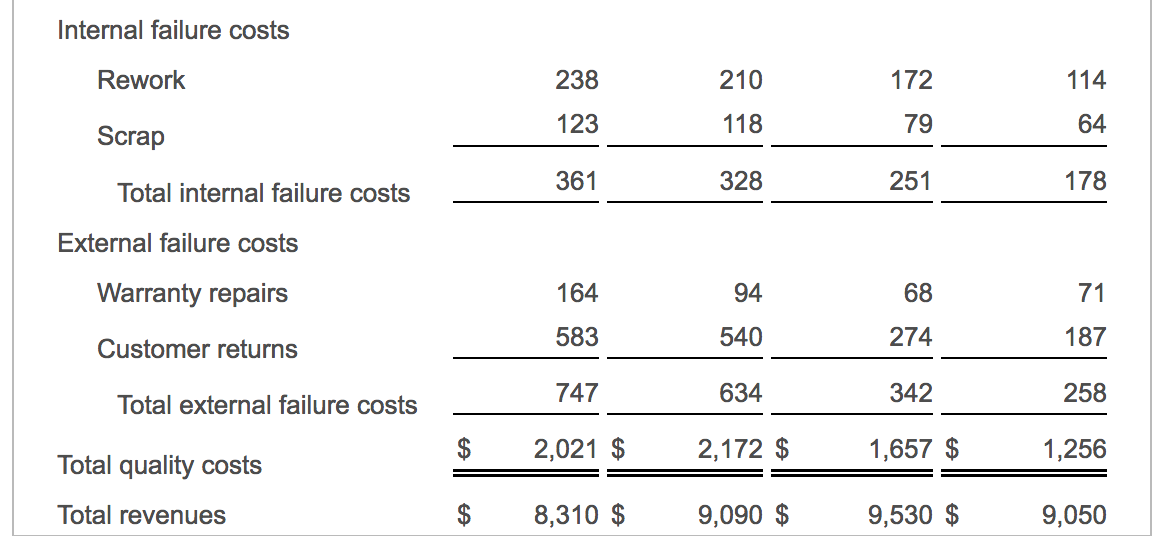

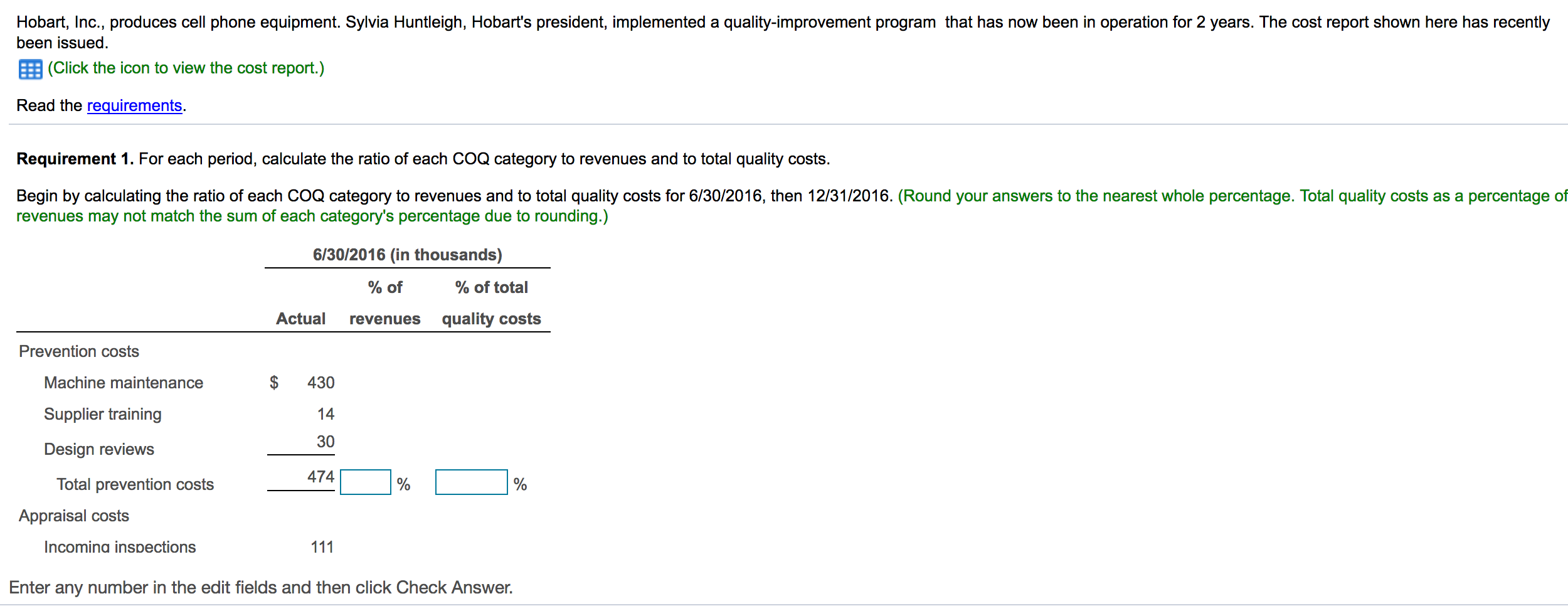

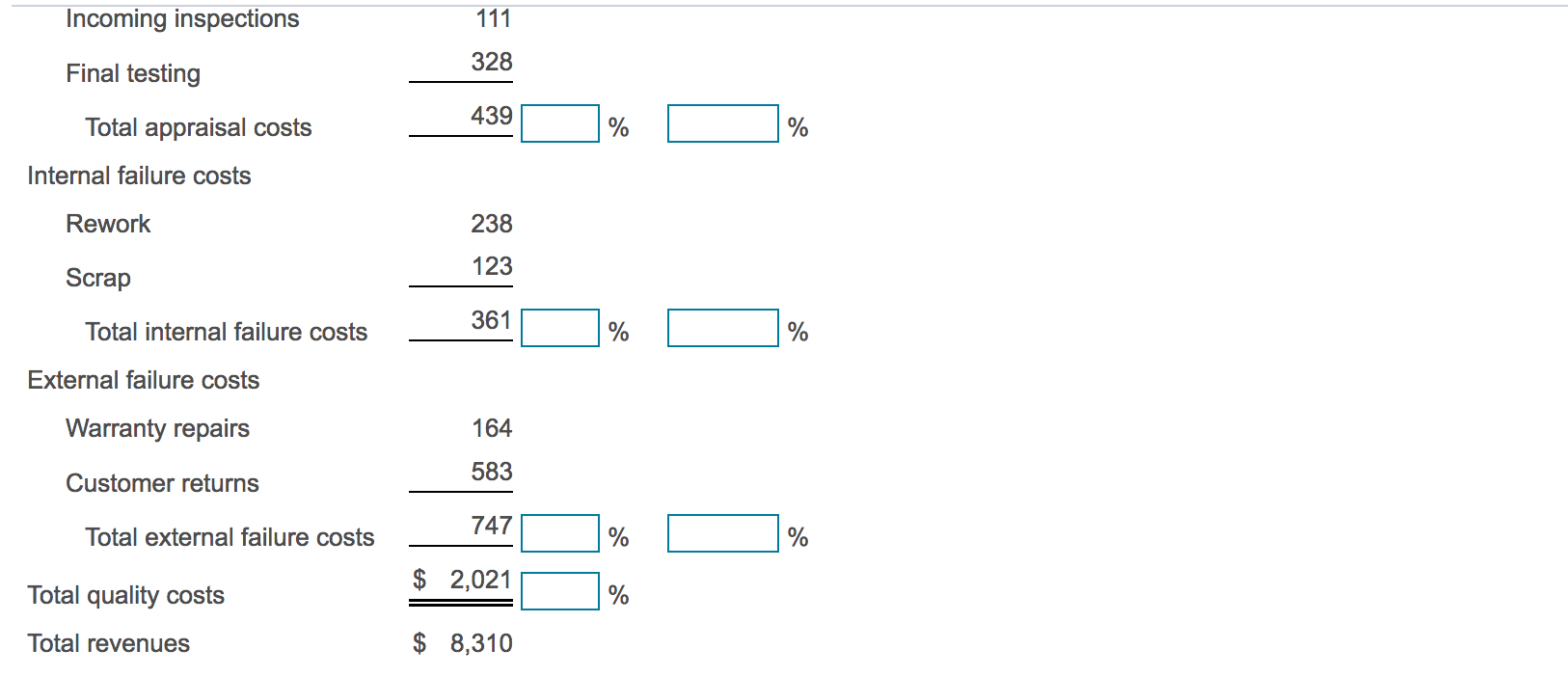

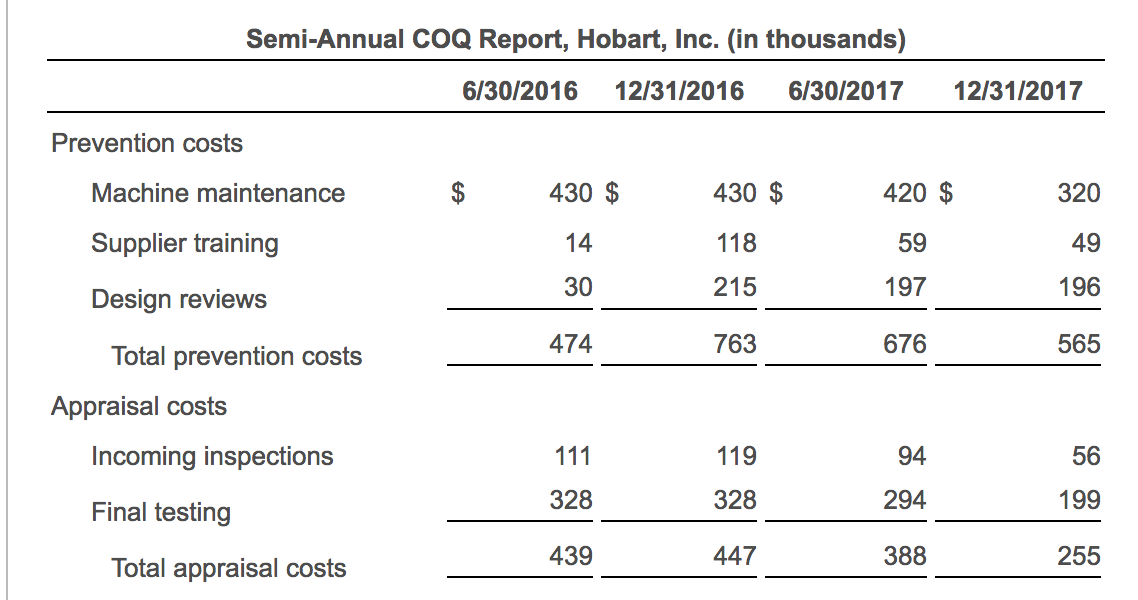

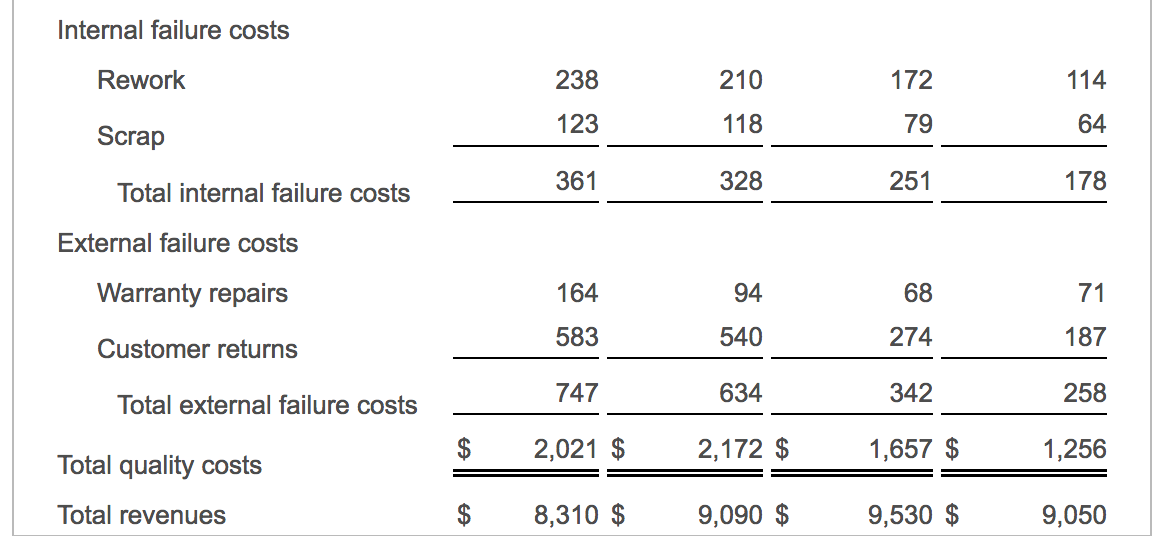

Hobart, Inc., produces cell phone equipment. Sylvia Huntleigh, Hobart's president, implemented a quality-improvement program that has now been in operation for 2 years. The cost report shown here has recently been issued. : (Click the icon to view the cost report.) Read the requirements. Requirement 1. For each period, calculate the ratio of each COQ category to revenues and to total quality costs. L our answers to the near Begin by calculating the ratio of each COQ category to revenues and to total quality costs for 6/30/2016, then 12/31/2016. (Round your answers to the nearest whole percentage. Total quality costs as a percentage of revenues may not match the sum of each category's percentage due to rounding.) 6/30/2016 (in thousands) % of % of total Actual revenues quality costs Prevention costs Machine maintenance $ 430 Supplier training 14 30 Design reviews Total prevention costs _474 % D % Appraisal costs Incomina inspections 111 Enter any number in the edit fields and then click Check Answer. Incoming inspections 111 328 Final testing 439 Total appraisal costs % % Internal failure costs Rework 238 123 Scrap Total internal failure costs 361 % % External failure costs Warranty repairs 164 583 Customer returns Total external failure costs | 747 $ 2,021 % % % Total quality costs Total revenues $ 8,310 1. For each period, calculate the ratio of each COQ category to revenues and to total quality costs. 2. Based on the results of requirement 1, would you conclude that Hobart's quality program has been successful? Prepare a short report to present your case. 3. Based on the 2015 survey, Sylvia Huntleigh believed that Hobart had to improve product quality. In making her case to Hobart management, how might Huntleigh have estimated the opportunity cost of not implementing the quality-improvement program? Semi-Annual COQ Report, Hobart, Inc. (in thousands) 6/30/2016 12/31/2016 6/30/2017 12/31/2017 Prevention costs 430 $ 430 $ 420 $ 320 Machine maintenance Supplier training 14 59 49 118 215 Design reviews 196 197 Total prevention costs 474 763 676 565 Appraisal costs Incoming inspections 111 119 94 328 328 Final testing 199 294 439 388 447 255 Total appraisal costs Internal failure costs Rework 238 210 172 114 123 118 79 64 Scrap 361 328 251 170 178 Total internal failure costs External failure costs Warranty repairs 164 94 68 71 583 540 274 187 Customer returns 747 634 342 258 Total external failure costs $ 2,021 $ 2,172 $ 1,657 $ 1,256 Total quality costs Total revenues $ 8,310 $ 9,090 $ 9,530 $ 9,050 Hobart, Inc., produces cell phone equipment. Sylvia Huntleigh, Hobart's president, implemented a quality-improvement program that has now been in operation for 2 years. The cost report shown here has recently been issued. : (Click the icon to view the cost report.) Read the requirements. Requirement 1. For each period, calculate the ratio of each COQ category to revenues and to total quality costs. L our answers to the near Begin by calculating the ratio of each COQ category to revenues and to total quality costs for 6/30/2016, then 12/31/2016. (Round your answers to the nearest whole percentage. Total quality costs as a percentage of revenues may not match the sum of each category's percentage due to rounding.) 6/30/2016 (in thousands) % of % of total Actual revenues quality costs Prevention costs Machine maintenance $ 430 Supplier training 14 30 Design reviews Total prevention costs _474 % D % Appraisal costs Incomina inspections 111 Enter any number in the edit fields and then click Check Answer. Incoming inspections 111 328 Final testing 439 Total appraisal costs % % Internal failure costs Rework 238 123 Scrap Total internal failure costs 361 % % External failure costs Warranty repairs 164 583 Customer returns Total external failure costs | 747 $ 2,021 % % % Total quality costs Total revenues $ 8,310 1. For each period, calculate the ratio of each COQ category to revenues and to total quality costs. 2. Based on the results of requirement 1, would you conclude that Hobart's quality program has been successful? Prepare a short report to present your case. 3. Based on the 2015 survey, Sylvia Huntleigh believed that Hobart had to improve product quality. In making her case to Hobart management, how might Huntleigh have estimated the opportunity cost of not implementing the quality-improvement program? Semi-Annual COQ Report, Hobart, Inc. (in thousands) 6/30/2016 12/31/2016 6/30/2017 12/31/2017 Prevention costs 430 $ 430 $ 420 $ 320 Machine maintenance Supplier training 14 59 49 118 215 Design reviews 196 197 Total prevention costs 474 763 676 565 Appraisal costs Incoming inspections 111 119 94 328 328 Final testing 199 294 439 388 447 255 Total appraisal costs Internal failure costs Rework 238 210 172 114 123 118 79 64 Scrap 361 328 251 170 178 Total internal failure costs External failure costs Warranty repairs 164 94 68 71 583 540 274 187 Customer returns 747 634 342 258 Total external failure costs $ 2,021 $ 2,172 $ 1,657 $ 1,256 Total quality costs Total revenues $ 8,310 $ 9,090 $ 9,530 $ 9,050