Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Home AutoSave 0 1 D Q51 3 Default A Keep B Insert A Exit X C Draw fx C New Options D Formulas Page Layout

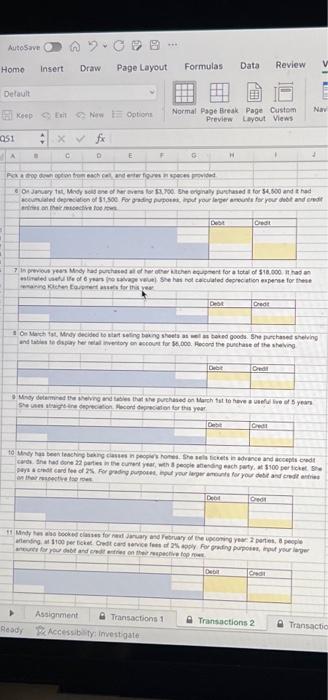

Home AutoSave 0 1 D Q51 3 Default A Keep B Insert A Exit X C Draw fx C New Options D Formulas Page Layout E F Normal Page Break Page Custom Preview Layout Views G Debit Assignment Ready Accessibility: Investigate Pick a drop down option from each cell, and enter figures in spaces provided. 6 On January 1st, Mindy sold one of her ovens for $3,700. She originally purchased it for $4,500 and it had accumulated depreciation of $1,500. For grading purposes, input your larger amounts for your debit and credit entries on their respective top rows. Debit Transactions 1 7 In previous years Mindy had purchased all of her other kitchen equipment for a total of $18,000. It had an estimated useful life of 6 years (no salvage value). She has not calculated depreciation expense for these remaining Kitchen Equipment assets for this year. Debit Data Review V H Debit 8 On March 1st, Mindy decided to start selling baking sheets as well as baked goods. She purchased shelving and tables to display her retail inventory on account for $6,000. Record the purchase of the shelving. Debit Credit Credit 9 Mindy determined the shelving and tables that she purchased on March 1st to have a useful live of 5 years. She uses straight-line depreciation. Record depreciation for this year. Debit Credit 10 Mindy has been teaching baking classes in people's homes. She sells tickets in advance and accepts credit cards. She had done 22 parties in the current year, with 8 people attending each party, at $100 per ticket. She pays a credit card fee of 2%. For grading purposes, input your larger amounts for your debit and credit entries on their respective top rows. Credit 11 Mindy has also booked classes for next January and February of the upcoming year: 2 parties, 8 people attending, at $100 per ticket. Credit card service fees of 2% apply. For grading purposes, input your larger amounts for your debit and credit entries on their respective top rows. Navi J Credit Credit Transactions 2 Transactio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started