Answered step by step

Verified Expert Solution

Question

1 Approved Answer

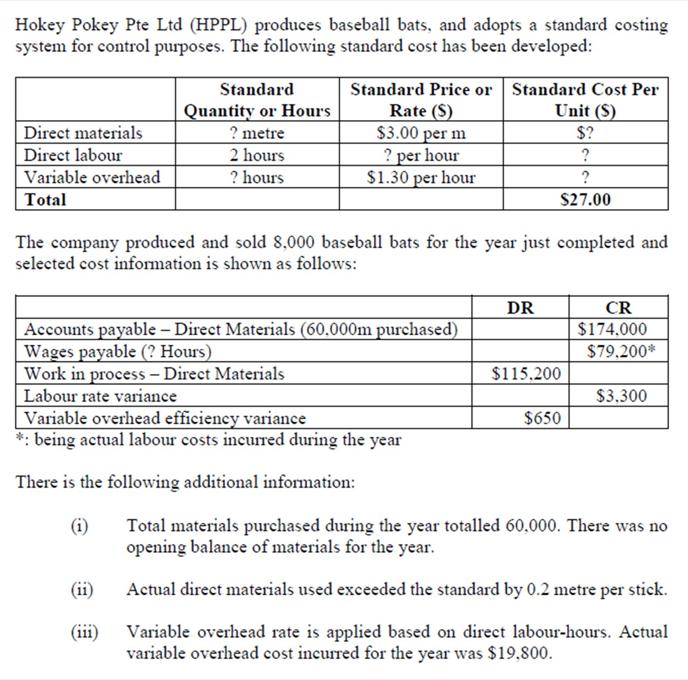

Hokey Pokey Pte Ltd (HPPL) produces baseball bats, and adopts a standard costing system for control purposes. The following standard cost has been developed:

Hokey Pokey Pte Ltd (HPPL) produces baseball bats, and adopts a standard costing system for control purposes. The following standard cost has been developed: Direct materials Direct labour Variable overhead Total Standard Quantity or Hours ? metre 2 hours ? hours Standard Price or Standard Cost Per Unit (S) Rate (S) $3.00 per m ? per hour $1.30 per hour Accounts payable - Direct Materials (60.000m purchased) Wages payable (? Hours) Work in process - Direct Materials Labour rate variance The company produced and sold 8.000 baseball bats for the year just completed and selected cost information is shown as follows: Variable overhead efficiency variance *: being actual labour costs incurred during the year There is the following additional information: (i) DR ? $27.00 $? ? $115.200 $650 CR $174.000 $79,200* $3.300 Total materials purchased during the year totalled 60,000. There was no opening balance of materials for the year. Actual direct materials used exceeded the standard by 0.2 metre per stick. (iii) Variable overhead rate is applied based on direct labour-hours. Actual variable overhead cost incurred for the year was $19.800. Required: (a) Compute ALL the possible variances for the year based on the information given. (b) Illustrate the journal entries to record ALL variances for materials, labour and variable overheads (narrations are not required). (c) State possible causes of each variance identified in part (b).

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Compute ALL the possible variances for the year based on the information given i Material Price Variance Standard price per meter Actual price per m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started