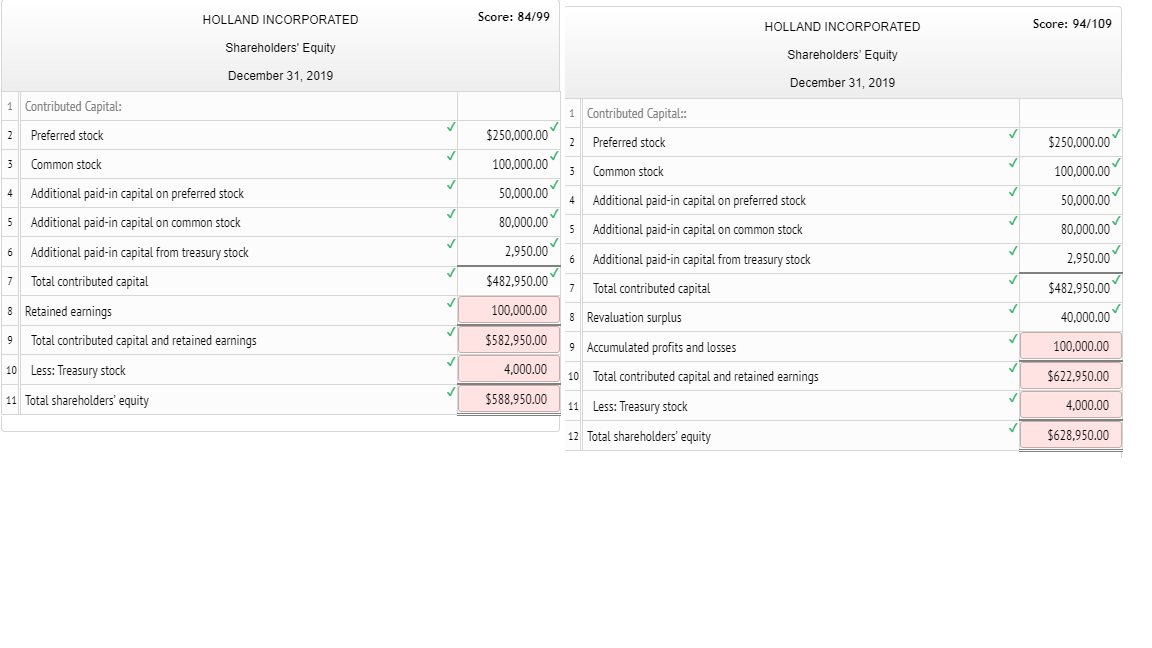

Holland Incorporated's records provide the following information on January 1, 2019: Preferred stock, $50 par (5,000 shares authorized, issued, and outstanding) $250,000 100,000 Common stock, $10 par (20,000 shares authorized, 10,000 shares issued and outstanding) Additional paid-in capital on preferred stock 50,000 Additional paid-in capital on common stock 80,000 Retained earnings 100,000 During 2019, the following transactions were recorded by Holland: 1. Reacquired 250 shares of preferred stock for $53 per share. 2. Reacquired 500 shares of common stock for $20 per share. 3. Sold 200 shares of the common stock acquired in Transaction 2 for $27 per share. 4. Sold 250 shares of preferred stock acquired in Transaction 1 for $60 per share. 5. Sold 100 shares of the common stock acquired in Transaction 2 for $18 per share. Required: 1. Prepare journal entries to record the stock transactions of Holland assuming it uses the cost method of accounting for treasury stock. 2. Prepare the shareholders' equity section of the Holland balance sheet at December 31, 2019, assuming 2019 net income was $30,000 and dividends distributed were $10,000. 3. Next Level Assume that Holland is using IFRS. At the end of 2019, Holland revalued its property, plant, and equipment upward by $40,000. Discuss how Holland's shareholders' equity items would be different under IFRS, and then, based on your answer, repeat Requirement 2. HOLLAND INCORPORATED Score: 84/99 HOLLAND INCORPORATED Score: 94/109 Shareholders' Equity Shareholders' Equity December 31, 2019 December 31, 2019 1 Contributed Capital: 2 Preferred stock 2 3 4 Common stock Additional paid-in capital on preferred stock $250,000.00 100,000.00 50,000.00 Contributed Capital: Preferred stock Common stock Additional paid-in capital on preferred stock Additional paid-in capital on common stock Additional paid-in capital from treasury stock Additional paid-in capital on common stock 80,000.00 2,950.00 $250.000.00 100.000.00 50,000.00 80.000.00 2.950.00 $482,950.00 40.000.00 Additional paid-in capital from treasury stock 6 7 Total contributed capital 5482,950.00 100,000.00 Total contributed capital 8 Revaluation surplus 8 Retained earnings 9 Total contributed capital and retained earnings $582.950.00 9 Accumulated profits and losses 100,000.00 4,000.00 10 Total contributed capital and retained earnings $622,950.00 10 Less: Treasury stock 11 Total shareholders' equity $588,950.00 11 Less: Treasury stock 4,000.00 12 Total shareholders' equity $628,950.00