Answered step by step

Verified Expert Solution

Question

1 Approved Answer

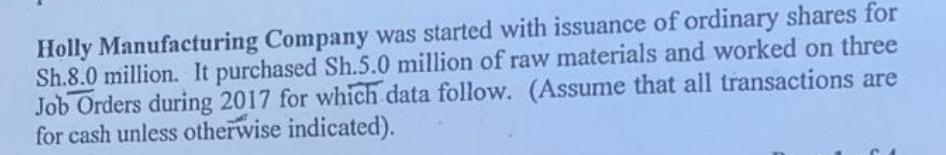

Holly Manufacturing Company was started with issuance of ordinary shares for Sh.8.0 million. It purchased Sh.5.0 million of raw materials and worked on three

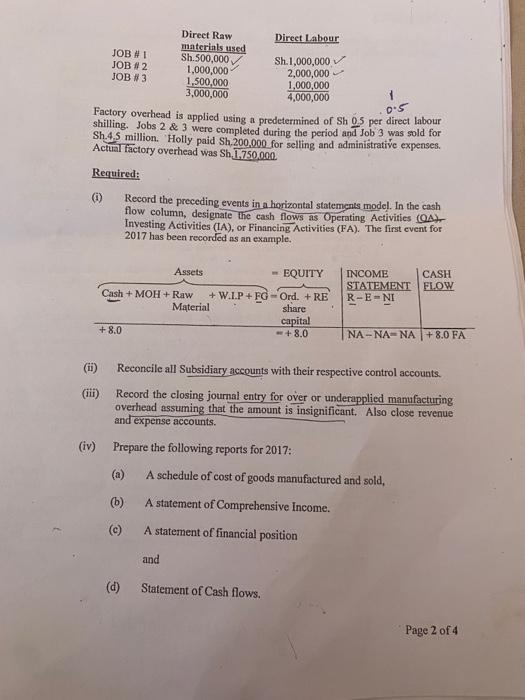

Holly Manufacturing Company was started with issuance of ordinary shares for Sh.8.0 million. It purchased Sh.5.0 million of raw materials and worked on three Job Orders during 2017 for which data follow. (Assume that all transactions are for cash unless otherwise indicated). (i) JOB #1 JOB #2 JOB #3 (ii) (iii) (iv) 0.5 Factory overhead is applied using a predetermined of Sh 0.5 per direct labour shilling. Jobs 2 & 3 were completed during the period and Job 3 was sold for Sh.4,5 million. Holly paid Sh 200,000 for selling and administrative expenses. Actual factory overhead was Sh.1,750,000 Required: +8.0 (b) Direct Raw materials used Sh.500,000. 1,000,000 - 1,500,000 3,000,000 - EQUITY Cash + MOH+ Raw +W.LP+ FG -Ord. + RE Material share capital +8.0 (d) Direct Labour Record the preceding events in a horizontal statements model. In the cash flow column, designate the cash flows as Operating Activities (QA) Investing Activities (IA), or Financing Activities (FA). The first event for 2017 has been recorded as an example. Assets Sh.1,000,000 2,000,000 1,000,000 4,000,000 and Reconcile all Subsidiary accounts with their respective control accounts. Record the closing journal entry for over or underapplied manufacturing overhead assuming that the amount is insignificant. Also close revenue and expense accounts. Prepare the following reports for 2017: Statement of Cash flows. INCOME CASH STATEMENT FLOW R-E-NI NA-NA-NA +8.0 FA A schedule of cost of goods manufactured and sold, A statement of Comprehensive Income. A statement of financial position Page 2 of 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started