Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hobson Company bought the securities listed below during 2023. These securities were classified as trading securities. In its December 31,2023 statement Hobson reported a net

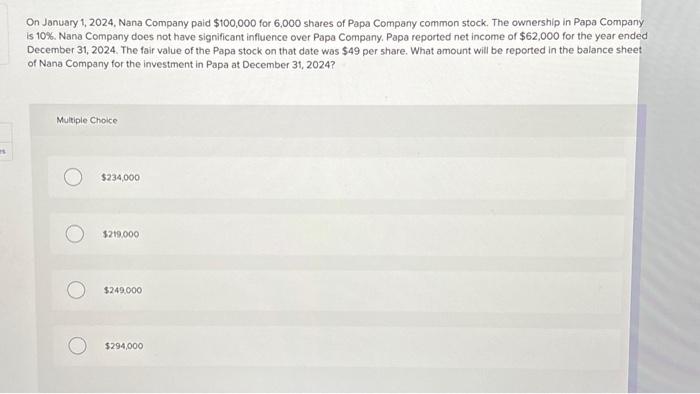

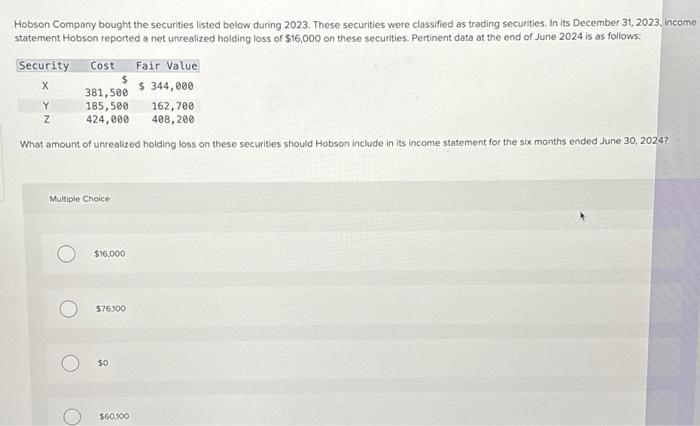

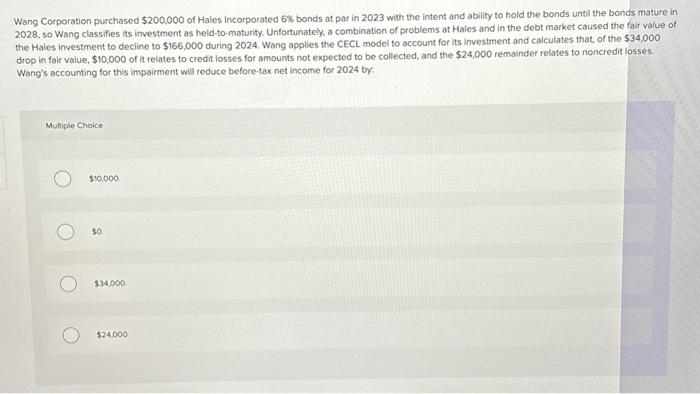

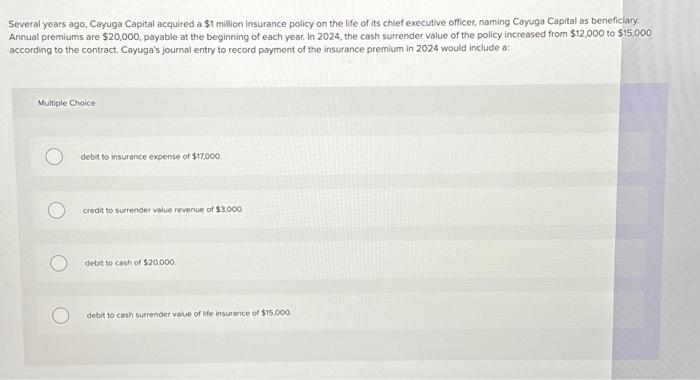

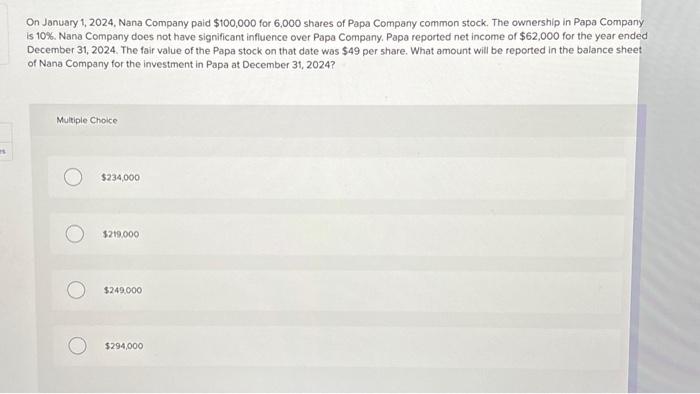

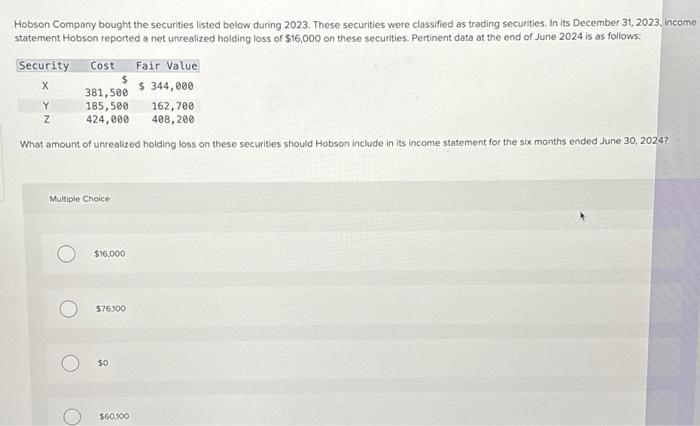

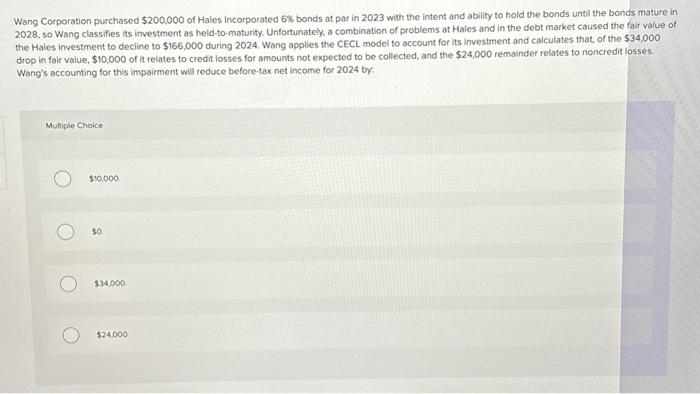

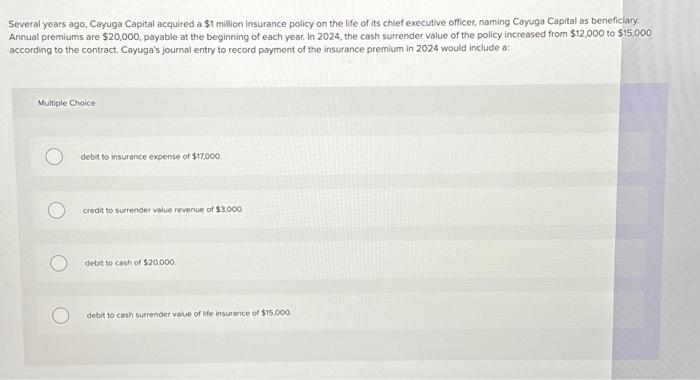

Hobson Company bought the securities listed below during 2023. These securities were classified as trading securities. In its December 31,2023 statement Hobson reported a net unrealized holding loss of $16,000 on these securities. Pertinent data at the end of June 2024 is as follows: What amount of unrealized holding loss on these securities should Hobson include in its income statement for the six months ended June 30,202 Multiple Choice $16,000 $76100 50 $60,100 Wang Corporation purchased $200,000 of Hales Incorporated 6% bonds at par in 2023 with the intent and ability to hold the bonds until the bonds mature in 2028 , so Wang classifies its investment as held-to-maturity. Unfortunately, a combination of problems at Hales and in the debt market caused the fair value of the Hales investment to decline to $166,000 during 2024. Wang applies the CECL model to account for its investment and calculates that, of the $34,000 drop in fair value, $10,000 of it relates to credit iosses for omounts not expected to be collected, and the $24,000 remainder relates to noncredit losses. Wang's accounting for this impairment will reduce before-tax net income for 2024 by: Mulliple Choice $10,000 50. $34,000 $24000. Several years ago, Cayuga Capital acquired a $1 million insurance policy on the life of its chlef executive officet, naming Cayuga Capital as beneficlary. Annual premiums are $20,000, payable at the beginning of each year. In 2024 , the cash surrender value of the policy increased from $12,000 to $15,000 according to the contract. Cayuga's journal entry to record payment of the insurance premium in 2024 would include a: Multiple Choice debit to insurance cxpense of $17,000. credit to surtender value revenue of $3,000 debin to cash of $20,000. debit to cath surrendet value of ife insurance of $15.000. On January 1, 2024, Nana Company paid $100,000 for 6,000 shares of Papa Company common stock. The ownership in Papa Company is 10\%. Nana Company does not have significant influence over Papa Company. Papa reported net income of $62,000 for the year endec December 31, 2024. The fair value of the Papa stock on that date was $49 per share. What amount will be reported in the balance sheet of Nana Company for the investment in Papa at December 3t, 2024? Multiple Choice $234,000 $219.000 $249000 $294,000

Hobson Company bought the securities listed below during 2023. These securities were classified as trading securities. In its December 31,2023 statement Hobson reported a net unrealized holding loss of $16,000 on these securities. Pertinent data at the end of June 2024 is as follows: What amount of unrealized holding loss on these securities should Hobson include in its income statement for the six months ended June 30,202 Multiple Choice $16,000 $76100 50 $60,100 Wang Corporation purchased $200,000 of Hales Incorporated 6% bonds at par in 2023 with the intent and ability to hold the bonds until the bonds mature in 2028 , so Wang classifies its investment as held-to-maturity. Unfortunately, a combination of problems at Hales and in the debt market caused the fair value of the Hales investment to decline to $166,000 during 2024. Wang applies the CECL model to account for its investment and calculates that, of the $34,000 drop in fair value, $10,000 of it relates to credit iosses for omounts not expected to be collected, and the $24,000 remainder relates to noncredit losses. Wang's accounting for this impairment will reduce before-tax net income for 2024 by: Mulliple Choice $10,000 50. $34,000 $24000. Several years ago, Cayuga Capital acquired a $1 million insurance policy on the life of its chlef executive officet, naming Cayuga Capital as beneficlary. Annual premiums are $20,000, payable at the beginning of each year. In 2024 , the cash surrender value of the policy increased from $12,000 to $15,000 according to the contract. Cayuga's journal entry to record payment of the insurance premium in 2024 would include a: Multiple Choice debit to insurance cxpense of $17,000. credit to surtender value revenue of $3,000 debin to cash of $20,000. debit to cath surrendet value of ife insurance of $15.000. On January 1, 2024, Nana Company paid $100,000 for 6,000 shares of Papa Company common stock. The ownership in Papa Company is 10\%. Nana Company does not have significant influence over Papa Company. Papa reported net income of $62,000 for the year endec December 31, 2024. The fair value of the Papa stock on that date was $49 per share. What amount will be reported in the balance sheet of Nana Company for the investment in Papa at December 3t, 2024? Multiple Choice $234,000 $219.000 $249000 $294,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started