Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Home Away From Home Ltd (HAFH) is an entity that specialises in investing in student residential complexes and then leases the units within the

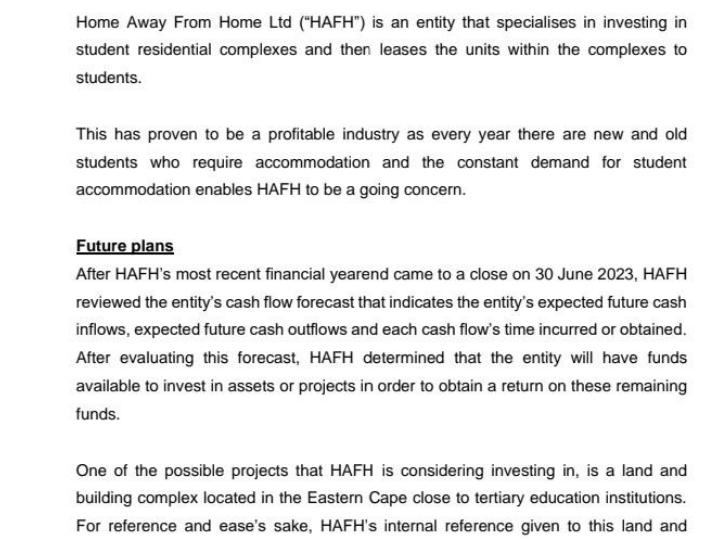

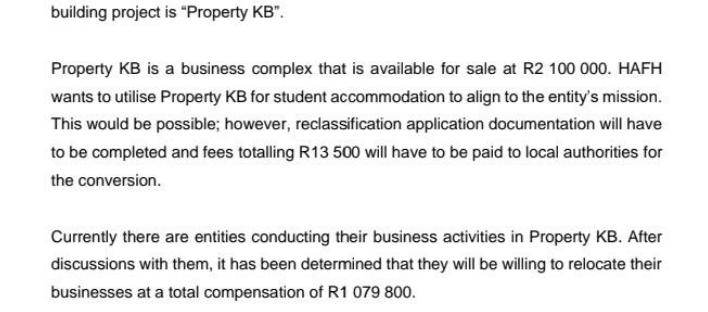

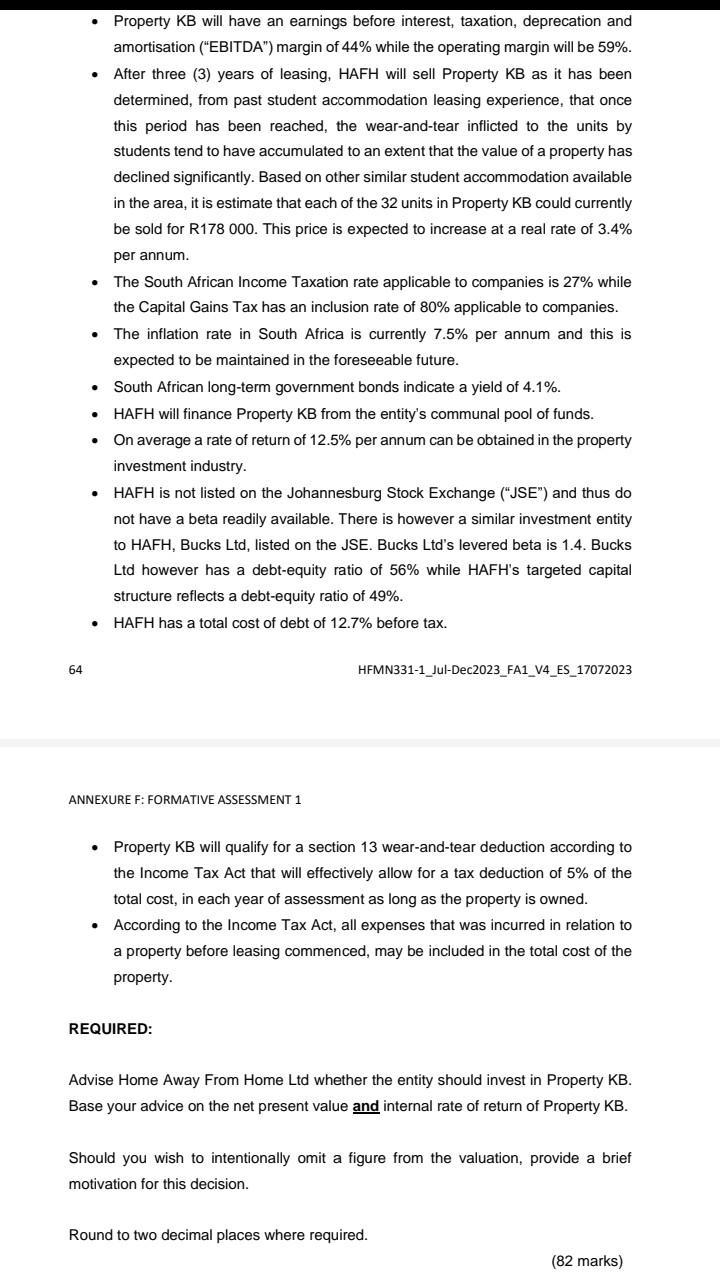

Home Away From Home Ltd ("HAFH") is an entity that specialises in investing in student residential complexes and then leases the units within the complexes to students. This has proven to be a profitable industry as every year there are new and old students who require accommodation and the constant demand for student accommodation enables HAFH to be a going concern. Future plans After HAFH's most recent financial yearend came to a close on 30 June 2023, HAFH reviewed the entity's cash flow forecast that indicates the entity's expected future cash inflows, expected future cash outflows and each cash flow's time incurred or obtained. After evaluating this forecast, HAFH determined that the entity will have funds available to invest in assets or projects in order to obtain a return on these remaining funds. One of the possible projects that HAFH is considering investing in, is a land and building complex located in the Eastern Cape close to tertiary education institutions. For reference and ease's sake, HAFH's internal reference given to this land and building project is "Property KB". Property KB is a business complex that is available for sale at R2 100 000. HAFH wants to utilise Property KB for student accommodation to align to the entity's mission. This would be possible; however, reclassification application documentation will have to be completed and fees totalling R13 500 will have to be paid to local authorities for the conversion. Currently there are entities conducting their business activities in Property KB. After discussions with them, it has been determined that they will be willing to relocate their businesses at a total compensation of R1 079 800. HAFH will then be able to start with the necessary adjustments to the current building of Property KB in order for it to be better suited for student accommodation. An architect has already been advised and provided HAFH with drafts for which HAFH paid the architect R65 700. According to the drafts, Property KB's building will have 32 student units. An estimation has been made of the annual rent received from students as well as the capacity: Annual rent per Estimated units that will be rent at Probability unit in year 1 this price R96 000 R67 200 R56 400 The annual rent per unit is payable at the beginning of each year and will escalate with 8% per annum to compensate for inflation. It is not deemed that the escalation will lead to a change in the probability distribution. 87.50% 93.75% 100% A construction entity that will conduct the earthworks, infrastructure development and construction of the residential units has been sourced. The contractor has indicated that the necessary construction will require two years to complete. To fund the construction activities, the contractor will require the total contracted fee to be paid in the following portions: 30% up front to initiate the construction activities; 25% after one year; 15% at the start of the second year and the remaining balance when the development is completed. The construction entity's quotation indicates a total development contract fee (in nominal terms) of R3 669 000. . 63 . 10% 65% 25% Additional notes: While the construction activities are conducted on Property KB, HAFH will erect an advertising board on the site of the property for the purpose of renting the space on the advertising board to external parties. This will allow for by-passers ANNEXURE F: FORMATIVE ASSESSMENT 1 HFMN331-1_Jul-Dec2023_FA1_V4_ES_17072023 to view the relevant advertisement. The cost to HAFH to erect such an advertising board is neglectable small. Once the construction on Property KB is completed, the advertising board will be removed, and the advertising will cease. Style (Pty) Ltd. ("Style") is a home dcor and utilities' wholesaler. Style is interested in the advertising board opportunity as it deems that this will 64 . . . . South African long-term government bonds indicate a yield of 4.1%. HAFH will finance Property KB from the entity's communal pool of funds. On average a rate of return of 12.5% per annum can be obtained in the property investment industry. HAFH is not listed on the Johannesburg Stock Exchange ("JSE") and thus do not have a beta readily available. There is however a similar investment entity to HAFH, Bucks Ltd, listed on the JSE. Bucks Ltd's levered beta is 1.4. Bucks Ltd however has a debt-equity ratio of 56% while HAFH's targeted capital structure reflects a debt-equity ratio of 49%. HAFH has a total cost of debt of 12.7% before tax. . . . Property KB will have an earnings before interest, taxation, deprecation and amortisation ("EBITDA") margin of 44% while the operating margin will be 59%. After three (3) years of leasing, HAFH will sell Property KB as it has been determined, from past student accommodation leasing experience, that once this period has been reached, the wear-and-tear inflicted to the units by students tend to have accumulated to an extent that the value of a property has declined significantly. Based on other similar student accommodation available in the area, it is estimate that each of the 32 units in Property KB could currently be sold for R178 000. This price is expected to increase at a real rate of 3.4% per annum. The South African Income Taxation rate applicable to companies is 27% while the Capital Gains Tax has an inclusion rate of 80% applicable to companies. The inflation rate in South Africa is currently 7.5% per annum and this is expected to be maintained in the foreseeable future. ANNEXURE F: FORMATIVE ASSESSMENT 1 . Property KB will qualify for a section 13 wear-and-tear deduction according to the Income Tax Act that will effectively allow for a tax deduction of 5% of the total cost, in each year of assessment as long as the property is owned. According to the Income Tax Act, all expenses that was incurred in relation to a property before leasing commenced, may be included in the total cost of the property. HFMN331-1 Jul-Dec2023_FA1_V4_ES_17072023 REQUIRED: Advise Home Away From Home Ltd whether the entity should invest in Property KB. Base your advice on the net present value and internal rate of return of Property KB. Should you wish to intentionally omit a figure from the valuation, provide a brief motivation for this decision. Round to two decimal places where required. (82 marks)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Home Away From Home Ltd Based on the information provided I would advise HAFH to invest in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started