Answered step by step

Verified Expert Solution

Question

1 Approved Answer

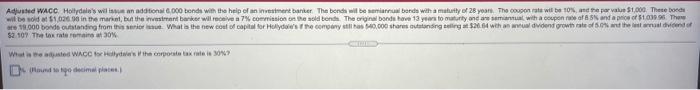

Hollydale's will issue an additional 6,000 bomds with the help of an investment banker. The homds will be semianuual bonds with a maturity of 28

Hollydale's will issue an additional 6,000 bomds with the help of an investment banker. The homds will be semianuual bonds with a maturity of 28 years. The coupon code rate will be 10%, and the par value $1,000. These bonds will be sold at $1,026.98 in the market, but the investment banker will receive a 7% commission on thr sold bonds. The original bonds have 13 years to maturity and are semiannual, with a coupon rate of 8.5% and a price of $1,039.96. There are 19,000 bonds outstanding crom this senior issue. What is the new cost of capital for Hollydale's if the company still has 540,000 shares outstanding selling at $26.64 with an annual dividend growth rate of 5.0% and the last annual dividend of $2.10? The tax rate remains at 30%.

A WACC www.debeant Theoben we een here.000 willet 20. no more than one comment on the world 10.000Mom Tissen Wat een coal to the cowy 40.000 de groter at dhe $2.107 The aromas What is adjusts WACC Sales comptes 304 Round to be decimal places Adjunte WACC Hotel's wil is an additions 6.000 bonds with the help of an investment banker The bonds will be in bords with a matuity of 28 years. The coupon rate will be 10% per value $1.000. These boede will be sold at $1,020 in the market, but the investmentbarke will receive a commission on the sold on the original bands have 13 years to turty and area with a coupons and post 51.030.06. There 18,000 borde outstanding from it. What is the new cost of capital for Hollydoles The company has 0.000 shares outstanding 20. wth an oldvidend growth rate of the talento 52.109 The tax ratom 30% Wat e WACC Wor's the corporate taxi Dopo decimal plane What is the adjusted WACC for Hollydale's if the corporate tax rate is 30%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started