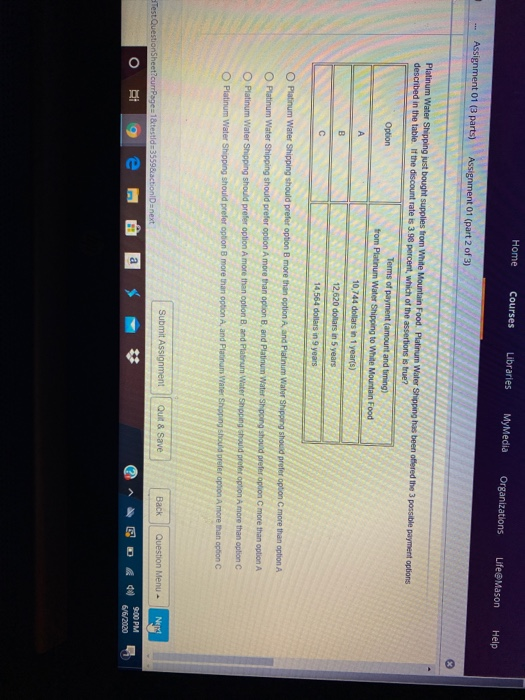

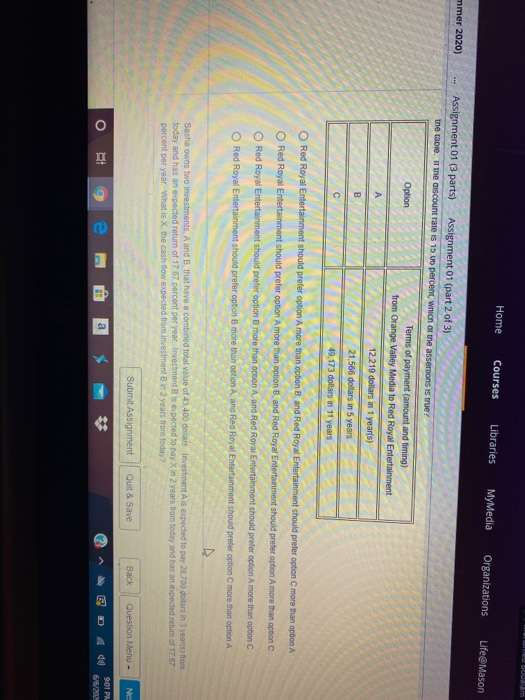

Home Courses Libraries MyMedia Organizations Life Mason Help Assignment 01 (3 parts) Assignment 01 (part 2 of 3) Platinum Water Shipping just bought supplies from White Mountain Food Platinum Water Shipping has been offered the 3 possible payment options described in the table. If the discount rate is 3.98 percent, which of the assertions is true? Terms of payment amount and timing) Option from Platinum Water Shipping to White Mountain Food 10.744 dollars in 1 year(s) B 12,620 dollars in 5 years C 14 564 dollars in 9 years O Platinum Water Shipping should prefer option B more than option A and Platinum Water Shipping should prefer option C more than option A O Platinum Water Shipping should prefer option Amore than option B. and Platinum Water Shpoing should prefer option C more than option A O Platinum Water Shipping should prefer option Amore than option B. and Planum Water Shoping should prefer option A more than option C Platinum Water Shipping should prefer option B more than option A and Platinum Water Shipping should prefer ophon Amore than option Submit Assignment Quit & Save Test.Question Sheet?currPage=1&testid=3559&actionDanext Back Question Menu NE ED a ? 9:00 PM 6/6/2020 JUMU DU. Home Courses Libraries MyMedia Organizations Ufe@Mason mmer 2020) Assignment 01 (3 parts) Assignment 01 (part 2 of 3) the table. If the discount rate is 15 UD percent, which of the asserons is true? Option Terms of payment amount and timing) from Orange Valley Media to Red Royal Entertainment 12,219 dollars in 1 year(s) A B 21,566 dollars in 5 years c 49,173 dollars in 11 years O Red Royal Entertainment should prefer option Amore than option B. and Red Royal Entertainment should prefer option C more than option A Red Royal Entertainment should prefer option Amore than option B, and Red Royal Entertainment should prefer option A more than option C Red Royal Entertainment should prefer option B more than option A and Red Royal Entertainment should prefer option A more than option C O Red Royal Entertainment should prefer option B more than option A and Red Royal Entertainment shoul refer option C more than option A Sasha owns two investments A and B that have a combined total value of 43,400 dollars. Investment is expected to pay 28.700 dollars in 3 years) from today and has an expected return of 17.67 percent per year. Investment B is expected to pay X in 2 years from today and has an expected return of 17.57 percent per year. What is the cash flow expected from investment B in 2 years from today? Submit Assignment Quit & Save Back Question Menu Ne O DI E a 9:01 PM 6/6/202 Home Courses Libraries MyMedia Organizations Life Mason Help Assignment 01 (3 parts) Assignment 01 (part 2 of 3) Platinum Water Shipping just bought supplies from White Mountain Food Platinum Water Shipping has been offered the 3 possible payment options described in the table. If the discount rate is 3.98 percent, which of the assertions is true? Terms of payment amount and timing) Option from Platinum Water Shipping to White Mountain Food 10.744 dollars in 1 year(s) B 12,620 dollars in 5 years C 14 564 dollars in 9 years O Platinum Water Shipping should prefer option B more than option A and Platinum Water Shipping should prefer option C more than option A O Platinum Water Shipping should prefer option Amore than option B. and Platinum Water Shpoing should prefer option C more than option A O Platinum Water Shipping should prefer option Amore than option B. and Planum Water Shoping should prefer option A more than option C Platinum Water Shipping should prefer option B more than option A and Platinum Water Shipping should prefer ophon Amore than option Submit Assignment Quit & Save Test.Question Sheet?currPage=1&testid=3559&actionDanext Back Question Menu NE ED a ? 9:00 PM 6/6/2020 JUMU DU. Home Courses Libraries MyMedia Organizations Ufe@Mason mmer 2020) Assignment 01 (3 parts) Assignment 01 (part 2 of 3) the table. If the discount rate is 15 UD percent, which of the asserons is true? Option Terms of payment amount and timing) from Orange Valley Media to Red Royal Entertainment 12,219 dollars in 1 year(s) A B 21,566 dollars in 5 years c 49,173 dollars in 11 years O Red Royal Entertainment should prefer option Amore than option B. and Red Royal Entertainment should prefer option C more than option A Red Royal Entertainment should prefer option Amore than option B, and Red Royal Entertainment should prefer option A more than option C Red Royal Entertainment should prefer option B more than option A and Red Royal Entertainment should prefer option A more than option C O Red Royal Entertainment should prefer option B more than option A and Red Royal Entertainment shoul refer option C more than option A Sasha owns two investments A and B that have a combined total value of 43,400 dollars. Investment is expected to pay 28.700 dollars in 3 years) from today and has an expected return of 17.67 percent per year. Investment B is expected to pay X in 2 years from today and has an expected return of 17.57 percent per year. What is the cash flow expected from investment B in 2 years from today? Submit Assignment Quit & Save Back Question Menu Ne O DI E a 9:01 PM 6/6/202