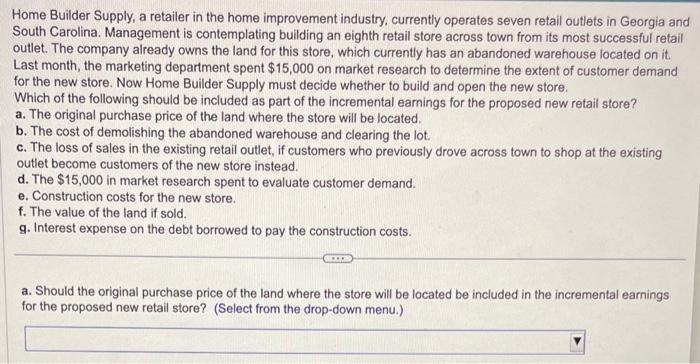

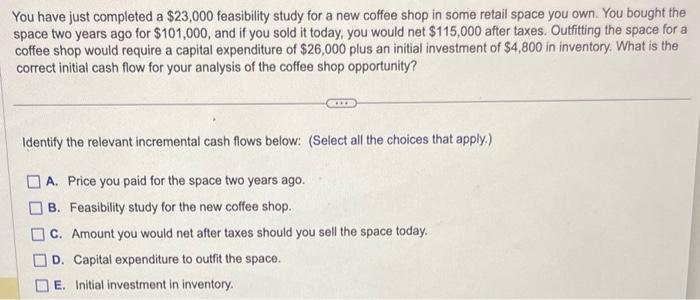

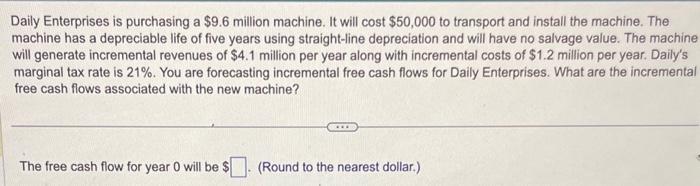

Home Builder Supply, a retailer in the home improvement industry, currently operates seven retail outlets in Georgia and South Carolina. Management is contemplating building an eighth retail store across town from its most successful retail outlet. The company already owns the land for this store, which currently has an abandoned warehouse located on it. Last month, the marketing department spent $15,000 on market research to determine the extent of customer demand for the new store. Now Home Builder Supply must decide whether to build and open the new store. Which of the following should be included as part of the incremental earnings for the proposed new retail store? a. The original purchase price of the land where the store will be located. b. The cost of demolishing the abandoned warehouse and clearing the lot. c. The loss of sales in the existing retail outlet, if customers who previously drove across town to shop at the existing outlet become customers of the new store instead. d. The $15,000 in market research spent to evaluate customer demand. e. Construction costs for the new store. f. The value of the land if sold. g. Interest expense on the debt borrowed to pay the construction costs. a. Should the original purchase price of the land where the store will be located be included in the incremental earnings for the proposed new retail store? (Select from the drop-down menu.) You have just completed a $23,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $101,000, and if you sold it today, you would net $115,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $26,000 plus an initial investment of $4,800 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) A. Price you paid for the space two years ago. B. Feasibility study for the new coffee shop. C. Amount you would net after taxes should you sell the space today. D. Capital expenditure to outfit the space. E. Initial investment in inventory. Daily Enterprises is purchasing a $9.6 million machine. It will cost $50,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.1 million per year along with incremental costs of $1.2 million per year. Daily's marginal tax rate is 21%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? The free cash flow for year 0 will be $. (Round to the nearest dollar.)