Home Depot and Lowes have both experienced very large increases in earnings in the last year due to the desire of people to improve homes where they are spending more time (and due to the inability to spend money elsewhere).

Both of these firms are truly Home improvement firms. As mentioned in class, Menards is the closest thing to them.

In the past 52 weeks, the percentage debt financing (wD based on market value) for Home Depot and Lowes have averaged the following:

Home Depot: 11% average debt /(debt + equity)

Lowes: 16.5% average debt /(debt + equity)

Below is the S&P bond rating and yield to maturity (YTM) on 10 year bonds (and for US treasury 10 year note as of June 7)

US Treasury 10-year note: 1.62%

Home Depot A rated: 1.99%

Lowes BBB rated: 2.39%

S&P bond ratings for 10 year bonds for made whole call bonds have the following approximate YTM:

A+ YTM = 1.95%

A YTM = 1.99%

A- YTM = 2.08%

BBB+ YTM = 2.22%

BBB YTM = 2.39%

BBB- YTM = 2.69%

There is an ETF (exchange traded fund) for Investment grade bonds with ticker symbol LQD.

The bonds in the ETF have an estimated average 10-year bond maturity and a median bond rating of A-

A regression of the return on the ETF weekly returns against the return to the S&P 500 suggests a bond beta for the ETF of about 0.08.

The ten year treasury ETF had a beta of essentially zero, consistent with using the ten year treasury note as a risk free asset with a YTM that reflects longer dated interest rates (not just todays extraordinarily low rates). The regression results for the beta on Home Depot and Lowes stock are below:

Regression result for estimate of Home Depot Beta: 0.92

Regression result for estimate of Lowes Beta: 1.10

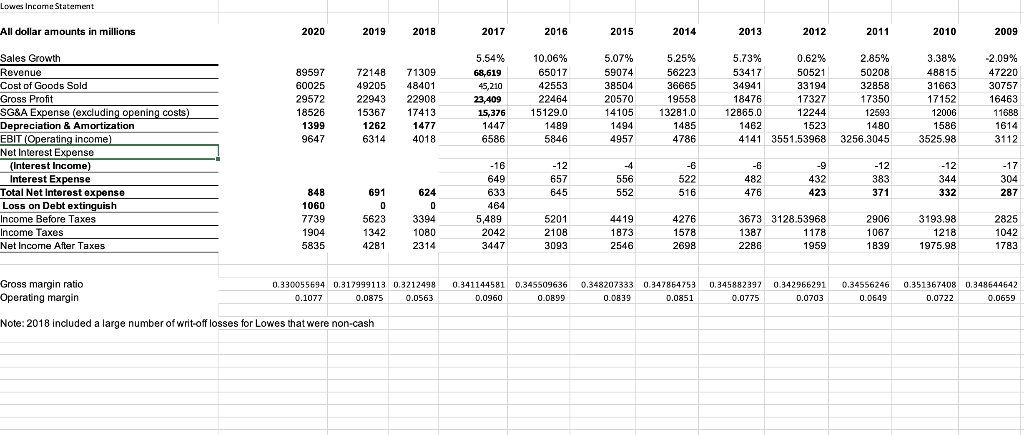

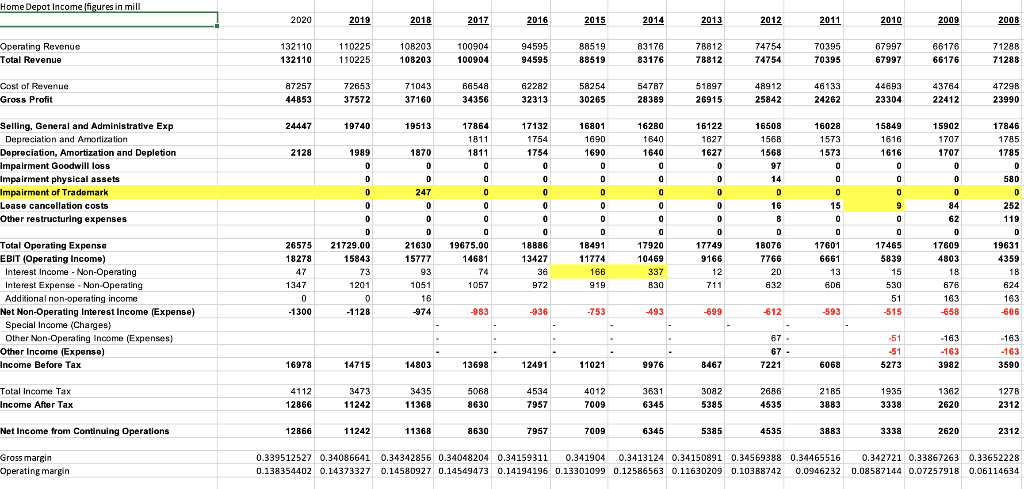

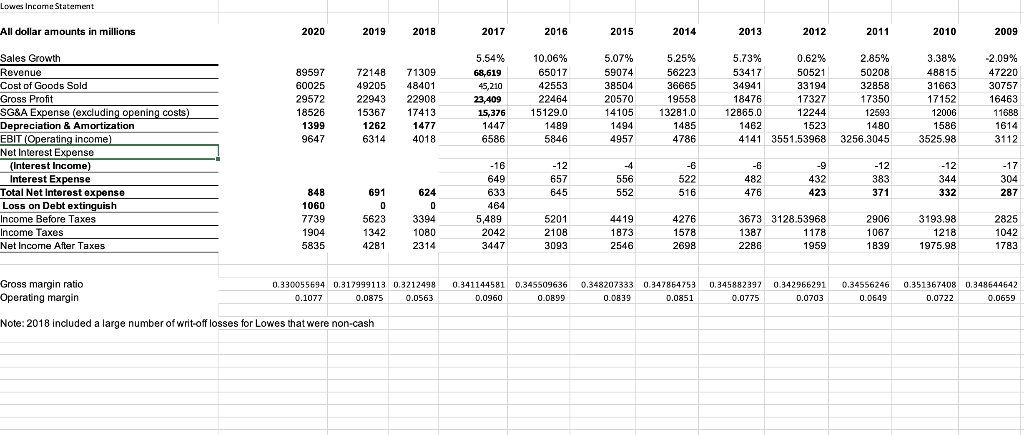

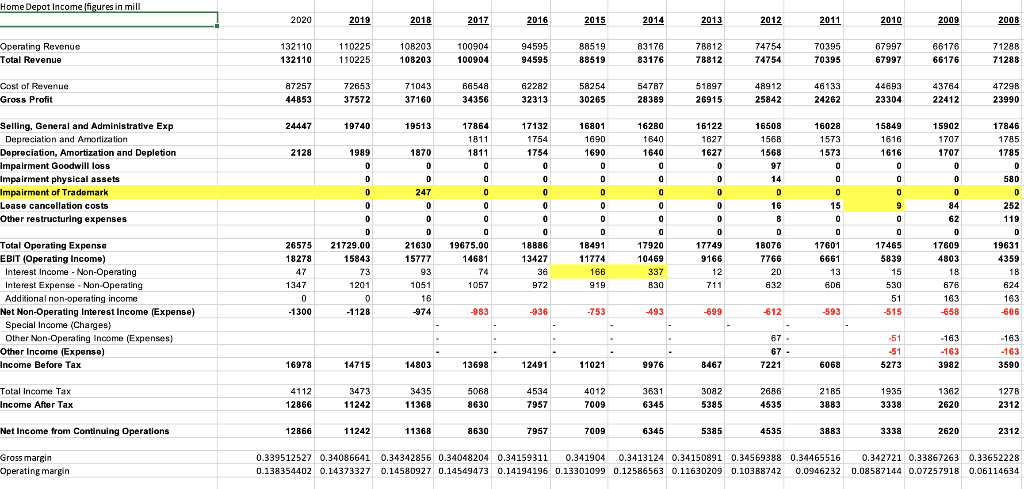

I have included some profitability figures (income statements) going back to 2007 for both firms in the file HDLOWProfitdata.xlsx. The firms are, of course, similar. Home Depot also has higher operating margins that seem related to lower fixed costs per dollar of sales. Hence, Lowes has greater operating leverage. 2008 and 2009 were the toughest years for both firms given the housing recession at that time. Lowes is also smaller.

While we often use levering and unlevering equations that assume debt betas = 0, this may not be the case. It tends to work better for explaining the logic of the levering and unlevering and showing the symmetry with APV. A reasonable guess for Lowes debt beta might be 0.12 and for Home Depot debt beta = .04. These, are of course guesses but roughly consistent with the beta on the investment grade bond ETF. For the purposes of this question assume the betas presented are best available. One could argue for incorporating other periods, but these are the most recent numbers and exclude the TOTALLY odd stock market activity in March and April of 2020.

- What is a reasonable estimate of the unlevered beta of each firm assuming both are targeting a percentage of debt financing stated above (Lowes: 16.5% and HD: 11%) and using our educated guesses about debt betas for each firm.

- Menards is a competitor in this space, but a private firm. It has about 350 stores, so it is smaller than Lowes which is smaller than Home Depot. Allegedly, Menards has historically lower margins than both firms and hence higher fixed costs as a percentage of sales. Without additional information what might be a reasonable estimate, (or lower bound), or range of estimates for Menards unlevered beta?

- Consider Home Depot. Assume it has the following forecasts for FCF

2021 2022 2023

FCF 17.5 bill 16 bill 15.1 bill

These forecasts reflect the still strong boom in home improvement that is expected to recede a bit, biut not too much with economic strength in 2022. Further erosion occurs in 2023 as the environment normalizes. Assume from that date forward the FCF grows at 2.3%.

Value of firm = FCF2021 / (1+WACC) + FCF2022 /(1+WACC)2 + [ FCF2023 /(WACC - .023) ] /(1+WACC)2

Following Mckinsey and Co, assume the required return on equity = 1.6% + beta x 5%

Using the unlevered beta for Home Depot what would your estimate of the value of the unlevered Home Depot, Vu?

- Increasing the % debt financing to 11%, the actual debt level, what is your estimate of the value of the levered firm? Use the YTM on the HD 10 year bond issue as your rD (Show the WACC estimate). Assume the tax rate is 26%. Note that one doesnt have to do any levering or unlevering. Just use the data given for Home Depots beta and YTM of debt.

- A) Upon examining HD profits, do you think there is much of a chance that they have to worry about hitting the 30% of EBIT limitation on interest deductions? Briefly explain.

- A firm of Home Depots scale is VERY large. It may have bankruptcy costs, if such an event occurred, of about $1 billion (and that is likely very high). Economies of scale in bankruptcy costs keep the number lower than usual as a % of assets. With A rated debt, the odds of default are likely about 0.5%. Also, the firm has few business relationship issues as a retailer. Given that and your answer in 5. A) does it look like Home Depot is trading off financial distress costs with the benefits of debt financing in a meaningful way or does more debt seem value maximizing?

- If HD took their debt level to 17% target debt financing and could borrow at the Lowes YTM of 2.39% and have a debt beta = 0.12, what would be the new WACC and new value of the levered firm (ignoring distress costs which are likely really low).

REMEMBER to include the beta of debt in your adjustment for levering HD beta at wD=17%

Lowes Incarne Statement All dollar amounts in millions 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 89597 60025 29572 18526 1399 9647 72148 49205 22943 15367 1262 6314 71309 48401 22908 17413 1477 4018 5.54% 68,619 45,210 23,409 15,376 1447 6586 10.06% 65017 42553 22464 15129.0 1489 5846 5.07% 59074 38504 20570 14105 1494 4957 5.25% 56223 36665 19558 13281.0 1485 4786 5.73% 0.62% 53417 50521 34941 33194 18476 17327 12865.0 12244 1462 1523 4141 3551.53968 2.85% 50208 32858 17350 12593 1480 3256.3045 3.38% 48815 31663 17152 12006 1586 3525.98 -2.09% 47220 30757 16463 11688 1614 3112 Sales Growth Revenue Cost of Goods Sold Gross Profit SG&A Expense (excluding opening costs) Depreciation & Amortization EBIT (Operating income) Net Interest Expense (Interest Income) Interest Expense Total Net Interest expense Loss on Debt extinguish Income Before Taxes Income Taxes Net Income After Taxes -12 657 645 -4 556 552 -6 522 516 -6 482 476 -9 432 423 -12 383 371 -12 344 332 -17 304 287 848 1060 7739 1904 5835 691 0 5623 1342 4281 624 0 3394 1080 2314 -16 649 633 464 5,489 2042 3447 5201 2108 3093 4419 1873 2546 4276 1578 2698 3673 3128.53968 1387 1178 2286 1959 2906 1067 1839 3193.98 1218 1975.98 2825 1042 1783 Gross margin ratio Operating margin 0.330055694 0.317999113 0.3212498 0.1077 0.0875 0.0563 0.341144581 0.0960 0.345509636 0.0899 0.348207333 0.347864753 0.0839 0.0851 0.345882392 0.0775 0.342966291 0.0703 0.34556246 0.0649 0.351367408 0.348644642 0.0722 0.0659 Note: 2018 included a large number of writ-off losses for Lowes that were non-cash Home Depot Income figures in mill 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 Operating Revenue Total Revenue 132110 132110 110225 110225 108203 108203 100904 100904 94595 94595 86519 88519 83176 83176 78812 78812 74754 74754 70395 70395 67997 67997 68176 66176 71288 71288 43764 Cost of Revenue Gross Profit 87257 44853 72653 37572 71043 37160 66548 34356 62282 32313 58254 30265 54787 28389 51897 26915 48912 25842 46133 24262 44693 23304 47298 23990 22412 24447 19740 19513 17132 1754 1754 0 16801 1690 1690 16280 1640 1640 16122 1627 1627 0 15849 1616 1616 0 2128 1989 17864 1811 1811 0 0 0 0 0 D 0 Selling, General and Administrative Exp Depreciation and Amortization Depreciation, Amortization and Depletion Impairment Goodwill loss Impairment physical assets Impairment of Trademark Lease cancellation costs Other restructuring expenses 0 1650B 1568 1568 97 14 0 16 8 0 n 0 0 0 0 0 0 0 0 0 0 9 0 0 0 0 0 0 16028 1573 1573 0 0 0 15 0 0 0 17601 6661 13 606 17846 1785 1785 0 580 0 252 119 D 19631 4359 18 0 0 1870 0 D 247 0 0 0 21630 15777 93 1051 16 -974 - 0 D 15902 1707 1707 0 0 0 84 62 0 17609 4803 18 676 163 -658 0 0 21729.00 15843 73 1201 0 -1128 19675.00 14681 74 0 0 18886 13427 36 972 26575 18278 47 1347 0 -1300 0 D 18491 11774 166 919 0 0 17920 10469 337 B30 17749 9166 12 711 Total Operating Expense EBIT (Operating Income) Interest Income - Non-Operating Interest Expense. Non-Operating Additional non-operating income Net Non-Operating Interest Income (Expense) Special Income (Charges) Other Non-Operating Income (Expenses) Other Income (Expense) Income Before Tax 18076 7766 20 632 0 0 17465 5839 15 530 51 -515 1057 624 183 606 -983 -936 -753 -493 -699 -593 - 612 - 67 - 67 - 7221 -163 - -51 -51 5273 -163 3982 -163 -163 3590 16978 14715 14803 13698 12491 11021 9976 8467 6068 1935 Total Income Tax Income After Tax 4112 12866 3473 11242 3435 11368 5068 8630 4534 7957 4012 7009 3631 6345 3082 5385 2686 4535 2185 3883 1362 2620 1278 2312 3338 Net Income from Continuing Operations 12866 11242 11368 8630 7957 7009 6345 5385 4535 3883 3338 2620 2312 Gross margin Operating margin 0.339512527 0.34086641 0.34342856 0.34048204 0.34159311 0.341904 0.3413124 0.34150891 0.34569388 0.34465516 0.342721 0.33867263 0.33652228 0.138354402 0.14373327 0.14580927 0.14549473 0.14194196 0.13301099 0.12586563 0.11630209 0.10388742 0.0946232 0.08587144 0.07257918 0.06114634 Lowes Incarne Statement All dollar amounts in millions 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 89597 60025 29572 18526 1399 9647 72148 49205 22943 15367 1262 6314 71309 48401 22908 17413 1477 4018 5.54% 68,619 45,210 23,409 15,376 1447 6586 10.06% 65017 42553 22464 15129.0 1489 5846 5.07% 59074 38504 20570 14105 1494 4957 5.25% 56223 36665 19558 13281.0 1485 4786 5.73% 0.62% 53417 50521 34941 33194 18476 17327 12865.0 12244 1462 1523 4141 3551.53968 2.85% 50208 32858 17350 12593 1480 3256.3045 3.38% 48815 31663 17152 12006 1586 3525.98 -2.09% 47220 30757 16463 11688 1614 3112 Sales Growth Revenue Cost of Goods Sold Gross Profit SG&A Expense (excluding opening costs) Depreciation & Amortization EBIT (Operating income) Net Interest Expense (Interest Income) Interest Expense Total Net Interest expense Loss on Debt extinguish Income Before Taxes Income Taxes Net Income After Taxes -12 657 645 -4 556 552 -6 522 516 -6 482 476 -9 432 423 -12 383 371 -12 344 332 -17 304 287 848 1060 7739 1904 5835 691 0 5623 1342 4281 624 0 3394 1080 2314 -16 649 633 464 5,489 2042 3447 5201 2108 3093 4419 1873 2546 4276 1578 2698 3673 3128.53968 1387 1178 2286 1959 2906 1067 1839 3193.98 1218 1975.98 2825 1042 1783 Gross margin ratio Operating margin 0.330055694 0.317999113 0.3212498 0.1077 0.0875 0.0563 0.341144581 0.0960 0.345509636 0.0899 0.348207333 0.347864753 0.0839 0.0851 0.345882392 0.0775 0.342966291 0.0703 0.34556246 0.0649 0.351367408 0.348644642 0.0722 0.0659 Note: 2018 included a large number of writ-off losses for Lowes that were non-cash Home Depot Income figures in mill 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 Operating Revenue Total Revenue 132110 132110 110225 110225 108203 108203 100904 100904 94595 94595 86519 88519 83176 83176 78812 78812 74754 74754 70395 70395 67997 67997 68176 66176 71288 71288 43764 Cost of Revenue Gross Profit 87257 44853 72653 37572 71043 37160 66548 34356 62282 32313 58254 30265 54787 28389 51897 26915 48912 25842 46133 24262 44693 23304 47298 23990 22412 24447 19740 19513 17132 1754 1754 0 16801 1690 1690 16280 1640 1640 16122 1627 1627 0 15849 1616 1616 0 2128 1989 17864 1811 1811 0 0 0 0 0 D 0 Selling, General and Administrative Exp Depreciation and Amortization Depreciation, Amortization and Depletion Impairment Goodwill loss Impairment physical assets Impairment of Trademark Lease cancellation costs Other restructuring expenses 0 1650B 1568 1568 97 14 0 16 8 0 n 0 0 0 0 0 0 0 0 0 0 9 0 0 0 0 0 0 16028 1573 1573 0 0 0 15 0 0 0 17601 6661 13 606 17846 1785 1785 0 580 0 252 119 D 19631 4359 18 0 0 1870 0 D 247 0 0 0 21630 15777 93 1051 16 -974 - 0 D 15902 1707 1707 0 0 0 84 62 0 17609 4803 18 676 163 -658 0 0 21729.00 15843 73 1201 0 -1128 19675.00 14681 74 0 0 18886 13427 36 972 26575 18278 47 1347 0 -1300 0 D 18491 11774 166 919 0 0 17920 10469 337 B30 17749 9166 12 711 Total Operating Expense EBIT (Operating Income) Interest Income - Non-Operating Interest Expense. Non-Operating Additional non-operating income Net Non-Operating Interest Income (Expense) Special Income (Charges) Other Non-Operating Income (Expenses) Other Income (Expense) Income Before Tax 18076 7766 20 632 0 0 17465 5839 15 530 51 -515 1057 624 183 606 -983 -936 -753 -493 -699 -593 - 612 - 67 - 67 - 7221 -163 - -51 -51 5273 -163 3982 -163 -163 3590 16978 14715 14803 13698 12491 11021 9976 8467 6068 1935 Total Income Tax Income After Tax 4112 12866 3473 11242 3435 11368 5068 8630 4534 7957 4012 7009 3631 6345 3082 5385 2686 4535 2185 3883 1362 2620 1278 2312 3338 Net Income from Continuing Operations 12866 11242 11368 8630 7957 7009 6345 5385 4535 3883 3338 2620 2312 Gross margin Operating margin 0.339512527 0.34086641 0.34342856 0.34048204 0.34159311 0.341904 0.3413124 0.34150891 0.34569388 0.34465516 0.342721 0.33867263 0.33652228 0.138354402 0.14373327 0.14580927 0.14549473 0.14194196 0.13301099 0.12586563 0.11630209 0.10388742 0.0946232 0.08587144 0.07257918 0.06114634