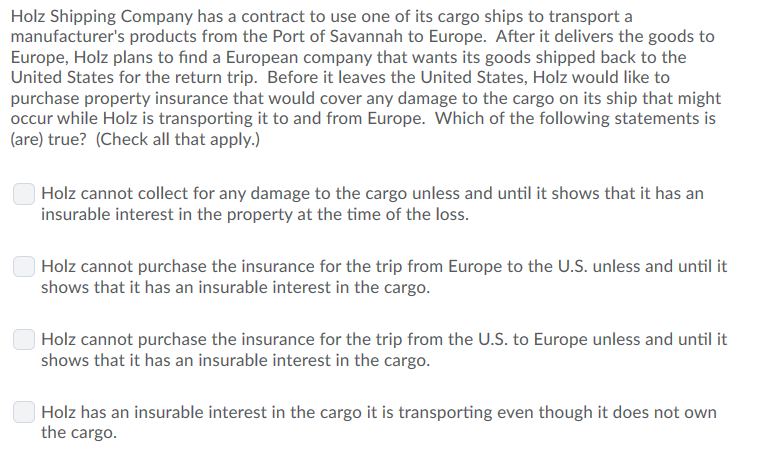

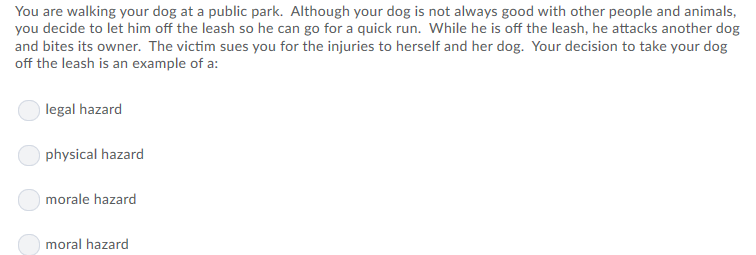

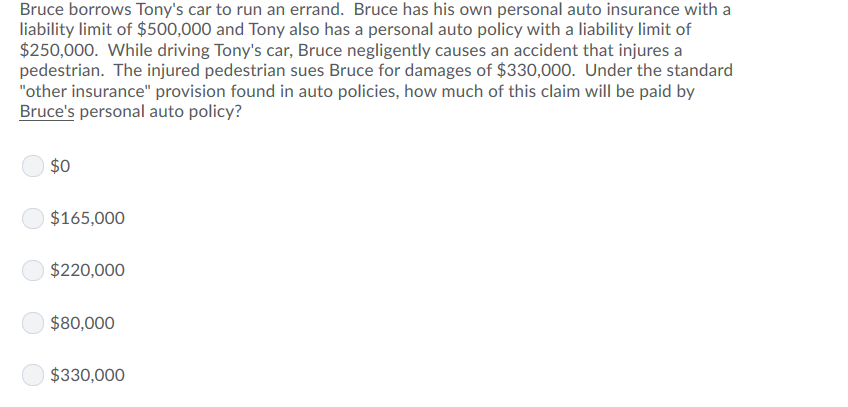

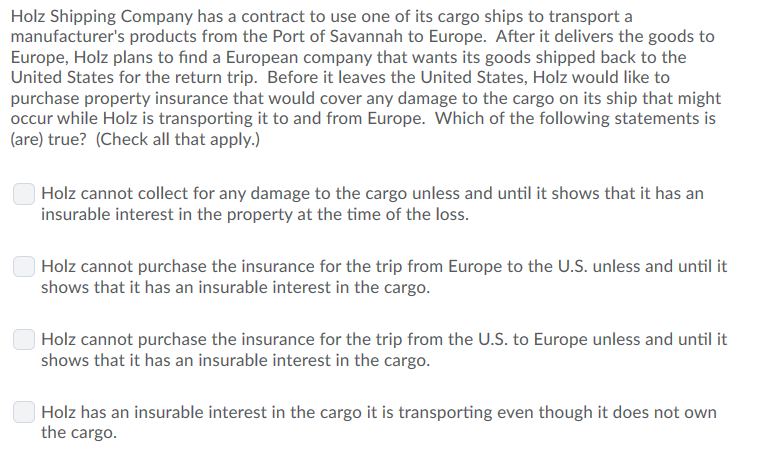

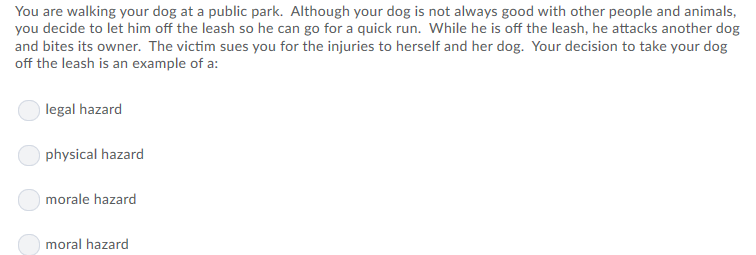

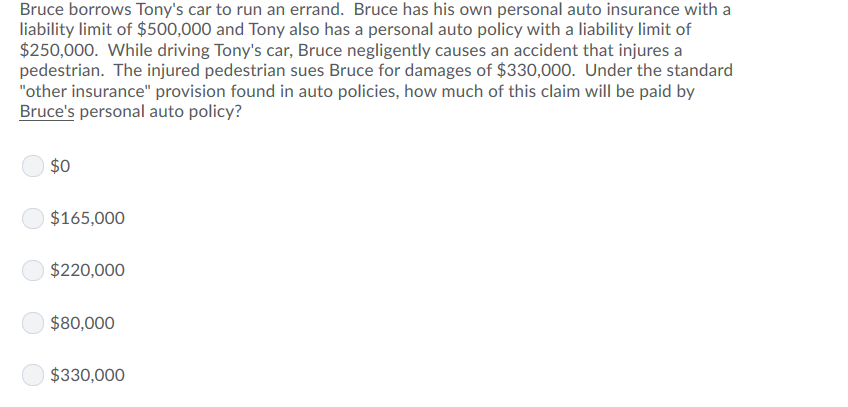

Holz Shipping Company has a contract to use one of its cargo ships to transport a manufacturer's products from the Port of Savannah to Europe. After it delivers the goods to Europe, Holz plans to find a European company that wants its goods shipped back to the United States for the return trip. Before it leaves the United States, Holz would like to purchase property insurance that would cover any damage to the cargo on its ship that might occur while Holz is transporting it to and from Europe. Which of the following statements is (are) true? (Check all that apply.) Holz cannot collect for any damage to the cargo unless and until it shows that it has an insurable interest in the property at the time of the loss. Holz cannot purchase the insurance for the trip from Europe to the U.S. unless and until it shows that it has an insurable interest in the cargo. Holz cannot purchase the insurance for the trip from the U.S. to Europe unless and until it shows that it has an insurable interest in the cargo. Holz has an insurable interest in the cargo it is transporting even though it does not own the cargo. You are walking your dog at a public park. Although your dog is not always good with other people and animals, you decide to let him off the leash so he can go for a quick run. While he is off the leash, he attacks another dog and bites its owner. The victim sues you for the injuries to herself and her dog. Your decision to take your dog off the leash is an example of a: legal hazard physical hazard morale hazard moral hazard Bruce borrows Tony's car to run an errand. Bruce has his own personal auto insurance with a liability limit of $500,000 and Tony also has a personal auto policy with a liability limit of $250,000. While driving Tony's car, Bruce negligently causes an accident that injures a pedestrian. The injured pedestrian sues Bruce for damages of $330,000. Under the standard "other insurance" provision found in auto policies, how much of this claim will be paid by Bruce's personal auto policy? $0 $165,000 $220,000 $80,000 O$330,000 Holz Shipping Company has a contract to use one of its cargo ships to transport a manufacturer's products from the Port of Savannah to Europe. After it delivers the goods to Europe, Holz plans to find a European company that wants its goods shipped back to the United States for the return trip. Before it leaves the United States, Holz would like to purchase property insurance that would cover any damage to the cargo on its ship that might occur while Holz is transporting it to and from Europe. Which of the following statements is (are) true? (Check all that apply.) Holz cannot collect for any damage to the cargo unless and until it shows that it has an insurable interest in the property at the time of the loss. Holz cannot purchase the insurance for the trip from Europe to the U.S. unless and until it shows that it has an insurable interest in the cargo. Holz cannot purchase the insurance for the trip from the U.S. to Europe unless and until it shows that it has an insurable interest in the cargo. Holz has an insurable interest in the cargo it is transporting even though it does not own the cargo. You are walking your dog at a public park. Although your dog is not always good with other people and animals, you decide to let him off the leash so he can go for a quick run. While he is off the leash, he attacks another dog and bites its owner. The victim sues you for the injuries to herself and her dog. Your decision to take your dog off the leash is an example of a: legal hazard physical hazard morale hazard moral hazard Bruce borrows Tony's car to run an errand. Bruce has his own personal auto insurance with a liability limit of $500,000 and Tony also has a personal auto policy with a liability limit of $250,000. While driving Tony's car, Bruce negligently causes an accident that injures a pedestrian. The injured pedestrian sues Bruce for damages of $330,000. Under the standard "other insurance" provision found in auto policies, how much of this claim will be paid by Bruce's personal auto policy? $0 $165,000 $220,000 $80,000 O$330,000